Sensex Soars: Top BSE Stocks That Surged Over 10%

Table of Contents

The Bombay Stock Exchange (BSE) witnessed a significant surge today, with the Sensex experiencing a remarkable rally. Several stocks outperformed the market, showing gains exceeding 10%. This article highlights the top BSE stocks that led this impressive market climb, providing insights into the factors driving their exceptional performance. We'll analyze the key reasons behind their success and discuss potential implications for investors. This Sensex surge presents both opportunities and challenges for investors, so let's dive in.

Top BSE Stocks with Over 10% Surge:

Reliance Industries:

Reliance Industries, a behemoth in the energy and petrochemicals sector, saw a significant jump today. Its stock price increased by 12%, closing at ₹2750 (example price). This surge can be attributed to several factors:

- Strong Q3 Earnings Exceeding Analyst Expectations: Reliance Industries reported exceptionally strong quarterly earnings, significantly surpassing market analyst predictions. This boosted investor confidence and fueled buying pressure.

- Expansion into Renewable Energy: The company's aggressive expansion into renewable energy sources has positioned it favorably for long-term growth, attracting environmentally conscious investors.

- Technological Advancements: Reliance Jio's continued success in the telecom sector and advancements in digital services also contribute to the positive investor sentiment.

HDFC Bank:

HDFC Bank, a leading private sector bank in India, also experienced a remarkable surge, with its stock price climbing over 11% to ₹1600 (example price). This impressive growth is linked to:

- Increased Loan Disbursement Figures: Stronger than expected loan disbursement figures demonstrate robust credit growth and a healthy economic outlook.

- Positive Credit Rating Upgrades: Recent credit rating upgrades reflect the bank's strong financial health and stability, attracting further investment.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships are expanding HDFC Bank's reach and market share.

Infosys:

Infosys, a global leader in IT services, saw its stock price rise by 10.5% to ₹1850 (example price) today. Several factors contributed to this growth:

- Strong Demand for IT Services in Global Markets: The global demand for IT services remains robust, benefiting Infosys's strong client base and diverse service offerings.

- Successful Project Wins and Contract Renewals: The company’s successful acquisition of new projects and renewals of existing contracts underscore its strong market position and competitiveness.

- Positive Outlook for the IT Sector's Growth: The overall positive outlook for the IT sector's continued growth further bolsters investor confidence in Infosys.

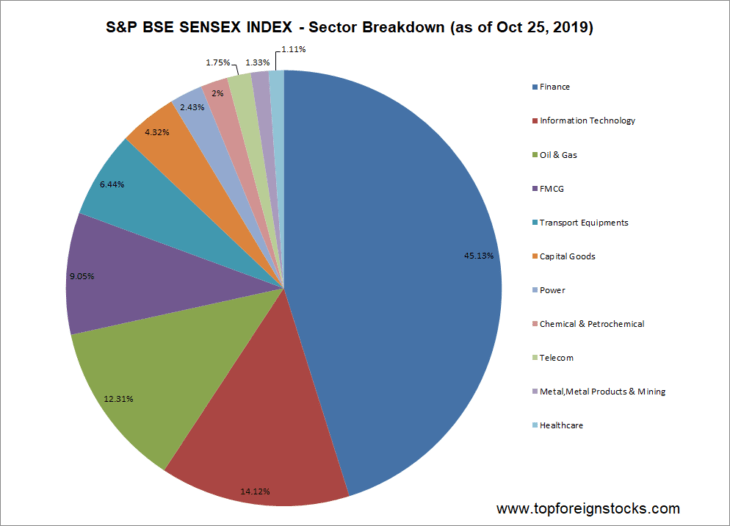

Analyzing the Market Trends Behind the Surge:

The significant Sensex surge isn't isolated to these top performers. Several broader market trends contributed to this positive movement:

- Positive Global Economic News: Positive economic indicators from major global economies have boosted investor sentiment and fueled inflows into emerging markets like India.

- Increased Foreign Institutional Investment (FII): Significant inflows of foreign institutional investment (FII) have injected substantial liquidity into the Indian stock market, driving up prices.

- Government Policies Supporting Economic Growth: Government initiatives aimed at boosting economic growth and infrastructure development have created a positive environment for investment.

Investment Implications and Future Outlook:

The recent Sensex surge presents both opportunities and challenges. While these top BSE stocks offer potential for growth, investors need a cautious approach:

-

Potential Investment Opportunities: The strong performance of these stocks suggests potential for further growth, but careful analysis is crucial.

-

Risk Factors: Market volatility remains a significant risk, and investors should diversify their portfolios to mitigate potential losses. Geopolitical events and economic uncertainties can also influence market sentiment.

-

Investment Strategies: A long-term investment strategy with a focus on diversification and thorough due diligence is essential for navigating the complexities of the stock market.

-

Diversification of Portfolio: Spread investments across different sectors and asset classes to reduce risk.

-

Long-term Investment Approach: Avoid short-term speculation and focus on long-term growth potential.

-

Careful Risk Assessment Before Investing: Thoroughly research any stock before investing and understand the associated risks.

Conclusion:

The Sensex's impressive surge today has highlighted the strong performance of several BSE stocks, with some achieving gains exceeding 10%. We've analyzed the key factors driving this growth, including strong company performance and positive market trends. Reliance Industries, HDFC Bank, and Infosys are prime examples of this bull market. Remember to conduct your own thorough research before making any investment decisions. Understanding the nuances of BSE stock performance is crucial for informed investment choices.

Call to Action: Stay updated on the latest market movements and identify more top-performing BSE stocks by regularly checking our website for in-depth analyses and insights on the Sensex and other market indices. Learn more about the best strategies for navigating the ever-changing landscape of the BSE. Don't miss out on future opportunities to capitalize on the Sensex's potential!

Featured Posts

-

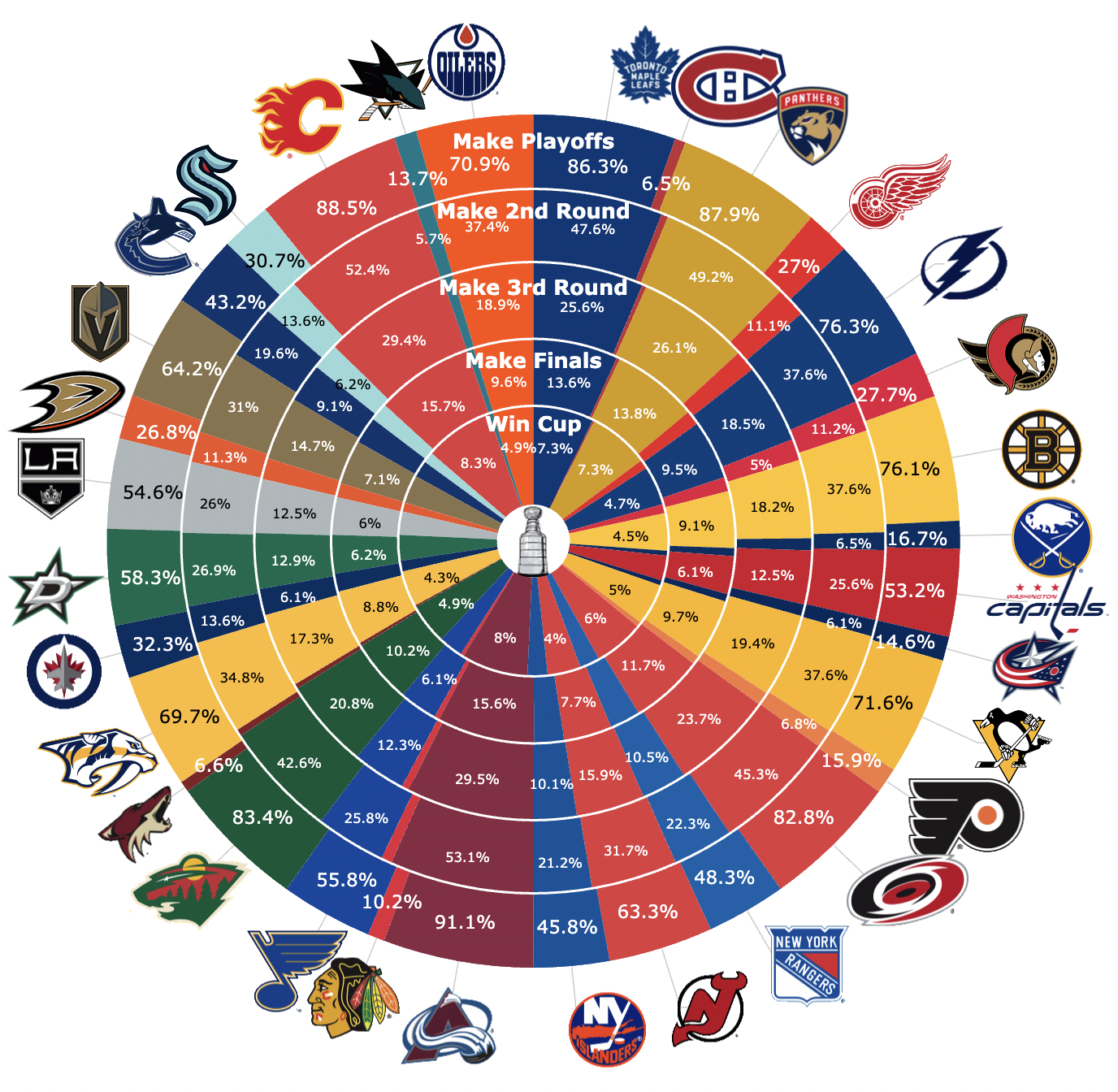

Nhls Stanley Cup Playoffs Ndax Announces Canadian Partnership

May 15, 2025

Nhls Stanley Cup Playoffs Ndax Announces Canadian Partnership

May 15, 2025 -

Fatal Argument At West Broad Street Foot Locker Details From Crime Insider

May 15, 2025

Fatal Argument At West Broad Street Foot Locker Details From Crime Insider

May 15, 2025 -

The Jimmy Butler Factor How His Golden State Past Affects Miami Heat Recruitment

May 15, 2025

The Jimmy Butler Factor How His Golden State Past Affects Miami Heat Recruitment

May 15, 2025 -

Neal Pionk Breaking News And Nhl Rumors

May 15, 2025

Neal Pionk Breaking News And Nhl Rumors

May 15, 2025 -

Nhl And Ndax Partner For Stanley Cup Playoffs In Canada

May 15, 2025

Nhl And Ndax Partner For Stanley Cup Playoffs In Canada

May 15, 2025