Rio Tinto Defends Dual Listing Against Activist Pressure

Table of Contents

Rio Tinto's Justification for its Dual Listing

Rio Tinto's decision to maintain a dual listing isn't arbitrary; it's a strategic choice based on several key factors. The company believes the advantages far outweigh the perceived complexities.

Access to a Broader Investor Base

A primary reason for Rio Tinto's dual listing is the access it provides to a significantly broader investor base. By listing on both the LSE and ASX, Rio Tinto taps into two distinct, yet overlapping, pools of capital. This translates to several concrete benefits:

- Larger investor pool: Access to both UK and Australian investors allows for greater diversification of its shareholder base.

- Increased trading volume: Higher trading volume on both exchanges increases market liquidity, making it easier for investors to buy and sell shares.

- Potential for diversification of shareholder base: Reduced reliance on any single market segment minimizes risks associated with market volatility in one region.

- Competitive advantages in attracting investment: A dual listing enhances Rio Tinto's profile and attractiveness to a wider range of institutional and retail investors, leading to more competitive funding options.

For example, the increased liquidity resulting from the dual listing has historically allowed Rio Tinto to raise capital at more favorable terms compared to a single-listing scenario. This directly translates into lower cost of capital and improved profitability.

Enhanced Corporate Governance and Transparency

Maintaining a dual listing necessitates compliance with the stringent regulatory requirements of both the UK and Australia. This, in turn, enhances corporate governance and transparency:

- Compliance with UK and Australian regulatory frameworks: Adherence to two robust regulatory environments ensures higher levels of accountability and transparency.

- Independent board oversight in both jurisdictions: The company operates under the scrutiny of independent boards in two major markets, providing an extra layer of oversight and accountability.

- Improved investor relations and communication: The need to engage with investors in two distinct markets drives improved communication and disclosure practices.

- Better stakeholder engagement: A dual listing necessitates greater engagement with a wider spectrum of stakeholders, including shareholders, employees, and communities.

Rio Tinto's robust corporate governance practices, further strengthened by its dual listing, are regularly audited and independently reviewed, demonstrating its commitment to transparency and ethical business conduct.

Strategic Advantages in Key Markets

The UK and Australia remain crucial markets for the mining industry, and Rio Tinto's presence in both is strategically vital:

- Stronger relationships with key stakeholders in both regions: A local presence fosters stronger relationships with governments, regulators, and local communities.

- Better access to resources and expertise: Access to resources and talent pools in both countries is crucial for efficient operations.

- Improved market intelligence: Having a presence in both markets enhances the company's ability to gather valuable market intelligence.

- Potential for future acquisitions or partnerships: A strong presence in both locations provides a platform for future growth through acquisitions or strategic partnerships.

Australia, being a major resource-rich nation, is critical for Rio Tinto’s raw material sourcing, while the UK offers access to sophisticated financial markets and a global network. This dual presence reinforces Rio Tinto’s strategic positioning within the mining landscape.

Addressing Activist Concerns

While the benefits of a dual listing are clear to Rio Tinto, the company acknowledges concerns raised by activist investors. Let's address these concerns directly:

Refuting Claims of Inefficiency

One common critique of dual listings is the perceived increase in administrative costs and complexities. However, Rio Tinto maintains that the operational efficiencies implemented far outweigh these costs:

- Cost-benefit analysis comparing dual listing costs with potential financial gains: Internal analyses have consistently demonstrated that the financial gains far outweigh the administrative overhead associated with the dual listing.

- Showcasing streamlining efforts to manage dual listing efficiently: Rio Tinto has implemented technological advancements and streamlined internal processes to minimize administrative burdens.

- Presenting data on improved shareholder returns: Data showcasing improved shareholder returns directly supports the claim that the dual listing strategy enhances shareholder value.

Countering Calls for a Single Listing

Arguments for a single listing often overlook the substantial strategic disadvantages:

- Loss of investor access: A single listing would significantly restrict access to a substantial pool of investors.

- Reduced liquidity: Reduced trading volume would negatively impact liquidity, making it harder for investors to buy and sell shares.

- Potential negative impact on share price: The reduced investor base and liquidity could negatively impact the share price.

- Weakening of corporate governance: Removing the regulatory oversight of one major market could potentially weaken corporate governance.

- Reduced competitive advantage: The reduced investor appeal could hinder the company's ability to compete for capital against its rivals.

Rio Tinto's Commitment to Shareholder Value

Rio Tinto's primary focus remains maximizing shareholder value. The dual listing strategy is seen as a key component of achieving this goal:

- Examples of decisions made to increase shareholder returns: Numerous initiatives, including strategic investments and efficient cost management, demonstrate the company's commitment to enhancing shareholder returns.

- Transparent communication with investors: The company actively engages with investors through regular reports and presentations, ensuring transparency in its operations and strategy.

- Active engagement with shareholder concerns: Rio Tinto proactively addresses shareholder concerns and feedback, fostering a constructive dialogue.

Conclusion

Rio Tinto's defense of its dual listing on the LSE and ASX rests on a solid foundation of strategic advantages and a commitment to maximizing shareholder value. The company has effectively refuted claims of inefficiency and highlighted the significant benefits of maintaining its presence in both key markets. The increased investor base, enhanced corporate governance, and strategic market positioning far outweigh the perceived costs. Understand the strategic rationale behind Rio Tinto's dual listing – it’s a carefully considered strategy aimed at ensuring long-term growth and maximizing returns for shareholders. To learn more about the benefits of Rio Tinto's dual listing and its broader financial strategy, visit the Rio Tinto investor relations website [Insert Link Here].

Featured Posts

-

Riot Fest 2025 Green Day Weezer Lead The Charge

May 02, 2025

Riot Fest 2025 Green Day Weezer Lead The Charge

May 02, 2025 -

Improved Fortnite Item Shop Enhanced Features For A Better Shopping Experience

May 02, 2025

Improved Fortnite Item Shop Enhanced Features For A Better Shopping Experience

May 02, 2025 -

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Ekonomik Etkiler

May 02, 2025

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Ekonomik Etkiler

May 02, 2025 -

21 Point Game Sets Stage For Colorados Matchup Against No 9 Texas Tech

May 02, 2025

21 Point Game Sets Stage For Colorados Matchup Against No 9 Texas Tech

May 02, 2025 -

Fortnite Update 34 20 Server Downtime And Whats New

May 02, 2025

Fortnite Update 34 20 Server Downtime And Whats New

May 02, 2025

Latest Posts

-

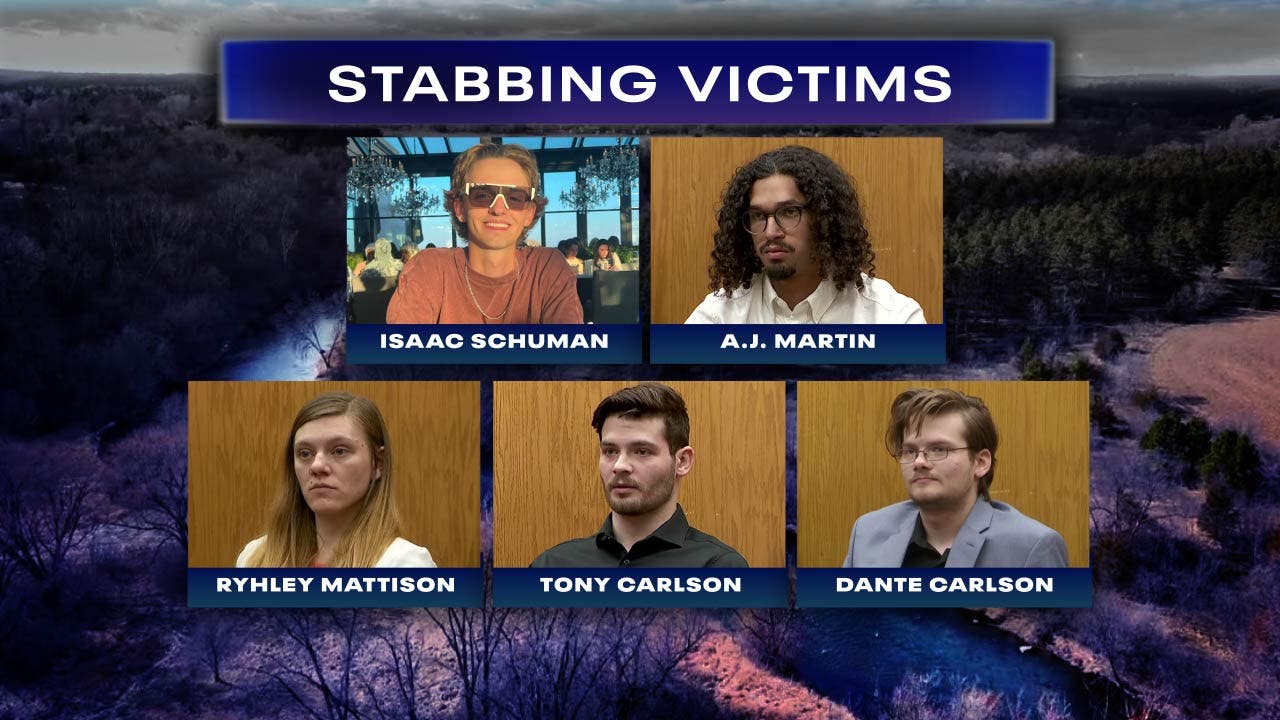

Nottingham Hospital Faces Backlash Over A And E Data Breach Affecting Stabbing Victims Families

May 10, 2025

Nottingham Hospital Faces Backlash Over A And E Data Breach Affecting Stabbing Victims Families

May 10, 2025 -

Nottingham Nhs Data Breach Families Outraged Over Access To A And E Records Of Stabbing Victims

May 10, 2025

Nottingham Nhs Data Breach Families Outraged Over Access To A And E Records Of Stabbing Victims

May 10, 2025 -

Valdo Calocane Nottingham Attack Survivor Shares Devastating Account

May 10, 2025

Valdo Calocane Nottingham Attack Survivor Shares Devastating Account

May 10, 2025 -

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 10, 2025

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 10, 2025 -

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025