Rio Tinto Retains Dual Listing Structure After Activist Challenge

Table of Contents

The Activist Challenge and its Arguments

The challenge to Rio Tinto’s dual listing stemmed from a group of activist investors who argued that maintaining two listings was inefficient and detrimental to shareholder value. Their primary concern revolved around the perceived complexities and increased costs associated with managing two separate listings.

-

Key Arguments Presented: The activists contended that a single listing would streamline operations, reduce administrative burdens, and potentially enhance trading liquidity. They also raised concerns about potential conflicts of interest arising from the dual listing structure and the added complexities in corporate governance.

-

Concerns Regarding Governance and Shareholder Value: A significant argument focused on the potential dilution of shareholder voting rights and the difficulties in ensuring consistent shareholder communication across two different jurisdictions. The activists believed a single listing would provide greater transparency and simplification of shareholder engagement.

-

Potential Benefits of a Single Listing: The proponents of a single listing highlighted the potential for improved share price performance, increased trading volume, and reduced compliance costs. They argued that these factors would ultimately contribute to maximizing shareholder value. This argument heavily utilized keywords like Rio Tinto shareholder activism, mining company governance, and dual listing disadvantages.

Rio Tinto's Justification for Retaining the Dual Listing

Rio Tinto, in response to the activist challenge, strongly defended its dual listing structure, emphasizing the strategic advantages it provides. The company argued that maintaining listings on both the London and Australian exchanges offers significant benefits.

-

Key Arguments for Retention: Rio Tinto highlighted the importance of maintaining access to both the London and Australian capital markets. This, they argued, provides a broader and more diverse investor base, crucial for accessing capital for large-scale projects and facilitating long-term growth.

-

Benefits Cited by Rio Tinto: The company cited improved access to a wider pool of investors, enhanced liquidity in both markets, and the advantages of complying with the regulatory requirements of two major financial centers as key reasons for retaining the dual listing. They also emphasized the importance of maintaining a strong presence in both the UK and Australian markets.

-

Strategic Considerations: The decision likely involved a complex assessment of the potential costs and benefits, taking into account regulatory hurdles, investor sentiment in both markets, and the company's overall strategic goals. This section prominently features keywords such as Rio Tinto investor relations, dual listing advantages, London Stock Exchange, and Australian Securities Exchange.

Analysis of the Impact on Shareholders and Investors

The decision to retain the Rio Tinto dual listing has significant implications for shareholders and investors, both in the short and long term. The effects vary depending on the type of investor and their investment horizon.

-

Potential Effects on Share Price and Trading Volume: While the immediate impact on the share price was relatively muted, the long-term effects remain to be seen. Some analysts predict increased trading volume and potentially improved price discovery due to the broader investor base.

-

Implications for Shareholder Voting Rights and Corporate Governance: The dual listing structure can present complexities in shareholder voting and corporate governance. Rio Tinto needs to ensure equitable treatment of shareholders across both listings to maintain investor confidence.

-

Impact on Investor Confidence and Future Investment Decisions: The activist challenge and Rio Tinto's response will undoubtedly influence investor sentiment and future investment decisions. The perceived success (or failure) in navigating this challenge will play a role in shaping investor perception of the company’s governance and strategic decision-making. Keywords like Rio Tinto share price, investor sentiment, stock market impact, and corporate governance best practices are strategically used in this analysis.

Future Implications and Outlook for Rio Tinto's Listing Structure

The long-term sustainability of Rio Tinto’s dual listing structure remains uncertain despite the recent successful defense. The company's decision will likely be revisited in the future, possibly due to evolving market conditions or new challenges.

-

Likelihood of Future Activist Challenges: It's plausible that future activist investors could target the dual listing structure again, particularly if the perceived inefficiencies persist or if market conditions change significantly.

-

Potential Changes in Market Conditions or Regulatory Frameworks: Shifts in global financial regulations or significant changes in the relative attractiveness of the London and Australian stock exchanges could influence Rio Tinto’s future listing strategy.

-

Possibility of a Future Shift Towards a Single Listing: While the current decision favors maintaining the dual structure, the possibility of a future shift towards a single listing remains. This decision might be driven by a desire for simplification, enhanced efficiency, or changes in the strategic landscape. Keywords such as Rio Tinto future strategy, long-term investment, market trends, and corporate restructuring are used to contextualize this future outlook.

Conclusion

Rio Tinto's decision to retain its Rio Tinto dual listing structure after facing activist pressure highlights the complexities involved in determining the optimal listing strategy for large multinational corporations. While the activists raised valid concerns regarding efficiency and governance, Rio Tinto successfully defended its position by emphasizing the benefits of maintaining access to diverse capital markets and a broader investor base. The long-term implications of this decision remain to be seen, and the debate surrounding the most efficient listing structure is likely to continue. Stay updated on the future of Rio Tinto's dual listing and its impact on the mining industry. Follow the debate surrounding Rio Tinto's dual listing structure and learn more about the implications of Rio Tinto's dual listing decision.

Featured Posts

-

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 02, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 02, 2025 -

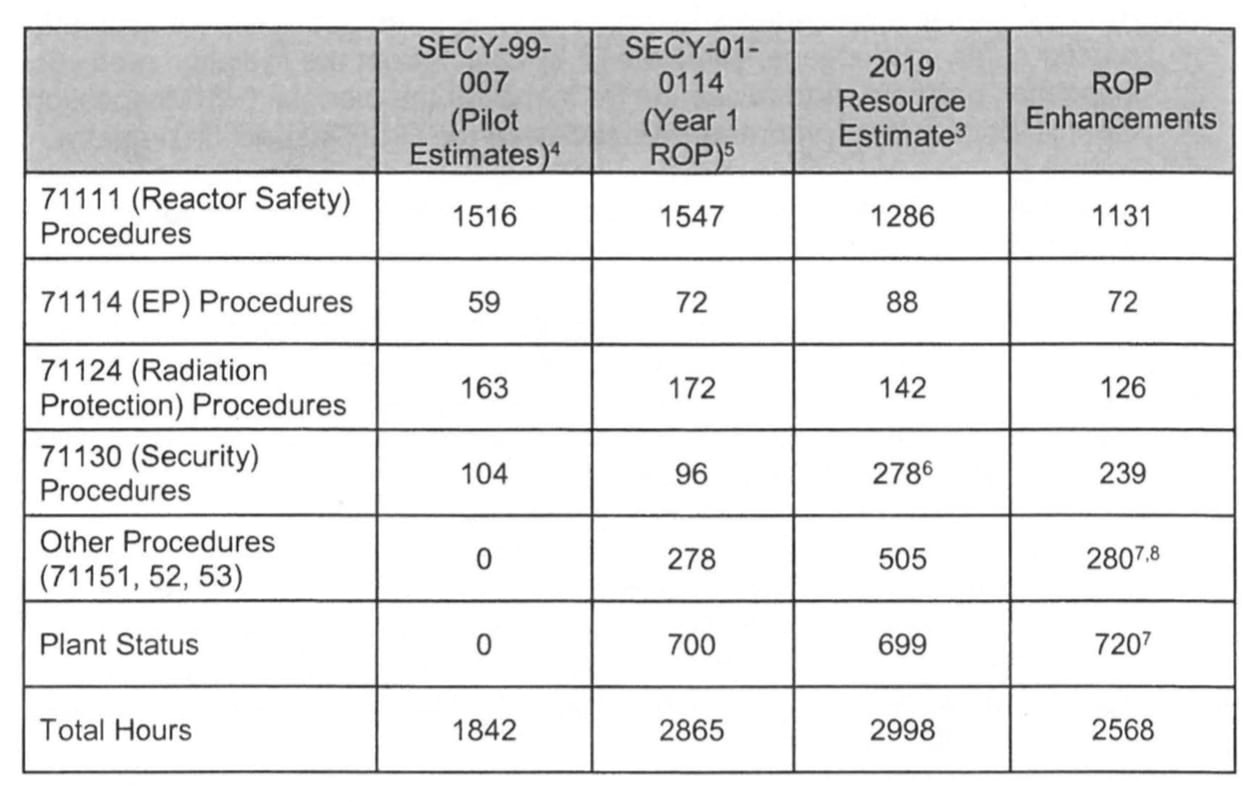

Understanding The Nrcs Review Process For Reactor Power Uprates

May 02, 2025

Understanding The Nrcs Review Process For Reactor Power Uprates

May 02, 2025 -

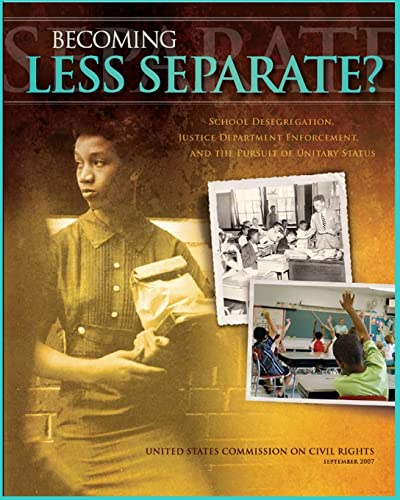

Justice Department Dismisses Longstanding School Desegregation Order Implications For The Future

May 02, 2025

Justice Department Dismisses Longstanding School Desegregation Order Implications For The Future

May 02, 2025 -

Euro 2025 Three Critical Questions For Sarina Wiegman And England

May 02, 2025

Euro 2025 Three Critical Questions For Sarina Wiegman And England

May 02, 2025 -

Presiden Erdogan Di Indonesia Kerja Sama Ekonomi Dan Pertahanan Ditingkatkan

May 02, 2025

Presiden Erdogan Di Indonesia Kerja Sama Ekonomi Dan Pertahanan Ditingkatkan

May 02, 2025

Latest Posts

-

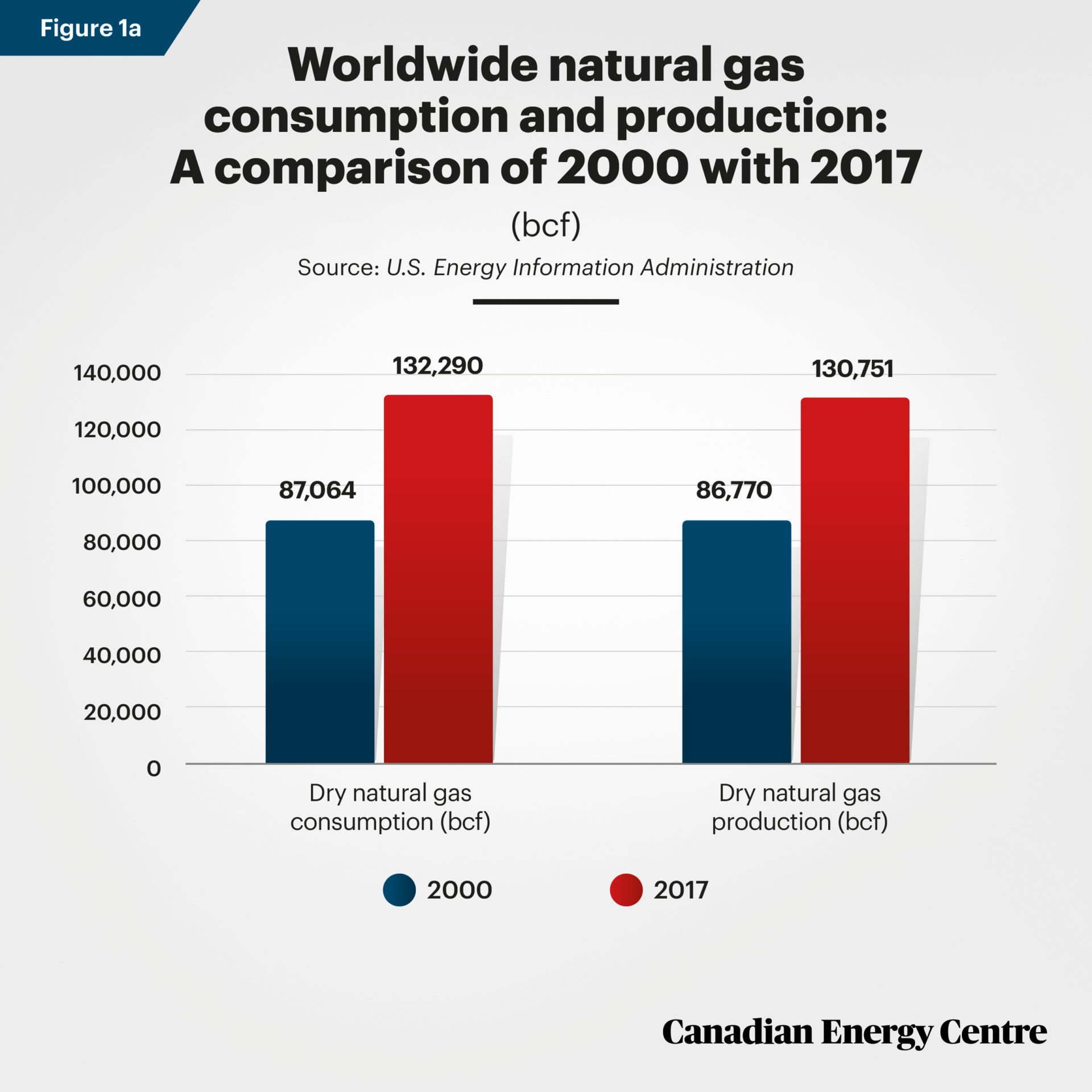

The Expanding Reach Of Canadas Leading Natural Gas Producer

May 12, 2025

The Expanding Reach Of Canadas Leading Natural Gas Producer

May 12, 2025 -

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 12, 2025

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 12, 2025 -

Ottawa Indigenous Group Signs Historic 10 Year Agreement

May 12, 2025

Ottawa Indigenous Group Signs Historic 10 Year Agreement

May 12, 2025 -

Growth Of Canadas Top Natural Gas Producer A Market Analysis

May 12, 2025

Growth Of Canadas Top Natural Gas Producer A Market Analysis

May 12, 2025 -

Telus Reports Higher Q1 Profit And Dividend Hike

May 12, 2025

Telus Reports Higher Q1 Profit And Dividend Hike

May 12, 2025