Retail Sales Growth Impacts Bank Of Canada Interest Rate Decision

Table of Contents

Retail Sales as a Key Economic Indicator

Retail sales growth serves as a powerful barometer of consumer spending and overall economic health. Analyzing these figures provides invaluable insights into the strength and direction of the Canadian economy.

Measuring Consumer Spending

Statistics Canada meticulously collects and analyzes retail sales data, providing a comprehensive picture of consumer spending habits. This data is crucial for understanding economic trends and informing policy decisions.

- Types of retail sales data: The data encompasses various categories, including durable goods (e.g., furniture, appliances), non-durable goods (e.g., food, clothing), and services (e.g., restaurants, auto repairs). Analyzing these individual segments helps paint a more nuanced picture of consumer behaviour.

- Seasonal adjustments: Statistics Canada applies seasonal adjustments to the data to account for predictable fluctuations throughout the year. This ensures that the analysis accurately reflects underlying economic trends rather than temporary seasonal variations.

- Limitations of the data: While comprehensive, the data does have limitations. It might not fully capture all consumer spending (e.g., online purchases from international retailers). Furthermore, the data can lag slightly behind real-time economic activity.

The significance of changes in spending patterns cannot be overstated. Significant increases in retail sales generally indicate economic strength and consumer confidence, while decreases often signal potential weakness or even a looming recession. The Bank of Canada closely monitors these trends.

The Link Between Consumer Confidence and Retail Sales

A strong correlation exists between consumer confidence and retail spending. High consumer confidence usually translates to increased spending, boosting retail sales. Conversely, low confidence often leads to decreased spending and lower retail sales.

- Factors influencing consumer confidence: Several factors contribute to consumer confidence, including employment levels, inflation rates, and – significantly – interest rates themselves. Uncertainty about the future can significantly dampen consumer spending.

- How confidence surveys are used: The Bank of Canada supplements retail sales data with consumer confidence surveys to gain a more holistic view of the economy. These surveys gauge consumer sentiment and expectations, providing additional context to the sales figures.

The Bank of Canada carefully considers consumer confidence data alongside retail sales figures to assess the overall health and resilience of the Canadian economy. A divergence between the two can indicate underlying economic tensions that require further investigation.

How Retail Sales Growth Influences Interest Rate Decisions

The Bank of Canada uses retail sales data as a crucial input when deciding on interest rate adjustments. Robust sales figures can indicate inflationary pressures, while weak sales can signal an economic slowdown.

Inflationary Pressures

Strong retail sales growth can fuel demand-pull inflation. Increased consumer spending leads to higher demand for goods and services, pushing prices upward. This inflationary pressure is a key concern for the Bank of Canada, which has a mandate to maintain price stability.

- The relationship between demand-pull inflation and retail sales: When demand significantly outpaces supply, prices rise. Strong retail sales are a clear indicator of this imbalance.

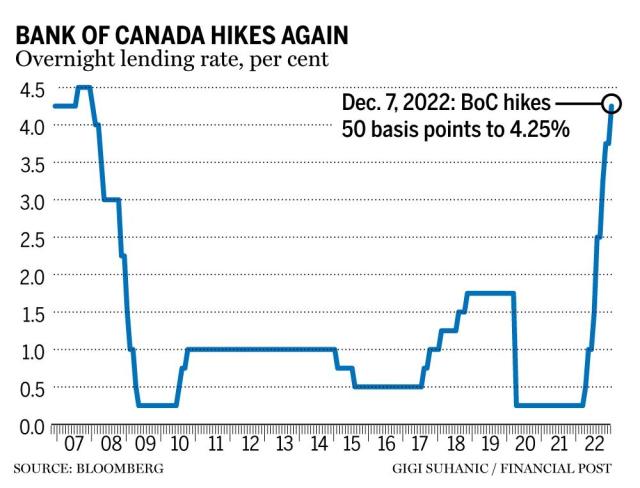

- The Bank of Canada's inflation target: The Bank of Canada aims to keep inflation within a specific target range (currently 2%). Persistent increases in retail sales that push inflation above the target typically result in interest rate hikes.

Historically, periods of strong retail sales growth have often preceded interest rate increases by the Bank of Canada. The central bank seeks to preemptively cool down an overheated economy by making borrowing more expensive.

Economic Slowdown Signals

Conversely, weak retail sales growth can signal an economic slowdown or even a potential recession. Declining consumer spending indicates reduced economic activity, prompting the Bank of Canada to consider lowering interest rates to stimulate the economy.

- The relationship between recessionary pressures and declining retail sales: Falling retail sales often precede or accompany a recession. They indicate decreased consumer demand and business investment.

- The Bank of Canada's mandate to maintain full employment: The Bank of Canada aims not only to control inflation but also to promote full employment. Lowering interest rates during economic slowdowns aims to boost investment and employment.

In instances of weak retail sales growth, the Bank of Canada has historically responded by lowering interest rates to make borrowing cheaper, thereby encouraging investment and consumer spending.

Balancing Act

The Bank of Canada faces a complex balancing act when setting interest rates. It must control inflation while simultaneously promoting sustainable economic growth and full employment. Analyzing retail sales data is crucial to this delicate process. Too aggressive a response could stifle growth, while an insufficient response could allow inflation to spiral out of control.

Impact on Businesses and Consumers

Changes in interest rates, driven by fluctuations in retail sales, have significant impacts on both businesses and consumers.

Impact on Businesses

Interest rate changes directly affect businesses' borrowing costs, investment decisions, and ultimately, their ability to compete and grow.

- How higher interest rates impact business loans and expansion plans: Higher rates increase the cost of borrowing for businesses, potentially delaying expansion plans and reducing investment in new equipment or hiring.

- How lower rates encourage investment: Lower rates make borrowing more attractive, encouraging businesses to invest, expand, and create jobs.

The impact varies across sectors. Interest-sensitive industries like real estate and construction are particularly affected by interest rate fluctuations.

Impact on Consumers

Changes in interest rates also significantly influence consumers' financial decisions, including mortgages, credit card debt, and savings.

- Impact of interest rate hikes and cuts on consumer debt and purchasing power: Higher interest rates increase the cost of borrowing, reducing consumer spending power and increasing debt burdens. Conversely, lower rates decrease borrowing costs, potentially stimulating consumer spending.

Interest rate changes influence different consumer spending segments differently. For example, homeowners with variable-rate mortgages are immediately affected by interest rate hikes, whereas those with fixed-rate mortgages are shielded for the duration of their term.

Conclusion

The strong correlation between retail sales growth and Bank of Canada interest rate decisions is undeniable. Understanding this relationship is key to navigating economic fluctuations and making informed financial choices. The Bank of Canada uses retail sales figures as a crucial input, alongside other economic data, when setting interest rates. Strong retail sales can indicate inflationary pressure, prompting rate increases, while weak sales may signal an economic slowdown, potentially leading to rate cuts.

Call to Action: Stay informed about retail sales data and Bank of Canada announcements to make informed financial decisions. Regularly monitor key economic indicators like retail sales growth to better understand the factors influencing Bank of Canada interest rates. Understanding the interplay between retail sales growth and the Bank of Canada's interest rate decisions is vital for both short-term and long-term financial planning.

Featured Posts

-

Congres Du Parti Socialiste Bouamrane Appelle A L Union Contre Faure

May 27, 2025

Congres Du Parti Socialiste Bouamrane Appelle A L Union Contre Faure

May 27, 2025 -

Controversial Best Picture Nominee Now Streaming On Netflix

May 27, 2025

Controversial Best Picture Nominee Now Streaming On Netflix

May 27, 2025 -

2025 March Madness The Cord Cutters Streaming Handbook

May 27, 2025

2025 March Madness The Cord Cutters Streaming Handbook

May 27, 2025 -

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Telymat Llmtrshhyn Almqbwlyn

May 27, 2025

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Telymat Llmtrshhyn Almqbwlyn

May 27, 2025 -

Ice Cube Reportedly Set To Write And Star In New Last Friday Film

May 27, 2025

Ice Cube Reportedly Set To Write And Star In New Last Friday Film

May 27, 2025

Latest Posts

-

Monte Carlo Masters Alcaraz Wins As Musetti Retires

May 30, 2025

Monte Carlo Masters Alcaraz Wins As Musetti Retires

May 30, 2025 -

Carlos Alcaraz Triumphs In Monte Carlo Musettis Retirement Fuels Victory

May 30, 2025

Carlos Alcaraz Triumphs In Monte Carlo Musettis Retirement Fuels Victory

May 30, 2025 -

Alcaraz Vs Musetti Predicting The 2025 Monte Carlo Masters Final

May 30, 2025

Alcaraz Vs Musetti Predicting The 2025 Monte Carlo Masters Final

May 30, 2025 -

Alcaraz Wins First Monte Carlo Masters Victory Against Injured Musetti

May 30, 2025

Alcaraz Wins First Monte Carlo Masters Victory Against Injured Musetti

May 30, 2025 -

Alcaraz Vs Musetti Monte Carlo Masters 2025 A Final Showdown

May 30, 2025

Alcaraz Vs Musetti Monte Carlo Masters 2025 A Final Showdown

May 30, 2025