Resilient Investments Boost China Life Profits

Table of Contents

Strategic Investment Portfolio Diversification

China Life's remarkable profit growth is directly attributable to its sophisticated and diversified investment portfolio. This strategy mitigates risk and ensures consistent returns, even amidst economic volatility. Let's examine the key components:

Real Estate Investments

China Life's strategic allocation to real estate has proven remarkably resilient. The company benefits from:

- Stable rental income streams: A significant portion of its real estate portfolio generates consistent rental income, providing a stable base for returns.

- Long-term capital appreciation potential: Strategic property acquisitions in high-growth areas offer significant long-term capital appreciation potential.

- Geographic diversification within the Chinese real estate market: China Life avoids over-concentration in any single region, spreading risk across various provinces and cities.

- Focus on high-demand areas: The company prioritizes investments in areas with strong population growth and robust economic activity, ensuring sustained demand for its properties. This targeted approach to real estate investment strengthens its overall portfolio.

Equities and Fixed Income

China Life maintains a balanced portfolio of equities and fixed-income securities, employing sophisticated risk management techniques. Key features include:

- Balanced portfolio approach: Careful allocation between equities and fixed income provides a balance between growth potential and capital preservation.

- Active fund management: China Life employs experienced fund managers to actively manage its equity and fixed-income holdings, optimizing returns and mitigating risks.

- Strategic allocation to both domestic and international markets: Diversification across both the Chinese stock market and international markets reduces overall portfolio volatility.

- Risk mitigation strategies such as hedging: The implementation of hedging strategies minimizes exposure to market downturns, protecting capital and ensuring consistent returns. This proactive approach to risk management is crucial for consistent performance in the equity and fixed income markets.

Alternative Investments

Beyond traditional assets, China Life explores alternative investment avenues, enhancing portfolio resilience and returns:

- Infrastructure investment returns: Investments in large-scale infrastructure projects generate long-term, stable returns while contributing to the nation's development.

- Private equity opportunities: China Life actively seeks high-growth potential through strategic private equity investments.

- Long-term growth prospects: Alternative investments often provide attractive long-term growth prospects, complementing the more established asset classes in the portfolio.

- Diversification benefits: These investments reduce overall portfolio correlation with traditional asset classes, improving overall stability.

- Lower correlation with traditional assets: The lower correlation with traditional assets like equities and bonds helps to reduce overall portfolio volatility and improve risk-adjusted returns. This careful consideration of asset correlation is critical to maintaining a truly resilient portfolio.

Impact of Macroeconomic Factors

China Life's investment success is also intrinsically linked to the macroeconomic environment:

China's Economic Growth

China's sustained economic growth has been a significant driver of China Life's investment returns:

- Correlation between GDP growth and investment performance: Strong GDP growth generally correlates with higher investment returns across various asset classes.

- Impact of government policies on investment landscape: Government policies and initiatives influence investment opportunities and market conditions.

- Opportunities arising from infrastructure development and urbanization: China's ongoing urbanization and infrastructure development create numerous attractive investment opportunities.

Regulatory Environment

Navigating the regulatory landscape is crucial for China Life's investment success:

- Compliance with regulatory frameworks: China Life strictly adheres to all relevant regulatory frameworks, ensuring legal and ethical investment practices.

- Adaptation to evolving regulatory landscape: The company actively adapts its investment strategies to keep pace with evolving regulations and reforms.

- Impact of financial reforms on investment strategies: China's ongoing financial reforms continuously shape the investment landscape and influence strategic decision-making.

Future Outlook and Growth Projections

China Life's resilient investment strategy is poised for continued success:

Continued Investment Strategy

The future of China Life's investments focuses on sustainable growth:

- Sustainable investment practices: Increasing emphasis is placed on Environmental, Social, and Governance (ESG) factors in investment decisions.

- Focus on ESG (Environmental, Social, and Governance) factors: Investing in companies with strong ESG profiles aligns with long-term sustainability goals.

- Exploration of new technological investment opportunities: China Life is actively exploring opportunities in emerging technologies with high growth potential.

- Expansion into new market segments: The company is actively seeking expansion opportunities into new and lucrative market segments.

Profitability and Shareholder Value

China Life's resilient investment strategy is expected to drive:

- Projected profit growth: Continued strong performance is projected across all asset classes.

- Return on investment (ROI): A strong and consistent ROI is anticipated, exceeding industry benchmarks.

- Dividend payouts: Regular and attractive dividend payouts will benefit shareholders.

- Share price appreciation: The robust investment strategy is likely to lead to sustained share price appreciation, increasing shareholder value.

Conclusion

China Life's impressive profit growth underscores the effectiveness of its resilient investment strategy, showcasing the importance of diversification and prudent risk management within the complex Chinese financial environment. By strategically allocating assets across multiple asset classes and capitalizing on opportunities presented by China's economic growth, China Life has secured strong financial performance. To stay informed about similar success stories in resilient investment strategies and their impact on the insurance sector, continue to follow our updates on impactful financial strategies and learn more about how resilient investments can safeguard your own financial future.

Featured Posts

-

Addio A Mario Nanni La Scomparsa Di Un Icona Del Giornalismo Politico Italiano

Apr 30, 2025

Addio A Mario Nanni La Scomparsa Di Un Icona Del Giornalismo Politico Italiano

Apr 30, 2025 -

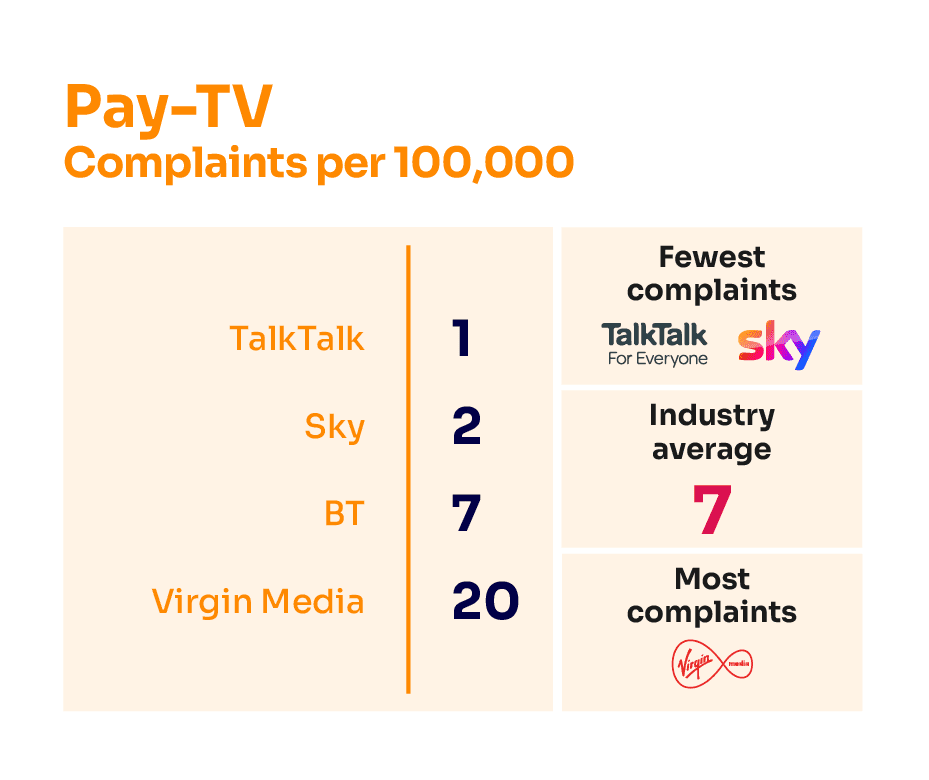

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025 -

Experience Earth Day At Pocono Center Educational And Entertaining Events

Apr 30, 2025

Experience Earth Day At Pocono Center Educational And Entertaining Events

Apr 30, 2025 -

Edenred Document Amf Cp 2025 E1029244 Analyse Et Telechargement

Apr 30, 2025

Edenred Document Amf Cp 2025 E1029244 Analyse Et Telechargement

Apr 30, 2025 -

Norwegian Cruise Line Nclh Stock A Look At Hedge Fund Ownership And Implications

Apr 30, 2025

Norwegian Cruise Line Nclh Stock A Look At Hedge Fund Ownership And Implications

Apr 30, 2025