Saudi Arabia's ABS Market Opens: A Rule Change Bigger Than Spain

Table of Contents

ABS are securities whose value is derived from a pool of underlying assets, such as auto loans, mortgages, credit card receivables, or even royalties. By bundling these assets and selling them as securities, companies can raise capital and free up resources for further lending and investment. This article will explore the significance of this regulatory change, comparing it to Spain’s experience, outlining the investment opportunities and risks, and discussing the future potential of Saudi Arabia's ABS market.

The Significance of the Regulatory Change in Saudi Arabia

The opening of Saudi Arabia's ABS market is the direct result of significant regulatory changes designed to modernize and deepen the Kingdom's financial sector. Previously, limitations on securitization hindered market growth. These restrictions included complex legal frameworks, a lack of clear regulatory guidelines, and limited investor understanding of ABS. The recent changes address these challenges head-on.

- Specific law changes or amendments: The introduction of [cite specific legislation or regulatory announcements] streamlined the process for securitizing assets, clarifying legal frameworks and reducing bureaucratic hurdles.

- Key regulatory bodies involved: The [mention specific regulatory bodies, e.g., Saudi Central Bank (SAMA), Capital Market Authority (CMA)] have played a pivotal role in shaping the new regulations and ensuring market transparency and stability.

- Timeline of the regulatory changes: The implementation of these changes occurred over [mention the timeframe], culminating in the official opening of the market in [mention date or period].

This regulatory overhaul now allows for the securitization of a wide range of assets, including:

- Auto loans

- Mortgages

- Credit card receivables

- Other receivables

Comparative Analysis: Saudi Arabia vs. Spain's ABS Market Development

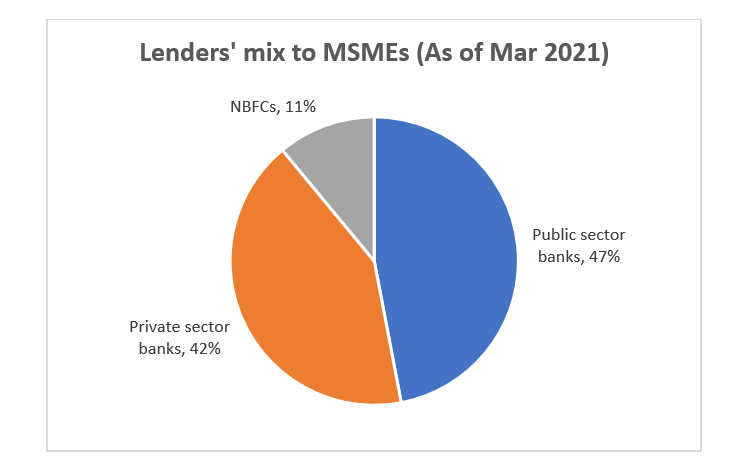

The potential scale of Saudi Arabia's ABS market is substantial, potentially exceeding even that of Spain's. While Spain experienced significant growth in its ABS market following its liberalization, Saudi Arabia's larger economy, rapidly growing population, and significant government support suggest an even more dramatic expansion.

- Key metrics comparing both markets (e.g., GDP, population, existing financial infrastructure): Saudi Arabia boasts a significantly larger GDP and population than Spain, providing a much broader base for asset securitization. Furthermore, the Kingdom's ongoing investments in infrastructure and financial technology create a fertile ground for ABS market growth.

- Growth projections for the Saudi ABS market: Analysts predict [cite sources and projections] for the Saudi ABS market within the next [timeframe], fueled by increasing demand for credit and financial innovation.

- Potential challenges and risks for the Saudi market: While the outlook is positive, potential risks include regulatory uncertainty (although mitigated by the recent changes), currency fluctuations, and broader geopolitical factors.

Investment Opportunities and Risks in Saudi Arabia's ABS Market

The opening of Saudi Arabia's ABS market presents compelling investment opportunities for both domestic and international investors. The market's nascent stage offers potential for high returns, while diversification benefits are considerable.

- Types of investors likely to be attracted (e.g., institutional investors, high-net-worth individuals): Both institutional investors seeking diversification and high-net-worth individuals looking for exposure to a rapidly growing market are expected to show strong interest.

- Potential return on investment (ROI) scenarios: While ROI is highly dependent on market conditions and specific investments, the potential for significant gains is substantial, particularly in the initial stages of market development.

- Risk mitigation strategies: Investors should carefully assess the creditworthiness of the underlying assets, diversify their investments across various ABS offerings, and understand the political and economic risks associated with investing in an emerging market.

The Future of Saudi Arabia's ABS Market and its Global Impact

The long-term prospects for Saudi Arabia's ABS market are exceptionally promising. The market's development will not only contribute to the Kingdom's economic growth but also have a ripple effect on the global financial landscape.

- Predictions for market size in the next 5-10 years: Experts predict [cite sources] substantial growth, potentially positioning Saudi Arabia as a key player in the global ABS market.

- Potential for innovation and new product development in the Saudi ABS market: The market's rapid growth is likely to drive innovation in product development, leading to new and sophisticated ABS offerings.

- Impact on regional financial integration: The success of Saudi Arabia's ABS market could stimulate similar developments in other Middle Eastern and North African (MENA) economies, fostering regional financial integration.

Conclusion: Investing in Saudi Arabia's Booming ABS Market

The opening of Saudi Arabia's ABS market marks a pivotal moment in the Kingdom's financial history. The significant regulatory changes, the potential for surpassing even Spain's market growth, and the considerable investment opportunities, coupled with the inherent risks, paint a picture of dynamic growth. This emerging market offers substantial diversification benefits and the potential for high returns. To learn more about investment opportunities in Saudi Arabia's ABS market and to consider diversifying your portfolio with this emerging market, further research into specific ABS offerings and consultation with financial professionals is recommended. Explore relevant resources like [insert links to relevant financial news articles and regulatory websites]. Don't miss the chance to be a part of the burgeoning Saudi Arabia's ABS market.

Featured Posts

-

Mini Camera Chaveiro Espia Seguranca E Privacidade

May 02, 2025

Mini Camera Chaveiro Espia Seguranca E Privacidade

May 02, 2025 -

Duurzame Energie En Noodstroomvoorziening Voor Bio Based Basisscholen

May 02, 2025

Duurzame Energie En Noodstroomvoorziening Voor Bio Based Basisscholen

May 02, 2025 -

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025 -

6aus49 Lottozahlen Des 12 April 2025 Ergebnis Der Ziehung

May 02, 2025

6aus49 Lottozahlen Des 12 April 2025 Ergebnis Der Ziehung

May 02, 2025 -

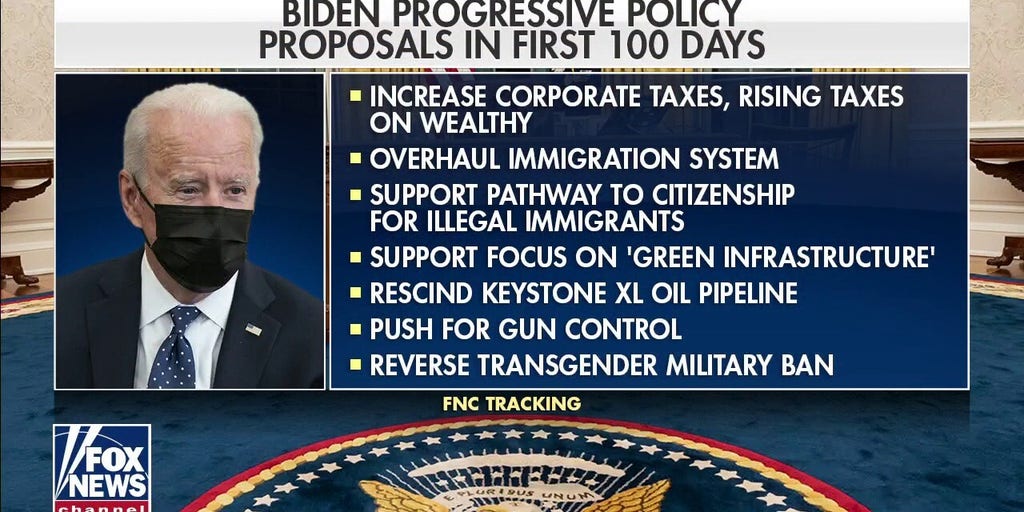

Joe Biden And The Economy Assessing The Impact Of His Policies

May 02, 2025

Joe Biden And The Economy Assessing The Impact Of His Policies

May 02, 2025

Latest Posts

-

The 10 Best Film Noir Movies Ever Made

May 10, 2025

The 10 Best Film Noir Movies Ever Made

May 10, 2025 -

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025 -

Top 10 Must See Film Noir Movies

May 10, 2025

Top 10 Must See Film Noir Movies

May 10, 2025 -

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025 -

10 Essential Film Noir Movies To Watch

May 10, 2025

10 Essential Film Noir Movies To Watch

May 10, 2025