Shareholder Lawsuits Against Tesla: The Fallout From Elon Musk's Pay Deal

Table of Contents

The Controversial Compensation Package

Elon Musk's compensation package is undeniably unconventional and has drawn intense scrutiny. Its structure hinges on ambitious performance goals, potentially leading to exorbitant payouts far exceeding those of CEOs at comparable companies.

-

Stock options tied to ambitious performance goals: The package grants Musk stock options contingent upon Tesla achieving aggressive market capitalization and other operational milestones. These milestones are arguably ambitious, leading to questions about their attainability and the potential for inflated compensation.

-

Potential for billions in compensation based on market capitalization milestones: The sheer potential for billions of dollars in compensation, based primarily on market capitalization increases, is unprecedented for a publicly traded company. This structure directly links Musk's personal wealth to Tesla's stock performance, creating a potential conflict of interest and raising concerns about excessive risk-taking.

-

Lack of clear performance metrics in some areas: While some milestones focus on operational achievements, others are less clearly defined, leaving room for interpretation and potential manipulation. This lack of transparency fuels concerns about the fairness and objectivity of the compensation structure.

-

Comparison to executive compensation packages at similar companies: Compared to compensation packages at similar companies in the automotive and technology sectors, Musk's deal is significantly larger and more performance-based, lacking the traditional salary and bonus structures commonly employed. This significant difference has led to the criticism of the package as being excessive and potentially detrimental to shareholder interests.

Key Allegations in Shareholder Lawsuits

Several shareholder derivative suits and class action lawsuits have been filed against Tesla and its board of directors, alleging various breaches of fiduciary duty and corporate mismanagement concerning Musk's compensation.

-

Breach of fiduciary duty by the board in approving the package: Plaintiffs argue that the Tesla board failed to act in the best interests of shareholders when approving such an expansive compensation package. This is a central argument in many shareholder lawsuits against Tesla.

-

Waste of corporate assets due to the excessive nature of the compensation: The sheer magnitude of potential payouts is central to the argument that this constitutes a waste of corporate assets and an unfair allocation of resources.

-

Lack of independence and objectivity in the board's decision-making process: Concerns have been raised regarding the independence and objectivity of the board members who approved the compensation package, questioning the impartiality of their judgment. This lack of independent oversight is highlighted in many of the shareholder lawsuits against Tesla.

-

Failure to properly consider shareholder interests: Plaintiffs argue that the board disregarded the interests of ordinary shareholders in approving a compensation plan with such a high potential payout to a single individual. This neglect of shareholder interests is a common thread throughout many filings.

-

Potential conflicts of interest among board members: Some lawsuits also allege potential conflicts of interest among board members involved in approving the package, further undermining the integrity of the decision-making process.

The Role of the SEC Investigation

The Securities and Exchange Commission (SEC) has also scrutinized Tesla and Elon Musk's compensation, adding another layer of complexity to the situation. While not directly part of the shareholder lawsuits, the SEC investigation's findings could significantly impact the ongoing legal battles.

-

Possible violations of securities laws: The SEC investigation focuses on potential violations of securities laws related to the disclosure and approval of the compensation package.

-

Scrutiny of disclosures related to the compensation package: The SEC is examining whether Tesla adequately disclosed all material information relating to the compensation package to investors.

-

Potential impact of any SEC findings on the shareholder lawsuits: Any SEC findings of wrongdoing could strengthen the arguments presented in the shareholder lawsuits and increase the likelihood of significant penalties or settlements.

Potential Outcomes and Implications

The shareholder lawsuits against Tesla carry significant potential consequences for the company, Elon Musk, and its board of directors.

-

Financial penalties and settlements: The lawsuits could result in substantial financial penalties and settlements for Tesla, potentially impacting its financial performance.

-

Changes to corporate governance practices: The lawsuits may prompt Tesla to implement significant changes to its corporate governance practices, aimed at improving transparency and accountability.

-

Impact on Tesla's stock price and investor confidence: The ongoing legal battles and negative publicity surrounding the lawsuits could negatively affect Tesla's stock price and investor confidence.

-

Broader implications for executive compensation practices in publicly traded companies: The outcome of these lawsuits could significantly influence executive compensation practices across the broader market, pushing for greater transparency and accountability.

-

Potential for future regulatory changes: The controversy surrounding Musk's compensation package may lead to calls for regulatory changes aimed at curbing excessive executive pay and improving corporate governance.

Conclusion

The shareholder lawsuits against Tesla stemming from Elon Musk's compensation package represent a major challenge to the company and raise crucial questions about corporate governance and executive pay. The outcomes of these lawsuits and related SEC investigations will profoundly impact Tesla's future and influence executive compensation practices globally. Stay informed about the unfolding developments in these crucial shareholder lawsuits against Tesla. Further research into corporate governance best practices and the implications of executive compensation packages is essential for investors and corporate leaders. Continue to monitor updates on this significant legal battle affecting the future of Tesla and the broader financial landscape.

Featured Posts

-

Hollywood At A Halt The Writers And Actors Joint Strike

May 18, 2025

Hollywood At A Halt The Writers And Actors Joint Strike

May 18, 2025 -

Bbc Three Hd Tv Guide When And Where To Watch Easy A

May 18, 2025

Bbc Three Hd Tv Guide When And Where To Watch Easy A

May 18, 2025 -

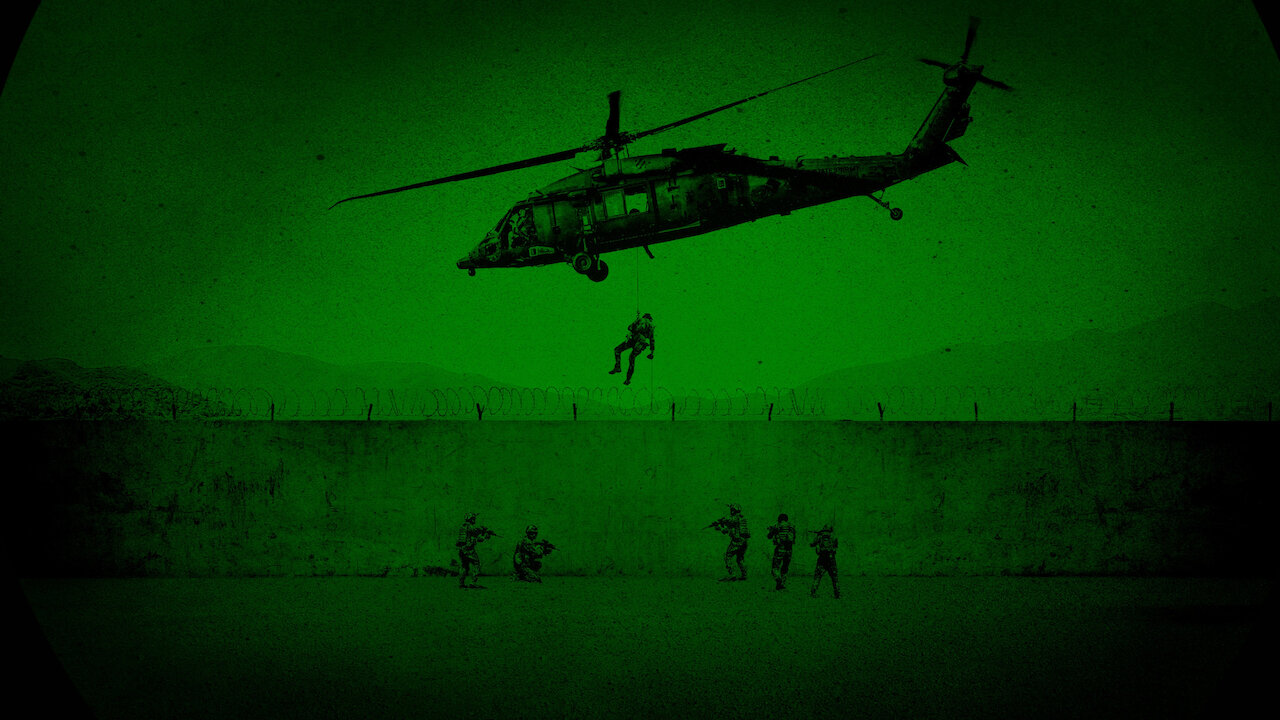

Is The Osama Bin Laden Manhunt Documentary Available On Netflix

May 18, 2025

Is The Osama Bin Laden Manhunt Documentary Available On Netflix

May 18, 2025 -

The Economic Benefits Of Large Scale Rave Events

May 18, 2025

The Economic Benefits Of Large Scale Rave Events

May 18, 2025 -

Kanye West And Taylor Swift The Super Bowl Controversy

May 18, 2025

Kanye West And Taylor Swift The Super Bowl Controversy

May 18, 2025

Latest Posts

-

Analyzing Stephen Millers Potential Appointment As Nsa Director

May 18, 2025

Analyzing Stephen Millers Potential Appointment As Nsa Director

May 18, 2025 -

Great Wolf Lodge Rescue Suffolk Boy Hailed A Hero

May 18, 2025

Great Wolf Lodge Rescue Suffolk Boy Hailed A Hero

May 18, 2025 -

Reports Suggest Stephen Miller As Mike Waltzs National Security Advisor Replacement

May 18, 2025

Reports Suggest Stephen Miller As Mike Waltzs National Security Advisor Replacement

May 18, 2025 -

Local Suffolk Boy Lauded For Drowning Rescue At Great Wolf Lodge

May 18, 2025

Local Suffolk Boy Lauded For Drowning Rescue At Great Wolf Lodge

May 18, 2025 -

Stephen Millers Potential Appointment As National Security Advisor Reports

May 18, 2025

Stephen Millers Potential Appointment As National Security Advisor Reports

May 18, 2025