Rolls-Royce's 2025 Financial Outlook: Tariff Impact Assessment

Table of Contents

Global Trade Tensions and their Impact on Rolls-Royce

Rising Protectionism

The rise of protectionist trade policies globally poses a considerable threat to internationally operating businesses like Rolls-Royce. Increased tariffs on imported goods disrupt established trade flows and create uncertainty for businesses reliant on global supply chains. This trend towards protectionism impacts various sectors, including the luxury automotive industry.

- Tariffs on luxury goods: Many countries impose significant tariffs on imported luxury vehicles, increasing their final price and potentially reducing consumer demand.

- Automotive parts tariffs: Rolls-Royce relies on a global network of suppliers for specialized components. Tariffs on these parts directly increase production costs.

- Raw material tariffs: Tariffs on raw materials like precious metals, leather, and specialized alloys used in Rolls-Royce vehicles also contribute to increased manufacturing expenses.

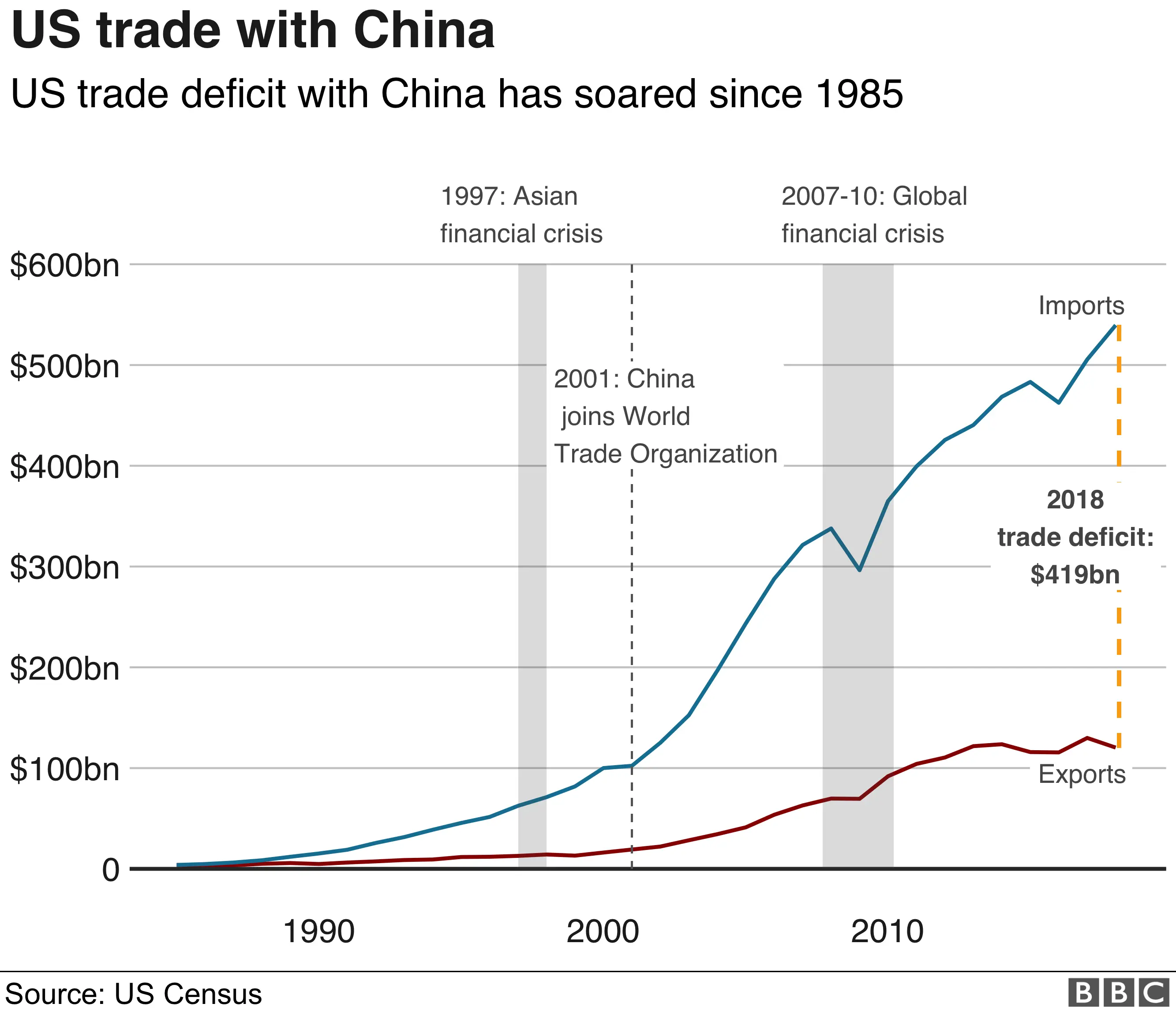

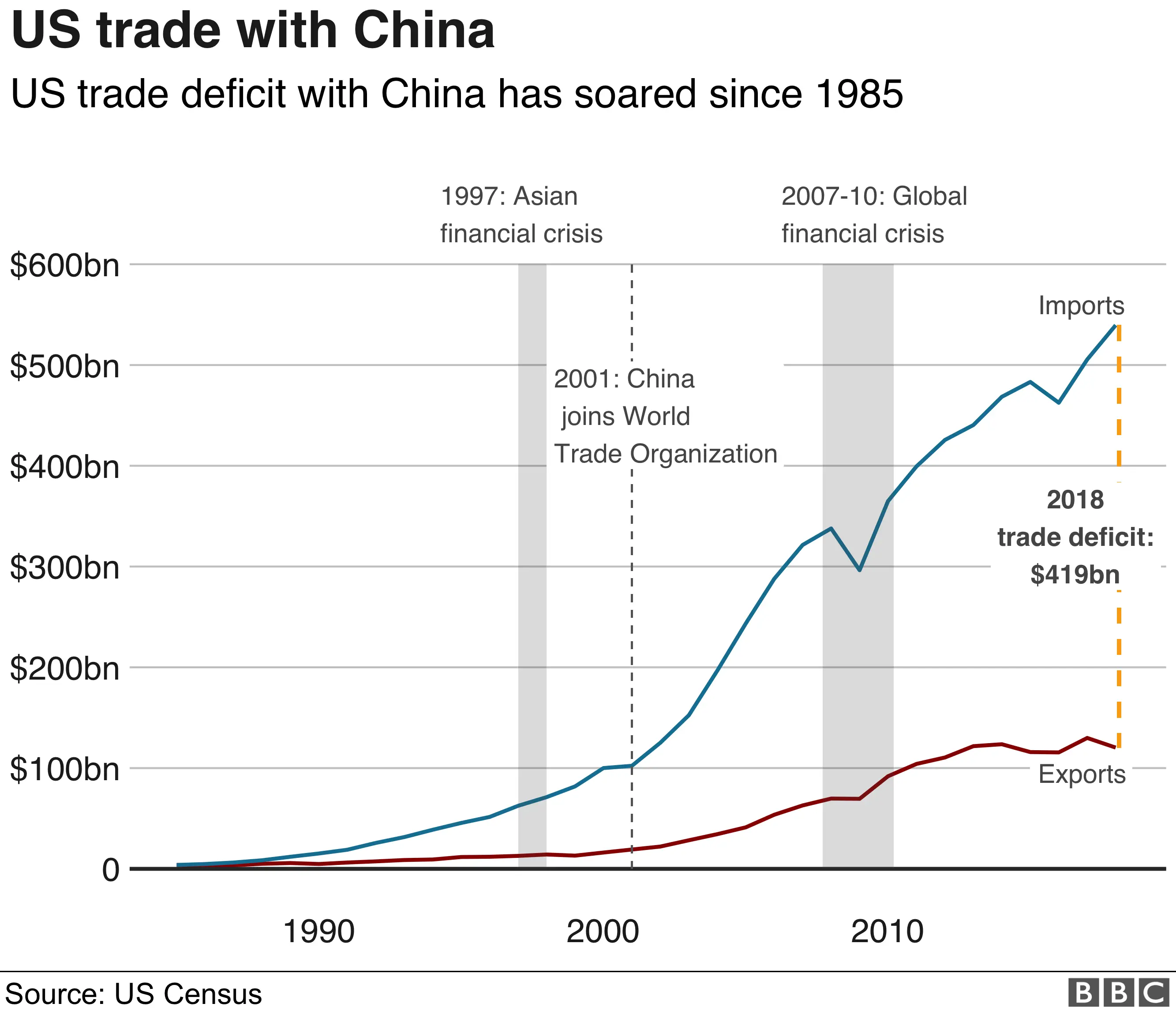

Data from the World Trade Organization (WTO) shows a concerning upward trend in tariff rates across various sectors, highlighting the escalating trade tensions that impact Rolls-Royce's operations. The impact of these escalating tariffs on global trade volumes is substantial, further adding to the challenges faced by the luxury car manufacturer.

Supply Chain Disruptions

Tariffs can severely disrupt Rolls-Royce's meticulously crafted global supply chain. The company sources components from various countries, and increased tariffs on these imports can lead to significant delays and increased costs.

- Engine components sourced from the EU: Potential tariffs on engine components imported from the European Union could significantly impact production schedules and costs.

- Leather and upholstery materials from Italy: Tariffs on high-quality leather and other upholstery materials sourced from Italy could increase the cost of manufacturing.

- Electronics and technology from Asia: Tariffs on advanced electronics and technology components sourced from Asia could hinder innovation and increase production expenses.

Examples like the impact of previous trade disputes on other luxury brands illustrate the potential severity of these disruptions. Understanding and mitigating these risks is crucial for Rolls-Royce’s long-term success.

Analyzing the Financial Implications for Rolls-Royce in 2025

Projected Revenue Impact

Increased prices due to tariffs can significantly decrease demand for Rolls-Royce vehicles, directly impacting revenue. The magnitude of this impact depends on the level and scope of tariffs imposed.

- Scenario 1 (Low Tariffs): A moderate increase in tariffs might lead to a 5-10% reduction in sales volume, impacting overall revenue accordingly.

- Scenario 2 (High Tariffs): Substantial tariffs could result in a 15-25% reduction in sales, significantly impacting the 2025 financial outlook.

[Insert Graph/Chart here visually depicting potential revenue impact under different tariff scenarios]. This visual representation will clearly illustrate the potential financial repercussions for Rolls-Royce.

Profit Margin Squeeze

Increased input costs due to tariffs directly squeeze Rolls-Royce's profit margins. The company will need to carefully consider strategies to mitigate this impact.

- Price adjustments: Rolls-Royce might consider adjusting its pricing to offset increased costs, but this could also reduce demand.

- Cost-cutting measures: The company might explore cost-cutting measures in other areas of the business to maintain profitability. This could involve streamlining operations or renegotiating contracts with suppliers.

"The escalating tariff environment presents a significant challenge to luxury automotive manufacturers like Rolls-Royce," says [Name of Financial Analyst], a leading expert in the automotive industry. "Maintaining profitability will require a strategic response to navigate these challenges."

Mitigation Strategies and Risk Management for Rolls-Royce

Pricing Strategies

Rolls-Royce needs to carefully assess and adjust its pricing strategies to offset tariff-related cost increases while minimizing the impact on sales volume.

- Targeted price adjustments: Rolls-Royce could selectively adjust prices in different markets based on tariff levels and consumer sensitivity.

- Value-added features: Offering additional features and services to justify price increases might help to offset the impact of tariffs.

- Absorbing some costs: Rolls-Royce might choose to absorb a portion of the increased costs to maintain market competitiveness.

Geographic Diversification

Reducing reliance on tariff-affected regions requires exploring geographic diversification.

- Expanding into new markets: Focusing on emerging markets less affected by tariffs can help to mitigate risks.

- Strategic partnerships: Establishing partnerships with local manufacturers or distributors in new markets can enhance market penetration.

- Regional production facilities: Considering establishing manufacturing facilities in different regions to reduce reliance on specific import sources.

Lobbying and Advocacy

Active participation in lobbying efforts can significantly influence trade policy and reduce tariff barriers.

- Industry collaborations: Working with other luxury goods manufacturers to lobby for tariff reductions or exemptions.

- Engagement with policymakers: Direct engagement with policymakers to highlight the negative impact of tariffs on the automotive industry.

- Public awareness campaigns: Raising public awareness about the impact of tariffs on the economy and jobs.

Understanding the Rolls-Royce 2025 Financial Outlook: Tariff Impacts and the Path Forward

This analysis highlights the potential negative impacts of tariffs on Rolls-Royce's 2025 financial performance. The company faces challenges related to increased production costs, reduced demand, and squeezed profit margins. However, through strategic pricing adjustments, geographic diversification, and proactive lobbying efforts, Rolls-Royce can effectively mitigate these risks. Understanding the ongoing tariff impact assessment and actively monitoring global trade developments is crucial for the company's success. To stay informed about the Rolls-Royce 2025 financial outlook and the evolving impact of tariffs on luxury goods, continue your research and follow relevant industry news.

Featured Posts

-

Orta Afrika Cumhuriyeti Ile Bae Arasindaki Ticaret Anlasmasinin Ayrintilari

May 02, 2025

Orta Afrika Cumhuriyeti Ile Bae Arasindaki Ticaret Anlasmasinin Ayrintilari

May 02, 2025 -

Loyle Carner Announces Upcoming Album A Deep Dive Into The News

May 02, 2025

Loyle Carner Announces Upcoming Album A Deep Dive Into The News

May 02, 2025 -

Islas Fight Sounesss Swim A Testament To Courage And Determination

May 02, 2025

Islas Fight Sounesss Swim A Testament To Courage And Determination

May 02, 2025 -

Facelift Fears Fan Backlash Over Stars Unrecognizable Photoshoot

May 02, 2025

Facelift Fears Fan Backlash Over Stars Unrecognizable Photoshoot

May 02, 2025 -

Sony Compensates Play Station Users For Christmas Voucher Glitch With Free Credit

May 02, 2025

Sony Compensates Play Station Users For Christmas Voucher Glitch With Free Credit

May 02, 2025

Latest Posts

-

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025 -

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025

Overtime Thriller Oilers Beat Kings To Tie Western Conference Series

May 10, 2025 -

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025

Leon Draisaitls Exceptional Season Hart Trophy Nomination And Oilers Success

May 10, 2025