Schroders Reports Asset Reduction: Analysis Of First Quarter Client Behavior

Table of Contents

Analysis of Net Outflows: Deconstructing the Data

Schroders' first-quarter report revealed significant net outflows, impacting their assets under management (AUM). While the precise figures require careful examination of the official report, the data likely shows a decline across various asset classes. Let's break down the potential components:

- Percentage change in AUM: The percentage decrease in AUM is a key indicator of the severity of the asset reduction. This figure needs to be analyzed in context with industry benchmarks and Schroders' historical performance.

- Specific sectors or regions showing significant outflows: A detailed breakdown by asset class (equities, bonds, alternatives) and geographic region will reveal where the most significant outflows occurred. This may pinpoint areas of market weakness or specific investor concerns. For example, exposure to particular sectors significantly impacted by inflation or geopolitical events might have triggered outflows.

- Comparison to previous quarters and industry benchmarks: Comparing the first-quarter performance to previous quarters and to the performance of other major asset management firms provides valuable context. This allows for a clearer understanding of whether the asset reduction reflects broader industry trends or specific challenges faced by Schroders. Analyzing this data helps to determine if the net outflows are part of a broader market correction or a unique situation.

Analyzing these aspects of the "Schroders Reports Asset Reduction" provides a more nuanced understanding of the first-quarter investment performance. Understanding the impact on investment performance is vital for evaluating future strategies.

Understanding Client Behavior: Identifying Motivating Factors

The reported asset reduction reflects shifting client behavior, driven by a complex interplay of macroeconomic factors, market volatility, and investor sentiment. Several key contributing factors warrant consideration:

- Geopolitical uncertainty: The ongoing war in Ukraine, coupled with escalating geopolitical tensions, created significant market uncertainty and risk aversion among investors. This uncertainty likely led to portfolio adjustments and withdrawals.

- Rising interest rates and their impact on fixed-income investments: Central banks' responses to inflation involved raising interest rates, impacting the value of fixed-income investments. This may have prompted some investors to re-evaluate their bond holdings and potentially withdraw assets.

- Concerns about inflation and its effect on purchasing power: Persistent inflation eroded purchasing power, causing investors to re-evaluate their risk tolerance and potentially shift their allocations to assets perceived as better inflation hedges.

- Shifting investor preferences towards alternative investments: Some investors might have shifted their preferences toward alternative investment strategies perceived as less correlated with traditional markets, leading to outflows from Schroders' traditional offerings.

These factors contributed to the overall negative investor sentiment, leading to a decrease in AUM and impacting the performance of investment portfolios. This highlights the importance of understanding the dynamic interplay of market volatility and investor sentiment.

Implications for Schroders and the Broader Investment Market

The "Schroders Reports Asset Reduction" has significant implications, both for Schroders and the wider asset management industry:

- Potential adjustments to Schroders' investment strategies: Schroders may need to adjust its investment strategies to adapt to the changing market conditions and investor preferences. This might involve a shift in asset allocation, a focus on specific sectors or strategies that resonate with investors, or a change in investment philosophy.

- Impact on Schroders' profitability and competitiveness: The asset reduction will undoubtedly impact Schroders' profitability and its competitive positioning within the asset management industry. It emphasizes the need for the firm to adapt and retain clients in a competitive environment.

- Broader trends in investor behavior and their implications for the future: The observed shift in investor behavior highlights broader trends towards risk aversion and a search for more resilient investment strategies. This underscores the need for asset managers to understand and anticipate shifts in investor sentiment and to adapt their offerings accordingly.

The implications of the "Schroders Reports Asset Reduction" extend beyond Schroders itself, affecting the entire competitive landscape of the asset management industry.

Conclusion: Key Takeaways and Future Outlook for Schroders Reports Asset Reduction

The asset reduction reported by Schroders in the first quarter reflects a complex interplay of macroeconomic factors, market volatility, and shifting investor behavior. Understanding client behavior in this turbulent market is critical. The outflows highlight the need for Schroders to adapt its investment strategies, and this situation reflects broader trends in investor preferences. To stay informed on further developments regarding "Schroders Reports Asset Reduction" and its impact on the investment landscape, subscribe to our updates, follow Schroders’ official reports, and conduct your own research on first-quarter investment trends and client behavior. Staying informed about "Schroders Reports Asset Reduction" and related market dynamics is vital for navigating the current investment climate.

Featured Posts

-

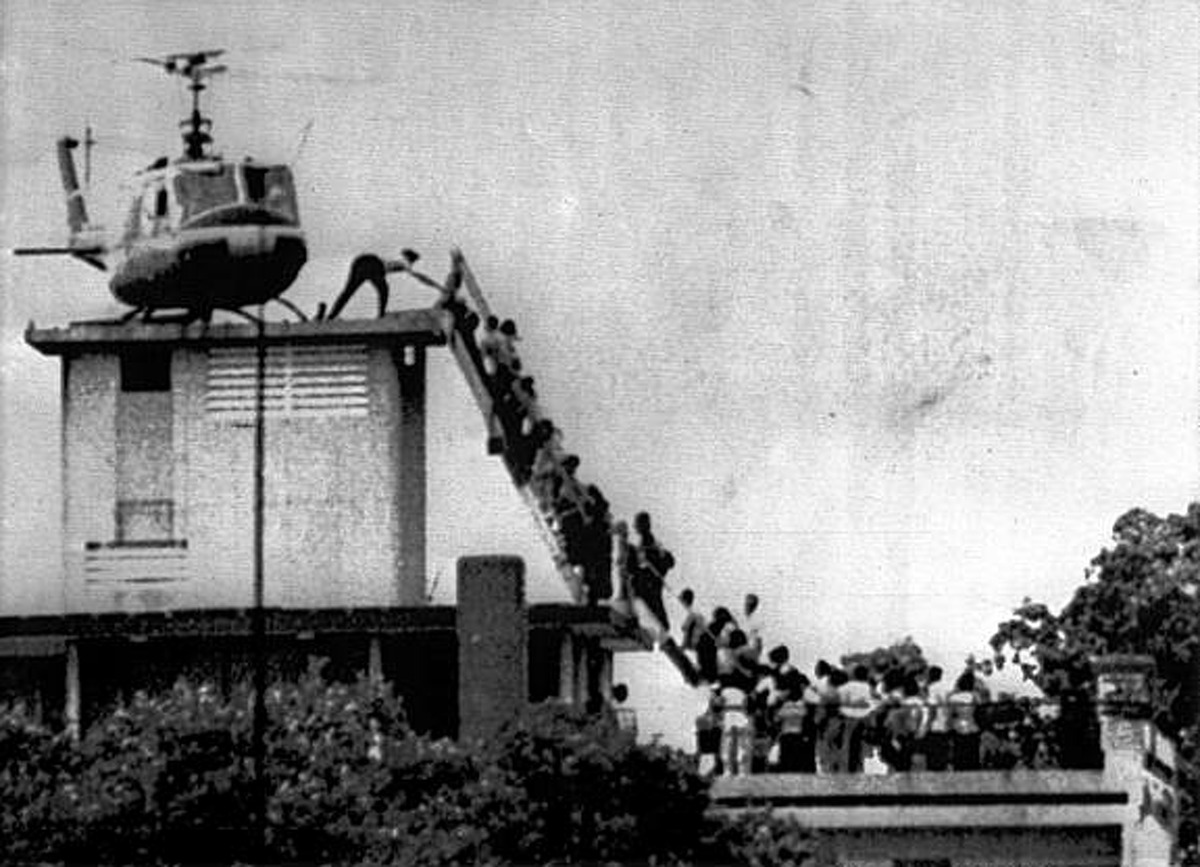

Fifty Years After Saigon Courageous Acts Of Us Military Personnel

May 02, 2025

Fifty Years After Saigon Courageous Acts Of Us Military Personnel

May 02, 2025 -

Mstqbl Aleab Alfydyw Nzrt Ela Blay Styshn 6

May 02, 2025

Mstqbl Aleab Alfydyw Nzrt Ela Blay Styshn 6

May 02, 2025 -

Fortnite Unveils New Icon Skin Everything We Know

May 02, 2025

Fortnite Unveils New Icon Skin Everything We Know

May 02, 2025 -

This Country Your Complete Travel Resource

May 02, 2025

This Country Your Complete Travel Resource

May 02, 2025 -

Ghanas Mental Healthcare System 80 Psychiatrists For 30 Million People

May 02, 2025

Ghanas Mental Healthcare System 80 Psychiatrists For 30 Million People

May 02, 2025

Latest Posts

-

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

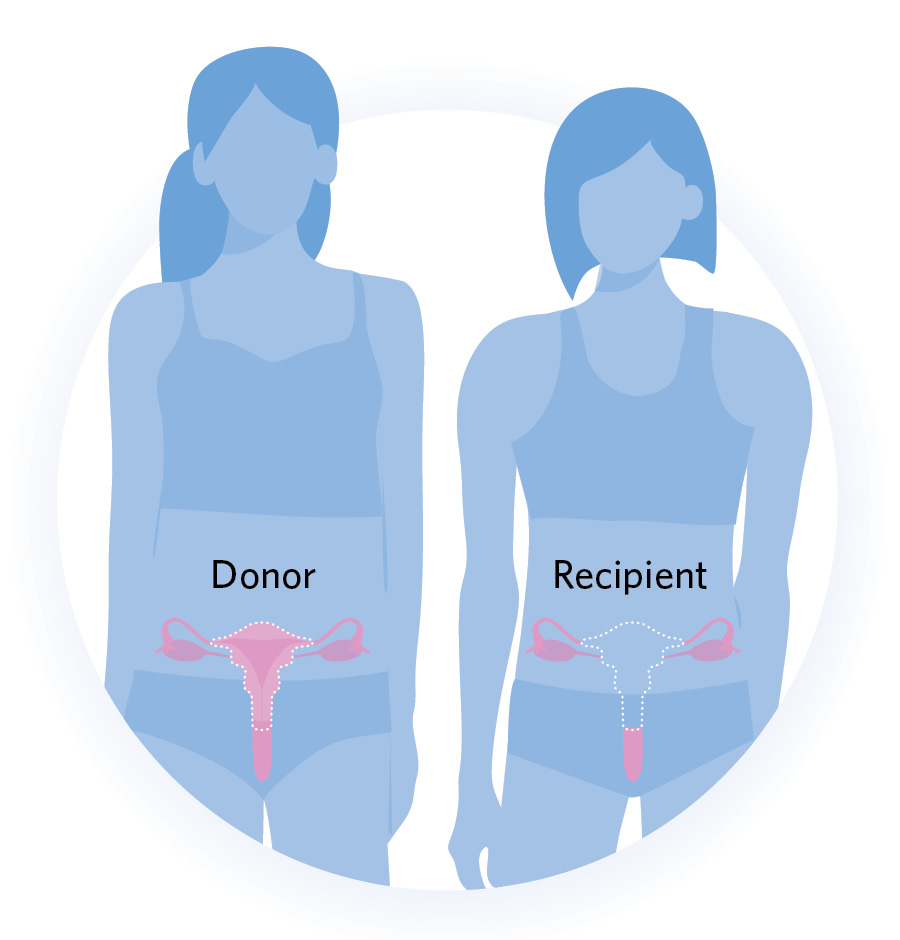

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025 -

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025 -

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025 -

Transgender Women And Childbearing Exploring The Possibility Of Uterus Transplantation

May 10, 2025

Transgender Women And Childbearing Exploring The Possibility Of Uterus Transplantation

May 10, 2025