Rockwell Automation Earnings Beat Expectations: Stock Surge And Market Movers

Table of Contents

Exceeding Expectations: A Detailed Look at Rockwell Automation's Financial Results

Rockwell Automation's Q[Quarter] financial results significantly outperformed analyst predictions, signaling robust growth and a positive outlook for the industrial automation sector. Let's examine the key performance indicators:

Key Performance Indicators (KPIs):

-

Revenue Growth: Rockwell Automation reported a [Specific Percentage]% increase in revenue compared to the same quarter last year, reaching $[Specific Dollar Amount] in total revenue. This substantial growth surpasses analyst projections of [Analyst Predicted Percentage]%. This strong revenue growth indicates increased demand for their automation solutions.

-

Earnings Per Share (EPS): The company reported an EPS of $[Specific Dollar Amount], exceeding analyst estimates of $[Analyst Predicted EPS] by $[Difference in EPS]. This positive EPS surprise reflects the company's efficient operations and strong profitability.

-

Order Backlog: The order backlog stands at $[Specific Dollar Amount], demonstrating continued demand and a strong pipeline of future projects. This healthy backlog indicates sustained revenue growth in upcoming quarters.

-

Profit Margins: Operating profit margins improved to [Specific Percentage]%, up from [Previous Quarter Percentage]%, showcasing enhanced operational efficiency and cost management. Net profit margins also saw a positive increase, reaching [Specific Percentage]%. This improvement is largely attributed to efficient cost control and increased sales volume.

-

Bullet Points:

- The success of their integrated architecture platform, particularly within the automotive and food and beverage sectors, significantly contributed to revenue growth.

- No significant one-time events negatively impacted the results; however, a successful strategic partnership with [Partner Company Name] contributed positively.

- The company issued positive guidance for the next quarter, projecting revenue growth between [Percentage Range]% and anticipating continued strong EPS performance.

Market Reaction and Stock Price Surge: Analyzing Investor Sentiment

The market reacted swiftly and positively to Rockwell Automation's better-than-expected earnings announcement.

Immediate Market Response:

- Immediately following the earnings release, Rockwell Automation's stock price surged by [Specific Percentage]%, reaching a new high of $[Stock Price].

- Trading volume increased significantly, reflecting heightened investor interest and activity. The increased volatility is a natural response to such positive news.

- Several prominent investment firms upgraded their ratings for Rockwell Automation stock, citing strong financial performance and positive future outlook as their rationale.

Long-Term Implications for Investors:

-

The exceeding performance has significantly enhanced Rockwell Automation's valuation, indicating a positive view of the company's long-term growth potential.

-

This strong performance strengthens investor confidence in the industrial automation sector as a whole, potentially driving investment in other related companies.

-

Rockwell Automation's strategic focus on digital transformation and Industry 4.0 technologies positions them for continued growth and competitiveness in the evolving industrial landscape.

-

Bullet Points:

- Investor sentiment was overwhelmingly positive, driven by the exceeding EPS, robust revenue growth, and confident future guidance.

- Compared to competitors, Rockwell Automation’s performance significantly outperformed many key players in the industrial automation market.

- Potential risks include global economic uncertainty and supply chain disruptions; however, the company's strong order backlog mitigates some of these concerns.

Driving Forces Behind Rockwell Automation's Success: Understanding the Underlying Factors

Rockwell Automation's exceptional performance is underpinned by several key factors:

Strong Demand in Key Sectors:

- The automotive, food and beverage, and pharmaceutical industries are driving significant growth for Rockwell Automation. Increased automation adoption in these sectors is a major contributing factor.

- The ongoing trend of automation and digital transformation across various industries fuels consistent demand for Rockwell Automation's advanced control and information solutions.

Innovative Product Portfolio and Technological Advancements:

-

Rockwell Automation's continuous investment in research and development has resulted in innovative product offerings that meet the evolving needs of its customers. Their focus on providing integrated solutions is a key differentiator.

-

The company's commitment to digital transformation, including the implementation of cloud-based solutions and advanced analytics, is enhancing efficiency and driving growth.

-

Bullet Points:

- The recent launch of their new [Product Name] automation system has been a significant driver of revenue growth.

- Strategic partnerships and acquisitions have broadened Rockwell Automation’s technological capabilities and market reach.

- Their ongoing commitment to sustainability and the development of energy-efficient automation solutions is attracting environmentally conscious customers.

Conclusion:

Rockwell Automation's better-than-expected Q[Quarter] earnings have resulted in a significant stock surge, driven by strong performance across key indicators, increased demand in key sectors, and the company's successful innovation strategy. This exceeding performance signifies the robustness of the industrial automation sector and highlights Rockwell Automation’s strategic position within it. The positive market reaction underscores investor confidence in the company's future growth potential.

Call to Action: Stay informed about future developments in Rockwell Automation's performance and the wider industrial automation market. Follow our updates to stay ahead on the latest news regarding Rockwell Automation earnings and its influence as a market mover in industrial automation.

Featured Posts

-

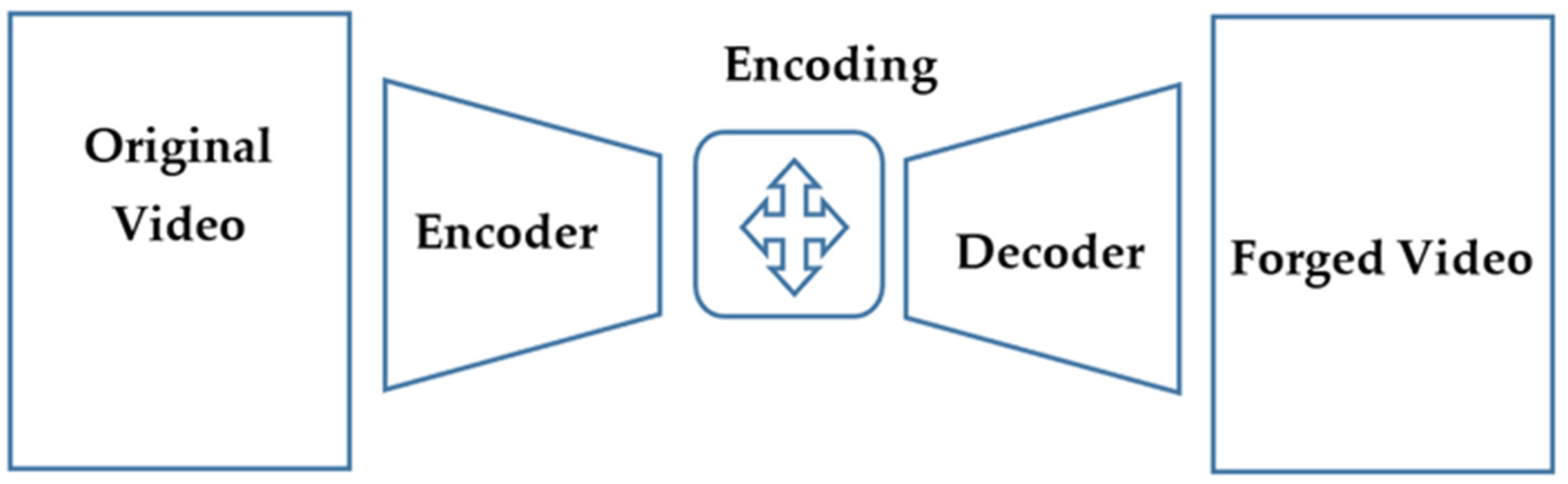

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025 -

Valerio Therapeutics 2024 Financial Report Publication Delayed And Financial Statement Approval

May 17, 2025

Valerio Therapeutics 2024 Financial Report Publication Delayed And Financial Statement Approval

May 17, 2025 -

What Angel Reese Said After Playing The Chicago Sky

May 17, 2025

What Angel Reese Said After Playing The Chicago Sky

May 17, 2025 -

Barcelonas And Arsenals Pursuit Of Angelo Stiller A Closer Look

May 17, 2025

Barcelonas And Arsenals Pursuit Of Angelo Stiller A Closer Look

May 17, 2025 -

Ray Epps Vs Fox News A Deep Dive Into The January 6th Defamation Case

May 17, 2025

Ray Epps Vs Fox News A Deep Dive Into The January 6th Defamation Case

May 17, 2025