Rethinking Retirement: Why This New Investment Idea Might Not Be The Answer

Table of Contents

The Allure of High-Yield, High-Risk Investments

The appeal of high-yield investments for retirement is undeniable. Cryptocurrencies, certain start-up ventures, and other speculative assets promise rapid wealth accumulation, a tempting prospect for those seeking to accelerate their retirement planning. These seemingly revolutionary investment ideas offer the potential for substantial returns, captivating those seeking a shortcut to financial security. However, this allure often overshadows the inherent risks.

- High volatility and potential for significant losses: High-yield investments are often incredibly volatile. Their value can fluctuate dramatically in short periods, leading to substantial losses. A market downturn could wipe out years of savings.

- Lack of diversification increases overall portfolio risk: Relying heavily on a single high-yield investment leaves your retirement portfolio vulnerable. If that investment fails, your entire retirement plan could be jeopardized. Diversification is key in retirement planning.

- Limited regulatory oversight increases investor vulnerability: Many high-yield investments operate in less regulated markets, making investors more susceptible to fraud or manipulation. This lack of oversight increases the risks associated with these investment ideas.

- Difficulty predicting long-term performance: Unlike more established investments, predicting the long-term performance of high-yield assets is extremely difficult, making reliable retirement planning challenging.

Ignoring the Importance of Diversification in Retirement Planning

Diversification is the cornerstone of sound retirement planning. It involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk. Relying on a single "new investment idea" is a direct contradiction of this fundamental principle.

- Diversification across asset classes (stocks, bonds, real estate, etc.) reduces risk: A balanced portfolio reduces the impact of losses in any single asset class.

- A diversified portfolio is better equipped to withstand market downturns: When one sector underperforms, others can help offset the losses, ensuring portfolio stability.

- Proper diversification requires a long-term perspective and patience: Diversification is a long-term strategy, requiring patience to weather market fluctuations and reap the benefits over time.

- Professional financial advice can help create a diversified retirement plan: A financial advisor can help you develop a retirement investment strategy tailored to your specific risk tolerance and financial goals.

The Hidden Fees and Costs of "New" Retirement Investment Strategies

Many "new" retirement investment strategies come with hidden fees and expenses that can significantly impact your returns. These costs are often overlooked during the initial excitement, only becoming apparent later when returns are far less than expected.

- Management fees, transaction costs, and other hidden charges: These charges can eat into your investment returns over time, particularly impacting long-term growth.

- Impact of fees on long-term investment growth: Even seemingly small fees can compound over decades, significantly reducing the final value of your retirement savings.

- Importance of comparing fees across different investment options: Before investing, carefully compare fees across various investment options to make informed decisions.

- Seeking transparency in investment fees: Always ask for clear and detailed explanations of all fees and charges associated with any investment.

The Role of Traditional Retirement Planning Strategies

Traditional retirement planning strategies, such as 401(k)s, IRAs, and pensions, shouldn't be dismissed. These established vehicles offer stability, predictability, and significant advantages.

- Tax advantages of traditional retirement accounts: Many traditional accounts offer tax advantages, either through tax deductions or tax-deferred growth.

- Long-term growth potential of established investment vehicles: Established investment vehicles have a proven track record of long-term growth and stability.

- Government protection and regulations: These plans are often subject to government regulations and protections, offering a greater degree of security.

- Professional guidance and support: Many employers and financial institutions offer guidance and support for traditional retirement plans.

Rethinking Retirement – A Balanced Approach

Relying solely on new, high-risk investment ideas for retirement is risky. While incorporating some newer investment options might be part of a well-diversified portfolio, it's crucial to proceed with caution, thorough research, and a clear understanding of the risks involved. A balanced approach that incorporates traditional retirement planning strategies along with carefully vetted newer options is the most secure path to a comfortable retirement. Seeking professional retirement investment advice is paramount. Don't let the allure of quick riches overshadow the importance of building a secure financial future. Rethink your retirement strategies today and explore the diverse options available to create a personalized, secure retirement planning approach. Seek professional guidance to build a comprehensive plan that aligns with your goals and risk tolerance. Secure your retirement planning future by understanding the full picture and seeking personalized retirement investment advice.

Featured Posts

-

Dry Weather Could Dampen Easter Bonfire Celebrations

May 18, 2025

Dry Weather Could Dampen Easter Bonfire Celebrations

May 18, 2025 -

Michael Confortos Hot Bat Leads Dodgers To Victory Over Mariners

May 18, 2025

Michael Confortos Hot Bat Leads Dodgers To Victory Over Mariners

May 18, 2025 -

Trump Condemns Springsteens Treasonous Remarks

May 18, 2025

Trump Condemns Springsteens Treasonous Remarks

May 18, 2025 -

Baltimore Native Ego Nwodims Snl Sketch Met With Profanity From Audience

May 18, 2025

Baltimore Native Ego Nwodims Snl Sketch Met With Profanity From Audience

May 18, 2025 -

Nederlandse Defensie Industrie Groeiende Steun Voor Expansie In Onzekere Tijden

May 18, 2025

Nederlandse Defensie Industrie Groeiende Steun Voor Expansie In Onzekere Tijden

May 18, 2025

Latest Posts

-

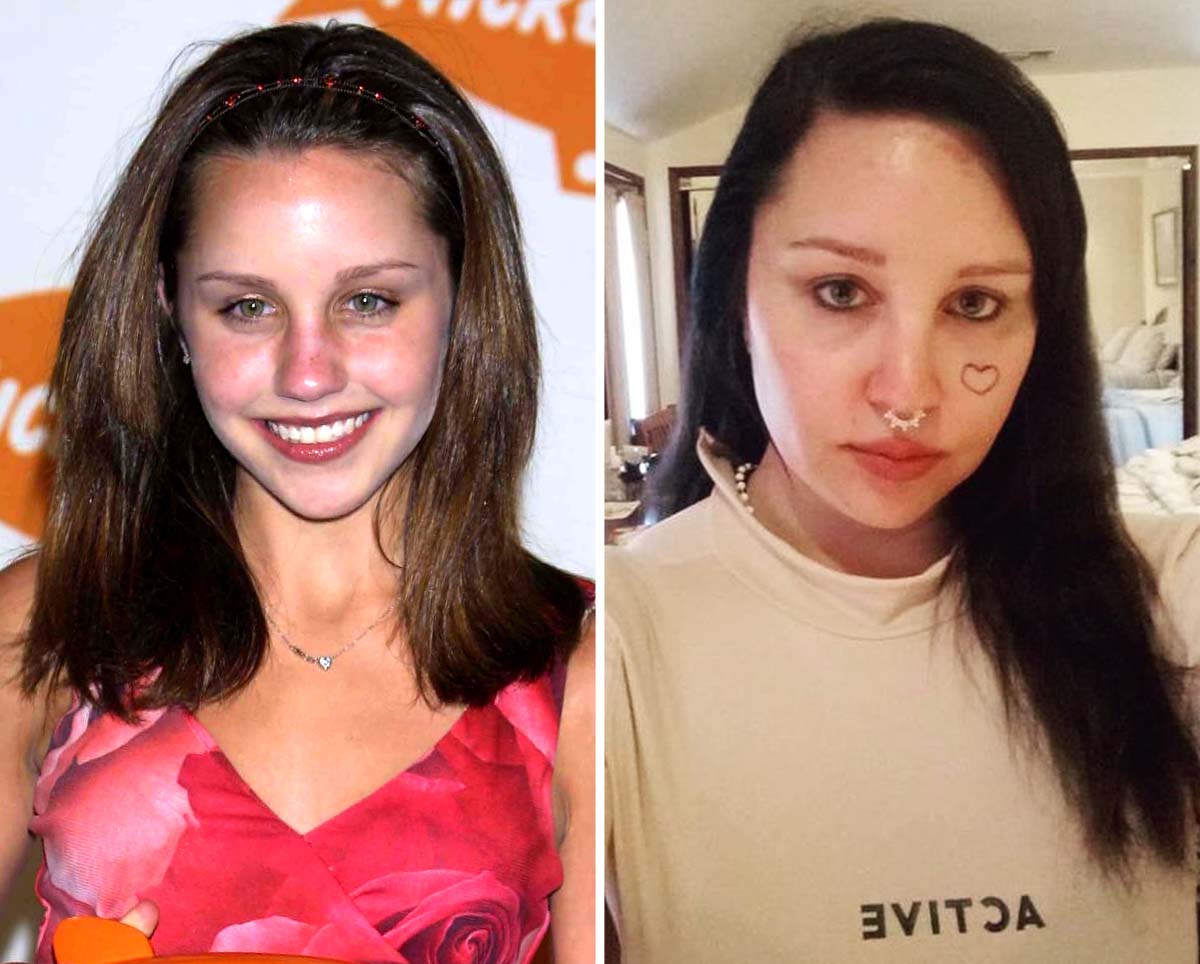

Fifteen Years Later Amanda Byness Comeback Project Announced

May 18, 2025

Fifteen Years Later Amanda Byness Comeback Project Announced

May 18, 2025 -

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025 -

From Hollywood To Only Fans Amanda Bynes Career Transition

May 18, 2025

From Hollywood To Only Fans Amanda Bynes Career Transition

May 18, 2025 -

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025 -

Amanda Bynes Only Fans Debut 50 Monthly Fee 15 Years After Acting Retirement

May 18, 2025

Amanda Bynes Only Fans Debut 50 Monthly Fee 15 Years After Acting Retirement

May 18, 2025