Self-Defense: Securing Your Future With The Right Insurance Policy

Table of Contents

Understanding the Importance of Self-Defense Insurance

Even if you act in self-defense, unforeseen financial burdens can arise from a self-defense situation. Self-defense insurance plays a critical role in mitigating these risks, offering crucial protection against potentially devastating costs. It's about peace of mind, knowing you have a safety net in place should the unexpected occur. The right policy can significantly reduce the financial strain associated with:

-

Legal Fees: Self-defense cases can quickly become complex and expensive. Legal representation, expert witnesses, and court costs can easily reach tens of thousands of dollars. Self-defense insurance can cover these substantial legal fees, ensuring you have the best possible defense.

-

Medical Expenses: Injuries sustained during a self-defense incident, whether yours or those of the other party involved, can lead to exorbitant medical bills. Insurance can help cover these costs, preventing you from facing financial ruin. This includes hospital stays, surgeries, rehabilitation, and ongoing medical care.

-

Lost Wages: Time off work due to injury or legal proceedings can severely impact your income. Self-defense insurance can compensate for lost wages, providing financial stability during a difficult period.

-

Property Damage: Self-defense situations can sometimes result in damage to your property or the property of others. Insurance can cover the costs of repairs or replacement, preventing further financial hardship.

Types of Insurance Policies Relevant to Self-Defense

Several insurance policies can offer varying degrees of protection in self-defense situations. Understanding the nuances of each is crucial in selecting the right coverage:

-

Homeowner's/Renter's Insurance: This is a fundamental policy. Liability coverage within these policies typically protects you against claims of injury or property damage that occur on your property. However, coverage limits can vary significantly, so carefully review your policy.

-

Umbrella Insurance: Often referred to as excess liability insurance, this policy provides additional liability coverage beyond the limits of your homeowner's/renter's or auto insurance. It's a vital supplement for added protection against substantial claims.

-

Personal Liability Insurance: This standalone policy offers broader protection for personal liability, regardless of location. This is beneficial if an incident occurs outside your home or while traveling.

-

Specific Self-Defense Insurance: While not widely available as a separate policy in many regions, some specialized insurers may offer products tailored to specific self-defense scenarios. It's worth investigating whether such options exist in your area.

Key Considerations When Choosing a Self-Defense Insurance Policy

Selecting the appropriate self-defense insurance policy requires careful consideration of several key factors:

-

Coverage Limits: Understand the maximum amount your insurer will pay out for a single claim. Higher limits offer greater protection but usually come with higher premiums.

-

Premiums: The cost of your policy is a significant factor. Balance the cost of premiums with the level of coverage you need. A higher premium may be worth it for significantly greater coverage.

-

Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically mean lower premiums.

-

Exclusions: Carefully review the policy's exclusions – situations or incidents that are not covered. Understanding these limitations is crucial in making an informed decision.

-

Reputation of the Insurance Company: Research the insurer's reputation, including their claims process and customer service. Look for companies with a proven track record of fair and efficient claims handling.

How to Find the Right Self-Defense Insurance Provider

Finding the right self-defense insurance provider requires a proactive approach:

-

Online Comparison Tools: Many websites allow you to compare quotes from multiple insurers simultaneously, simplifying the process of finding the best rates and coverage.

-

Independent Insurance Agents: These agents represent multiple insurance companies, allowing them to provide personalized recommendations based on your specific needs and budget.

-

Directly Contacting Insurance Companies: Research companies directly to compare policies and obtain quotes. This allows you to delve deeper into the details of each policy.

-

Reading Reviews and Ratings: Check online reviews and ratings from reputable sources to gauge customer experiences with different insurance providers. This provides valuable insight into the claims process and overall customer satisfaction.

Conclusion

While practicing self-defense techniques is crucial, securing your future requires a comprehensive approach. Investing in the right self-defense insurance policy is a vital step in protecting yourself and your financial well-being. Don't wait until it's too late. Start exploring your options for self-defense insurance today and ensure you have the necessary protection against unexpected events. Contact an insurance professional or utilize online tools to find the best self-defense insurance policy to fit your specific needs and budget. Remember, proactive planning is the best form of self-defense.

Featured Posts

-

Predlog Novele Zakona O Romski Skupnosti Pomembne Podrobnosti Javne Obravnave

May 13, 2025

Predlog Novele Zakona O Romski Skupnosti Pomembne Podrobnosti Javne Obravnave

May 13, 2025 -

Elsbeth Season 2 Finale Multiple Familiar Faces To Return

May 13, 2025

Elsbeth Season 2 Finale Multiple Familiar Faces To Return

May 13, 2025 -

Jay Idzes 90 Menit Di Lapangan Venezia Bertahan Imbang Lawan Atalanta

May 13, 2025

Jay Idzes 90 Menit Di Lapangan Venezia Bertahan Imbang Lawan Atalanta

May 13, 2025 -

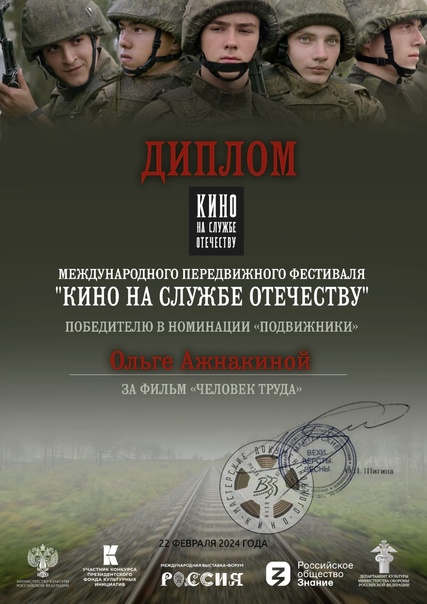

Kino Na Sluzhbe Otechestvu Obzor Festivalya V Moskve

May 13, 2025

Kino Na Sluzhbe Otechestvu Obzor Festivalya V Moskve

May 13, 2025 -

Exploring The Life And Legacy Of Angela Swartz

May 13, 2025

Exploring The Life And Legacy Of Angela Swartz

May 13, 2025