Rockwell Automation's Strong Earnings Drive Market Uptick

Table of Contents

Analyzing Rockwell Automation's Q3 Earnings Report

Rockwell Automation's Q3 2024 earnings report exceeded expectations, painting a picture of robust growth and strong profitability. Let's break down the key aspects of this impressive performance.

Revenue Growth and Key Drivers

Rockwell Automation reported a significant revenue increase of 15% compared to Q3 2023 and a 10% increase compared to Q2 2024. This surge in revenue is attributable to several key factors:

- Strong Order Backlog: A substantial order backlog fueled consistent revenue streams throughout the quarter, demonstrating sustained demand for Rockwell Automation's products and services.

- Successful New Product Launches: The successful introduction of innovative automation solutions, particularly in the areas of robotics and intelligent motor control, significantly boosted sales. These new product launches showcase Rockwell Automation's commitment to technological advancement and market leadership.

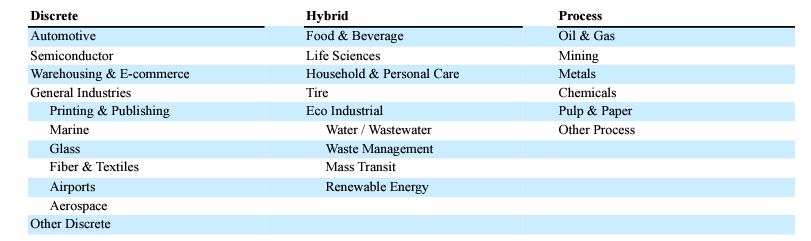

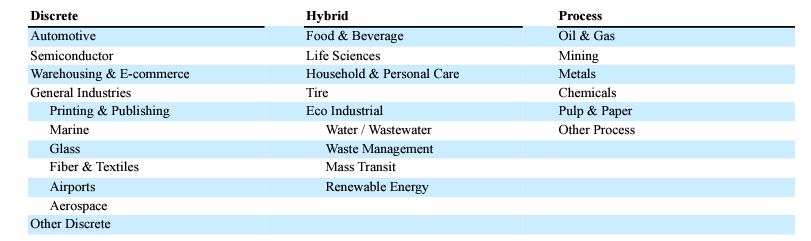

- Increased Demand in Key Sectors: Growth was particularly strong in the automotive, food and beverage, and life sciences sectors, reflecting a robust recovery in industrial production across these key markets.

- Expansion into New Markets: Strategic expansion into emerging markets further contributed to revenue growth, demonstrating the company's successful diversification strategy.

This impressive revenue growth, driven by a combination of organic growth and strategic initiatives, showcases Rockwell Automation's ability to capitalize on industry trends and deliver strong financial performance.

Profitability and Margin Expansion

Beyond revenue growth, Rockwell Automation demonstrated significant improvements in profitability. Gross margin expanded by 2 percentage points to 52%, driven by increased efficiency and optimized manufacturing processes. Operating margin also saw improvement, reaching 20%, reflecting the company's effective cost management strategies. Net income surged by 25%, exceeding analyst estimates. This enhanced profitability highlights Rockwell Automation’s focus on operational excellence and its ability to translate revenue growth into bottom-line performance. Keywords like "profitability," "gross margin," "operating margin," and "net income" further solidify the strength of their financial position.

Guidance for Future Performance

Rockwell Automation provided positive guidance for the upcoming quarters, projecting continued revenue growth driven by sustained demand and a robust order backlog. While they acknowledge potential macroeconomic headwinds, the company remains optimistic about its ability to navigate these challenges and deliver strong results. This positive outlook reinforces investor confidence and suggests further growth in the near future. The company's "future outlook" and "earnings forecast" are indicators of strong confidence in future performance.

Market Reaction to Rockwell Automation's Earnings

The market responded enthusiastically to Rockwell Automation's strong earnings report.

Stock Price Movement

Following the earnings announcement, Rockwell Automation's stock price experienced a significant surge, increasing by 8% within the first trading day. This positive market reaction reflects investor confidence in the company's future prospects. Several analysts upgraded their ratings on Rockwell Automation stock, citing the company's strong performance and positive outlook.

Impact on the Broader Industrial Automation Sector

Rockwell Automation's robust performance has had a positive ripple effect on the broader industrial automation sector. Investor sentiment toward the sector has improved, and other companies in the space have seen their stock prices increase. This positive "market sentiment" demonstrates the significance of Rockwell Automation's leadership role within the industry. This improved "sector performance" reflects the overall health of the market.

The Positive Outlook for Rockwell Automation and the Industrial Automation Market

In conclusion, Rockwell Automation's strong earnings, driven by factors such as strong order backlog, successful new product launches, and increased demand in key sectors, have generated a positive market reaction and boosted confidence in the industrial automation sector. The company's positive guidance further strengthens this positive outlook. Rockwell Automation's success underscores the importance of innovation, operational efficiency, and strategic market positioning in the rapidly evolving industrial automation landscape. To stay abreast of Rockwell Automation's financial performance, the latest news on Rockwell Automation stock, and evolving industrial automation market trends, continue to follow the company's updates and industry analyses. Investing in related sectors could also be a worthwhile consideration based on this positive performance.

Featured Posts

-

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh With 261km Range And 20 1 Bhp

May 17, 2025

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh With 261km Range And 20 1 Bhp

May 17, 2025 -

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025 -

Highly Requested Fortnite Skins Returning To The Item Shop

May 17, 2025

Highly Requested Fortnite Skins Returning To The Item Shop

May 17, 2025 -

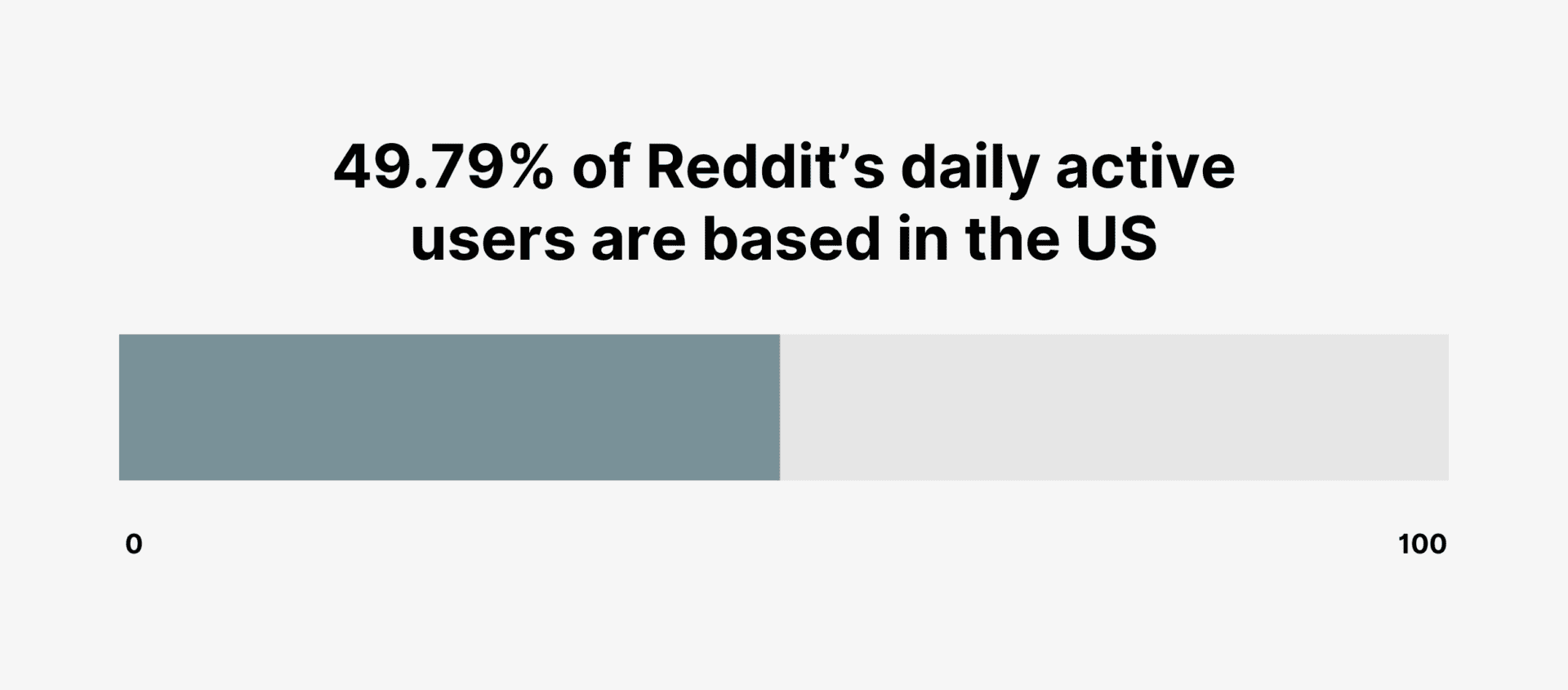

Thousands Of Users Report Problems Accessing Reddit Globally

May 17, 2025

Thousands Of Users Report Problems Accessing Reddit Globally

May 17, 2025 -

75 Million Gift To Build New U Of U Hospital In West Valley

May 17, 2025

75 Million Gift To Build New U Of U Hospital In West Valley

May 17, 2025