Sasol (SOL) Investor Concerns Following 2023 Strategy Presentation

Table of Contents

Debt Burden and Leverage Remain a Major Concern

Sasol's high leverage and substantial debt levels remain a major source of investor anxiety. While the company has made progress in debt reduction, the scale of the challenge is substantial. This impacts Sasol's credit rating and overall financial health, increasing the risk profile for potential investors.

-

High Debt Levels: Despite efforts, Sasol's debt remains considerable, impacting its financial flexibility and ability to respond to market downturns. This high debt-to-equity ratio is a key concern for credit rating agencies and potential investors alike.

-

Debt Reduction Strategy Scrutiny: The effectiveness of Sasol's announced debt reduction strategy is being closely scrutinized by analysts. Concerns remain about the timeline for achieving meaningful debt reduction and the potential for unforeseen setbacks.

-

Interest Rate Sensitivity: The current interest rate environment adds further pressure. Increased borrowing costs make servicing Sasol's debt even more challenging, potentially impacting profitability and future investment plans.

-

Economic Downturn Vulnerability: Investors are wary of Sasol's ability to withstand a future economic downturn. A recession could significantly strain the company's ability to manage its debt and maintain its financial stability.

Uncertainty Surrounding Energy Transition and Future Growth

Sasol's strategy regarding the energy transition and decarbonization remains a significant source of uncertainty for investors. The company's future growth prospects are closely tied to its ability to successfully adapt to a rapidly changing energy landscape. The shift towards renewable energy sources presents both opportunities and challenges for Sasol.

-

Unclear Energy Transition Path: The lack of clarity surrounding Sasol's long-term strategy for decarbonization and its commitment to sustainable practices is a key concern. Investors are looking for a more detailed roadmap outlining the company's transition to lower-carbon operations.

-

Competitive Landscape Concerns: Sasol faces intense competition from both established and emerging players in the energy and chemicals sectors. The company's ability to compete effectively in a market increasingly focused on sustainability is under scrutiny.

-

Long-Term Growth Prospects: Investors are questioning Sasol's long-term growth potential in a world moving towards renewable energy. Demonstrating a clear pathway to sustainable and profitable growth is crucial for regaining investor confidence.

-

ESG Concerns: The lack of detailed plans regarding Environmental, Social, and Governance (ESG) initiatives further fuels investor apprehension. Strong ESG performance is increasingly important for attracting both investors and customers.

Market Volatility and Geopolitical Risks Impacting Sasol's Performance

Sasol's performance is significantly influenced by volatile commodity prices, geopolitical instability, and broader macroeconomic factors. These external factors present significant risks to the company's profitability and financial outlook.

-

Commodity Price Fluctuations: Fluctuations in oil and gas prices, along with other key commodities, directly impact Sasol's profitability. The company's ability to manage price volatility is a crucial factor in its financial performance.

-

Geopolitical Risk Exposure: Geopolitical instability and potential conflicts can significantly disrupt Sasol's operations and supply chains. This risk is particularly relevant given Sasol's international operations.

-

Economic Recession Risk: A global economic recession could severely impact demand for Sasol's products, reducing profitability and potentially leading to financial difficulties.

-

Risk Management Capabilities: Investors are evaluating Sasol's risk management capabilities and its ability to mitigate these external challenges effectively. Transparency and clear communication on risk management strategies are essential for regaining investor trust.

Analysis of Sasol's Response to Investor Concerns

Sasol's communication strategy in response to investor concerns is crucial in rebuilding shareholder confidence. The clarity and transparency of its responses are being closely analyzed.

-

Communication Strategy Effectiveness: The effectiveness of Sasol's communication efforts in addressing investor anxieties is being assessed. Clear, concise, and frequent communication is necessary.

-

Management Response Quality: Management's responses to questions concerning debt, growth strategy, and energy transition are under scrutiny. Credible and well-reasoned answers are essential to reassure investors.

-

Transparency and Clarity: The level of transparency provided in addressing investor concerns is vital. Open and honest communication builds trust and fosters positive investor relations.

-

Impact on Shareholder Confidence: The overall impact of Sasol's responses on shareholder confidence will determine the effectiveness of its efforts to regain trust and attract investment.

Conclusion

The 2023 strategy presentation by Sasol (SOL) has left several investors with significant concerns regarding the company's debt levels, its approach to the energy transition, and its exposure to market volatility. The effectiveness of its response to these concerns will be critical in rebuilding investor confidence. Careful management of debt, a clear energy transition strategy, and effective communication will be key to addressing these investor concerns and improving Sasol's long-term prospects.

Call to Action: Stay informed on the evolving situation regarding Sasol (SOL) and its investor concerns by following reputable financial news sources and actively engaging with the company's investor relations materials. Careful monitoring of Sasol's financial performance and strategic updates is crucial for any investor considering exposure to this dynamic energy and chemical company. Understanding the challenges and opportunities facing Sasol (SOL) is essential for making informed investment decisions.

Featured Posts

-

Abn Amro Sterke Stijging Occasionverkoop Door Toename Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toename Autobezit

May 21, 2025 -

Photos Paulina Gretzkys Elegant Soprano Inspired Leopard Dress

May 21, 2025

Photos Paulina Gretzkys Elegant Soprano Inspired Leopard Dress

May 21, 2025 -

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

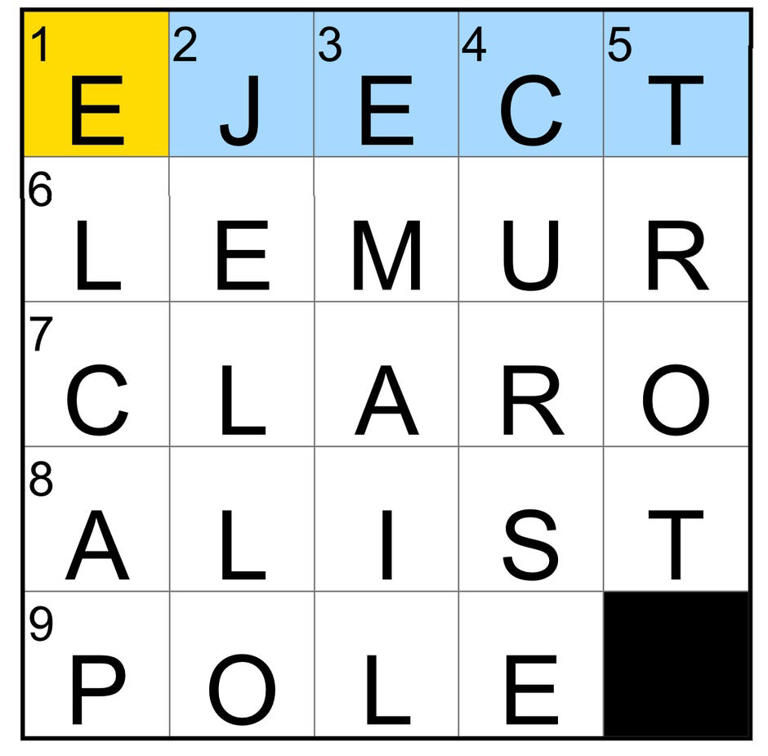

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025 -

Abn Amro Sterke Kwartaalcijfers Stuwen Aandelenkoers Omhoog

May 21, 2025

Abn Amro Sterke Kwartaalcijfers Stuwen Aandelenkoers Omhoog

May 21, 2025

Latest Posts

-

Leverkusen Thwarts Bayern Kane Misses Potential Title Party

May 21, 2025

Leverkusen Thwarts Bayern Kane Misses Potential Title Party

May 21, 2025 -

Bayern Munichs Bundesliga Celebrations Delayed By Leverkusen

May 21, 2025

Bayern Munichs Bundesliga Celebrations Delayed By Leverkusen

May 21, 2025 -

Leverkusens Win Delays Bayern Munichs Bundesliga Celebration Kane Out

May 21, 2025

Leverkusens Win Delays Bayern Munichs Bundesliga Celebration Kane Out

May 21, 2025 -

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025 -

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025