Ryanair: Tariff War Biggest Obstacle To Growth, Announces Share Buyback

Table of Contents

Ryanair, Europe's largest low-cost carrier, recently announced a significant share buyback program, signaling confidence in its financial health. However, the airline giant simultaneously highlighted a significant obstacle to its future growth: the escalating impact of tariff wars within the European aviation industry. This article delves into how these tariffs are impacting Ryanair's expansion plans and the implications of its strategic share buyback.

The Impact of Tariff Wars on Ryanair's Growth

Keywords: Aviation tariffs, EU regulations, fuel costs, operational costs, profitability, competitive landscape

The ongoing tariff wars are significantly impacting Ryanair's operational efficiency and profitability. Increased costs stemming from these disputes directly affect several key aspects of the airline's business:

-

Increased Fuel Costs: Tariffs on fuel imports, often driven by geopolitical factors and trade disputes, directly increase Ryanair's operational costs. This impacts profit margins, particularly given the airline's already lean business model. Fluctuations in fuel prices, exacerbated by tariffs, make accurate cost projections challenging and limit the airline's ability to consistently offer its ultra-low fares.

-

Higher Airport Charges and Landing Fees: Tariff disputes can lead to increased airport charges and landing fees, especially at airports within the EU. These charges represent a significant portion of an airline's operational expenses, making it more difficult to compete effectively on price. This disproportionately affects low-cost carriers like Ryanair, who depend on cost-effectiveness to maintain their competitive edge.

-

Expansion Challenges: Navigating complex regulatory hurdles and increased costs associated with tariffs makes expanding routes and increasing flight frequency considerably more challenging for Ryanair. This limits the airline's ability to reach new markets and increase passenger numbers, hindering overall growth potential.

-

Competitive Pressure: The increase in operational costs due to tariffs puts pressure on Ryanair's competitive advantage in the low-cost market. Competitors may be less affected, leading to a reduction in market share and a decline in profitability.

-

Reduced Passenger Numbers and Revenue: The cumulative effect of these increased costs may force Ryanair to raise fares, potentially reducing passenger numbers and affecting overall revenue growth. This creates a delicate balancing act between maintaining affordability and ensuring profitability.

For example, the recent dispute between the EU and a specific country regarding aviation fuel imports resulted in a significant spike in fuel costs for Ryanair, forcing a reassessment of routes and capacity planning. This demonstrates the real-world impact of these tariff wars on the airline's bottom line.

Ryanair's Share Buyback Program: A Strategic Response?

Keywords: Share buyback, investor confidence, stock price, financial strategy, capital allocation, return on investment

Ryanair's recent announcement of a substantial share buyback program is a significant strategic move. The details of the program, including the amount and timeline, demonstrate a strong financial position and confidence in the company's future prospects.

-

Program Details: While the exact figures may vary depending on market conditions, the scale of the buyback signifies a considerable allocation of capital. This commitment reflects the company's belief that its stock is currently undervalued in the market.

-

Justification for Buyback: Ryanair's justification for the buyback centers around its belief in the company's long-term potential and a commitment to return value to shareholders. This strategy implies that the company believes it can generate higher returns by repurchasing its shares than by investing in other projects.

-

Impact on Shareholder Value: The buyback is expected to increase the value of remaining shares, boosting shareholder confidence and potentially increasing the stock price. This can attract further investment and bolster the company's overall valuation.

-

Alternative Uses of Capital: Ryanair could have used this capital for various purposes including expanding its fleet, investing in new technologies, or pursuing acquisitions. The decision to prioritize a share buyback signals the company's assessment of the current opportunities and risks.

Analyzing the share buyback’s success will require tracking the stock price movements and evaluating the overall return on investment. While the buyback demonstrates financial strength, its long-term effectiveness remains to be seen. It's also crucial to consider this decision in the context of the ongoing tariff wars and their impact on Ryanair's future investment opportunities.

The Future of Ryanair in a Challenging Market

Keywords: Market outlook, competitive analysis, future growth, strategic planning, industry trends, sustainability

The future of Ryanair in this challenging market hinges on its ability to adapt to the evolving competitive landscape and mitigate the effects of tariff wars.

-

Competitive Landscape: The European airline industry is highly competitive, with both established carriers and new entrants vying for market share. Ryanair must remain agile to stay ahead of the competition.

-

Mitigating Tariff Effects: Ryanair can explore several strategies to mitigate tariff impacts, such as route optimization, fuel hedging, and potentially seeking more fuel-efficient aircraft.

-

Long-Term Implications: The long-term implications of tariff wars on Ryanair's business model require careful consideration. The airline needs to find a balance between maintaining low fares and absorbing higher costs.

-

Potential Strategic Alliances: To cope with increased pressures, mergers, acquisitions, or strategic alliances could become necessary to gain greater economies of scale and resilience.

Experts predict that the European airline industry will undergo significant restructuring in the coming years, driven by both economic factors and increased environmental concerns. Ryanair's success will depend on its ability to innovate, adapt its strategy, and leverage its financial strength to navigate these challenges effectively.

Conclusion

Ryanair's share buyback signals financial strength, but the ongoing tariff wars represent a substantial obstacle to its future growth trajectory. The airline must carefully balance its cost structure, expansion plans, and the need to deliver returns to shareholders in a turbulent economic and geopolitical environment.

Call to Action: Stay informed about the evolving situation surrounding Ryanair and the impact of tariff wars on the airline industry. Continue to follow our coverage of Ryanair to understand how this low-cost carrier navigates these significant obstacles and their implications for air travel in Europe. Learn more about the latest developments in the Ryanair tariff war saga by subscribing to our newsletter.

Featured Posts

-

Legal Battle Ex Tory Councillors Wife Appeals Racial Hatred Tweet Conviction

May 21, 2025

Legal Battle Ex Tory Councillors Wife Appeals Racial Hatred Tweet Conviction

May 21, 2025 -

Mkhalfat Malyt Jsymt Albrlman Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025

Mkhalfat Malyt Jsymt Albrlman Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025 -

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 21, 2025

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 21, 2025 -

Navy Leadership Scandal Former Second In Command Faces Conviction

May 21, 2025

Navy Leadership Scandal Former Second In Command Faces Conviction

May 21, 2025 -

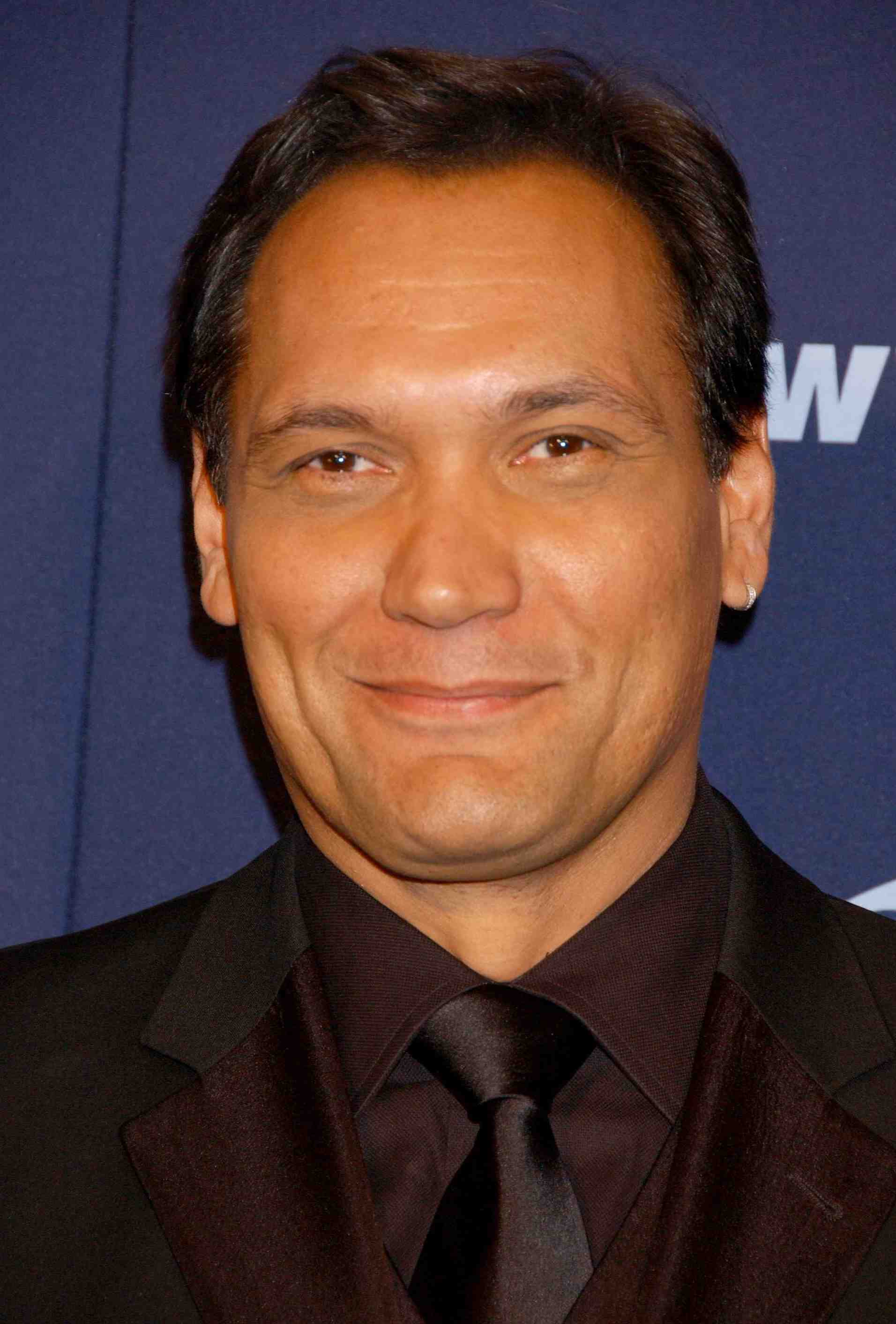

John Lithgow Und Jimmy Smits In Dexter Resurrection

May 21, 2025

John Lithgow Und Jimmy Smits In Dexter Resurrection

May 21, 2025

Latest Posts

-

Puede Javier Baez Recuperar Su Productividad Analisis Y Pronostico

May 22, 2025

Puede Javier Baez Recuperar Su Productividad Analisis Y Pronostico

May 22, 2025 -

Baez Busca Demostrar Su Salud Y Su Valor En La Nueva Temporada

May 22, 2025

Baez Busca Demostrar Su Salud Y Su Valor En La Nueva Temporada

May 22, 2025 -

First Look Echo Valley Images Preview Sydney Sweeney And Julianne Moore

May 22, 2025

First Look Echo Valley Images Preview Sydney Sweeney And Julianne Moore

May 22, 2025 -

Echo Valley Images A Glimpse Into Sydney Sweeney And Julianne Moores Thriller

May 22, 2025

Echo Valley Images A Glimpse Into Sydney Sweeney And Julianne Moores Thriller

May 22, 2025 -

El Regreso De Baez Salud Y Rendimiento En El Campo

May 22, 2025

El Regreso De Baez Salud Y Rendimiento En El Campo

May 22, 2025