Secure Your Lowest Personal Loan Interest Rates Today

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest rates is crucial for securing the best deal. The Annual Percentage Rate (APR) represents the yearly cost of borrowing, encompassing the interest rate and any additional fees. Several factors influence the APR you'll receive:

-

Credit Score: Your credit score is a primary determinant of your interest rate. A higher credit score signifies lower risk to the lender, resulting in lower interest rates. Aim for a score above 700 for the most favorable rates.

-

Loan Amount: Larger loan amounts often correlate with slightly higher interest rates due to increased risk for the lender.

-

Loan Term: The loan term (length of the loan) impacts both your monthly payments and the total interest paid. A shorter loan term means higher monthly payments but lower overall interest. Conversely, a longer term results in lower monthly payments but significantly higher total interest.

-

Lender Type: Different lenders – banks, credit unions, and online lenders – offer varying interest rates and fees. Shop around to compare offers.

-

Debt-to-Income Ratio: Lenders also evaluate your debt-to-income ratio (DTI), which is the proportion of your monthly income dedicated to debt repayment. A lower DTI suggests lower risk and can improve your chances of securing a favorable interest rate.

Improving Your Credit Score for Better Rates

A good credit score is paramount for obtaining the lowest personal loan interest rates. Lenders view a high credit score as an indicator of your reliability in repaying debt. Here's how to improve your credit score:

-

Pay Bills On Time: Consistent on-time payments are the most significant factor impacting your credit score. Set up automatic payments to avoid missed deadlines.

-

Keep Credit Utilization Low: Maintain a low credit utilization ratio (the amount of credit you use compared to your total available credit). Aim to keep it below 30%.

-

Monitor Your Credit Reports: Regularly check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors. You can access your free reports annually at annualcreditreport.com.

-

Avoid Opening Too Many New Accounts: Opening numerous new accounts in a short period can negatively affect your credit score.

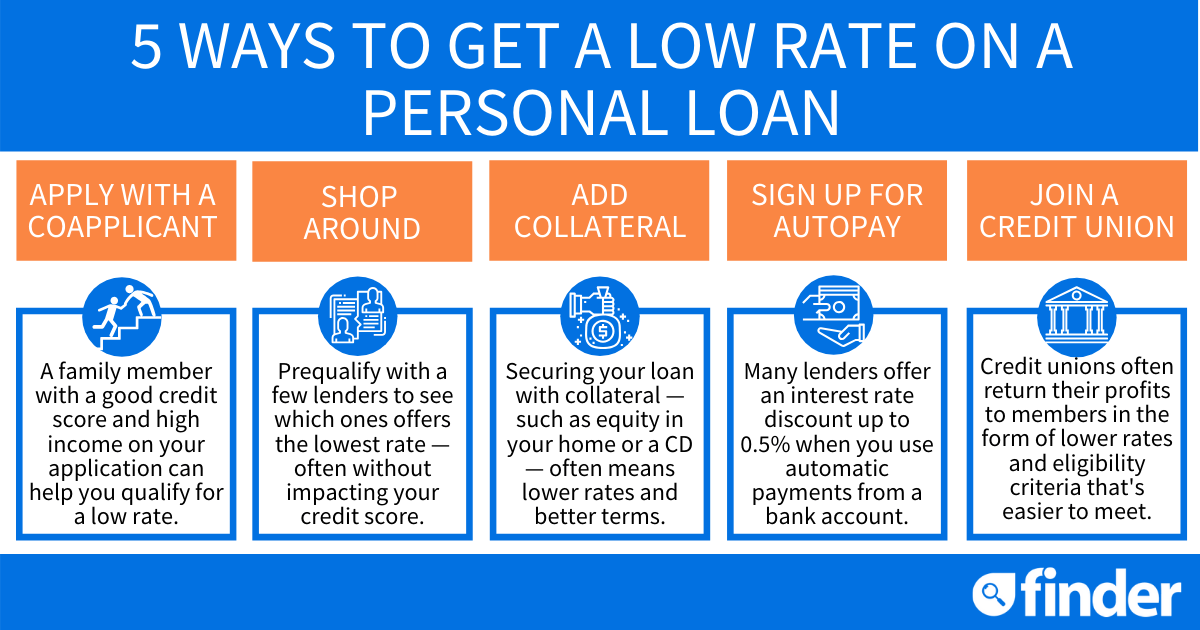

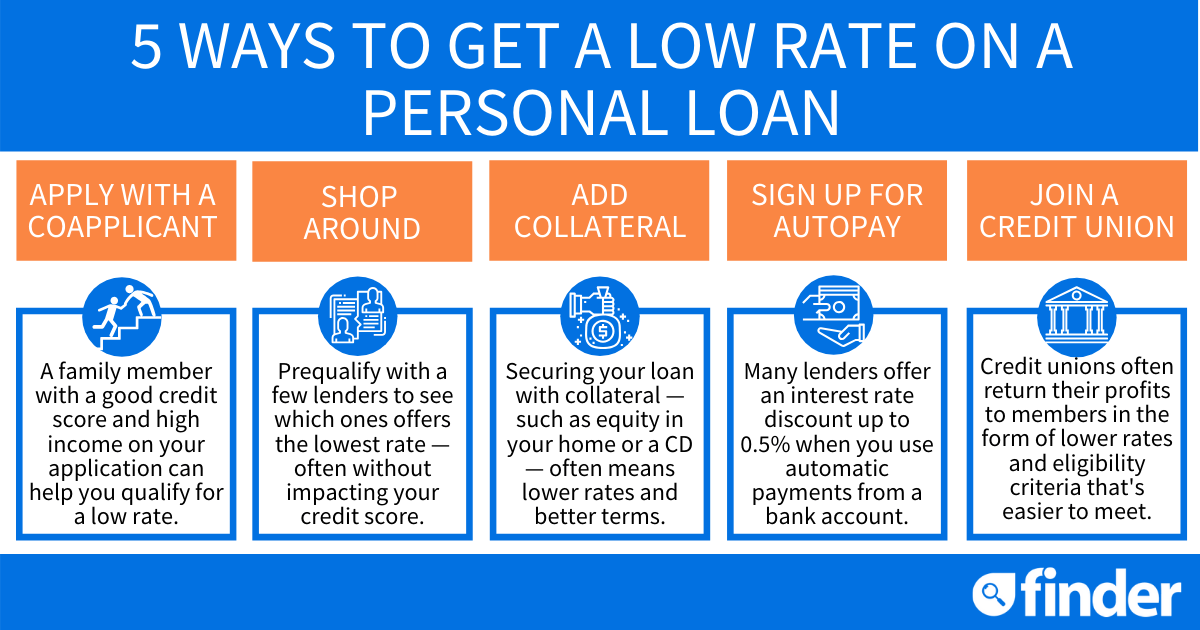

Shopping Around for the Best Personal Loan Offers

Comparing rates from multiple lenders is essential to secure the lowest personal loan interest rates. Don't settle for the first offer you receive.

-

Use Online Loan Comparison Tools: Several websites provide comparison tools that allow you to see rates from various lenders simultaneously.

-

Contact Multiple Banks and Credit Unions Directly: Visit local branches and inquire about their personal loan options and rates.

-

Consider Online Lenders: Online lenders often offer competitive rates and streamlined application processes.

Remember to consider factors beyond the interest rate, such as origination fees, prepayment penalties, and repayment terms, when comparing offers.

Negotiating Your Personal Loan Interest Rate

Negotiating a lower interest rate is sometimes possible, particularly if you have an excellent credit score and a strong financial history.

-

Highlight Your Strong Credit History: Emphasize your positive credit history and your commitment to timely repayment.

-

Present Competing Offers: If you've received offers from other lenders, use them as leverage to negotiate a better rate.

-

Negotiate a Shorter Loan Term: Offering to shorten the loan term can demonstrate your commitment to paying off the loan quickly and might lead to a reduced interest rate.

Avoiding Predatory Lending Practices

Be aware of predatory lending practices, which involve unfair or abusive loan terms. Warning signs include:

-

Excessively High Fees and Interest Rates: Be wary of lenders charging significantly higher fees and interest rates than average.

-

Hidden Charges: Carefully review the loan agreement for hidden charges or fees.

-

Aggressive Sales Tactics: Legitimate lenders won't pressure you into making quick decisions.

To avoid predatory lenders:

-

Research Lenders Thoroughly: Check online reviews and ratings before applying.

-

Read All Loan Documents Carefully: Don't sign anything you don't fully understand.

-

Be Wary of Lenders Who Pressure You: Legitimate lenders will give you time to consider your options.

Conclusion: Secure Your Lowest Personal Loan Interest Rates Today

Securing the lowest personal loan interest rates involves understanding interest rate components, improving your credit score, shopping around for competitive offers, and potentially negotiating a better deal. By following these strategies and avoiding predatory lending practices, you can significantly reduce the overall cost of your personal loan and save thousands of dollars over time. Don't delay your savings – start securing your lowest personal loan interest rates today! Use our tips to find the best offer for your financial needs.

Featured Posts

-

Applying For No Credit Check Loans With Guaranteed Approval A Direct Lender Guide

May 28, 2025

Applying For No Credit Check Loans With Guaranteed Approval A Direct Lender Guide

May 28, 2025 -

Should You Take Ozempic A Comprehensive Guide To Glp 1 Receptor Agonists

May 28, 2025

Should You Take Ozempic A Comprehensive Guide To Glp 1 Receptor Agonists

May 28, 2025 -

Serious Injury Blow For Ipswich Mc Kenna And Philogene Out

May 28, 2025

Serious Injury Blow For Ipswich Mc Kenna And Philogene Out

May 28, 2025 -

Kanye Wests Wife Bianca Censori Under Fire For Repeated Public Nudity

May 28, 2025

Kanye Wests Wife Bianca Censori Under Fire For Repeated Public Nudity

May 28, 2025 -

French Open 2025 Top Seed Sinners Dominant Performance Against Rinderknech

May 28, 2025

French Open 2025 Top Seed Sinners Dominant Performance Against Rinderknech

May 28, 2025

Latest Posts

-

Debat Caveriviere Tabarot Loeil Du 24 Avril 2025 Replay Video

May 30, 2025

Debat Caveriviere Tabarot Loeil Du 24 Avril 2025 Replay Video

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Apres Son Annulation

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Apres Son Annulation

May 30, 2025 -

Philippe Caveriviere Vs Philippe Tabarot Video Integrale Du 24 Avril 2025

May 30, 2025

Philippe Caveriviere Vs Philippe Tabarot Video Integrale Du 24 Avril 2025

May 30, 2025 -

Ouverture Du Tunnel De Tende Le Point Sur La Situation En Juin Selon Le Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende Le Point Sur La Situation En Juin Selon Le Ministre Tabarot

May 30, 2025 -

Epcots Flower And Garden Festival What To See And Do

May 30, 2025

Epcots Flower And Garden Festival What To See And Do

May 30, 2025