Rio Tinto's Dual Listing Survives Activist Campaign

Table of Contents

The Activist Campaign Against Rio Tinto's Dual Listing

The activist campaign against Rio Tinto's dual listing stemmed from concerns about efficiency and shareholder value. Investors argued that maintaining two separate listings increased administrative costs, complicated corporate governance, and potentially diluted shareholder influence. The key argument centered on the belief that a single listing would streamline operations, enhance transparency, and ultimately boost shareholder returns.

- Motivations: Increased administrative costs, perceived lack of efficiency, and a belief that a single listing would simplify decision-making and increase shareholder value.

- Key Activists: While specific investor names might not be publicly available due to confidentiality agreements, the campaign likely involved a coalition of institutional investors motivated by maximizing returns.

- Arguments:

- Higher corporate governance costs associated with maintaining two separate listings.

- Reduced shareholder value due to potential inefficiencies and complexities.

- Concerns about a lack of transparency and potential conflicts of interest arising from the dual structure.

- Timing and Scale: The campaign likely spanned several months, involving sustained pressure through various channels including direct engagement with the board, public statements, and potentially proxy fights.

Rio Tinto's Defense Strategy

Rio Tinto employed a robust defense strategy, highlighting the advantages of its dual listing. The company argued that maintaining listings in both London and Australia provided vital access to diverse capital markets, enhanced its global reach, and catered to a geographically dispersed shareholder base. Furthermore, they likely emphasized the strategic importance of maintaining a strong presence in both key markets.

- Key Arguments: Access to diverse investor pools in London and Australia, enhanced global reach and brand recognition, and a balanced shareholder base representing different investor preferences.

- Communication Strategy: Rio Tinto likely engaged in proactive communication with shareholders, issuing detailed press releases, hosting investor presentations, and publishing comprehensive financial reports highlighting the advantages of the dual listing structure. They may have also engaged in direct dialogue with key investors to address concerns.

- Actions Taken:

- Investor presentations emphasizing the benefits of the dual listing structure.

- Detailed financial reports demonstrating strong performance despite the dual listing.

- Proactive engagement with media to counter negative narratives.

- Concessions: While the exact details might remain confidential, Rio Tinto may have made some minor concessions, such as enhanced transparency measures or improvements in corporate governance to appease some of the concerns.

The Outcome: Survival of the Dual Listing Structure

Ultimately, Rio Tinto successfully defended its dual listing. The company retained both its London and Australian listings, demonstrating the strength of its arguments and the effectiveness of its defense strategy. This success likely reflects a combination of factors: the strategic advantages of the dual listing, the strength of Rio Tinto's performance, and the company's ability to effectively communicate its position to shareholders.

- Reasons for Success: Strong financial performance, effective communication strategy, and the inherent benefits of dual listings for a global company like Rio Tinto.

- Implications for Future Campaigns: This outcome sets a precedent, suggesting that well-justified dual listing structures can withstand activist pressure. Future campaigns will likely need to present more compelling arguments or leverage significant weaknesses in a company's governance or performance.

- Financial & Governance Factors: Strong financial results, consistent dividend payments, and a robust corporate governance framework likely contributed significantly to Rio Tinto's successful defense.

- Market Reaction: The immediate market reaction likely involved a period of uncertainty followed by stabilization, as investors digested the outcome and reassessed their positions.

Long-Term Implications for Rio Tinto and Dual Listings Globally

The successful defense of Rio Tinto's dual listing has broader implications for corporate governance and the future of dual listings globally. It suggests that the strategic benefits of dual listings, when effectively communicated and supported by strong performance, can outweigh concerns about administrative complexity.

- Impact on Corporate Governance: This case underscores the importance of clear and transparent communication between companies and shareholders in addressing concerns related to corporate structure.

- Impact on Other Companies: Other companies with dual listings may feel more confident in maintaining their structure, providing a case study demonstrating the resilience of such models against activist pressure.

- Future Trends: The interplay between shareholder activism and corporate structure is likely to continue evolving. Companies may need to be more proactive in demonstrating the value and benefits of their chosen structures to maintain investor confidence.

- Potential Scenarios:

- Increased scrutiny of dual listings by investors.

- Further refinement of corporate governance frameworks to address the concerns raised by activist investors.

- A potential shift toward single listings for some companies, but not a complete abandonment of dual listings.

Conclusion: Rio Tinto's Dual Listing: A Case Study in Shareholder Activism

The battle over Rio Tinto's dual listing provides a compelling case study in shareholder activism. While activist investors raised legitimate concerns about efficiency and shareholder value, Rio Tinto successfully defended its structure by highlighting the strategic advantages and demonstrating strong performance. This outcome underscores the importance of effective communication, robust corporate governance, and a clear understanding of the benefits of the chosen corporate structure. What are your thoughts on the future of Rio Tinto's dual listing strategy? Share your insights in the comments below!

Featured Posts

-

Toppins 21 Points Fuel Colorados Trip To No 9 Texas Tech

May 02, 2025

Toppins 21 Points Fuel Colorados Trip To No 9 Texas Tech

May 02, 2025 -

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025 -

Newsround Broadcast Times Bbc Two Hd Tv Listings

May 02, 2025

Newsround Broadcast Times Bbc Two Hd Tv Listings

May 02, 2025 -

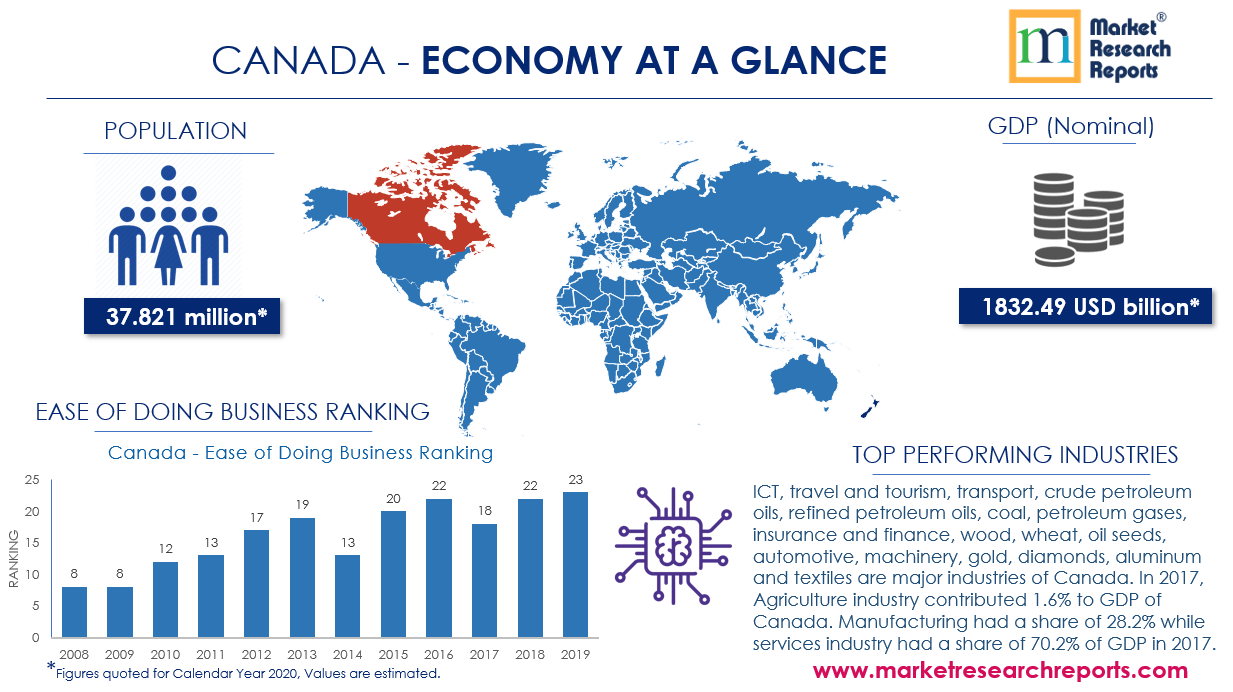

Canadas Economy David Dodge Predicts Ultra Low Growth In 2024

May 02, 2025

Canadas Economy David Dodge Predicts Ultra Low Growth In 2024

May 02, 2025 -

Why Alfonso Cuaron Took Over Examining The Directorial Shift In Harry Potter 3

May 02, 2025

Why Alfonso Cuaron Took Over Examining The Directorial Shift In Harry Potter 3

May 02, 2025

Latest Posts

-

5 Must Read Stephen King Books For True Fans

May 10, 2025

5 Must Read Stephen King Books For True Fans

May 10, 2025 -

Legendarniy Stiven Fray Udostoen Rytsarskogo Zvaniya Ot Korolya Charlza Iii

May 10, 2025

Legendarniy Stiven Fray Udostoen Rytsarskogo Zvaniya Ot Korolya Charlza Iii

May 10, 2025 -

Netflix Adaptira Kultov Roman Na Stivn King Vsichko Koeto Znaem

May 10, 2025

Netflix Adaptira Kultov Roman Na Stivn King Vsichko Koeto Znaem

May 10, 2025 -

Rytsarstvo Stivena Fraya Istoriya I Znachenie Sobytiya

May 10, 2025

Rytsarstvo Stivena Fraya Istoriya I Znachenie Sobytiya

May 10, 2025 -

Stephen Kings 2024 Movie Slate More Than Just The Monkey

May 10, 2025

Stephen Kings 2024 Movie Slate More Than Just The Monkey

May 10, 2025