Sharp Decline In Amsterdam Stock Market: 7% Drop At Open Due To Trade War

Table of Contents

The Immediate Impact of the Trade War on the AEX

The AEX index opened 7% lower than its previous closing price, representing a substantial loss in market capitalization. This immediate impact was felt most acutely in specific sectors. Export-oriented industries, particularly technology companies reliant on international trade, suffered the most significant losses.

- Specific Stock Price Drops: Several prominent AEX-listed companies saw double-digit percentage drops in their share prices. (Insert specific examples and data if available).

- Trading Volume Surge: The heightened market volatility led to a significant increase in trading volume, indicating heightened investor activity and concern. (Insert data on trading volume if available).

- Sectoral Impact: The technology sector experienced the steepest decline, followed by industrial goods and materials, highlighting the vulnerability of export-driven businesses to trade war uncertainties. This sectoral impact underscores the interconnectedness of the global economy. Keywords: AEX index, sectoral impact, market capitalization, trading volume, stock prices.

Underlying Causes of the Amsterdam Stock Market Decline

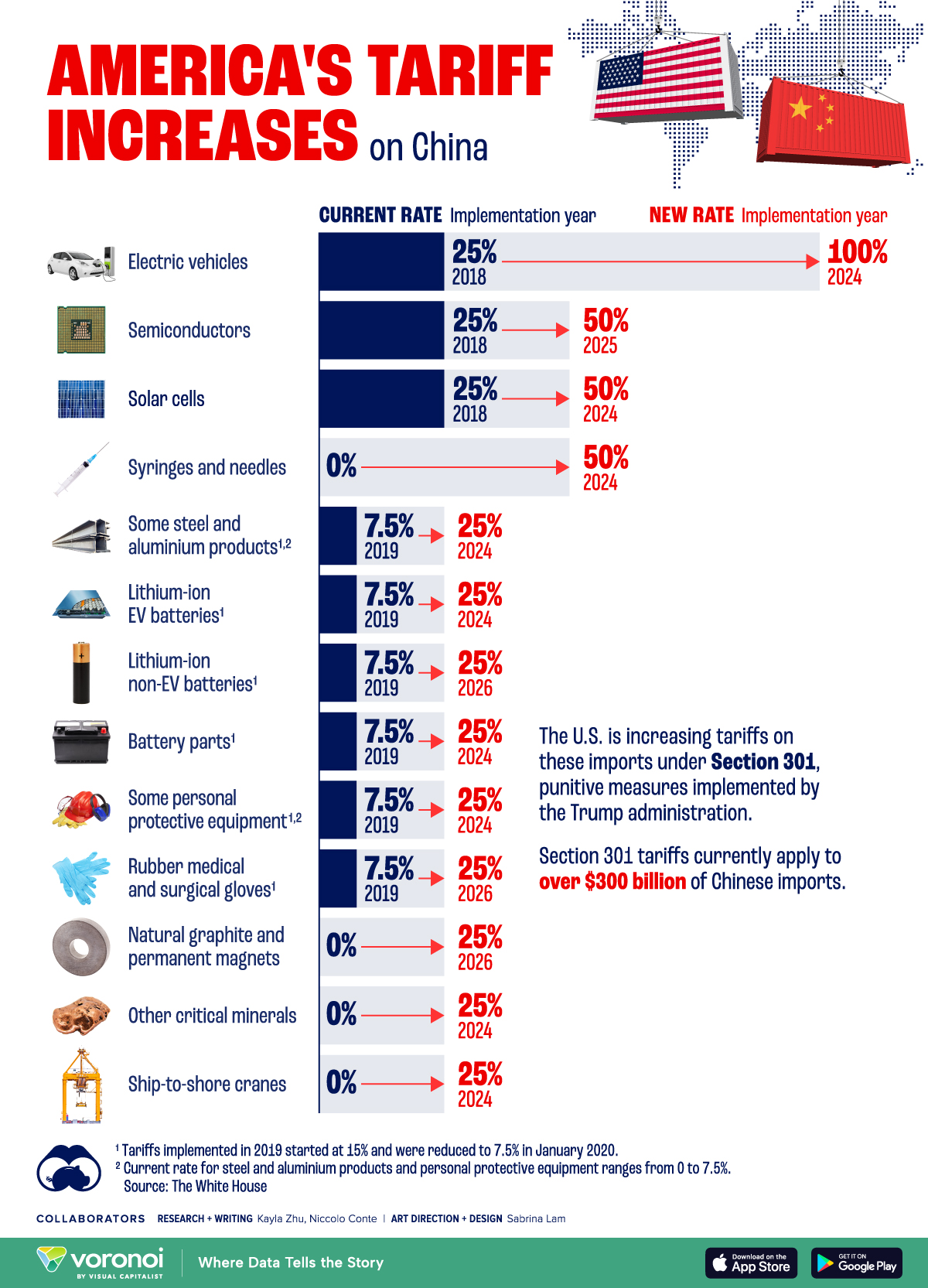

The precipitous drop in the AEX can be directly linked to the escalating trade war. New tariffs imposed (specify which tariffs and by whom) created significant uncertainty for Dutch businesses, many of whom rely heavily on international trade.

- Trade Tariffs and Restrictions: The imposition of new tariffs on (specify goods) directly impacted Dutch exporters, reducing their competitiveness in global markets and squeezing profit margins.

- Global Economic Uncertainty: The trade war has created a climate of global economic uncertainty, causing investors to adopt a more risk-averse approach and withdraw investments from potentially affected markets.

- Investor Sentiment and Market Psychology: Negative news surrounding the trade war fueled a wave of pessimism amongst investors, leading to a sell-off in the Amsterdam stock market. Keywords: trade tariffs, global uncertainty, investor confidence, market sentiment, risk aversion.

Impact on Dutch Businesses and the Economy

The decline in the AEX has significant implications for the Dutch economy. Dutch businesses, especially exporters, face reduced demand and increased costs due to trade restrictions.

- Export Impact: The Netherlands, with its highly export-oriented economy, is particularly vulnerable to trade disruptions. (Insert data on the percentage of Dutch GDP reliant on exports).

- Potential Job Losses: Reduced export revenue and decreased business activity could lead to job losses across various sectors.

- Government Intervention: The Dutch government may need to implement measures to mitigate the economic fallout, potentially through fiscal stimulus or support for affected industries. Keywords: Dutch economy, economic growth, job losses, government intervention, export impact.

International Market Reactions and Correlation

The Amsterdam stock market's decline wasn't isolated. Other major global stock markets experienced similar, albeit less severe, drops, indicating a broader investor response to the escalating trade tensions.

- Global Stock Market Reactions: (Mention specific reactions in other major markets, e.g., the Dow Jones, FTSE, etc.).

- Market Correlation: The correlation between the AEX's decline and other global markets highlights the interconnected nature of the international financial system.

- Geopolitical Risks: The trade war is just one element of a broader geopolitical landscape filled with uncertainties, further contributing to market volatility. Keywords: global stock markets, market correlation, geopolitical risks, international trade.

Analyst Predictions and Future Outlook for the AEX

Analysts offer mixed predictions for the AEX's short-term and long-term prospects. While some foresee a short-term recovery based on (mention reasons), others warn of a more prolonged period of uncertainty.

- Market Forecast: (Summarize the range of expert opinions).

- Investment Strategy: Analysts advise investors to adopt a cautious approach, diversifying portfolios and closely monitoring global trade developments.

- Market Recovery Factors: A resolution to trade disputes and improved global economic sentiment could trigger a market recovery. Keywords: market forecast, investment strategy, risk management, market recovery, economic outlook.

Strategies for Investors During Market Volatility

Navigating market volatility requires a strategic approach:

- Portfolio Diversification: Spread investments across different asset classes and geographical regions to reduce risk.

- Risk Mitigation: Implement risk management strategies, such as stop-loss orders, to limit potential losses.

- Stay Informed: Keep abreast of market developments through reliable financial news sources and expert analysis. Keywords: portfolio diversification, risk mitigation, investment advice, market analysis, financial planning.

Conclusion: Understanding the Amsterdam Stock Market's Vulnerability to Trade Wars

The sharp decline in the Amsterdam stock market underscores the vulnerability of even robust economies to the destabilizing effects of global trade wars. The impact on Dutch businesses and the wider economy is significant, requiring careful monitoring and strategic responses. Understanding the interconnectedness of global markets and the factors influencing the AEX is crucial for investors and policymakers alike.

Conclusion: Navigating the Volatility in the Amsterdam Stock Market

The 7% drop in the AEX highlights the significant impact of escalating trade wars on global markets. The consequences for Dutch businesses and investors are substantial, demanding careful attention to market trends and risk mitigation strategies. Understanding the interplay between global trade developments and the performance of the Amsterdam Stock Exchange is paramount. Stay informed about the Amsterdam Stock Market and the ongoing impact of trade wars by regularly consulting reputable financial news sources and seeking expert advice.

Featured Posts

-

Analyzing The Future Price Movement Of Apple Stock Aapl

May 25, 2025

Analyzing The Future Price Movement Of Apple Stock Aapl

May 25, 2025 -

Francis Sultanas Contribution To The Design Of Monacos Robuchon Restaurants

May 25, 2025

Francis Sultanas Contribution To The Design Of Monacos Robuchon Restaurants

May 25, 2025 -

17 Famous Figures Overnight Falls From Grace

May 25, 2025

17 Famous Figures Overnight Falls From Grace

May 25, 2025 -

Zheng Qinwen Earns Semifinal Berth At Italian Open With Win Over Sabalenka

May 25, 2025

Zheng Qinwen Earns Semifinal Berth At Italian Open With Win Over Sabalenka

May 25, 2025 -

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025