Riot Platforms (NASDAQ: RIOT): 52-Week Low And Future Outlook

Table of Contents

Analyzing Riot Platforms' Current 52-Week Low

Impact of the Bear Market on Bitcoin Mining Stocks

The broader cryptocurrency market downturn has significantly impacted Bitcoin mining companies, including Riot Platforms. The decline in Bitcoin's price, a crucial factor for Bitcoin mining profitability, has been a major contributor to RIOT's current 52-week low.

- Bitcoin Price Decline: The sharp decrease in Bitcoin's value directly reduces the revenue generated from mining operations.

- Increased Energy Costs: Rising energy prices, a significant expense for Bitcoin mining, further squeeze profit margins.

- Regulatory Uncertainty: Evolving regulations surrounding cryptocurrency mining in different jurisdictions add uncertainty and potential operational challenges.

These combined factors have created a challenging environment for Bitcoin mining stocks, impacting investor sentiment and pushing RIOT's price down.

Riot Platforms' Financial Performance and Key Metrics

Examining Riot Platforms' recent financial reports reveals key insights into its performance. While precise figures fluctuate, analyzing metrics such as mining hash rate, Bitcoin production, and operating costs provides a clearer picture.

- Mining Hash Rate: This metric indicates the company's computing power and its ability to compete for Bitcoin mining rewards. A strong hash rate suggests greater potential for Bitcoin production.

- Bitcoin Production: The amount of Bitcoin mined directly reflects the company's revenue generation capacity. Trends in Bitcoin production over time are vital for evaluating performance.

- Operating Costs: Analyzing operating costs, including energy consumption and maintenance, is crucial for understanding profitability. A reduction in operating costs can significantly improve margins.

Comparing these metrics across quarters allows for a comprehensive assessment of Riot Platforms' operational efficiency and financial health. Visual representations, such as charts and graphs showing trends in these key metrics, will offer a clear understanding of the company’s recent performance.

Debt Levels and Capital Structure

Riot Platforms' debt levels and its ability to manage financial obligations during this downturn are critical considerations.

- Debt-to-Equity Ratio: This ratio indicates the company's leverage and its ability to service its debt. A high ratio may signify increased financial risk.

- Liquidity Position: Analyzing Riot's cash reserves and short-term liabilities highlights its ability to meet immediate financial obligations.

- Potential for Further Financing: The company's access to additional funding, through equity offerings or debt financing, is crucial for navigating challenging market conditions.

Factors Influencing Riot Platforms' Future Outlook

Bitcoin Price Prediction and its Correlation to RIOT's Stock Price

The future price of Bitcoin is intrinsically linked to Riot Platforms' valuation. Various scenarios exist:

- Bullish Scenario: A significant rise in Bitcoin's price would likely boost RIOT's stock price considerably, potentially leading to substantial gains for investors.

- Bearish Scenario: Continued downward pressure on Bitcoin could further depress RIOT's stock price, increasing the risk for investors.

- Neutral Scenario: A period of sideways trading in Bitcoin might result in limited price movement for RIOT, presenting a period of consolidation.

Expert opinions and market analyses offer valuable insights into potential Bitcoin price movements and their impact on RIOT.

Expansion Plans and Technological Advancements

Riot Platforms' future growth hinges on expansion plans and technological advancements.

- New Mining Facilities: The development of new mining facilities increases the company's hash rate and Bitcoin production capacity.

- Technological Upgrades (ASIC Upgrades): Investing in more efficient mining hardware (ASICs) enhances profitability by lowering operating costs and increasing hash rate.

- Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions can provide access to new technologies, resources, or markets, bolstering growth.

- Sustainability Initiatives: A commitment to environmentally responsible mining practices can improve the company's image and attract environmentally conscious investors.

Regulatory Landscape and its Impact on Bitcoin Mining

The regulatory environment surrounding Bitcoin mining is constantly evolving and significantly impacts Riot Platforms.

- Favorable Regulations: Supportive regulations could boost the industry and benefit RIOT's operations.

- Unfavorable Regulations: Restrictive regulations could increase operational costs or limit expansion opportunities.

- Future Regulatory Changes: Anticipating and adapting to potential future regulatory changes is crucial for long-term success.

Assessing the Risk and Reward of Investing in Riot Platforms at its 52-Week Low

Risk Assessment

Investing in Riot Platforms, or any cryptocurrency-related stock, carries significant risk.

- Market Volatility: The cryptocurrency market is highly volatile, making RIOT's stock price susceptible to sharp fluctuations.

- Regulatory Uncertainty: Changes in regulations could negatively impact operations and profitability.

- Operational Challenges: Unexpected technical issues or disruptions could affect Bitcoin production and profitability.

- Bitcoin Price Fluctuations: The direct correlation between Bitcoin's price and RIOT's valuation creates inherent risk.

Reward Potential

Despite the risks, investing in RIOT at its current price offers potential rewards.

- Price Appreciation: If Bitcoin's price recovers, RIOT's stock price is likely to appreciate significantly.

- Long-Term Growth Potential: The Bitcoin mining industry is expected to experience long-term growth, presenting opportunities for substantial returns.

Conclusion: Riot Platforms (NASDAQ: RIOT) – A Potential Long-Term Investment?

Riot Platforms (NASDAQ: RIOT) currently sits at a 52-week low, primarily due to the bear market impacting the Bitcoin mining industry. While significant risks exist, including market volatility and regulatory uncertainty, the potential for long-term growth remains considerable. The company's expansion plans, technological advancements, and the inherent potential of the Bitcoin mining industry contribute to this outlook. Ultimately, investing in Riot Platforms requires careful consideration of your risk tolerance and investment strategy. Conduct thorough due diligence, analyze the factors discussed above, and assess your own comfort level with the inherent volatility before making a decision. The current 52-week low might represent a compelling entry point for those with a long-term outlook on the growth potential within the Bitcoin mining sector. Remember to always conduct thorough research before investing in any security.

Featured Posts

-

Improved Fortnite Item Shop Enhanced Features For A Better Shopping Experience

May 02, 2025

Improved Fortnite Item Shop Enhanced Features For A Better Shopping Experience

May 02, 2025 -

Carrie Actress Priscilla Pointer Passes Away A Tribute

May 02, 2025

Carrie Actress Priscilla Pointer Passes Away A Tribute

May 02, 2025 -

When Is Sabrina Carpenter Coming To Fortnite Confirmed Date And Time

May 02, 2025

When Is Sabrina Carpenter Coming To Fortnite Confirmed Date And Time

May 02, 2025 -

2027 M Sanchajuje Duris Atvers Haris Poterio Teminis Parkas

May 02, 2025

2027 M Sanchajuje Duris Atvers Haris Poterio Teminis Parkas

May 02, 2025 -

A Dallas Legend Lost Remembering The 80s Tv Icon

May 02, 2025

A Dallas Legend Lost Remembering The 80s Tv Icon

May 02, 2025

Latest Posts

-

Cheap Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025

Cheap Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025 -

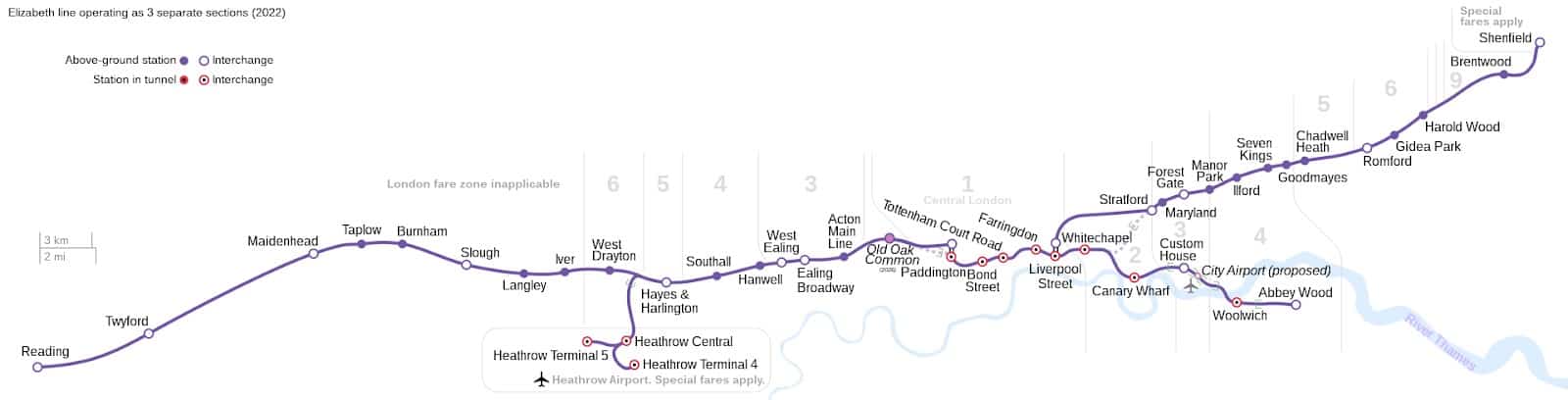

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 10, 2025

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 10, 2025 -

Compare Elizabeth Arden Skincare Prices Walmart Vs Others

May 10, 2025

Compare Elizabeth Arden Skincare Prices Walmart Vs Others

May 10, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025 -

How To Get Elizabeth Arden Skincare At Walmart Prices

May 10, 2025

How To Get Elizabeth Arden Skincare At Walmart Prices

May 10, 2025