Republican Tax Cuts: A Hard Look At The Numbers And The Deficit

Table of Contents

The Promises vs. Reality: Analyzing the Initial Claims of the Republican Tax Cuts

The 2017 Tax Cuts and Jobs Act, championed by the Republican party, promised significant economic benefits. Proponents argued the cuts would stimulate economic growth through increased investment and job creation, ultimately leading to higher tax revenues despite lower tax rates. This "supply-side economics" approach predicted a surge in economic activity.

- Projected GDP growth rates: Initial projections suggested significantly increased GDP growth, often exceeding 3% annually.

- Predicted job creation numbers: Supporters forecast substantial job creation as businesses invested more due to lower corporate tax rates.

- Promises of increased investment: A key argument was that businesses would reinvest their tax savings, boosting capital expenditures and leading to technological advancements.

However, the reality fell short of these optimistic projections. While GDP growth did occur in the years following the tax cuts, it remained relatively modest compared to the predictions. Job creation also showed positive trends, but again, not at the levels initially touted. Furthermore, much of the corporate tax savings was used for stock buybacks and dividends, rather than the promised investment in new equipment and job creation. Analysis by various independent economic organizations, like the Congressional Budget Office (CBO), demonstrated a less dramatic impact on economic growth than initially claimed.

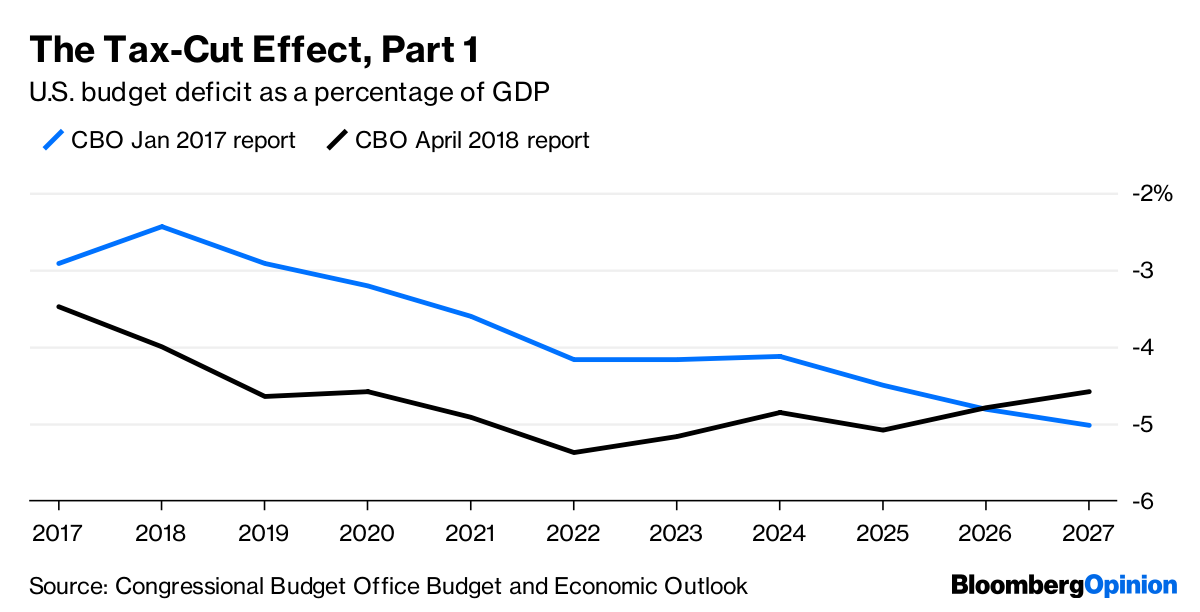

The Impact on the National Deficit and Debt

The Republican tax cuts had a profound impact on the federal budget deficit and national debt. The significant reduction in tax rates, particularly for corporations and high-income earners, resulted in a substantial decrease in government revenue.

- Changes in tax revenue collection post-tax cuts: Tax revenue collection fell significantly short of projections, leading to larger budget deficits than anticipated.

- Increased government spending: While not directly a consequence of the tax cuts themselves, the resulting deficits limited the government's ability to invest in crucial social programs and infrastructure.

- The growth of the national debt: The combination of reduced revenue and increased deficits fueled a dramatic increase in the national debt, adding trillions to the already substantial figure.

[Insert a chart here visually representing the growth of the national debt pre- and post-tax cuts]

The long-term implications of this increased debt are significant, potentially impacting future generations through higher interest payments and reduced government spending capacity. The rise in the national debt raises concerns about fiscal responsibility and the sustainability of current government programs.

Distributional Effects: Who Benefited Most from the Republican Tax Cuts?

The distributional effects of the Republican tax cuts were highly uneven. While the cuts were presented as benefiting all Americans, the reality shows a disproportionate benefit towards corporations and high-income earners.

- Tax cuts for corporations: The reduction in the corporate tax rate from 35% to 21% provided a substantial benefit to corporations.

- Tax cuts for high-income earners: High-income individuals also enjoyed significant tax savings due to changes in individual income tax rates and deductions.

- Tax cuts for middle- and low-income earners: While some middle- and lower-income earners received minor tax cuts through standard deductions and child tax credits, the overall benefit was considerably smaller compared to the wealthy.

[Insert a chart or graph here showcasing income distribution before and after the tax cuts]

The resulting increase in income inequality raises concerns about the fairness and equity of the tax cuts. The concentration of wealth continued to grow in the years following the implementation of these policies.

Long-Term Economic Consequences: Assessing Sustainability and Future Impacts

The long-term economic consequences of the Republican tax cuts remain a subject of debate. Several potential negative impacts are worth considering:

- Inflationary pressures: The increased government debt and potential stimulus from the tax cuts could contribute to inflationary pressures.

- Impact on future government spending programs: The increased deficit limits the government's ability to invest in critical areas like education, healthcare, and infrastructure.

- International competitiveness: While intended to boost the competitiveness of US businesses, some argue the cuts haven't significantly improved this aspect.

The current fiscal path is unsustainable in the long run. Without significant changes to government spending or tax policies, the national debt will continue to grow at an alarming rate, potentially leading to significant economic instability. The question of sustainable economic policy becomes critical in light of this fiscal reality.

Conclusion

Our analysis shows that the promised economic benefits of the Republican tax cuts did not fully materialize. While some economic growth occurred, it did not reach the levels initially projected. Moreover, the tax cuts led to a significant increase in the national deficit and debt, raising serious concerns about long-term fiscal sustainability. The benefits were also disproportionately distributed, with corporations and high-income earners receiving the lion's share of the tax savings. Understanding the financial implications of such significant legislation is paramount. Continue to research and engage in informed discussions about the Republican tax cuts and their impact to promote fiscal responsibility and transparency in government. Understand the implications of future tax policies and advocate for responsible fiscal planning regarding tax cuts and Republican tax policy. Informed engagement is crucial to ensure that future fiscal policies are both economically sound and equitable.

Featured Posts

-

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025 -

Mysterious Red Lights Flash Over France What Was It

May 21, 2025

Mysterious Red Lights Flash Over France What Was It

May 21, 2025 -

Fastest Ever Mans Record Setting Australian Foot Crossing

May 21, 2025

Fastest Ever Mans Record Setting Australian Foot Crossing

May 21, 2025 -

March 24 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025 -

Hellfest 2024 Profitez De La Brasserie Hell City A Clisson

May 21, 2025

Hellfest 2024 Profitez De La Brasserie Hell City A Clisson

May 21, 2025

Latest Posts

-

Huuhkajien Avauskokoonpano Naein Se Muuttuu Kaellmanin Asema Uhattuna

May 21, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu Kaellmanin Asema Uhattuna

May 21, 2025 -

Yllaetysmuutokset Huuhkajien Avauskokoonpanossa Kaellman Ja Muut Vaihtopenkille

May 21, 2025

Yllaetysmuutokset Huuhkajien Avauskokoonpanossa Kaellman Ja Muut Vaihtopenkille

May 21, 2025 -

Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia Kaellman Sivussa

May 21, 2025

Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia Kaellman Sivussa

May 21, 2025 -

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 21, 2025

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 21, 2025 -

Jalkapallo Huuhkajien Avauskokoonpanossa Yllaetyksiae Kaellman Poissa

May 21, 2025

Jalkapallo Huuhkajien Avauskokoonpanossa Yllaetyksiae Kaellman Poissa

May 21, 2025