Rockwell Automation's Strong Earnings Drive Market Gains

Table of Contents

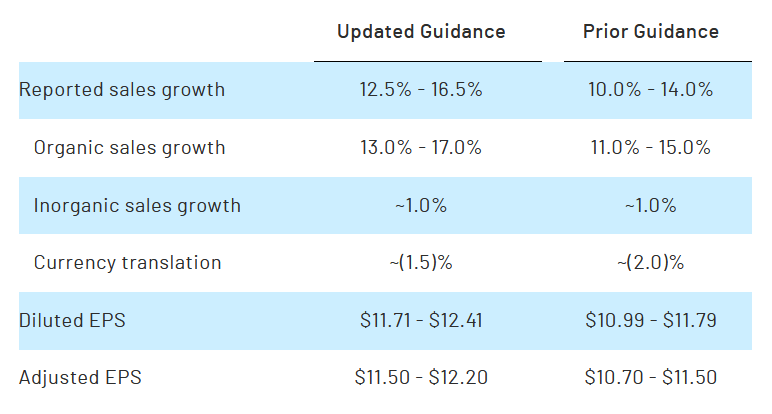

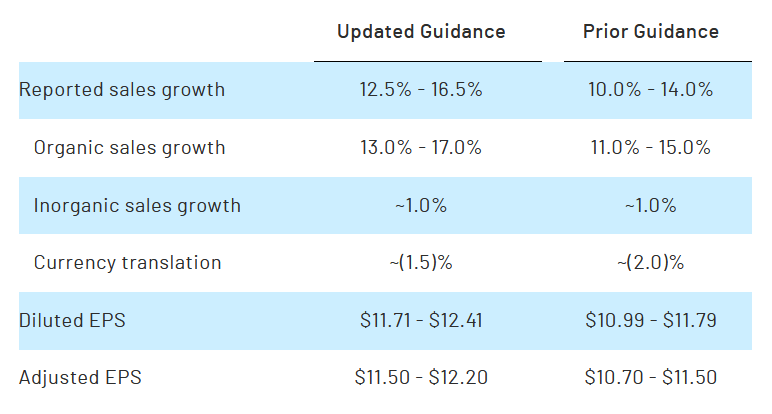

Record-Breaking Revenue and Profitability

Rockwell Automation's latest financial report showcases record-breaking revenue and profitability, exceeding analyst expectations and demonstrating the company's strong market position. This exceptional performance is a testament to the increasing demand for advanced automation solutions and Rockwell Automation's ability to capitalize on this trend. Let's examine the numbers:

- Revenue Growth: Rockwell Automation reported a [Insert Percentage]% year-over-year increase in revenue, reaching $[Insert Revenue Figure]. This surpasses the previous quarter's performance and demonstrates consistent growth.

- Profit Margin Expansion: The company's operating profit margin increased to [Insert Percentage]%, reflecting improved operational efficiency and strong pricing power. This translates into a significant boost in net income, reaching $[Insert Net Income Figure].

- Revenue Breakdown: [Insert a brief breakdown of revenue by segment, e.g., "The majority of revenue came from the industrial automation segment, followed by significant contributions from the lifecycle services division."]

- Analyst Expectations: The reported earnings significantly exceeded analyst consensus estimates, further solidifying investor confidence in the company's future prospects.

Key Drivers of Rockwell Automation's Success

Several factors contributed to Rockwell Automation's outstanding performance. The ongoing digital transformation across various industries, coupled with the increasing adoption of Industry 4.0 principles, is fueling demand for smart manufacturing solutions. Rockwell Automation is expertly positioned to benefit from this trend.

- Strong Demand Across Key Sectors: The company experienced robust demand across key industrial sectors, including automotive, food and beverage, and life sciences. These sectors are actively investing in automation to improve efficiency, productivity, and resilience.

- Technological Innovation: Rockwell Automation's continuous investment in research and development, particularly in areas like artificial intelligence (AI), machine learning (ML), and cloud-based solutions, allows them to offer cutting-edge technologies to its customers.

- Market Share Gains: The company's strategic initiatives and successful product launches have resulted in significant market share gains, solidifying its position as a leader in the industrial automation space.

- Effective Supply Chain Management: While global supply chain challenges persist, Rockwell Automation has demonstrated effective management strategies, mitigating potential disruptions and ensuring consistent product delivery.

Investor Sentiment and Market Reaction

The market reacted positively to Rockwell Automation's strong earnings report, reflecting investor confidence in the company's future growth trajectory.

- Stock Price Surge: Following the earnings release, Rockwell Automation's stock price experienced a [Insert Percentage]% increase, demonstrating a strong market response.

- Increased Market Capitalization: The company's market capitalization saw a significant boost, reflecting the increased valuation driven by strong financial performance.

- Positive Analyst Ratings: Several financial analysts upgraded their ratings for Rockwell Automation, citing the impressive results and optimistic outlook for the company.

- High Trading Volume: The announcement sparked increased trading volume, indicating strong investor interest and activity.

Conclusion

Rockwell Automation's exceptional Q[Quarter] earnings demonstrate the company's robust financial performance and its leading position in the rapidly expanding industrial automation market. The record-breaking revenue, expanding profit margins, and positive market reaction underscore the significant demand for advanced automation solutions and the company's ability to capitalize on this trend. The success stems from strategic investments in technological innovation, effective supply chain management, and a focus on key growth sectors. This strong performance is not just a win for Rockwell Automation; it highlights the bullish outlook for the broader industrial automation sector and its transformative potential.

Learn more about Rockwell Automation's innovative solutions and the potential for continued growth in the industrial automation market. Analyze their financial reports and consider the investment implications of these strong earnings. Understanding Rockwell Automation's success can provide valuable insights into the future of industrial automation and potential investment opportunities within this dynamic sector.

Featured Posts

-

Exploring The Reebok And Angel Reese Collaboration

May 17, 2025

Exploring The Reebok And Angel Reese Collaboration

May 17, 2025 -

Magic Johnson Weighs In Who Wins The Knicks Pistons Series

May 17, 2025

Magic Johnson Weighs In Who Wins The Knicks Pistons Series

May 17, 2025 -

Pasimet E Granit Xhakes Nje Veshtrim I Afert Ne Bundeslige

May 17, 2025

Pasimet E Granit Xhakes Nje Veshtrim I Afert Ne Bundeslige

May 17, 2025 -

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025

Ferrexpo I Zhevago Ugroza Prekrascheniya Investitsiy V Ukraine

May 17, 2025 -

Novak Djokovic In Carpici Geliri 186 Milyon Dolar Kazandi

May 17, 2025

Novak Djokovic In Carpici Geliri 186 Milyon Dolar Kazandi

May 17, 2025