SEC To Overhaul Crypto Broker Rules: Atkins' Statement And Implications

Table of Contents

Commissioner Peirce's Statement: A Call for Clarity and Reform

Commissioner Hester Peirce, often referred to as "Crypto Mom" for her relatively pro-crypto stance within the SEC, has issued a statement calling for significant reforms in the regulation of crypto brokers. Her key points highlight the need for clearer regulatory definitions, improved investor protections, and a more balanced approach to regulating this burgeoning sector. She expressed concerns about the current framework's potential to stifle innovation and inadvertently harm investors through overly broad or unclear rules.

- Specific concerns highlighted by Peirce: Ambiguity in the definition of "security" as applied to crypto assets, leading to uncertainty for businesses and investors. Lack of clear guidance on registration requirements for crypto exchanges and brokers.

- Call for improved registration processes: Peirce advocated for streamlined and more transparent registration processes that are tailored to the specific characteristics of the crypto industry, avoiding a one-size-fits-all approach that may be overly burdensome for smaller firms.

- Emphasis on investor education and protection: She stressed the importance of investor education initiatives to help individuals understand the risks associated with crypto investments and make informed decisions. This includes protection from fraud and manipulation.

- Discussion of potential unintended consequences of overly stringent regulations: Peirce warned against regulations that could inadvertently drive crypto activity offshore, hindering US competitiveness in the global digital asset market.

The Proposed Overhaul: Key Changes and Their Impact

The SEC's proposed overhaul of crypto broker rules is expected to bring significant changes impacting various aspects of the industry. These changes aim to enhance investor protection and ensure market integrity but may present challenges for crypto businesses.

- Changes to registration requirements for crypto exchanges and brokers: Expect stricter registration requirements, potentially including more rigorous background checks and financial audits for those seeking to operate as regulated entities.

- New rules regarding the custody of digital assets: The SEC is likely to implement stricter rules on how crypto exchanges and brokers store and manage customer assets, emphasizing security and segregation of funds.

- Increased scrutiny of AML/KYC (Know Your Customer) procedures: Enhanced anti-money laundering and know-your-customer regulations are anticipated, requiring more robust identity verification and transaction monitoring processes.

- Enhanced reporting requirements for trading activities: Crypto brokers can expect more detailed and frequent reporting requirements to the SEC, providing greater transparency into trading activities and market trends.

- Potential impact on smaller crypto brokers: Smaller crypto brokers may face disproportionate challenges in meeting the increased compliance costs and regulatory burdens associated with the new rules, potentially leading to market consolidation.

Implications for Crypto Businesses and Investors

The SEC's regulatory overhaul will have significant consequences for both crypto businesses and investors.

- Potential increase in compliance costs for crypto businesses: Meeting the new regulatory requirements will likely involve substantial investments in technology, personnel, and legal expertise.

- Impact on the profitability of crypto brokerages: Increased compliance costs may negatively impact the profitability of crypto brokerages, potentially squeezing margins and affecting their ability to compete.

- Potential for market consolidation among crypto firms: Smaller firms may struggle to cope with the heightened regulatory burden, leading to mergers, acquisitions, or exits from the market.

- Changes to investment strategies for crypto investors: Investors may need to adapt their investment strategies in response to the regulatory changes, focusing on compliance and choosing regulated platforms.

- Increased legal risks for non-compliant businesses: Non-compliance with the new rules carries significant legal and financial risks, including hefty fines and potential criminal charges.

Navigating the New Regulatory Landscape

Adapting to the evolving regulatory environment requires proactive steps from both crypto businesses and investors.

- Importance of seeking legal advice: Businesses should consult with legal professionals specializing in securities law and cryptocurrency regulation to ensure compliance with the new rules.

- Implementing comprehensive compliance programs: Crypto businesses need to develop and implement robust compliance programs encompassing KYC/AML, data security, and reporting requirements.

- Staying updated on regulatory changes: Continuous monitoring of SEC announcements, regulatory updates, and industry news is crucial to stay informed about changes.

- The role of industry associations and advocacy groups: Industry associations and advocacy groups can play a crucial role in providing guidance, promoting best practices, and advocating for industry-friendly regulations.

Conclusion

The SEC's planned overhaul of crypto broker rules represents a significant shift in the regulatory landscape. Understanding the implications of these changes – including increased regulatory scrutiny, compliance costs, and potential market shifts – is crucial for all stakeholders. Staying informed about updates to SEC rules and seeking expert advice will be essential for navigating this evolving regulatory landscape and ensuring compliance. Keep up-to-date with the latest developments on the SEC to Overhaul Crypto Broker Rules and ensure your business or investments are prepared for the changes ahead.

Featured Posts

-

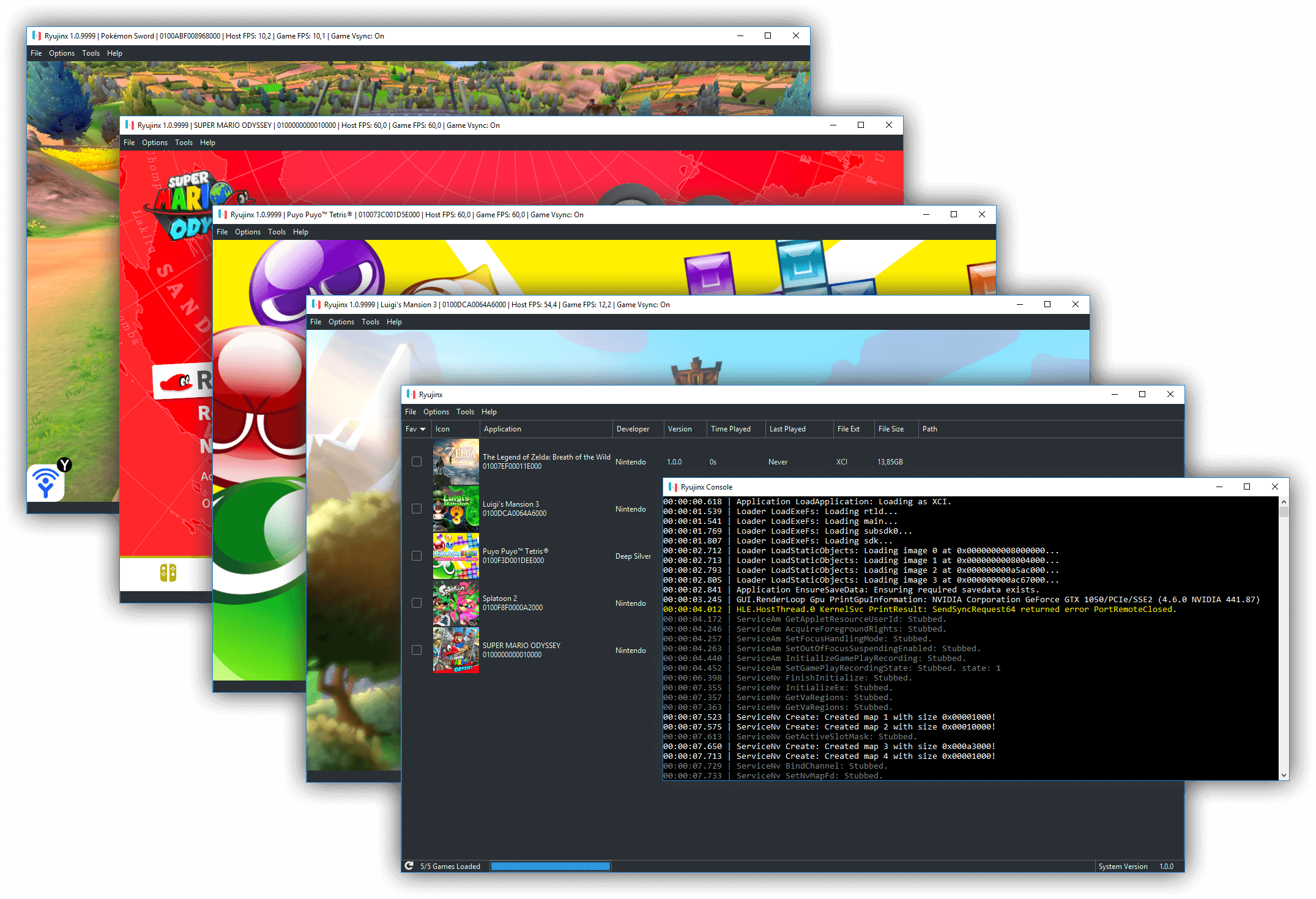

Nintendos Action Forces Ryujinx Switch Emulator To Cease Development

May 13, 2025

Nintendos Action Forces Ryujinx Switch Emulator To Cease Development

May 13, 2025 -

What Was Ethan Slaters Point In Elsbeth Season 2 Episode 17

May 13, 2025

What Was Ethan Slaters Point In Elsbeth Season 2 Episode 17

May 13, 2025 -

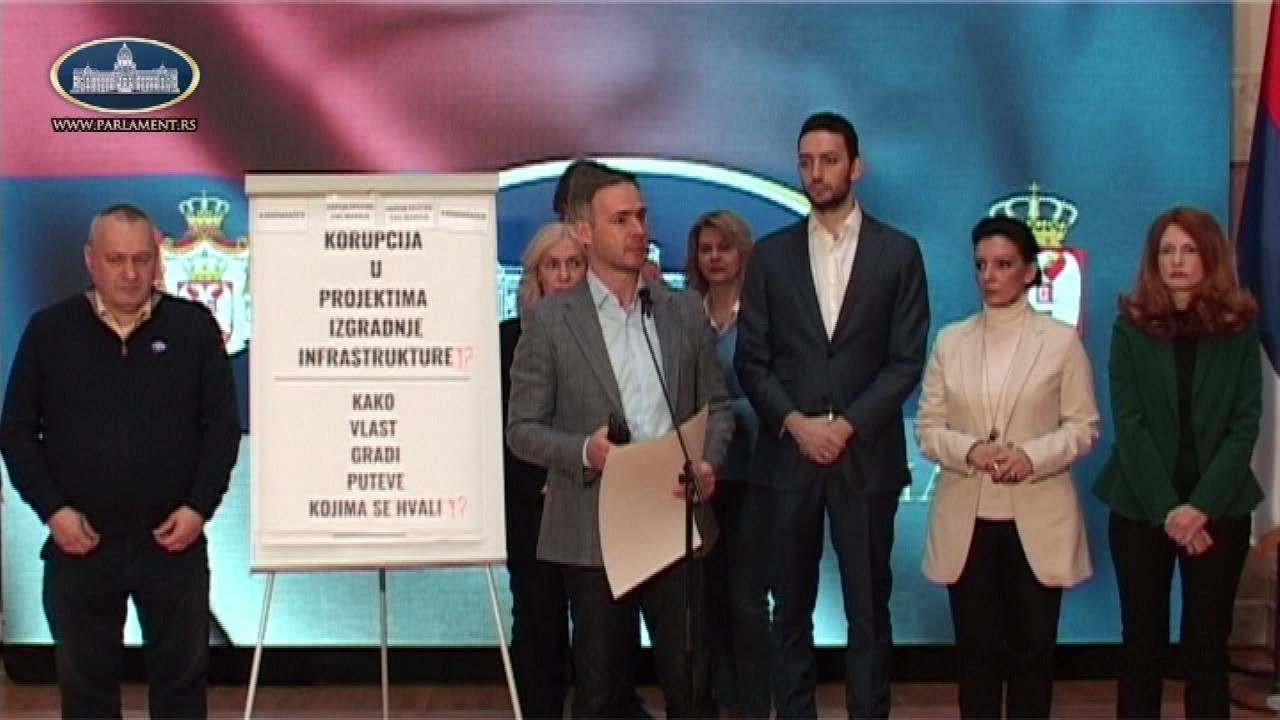

Spor Oko Iz Ava Marinike Tepi Natsionalni Savet Roma Protiv Govora Mrzhnje

May 13, 2025

Spor Oko Iz Ava Marinike Tepi Natsionalni Savet Roma Protiv Govora Mrzhnje

May 13, 2025 -

Lineups Broadcast Details And Live Game Thread Cubs Vs Dodgers 2 05 Ct

May 13, 2025

Lineups Broadcast Details And Live Game Thread Cubs Vs Dodgers 2 05 Ct

May 13, 2025 -

The World Of The Hobbit The Battle Of The Five Armies Locations And Creatures

May 13, 2025

The World Of The Hobbit The Battle Of The Five Armies Locations And Creatures

May 13, 2025