Ripple SEC Lawsuit: Will Victory Mean A US XRP ETF? Today's XRP News

Table of Contents

The Ripple SEC Lawsuit: A Summary and Key Implications

Understanding the Core Dispute

The core of the SEC's case against Ripple Labs centers on whether XRP, Ripple's native cryptocurrency, constitutes an unregistered security under US securities laws. The SEC argues that Ripple's sales of XRP, particularly its programmatic sales to institutional investors and retail investors, violated these laws, applying the Howey test to define XRP as a security. Ripple counters that XRP is a decentralized digital asset, akin to Bitcoin or Ether, and therefore not subject to securities regulations. The heart of the debate hinges on the level of centralization and control Ripple maintains over XRP.

Key Developments and Timeline

The lawsuit, filed in December 2020, has seen numerous significant developments. Key events include:

- 2020: The SEC files its complaint against Ripple Labs, its CEO Brad Garlinghouse, and its co-founder Chris Larsen.

- 2021-2022: Extensive legal briefs and discovery processes unfold. Both sides present their arguments and evidence.

- July 2023: Judge Analisa Torres issues a partial summary judgment, ruling that XRP sales on public exchanges were not securities, but programmatic sales to institutional investors might be. This ruling is a complex and nuanced decision that has led to much debate within the crypto community.

Potential Outcomes and Their Impact on XRP

The Ripple SEC lawsuit could have three primary outcomes:

- Ripple Wins: A complete victory for Ripple could lead to a significant surge in XRP's price, boosted by increased investor confidence and the potential for wider adoption. It would also pave the way for a smoother path toward SEC approval for an XRP ETF.

- SEC Wins: An SEC victory would likely result in a significant drop in XRP's price, potential delisting from major exchanges, and a chilling effect on innovation in the crypto space. The possibility of an XRP ETF would be significantly diminished.

- Settlement: A settlement between Ripple and the SEC is also possible. The terms of any settlement would significantly impact XRP's future, potentially resulting in a mixed market reaction. The outcome of a settlement on the potential for an XRP ETF would be unpredictable, dependent on the specifics.

Expert opinions vary widely, with some analysts predicting a substantial price increase for XRP in the event of a Ripple victory, while others remain cautious, citing ongoing regulatory uncertainty.

The Path to a US XRP ETF: Regulatory Hurdles and Opportunities

SEC Approval Process for Crypto ETFs

The SEC's approval process for cryptocurrency ETFs is notoriously rigorous. Key regulatory concerns include:

- Market Manipulation: Preventing artificial inflation or deflation of the ETF's underlying asset.

- Investor Protection: Ensuring adequate safeguards against fraud and market manipulation.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Compliance with regulations designed to prevent illicit financial activities.

- Custody and Security: Ensuring safe and secure storage of the underlying cryptocurrency assets.

How a Ripple Victory Could Influence SEC Decision-Making

A Ripple victory could significantly influence the SEC's approach to XRP and other cryptocurrencies. A clear legal definition of XRP as a non-security would alleviate a major hurdle for ETF approval. It would establish a legal precedent, potentially making it easier for other cryptocurrencies to navigate the regulatory landscape and seek ETF listing.

Market Demand for an XRP ETF

The demand for an XRP ETF is substantial. An XRP ETF would provide a regulated and accessible investment vehicle for institutional investors, boosting XRP's trading volume and liquidity. This increased institutional adoption could propel XRP into the mainstream financial markets.

Today's XRP News: Market Sentiment and Price Analysis

Current XRP Market Performance

As of [Insert Date], XRP is trading at [Insert Current Price] with a 24-hour trading volume of [Insert Trading Volume]. [Insert brief summary of recent price movements – positive or negative, with supporting evidence].

Analyst Predictions and Market Sentiment

Market sentiment towards XRP is currently [Insert description of market sentiment – bullish, bearish, neutral]. Many analysts believe that a Ripple victory would significantly impact XRP's price and market capitalization. [Include links to relevant articles and analyses]. [Optional: Include a chart or graph showing XRP's price performance over a relevant period].

Conclusion: Will Victory Lead to an XRP ETF? A Call to Action

The Ripple SEC lawsuit's outcome will profoundly impact XRP's future and the potential for a US XRP ETF. A Ripple victory would significantly increase the likelihood of ETF approval, unlocking substantial growth potential for XRP. However, even with a positive outcome, regulatory hurdles remain. The ongoing legal battle and its implications for the crypto space remain crucial to monitor. Follow the latest developments in the Ripple SEC lawsuit and the potential for an XRP ETF to stay informed about this pivotal moment in the cryptocurrency market.

Featured Posts

-

Is Mo Salahs Liverpool Future In Jeopardy Contract Negotiations Explained

May 02, 2025

Is Mo Salahs Liverpool Future In Jeopardy Contract Negotiations Explained

May 02, 2025 -

The Future Of Riot Platforms Stock Riot Predictions And Projections

May 02, 2025

The Future Of Riot Platforms Stock Riot Predictions And Projections

May 02, 2025 -

Voter Turnout In Florida And Wisconsin A Window Into The Shifting Political Landscape

May 02, 2025

Voter Turnout In Florida And Wisconsin A Window Into The Shifting Political Landscape

May 02, 2025 -

Fortnite Unveils New Icon Skin Everything We Know

May 02, 2025

Fortnite Unveils New Icon Skin Everything We Know

May 02, 2025 -

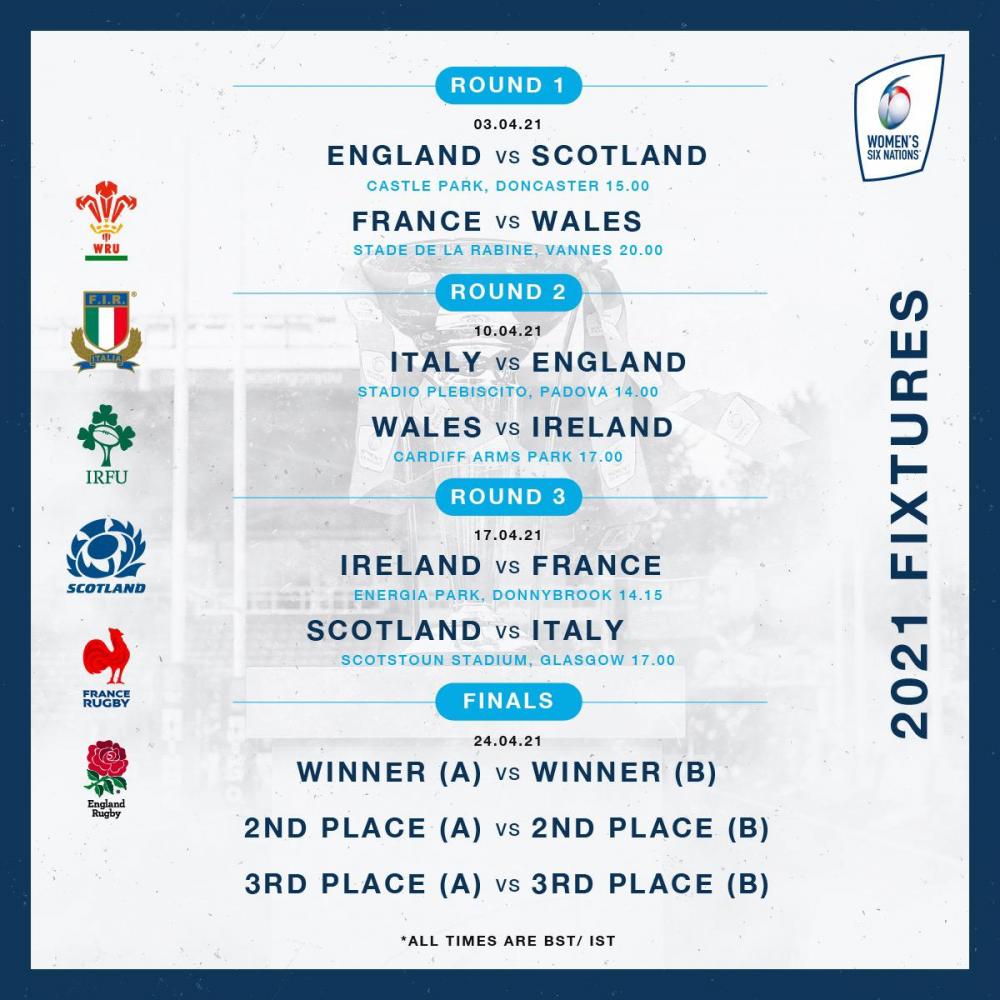

Ramos And Frances Six Nations Conquest Scotlands Defeat

May 02, 2025

Ramos And Frances Six Nations Conquest Scotlands Defeat

May 02, 2025

Latest Posts

-

The 10 Best Film Noir Movies Ever Made

May 10, 2025

The 10 Best Film Noir Movies Ever Made

May 10, 2025 -

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025 -

Top 10 Must See Film Noir Movies

May 10, 2025

Top 10 Must See Film Noir Movies

May 10, 2025 -

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025 -

10 Essential Film Noir Movies To Watch

May 10, 2025

10 Essential Film Noir Movies To Watch

May 10, 2025