Revised Trump Tax Plan: Details Released By House Republicans

Table of Contents

Individual Income Tax Changes in the Revised Trump Tax Plan

The revised Trump tax plan introduces substantial modifications to individual income taxes. These changes affect tax brackets, deductions, and credits, potentially altering the tax burden for millions of Americans.

Changes to Tax Brackets and Rates

The proposed changes to tax brackets and rates are a central feature of the revised plan. While specific numbers may fluctuate during the legislative process, the general direction indicates:

- Lower Rates for Higher Earners: A potential reduction in the top marginal tax rate, aiming to incentivize investment and economic activity. (Specific percentage needs to be inserted here when available from official sources).

- Slight Adjustments for Middle-Income Earners: Minor changes in tax rates for middle-income brackets, aiming for a modest tax relief. (Specific percentage needs to be inserted here when available from official sources).

- Minimal Change for Low-Income Earners: The plan may include minimal changes, possibly leaving the lowest brackets largely unaffected. (Specific percentage needs to be inserted here when available from official sources).

- Adjusted Standard Deduction: An increase in the standard deduction is anticipated to benefit taxpayers who itemize fewer deductions. (Specific dollar amount needs to be inserted here when available from official sources).

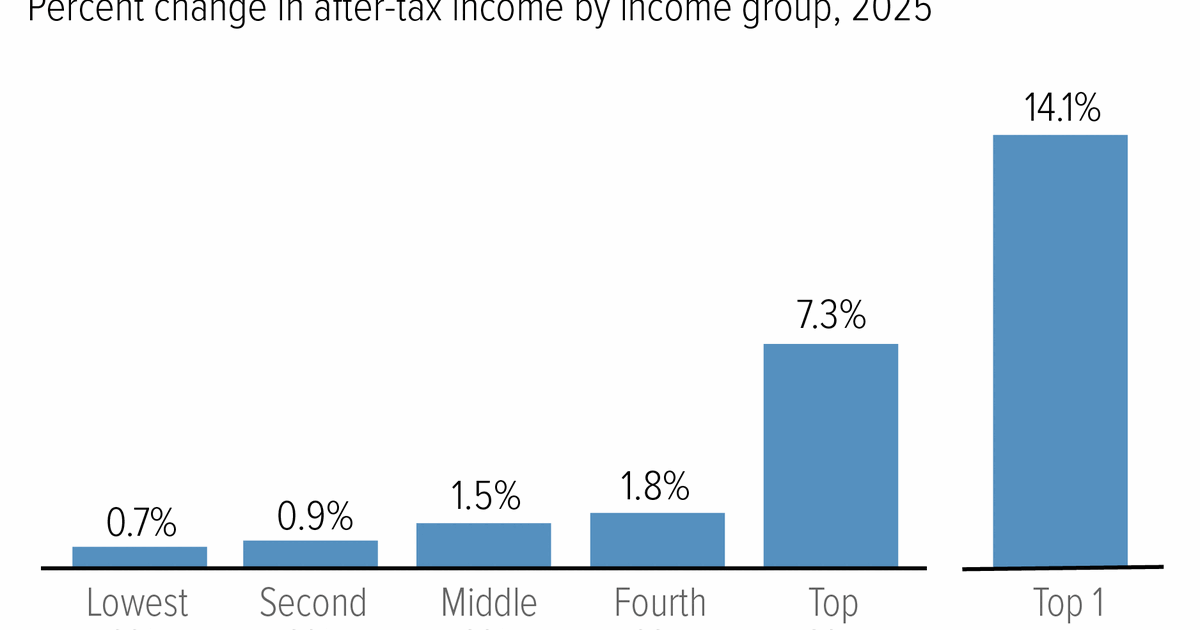

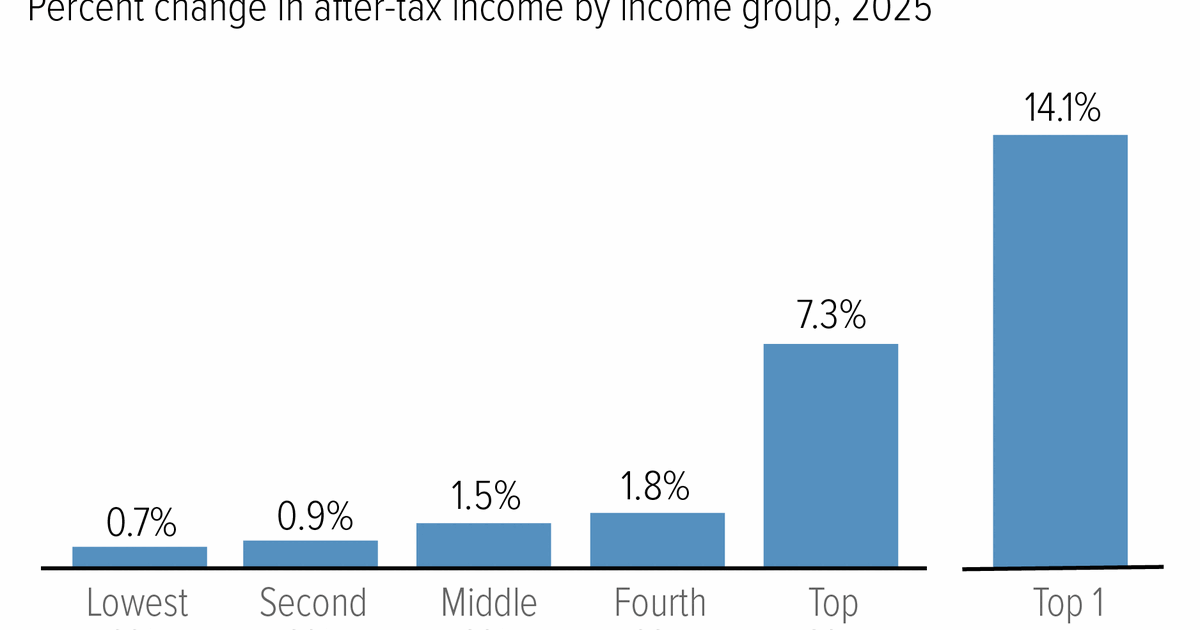

These changes will significantly impact different income groups, with higher earners potentially seeing the most substantial reductions in their tax liability. However, the overall distributional effects are subject to ongoing debate and further analysis.

Elimination or Modification of Tax Deductions and Credits

The revised plan proposes the elimination or modification of several popular tax deductions and credits. These changes aim to simplify the tax code and potentially offset the revenue losses from lower tax rates. Key alterations include:

- State and Local Tax (SALT) Deduction: The potential limitations or complete elimination of the SALT deduction will impact taxpayers in high-tax states disproportionately.

- Mortgage Interest Deduction: Possible modifications to the mortgage interest deduction could limit the amount of interest that is deductible, particularly for larger mortgages.

- Itemized Deductions: Further restrictions on itemized deductions might incentivize more taxpayers to use the standard deduction instead.

These modifications to deductions and credits could significantly impact taxpayers who previously relied on these provisions to reduce their tax burden.

Impact on Capital Gains and Dividends

The revised plan may also incorporate changes to the taxation of capital gains and dividends. Potential adjustments include:

- Lower Capital Gains Tax Rates: A possible reduction in capital gains tax rates could encourage investment and stimulate economic growth. (Specific percentage needs to be inserted here when available from official sources).

- Changes to Dividend Taxation: Potential adjustments to dividend tax rates, potentially aligning them more closely with capital gains rates. (Specific percentage needs to be inserted here when available from official sources).

These changes could have significant implications for investors and businesses, influencing investment decisions and portfolio strategies.

Corporate Tax Rate Changes in the Revised Trump Tax Plan

The revised plan also includes significant changes to corporate tax rates and international taxation, with potential repercussions for businesses of all sizes.

Revised Corporate Tax Rate

The heart of the corporate tax reform lies in the proposed corporate tax rate. While the precise figure requires confirmation from official sources, the plan suggests:

- A Lower Corporate Tax Rate: A substantial reduction in the corporate tax rate is anticipated, aiming to enhance competitiveness and encourage investment. (Specific percentage needs to be inserted here when available from official sources).

- Comparison to Previous Proposals: The revised rate needs to be compared and contrasted to both the original Trump tax plan and the current corporate tax rate.

- Impact on Corporate Profits and Investment: A lower corporate tax rate is expected to boost after-tax profits, potentially leading to increased investment and job creation.

Changes to International Taxation

The international tax provisions are expected to undergo significant alterations, affecting multinational corporations and their global operations. Potential changes include:

- Territorial Tax System: A potential shift towards a territorial tax system, taxing only domestic profits.

- Repatriation of Profits: Incentives or adjustments to the taxation of repatriated profits from overseas operations.

- Taxation of Foreign Earnings: Changes in how foreign earnings are taxed, potentially impacting the competitiveness of American companies.

Impact on Small Businesses

Small businesses, particularly pass-through entities like S corporations and partnerships, will also feel the effects of the revised plan. The plan aims to:

- Benefit Small Businesses: Provide tax relief to small businesses through adjusted tax rates and deductions applicable to their structure. (Specific details needs to be inserted here when available from official sources).

- Impact on Job Creation and Economic Growth: The tax cuts for small businesses are expected to spur job creation and stimulate economic growth at a local level.

Projected Economic Impacts of the Revised Trump Tax Plan

The projected economic impacts of the revised Trump tax plan are a subject of intense debate among economists. Forecasts vary depending on the underlying assumptions and methodologies used.

GDP Growth Projections

Various organizations and economists have offered GDP growth projections associated with the plan. These projections should be critically examined, taking into account:

- Methodology: Understanding the assumptions and models used to generate these projections is critical for evaluating their reliability.

- Uncertainties: Economic forecasting is inherently uncertain, and external factors could significantly affect the actual outcome.

- Time Horizon: The projected impacts will likely vary over time, with short-term effects potentially differing from long-term consequences.

Job Creation Estimates

Estimates regarding job creation as a result of the revised plan also vary considerably. Key considerations include:

- Sectoral Impacts: Job creation may be concentrated in specific sectors, with uneven effects across different industries.

- Productivity Gains: The plan's impact on productivity will influence the overall number of jobs created.

- Labor Force Participation: The plan's effect on labor force participation will also influence employment figures.

Government Debt and Deficit Implications

The revised plan's potential effects on the national debt and deficit are a major concern for many. Analysis should address:

- Revenue Losses: The extent of revenue losses from tax cuts will influence the budget deficit.

- Economic Growth Effects: The potential offsetting effects of economic growth on tax revenues should be carefully considered.

- Long-Term Fiscal Sustainability: Evaluating the long-term fiscal sustainability of the plan is crucial for long-term economic stability.

Conclusion

The revised Trump tax plan, as detailed by House Republicans, represents a significant overhaul of the US tax system. Understanding the nuanced changes to individual and corporate tax rates, deductions, and international taxation is crucial for both individuals and businesses. While proponents argue that the plan will stimulate economic growth through job creation and increased investment, its long-term fiscal sustainability remains a key point of contention. For a comprehensive understanding of how this Revised Trump Tax Plan might impact your specific situation, consulting a qualified tax professional is strongly advised. Stay informed about updates to the Revised Trump Tax Plan to proactively manage your financial future.

Featured Posts

-

Pimblett Vs Chandler Adesanyas Endorsement Of A Deserving Contender

May 16, 2025

Pimblett Vs Chandler Adesanyas Endorsement Of A Deserving Contender

May 16, 2025 -

New Details Emerge In Amber Heards Twins Paternity Case

May 16, 2025

New Details Emerge In Amber Heards Twins Paternity Case

May 16, 2025 -

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025 -

10 Run Inning Doesnt Dim Padres Bullpens Positive Outlook Tom Krasovic

May 16, 2025

10 Run Inning Doesnt Dim Padres Bullpens Positive Outlook Tom Krasovic

May 16, 2025 -

Predicting The Padres Vs Pirates Mlb Game Picks And Odds Analysis

May 16, 2025

Predicting The Padres Vs Pirates Mlb Game Picks And Odds Analysis

May 16, 2025