Ripple's Position As Fourth Largest Crypto: A Path To Financial Freedom?

Table of Contents

Ripple's Market Position and Technological Advantages

Understanding Ripple and XRP

Ripple is a real-time gross settlement system (RTGS), currency exchange, and remittance network created in 2011. Unlike Bitcoin, which focuses on peer-to-peer transactions, or Ethereum, which emphasizes smart contracts, Ripple's primary function is facilitating fast and efficient cross-border payments for financial institutions. XRP is Ripple's native cryptocurrency, used to power transactions on the RippleNet network.

- RippleNet: A global network connecting banks and financial institutions, enabling faster and cheaper international money transfers.

- Speed and Scalability: XRP transactions are significantly faster and more scalable than those on many other blockchain networks, handling thousands of transactions per second.

- Low Transaction Fees: Compared to other cryptocurrencies, XRP transactions typically involve lower fees, making it a more cost-effective solution for large-scale payments.

Analyzing Ripple's Market Capitalization

Ripple's substantial market capitalization is a result of several factors, including its wide adoption by financial institutions, its focus on practical applications, and the increasing demand for faster, cheaper cross-border payments. However, its price remains volatile, subject to market fluctuations and regulatory news.

- Market Cap Fluctuations: XRP's market capitalization has experienced significant swings, influenced by overall crypto market trends, regulatory developments, and news related to Ripple's partnerships and legal battles.

- Trading Volume: The daily trading volume of XRP provides an indicator of market activity and investor interest. Analyzing this data offers insights into current market sentiment.

- Price Volatility: Like most cryptocurrencies, XRP’s price is highly volatile and subject to rapid changes. Investors should be prepared for potential significant losses.

Ripple's Partnerships and Adoption

Ripple's success is largely attributed to its strategic partnerships with major financial institutions globally. These collaborations demonstrate the real-world application of its technology and its growing acceptance within the traditional financial sector.

- Key Partnerships: Ripple boasts collaborations with numerous banks and payment providers worldwide, facilitating faster and cheaper international transactions.

- Growing Adoption: More financial institutions are integrating Ripple's technology into their systems, signaling increased trust and adoption within the industry.

- Real-world Use Cases: Ripple's technology is actively used for cross-border payments, demonstrating its practical value beyond speculation.

The Potential for Financial Freedom with Ripple

Investment Opportunities and Risks

Investing in XRP presents the potential for significant returns, especially if Ripple continues its expansion and adoption within the financial sector. However, it's crucial to acknowledge the substantial risks involved.

- Potential Returns: Past performance doesn't guarantee future results, but the potential for significant gains is undeniable, especially in a bullish crypto market.

- Market Volatility: The cryptocurrency market is highly volatile. XRP’s price can fluctuate dramatically in short periods, leading to substantial losses.

- Risk Management: Diversification is crucial. Don't invest more than you can afford to lose, and consider a diversified investment portfolio.

Ripple's Role in Decentralized Finance (DeFi)

While primarily focused on institutional payments, Ripple's potential role in the DeFi space remains an area of ongoing development. Its potential involvement could expand access to financial services and further enhance its impact on global finance.

- Future DeFi Integration: While Ripple's primary focus isn't DeFi, future developments could see increased integration with decentralized applications and protocols.

- Improved Financial Accessibility: Through DeFi integration, Ripple could potentially offer more accessible financial services to underserved populations globally.

- Expanding Ecosystem: Partnerships and collaborations within the DeFi ecosystem could further enhance Ripple's capabilities and market reach.

Ripple and Global Remittances

Ripple's technology offers a solution to the challenges of costly and slow international money transfers. By significantly reducing transaction times and fees, Ripple aims to increase financial accessibility globally.

- Reduced Transaction Costs: Ripple's technology helps reduce the fees associated with traditional remittance services, making it more affordable for individuals and businesses.

- Faster Transfer Speeds: Cross-border payments can be processed significantly faster using Ripple's network, accelerating the transfer of funds.

- Increased Financial Inclusion: Lower costs and faster transfers can enhance financial inclusion for people in developing countries who rely on remittances.

Challenges and Regulatory Concerns Facing Ripple

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple significantly impacts investor confidence and the price of XRP. The outcome of this legal battle could have profound consequences for the future of the company and its cryptocurrency.

- Legal Uncertainty: The lawsuit creates uncertainty regarding XRP's regulatory status in the United States.

- Price Volatility: The lawsuit has contributed to significant price volatility for XRP.

- Investor Sentiment: Negative news related to the lawsuit can negatively impact investor sentiment and potentially lead to sell-offs.

Regulatory Uncertainty in the Crypto Market

The regulatory landscape for cryptocurrencies remains uncertain globally, posing challenges for Ripple and other companies in the industry. Navigating these regulatory hurdles is crucial for Ripple’s long-term success.

- Varying Regulations: Different countries have vastly different approaches to regulating cryptocurrencies, creating a complex regulatory environment.

- Compliance Challenges: Adhering to diverse regulatory frameworks across different jurisdictions poses a significant challenge for global crypto companies.

- Future Regulatory Changes: The regulatory landscape is constantly evolving, requiring companies like Ripple to adapt to new rules and regulations.

Conclusion

Ripple's position as fourth largest crypto presents an intriguing case study in the intersection of traditional finance and decentralized technology. Its technological advantages, particularly in cross-border payments, offer substantial potential for revolutionizing the global financial system and increasing financial freedom. However, the ongoing SEC lawsuit and the inherent volatility of the cryptocurrency market highlight the significant risks involved. While Ripple's innovative technology and strategic partnerships demonstrate a clear path towards real-world adoption, investors must carefully weigh the potential rewards against the substantial risks. While Ripple's position as fourth largest crypto presents intriguing possibilities, careful consideration of the risks associated with cryptocurrency investments is paramount before making any decisions. Do your own thorough research before investing in XRP or any other cryptocurrency.

Featured Posts

-

Ngjarje E Rende Ne Ceki Sulm Me Thike Dy Viktima Ne Qender Tregtare

May 02, 2025

Ngjarje E Rende Ne Ceki Sulm Me Thike Dy Viktima Ne Qender Tregtare

May 02, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 02, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 02, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025 -

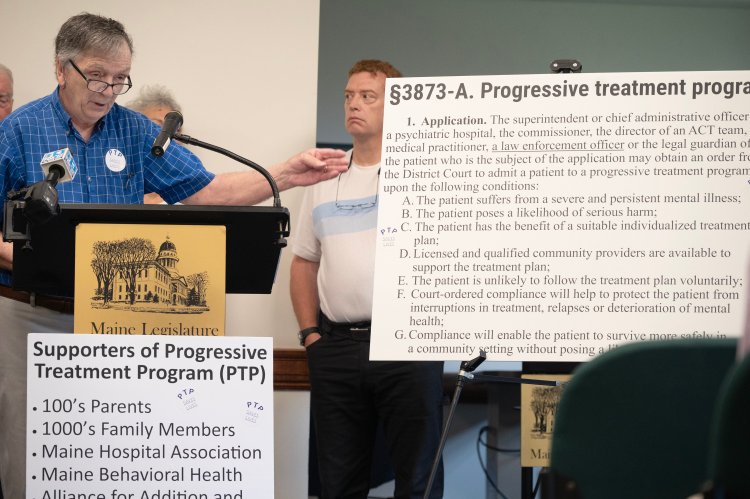

High Cost And Stigma Why Mental Healthcare Remains Underutilized

May 02, 2025

High Cost And Stigma Why Mental Healthcare Remains Underutilized

May 02, 2025 -

Norfolk Mps Supreme Court Challenge Nhs Gender Identity Dispute

May 02, 2025

Norfolk Mps Supreme Court Challenge Nhs Gender Identity Dispute

May 02, 2025

Latest Posts

-

Ocasio Cortez Calls Out Fox News Host For Trump Support

May 10, 2025

Ocasio Cortez Calls Out Fox News Host For Trump Support

May 10, 2025 -

Fox News Jesse Watters Hypocrite Label After Wifes Infidelity Joke

May 10, 2025

Fox News Jesse Watters Hypocrite Label After Wifes Infidelity Joke

May 10, 2025 -

Behind The Scenes With Jeanine Pirro Insights Into Her Fox News Career

May 10, 2025

Behind The Scenes With Jeanine Pirro Insights Into Her Fox News Career

May 10, 2025 -

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025 -

Jesse Watters Faces Backlash Wife Cheating Joke Sparks Hypocrisy Claims

May 10, 2025

Jesse Watters Faces Backlash Wife Cheating Joke Sparks Hypocrisy Claims

May 10, 2025