Shopify Stock Jumps Over 14% After Nasdaq 100 Listing

Table of Contents

The Nasdaq 100 Listing: A Catalyst for Growth

The addition of Shopify to the Nasdaq 100 served as a powerful catalyst, boosting the company's profile and attracting significant investor interest.

Increased Market Visibility and Investor Confidence

Inclusion in the Nasdaq 100 instantly elevates Shopify's visibility among a much wider pool of investors. This increased exposure leads to greater confidence and substantially increased trading volume.

- Prestige and Recognition: The Nasdaq 100 comprises the 100 largest non-financial companies listed on the Nasdaq Stock Market, representing a benchmark for technological innovation and market leadership. Being included signifies Shopify's achievement of a significant milestone.

- Index Fund Exposure: Many index funds track the Nasdaq 100, meaning that Shopify's inclusion automatically leads to increased investment from these passively managed funds, driving up demand for the stock.

- Attracting Institutional Investors: The Nasdaq 100 listing makes Shopify a more attractive target for institutional investors like pension funds and mutual funds, who often prioritize companies within established indices. This influx of institutional money can significantly impact the Shopify stock price.

The Nasdaq 100 itself has a strong historical performance, consistently outperforming broader market indices over the long term. This track record further enhances the appeal of its constituent companies, including Shopify.

Impact on Shopify Stock Price Volatility

While the Nasdaq 100 listing is overwhelmingly positive, it's crucial to analyze its potential impact on Shopify stock price volatility.

- Short-Term Volatility: The immediate aftermath of a major listing often sees increased price fluctuations due to heightened trading activity and investor speculation. This short-term volatility is typical, but should subside as the market adjusts.

- Long-Term Stability (Potential): Increased liquidity resulting from the greater trading volume associated with being part of the Nasdaq 100 could, in the long run, contribute to greater price stability. The influx of diverse investors helps to mitigate extreme price swings.

Underlying Factors Contributing to Shopify's Success

The Nasdaq 100 listing amplified existing positive trends for Shopify. Several underlying factors already contributed to the company's strong performance and market position.

Strong E-commerce Growth and Market Position

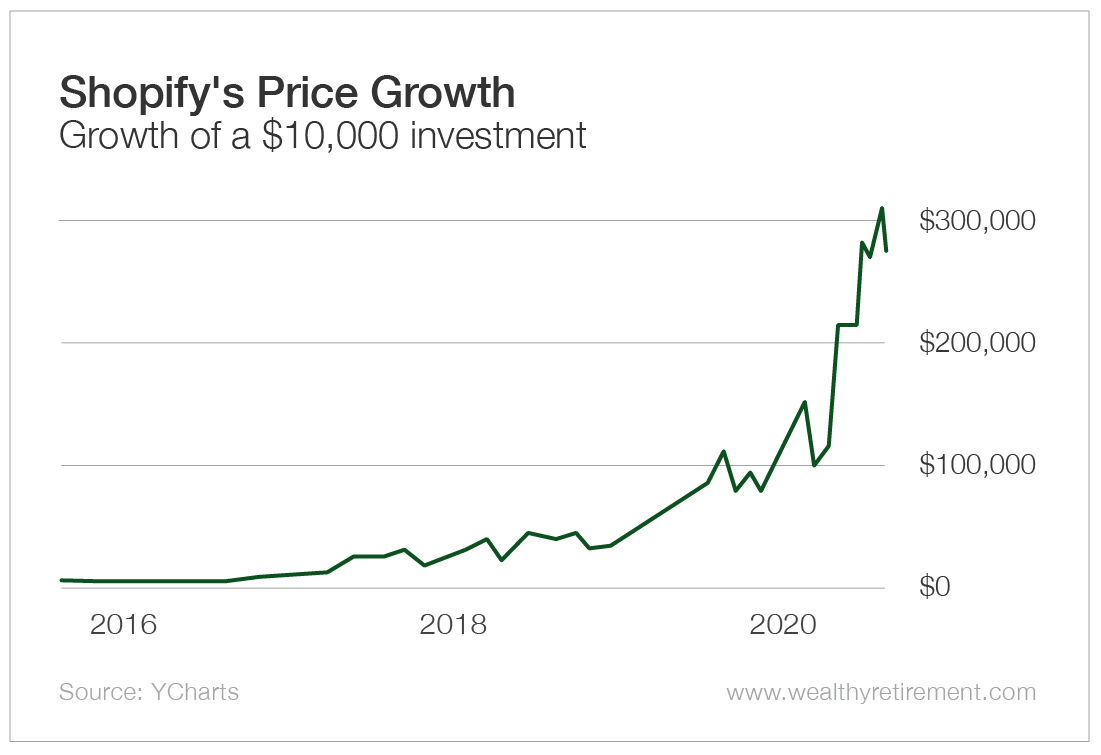

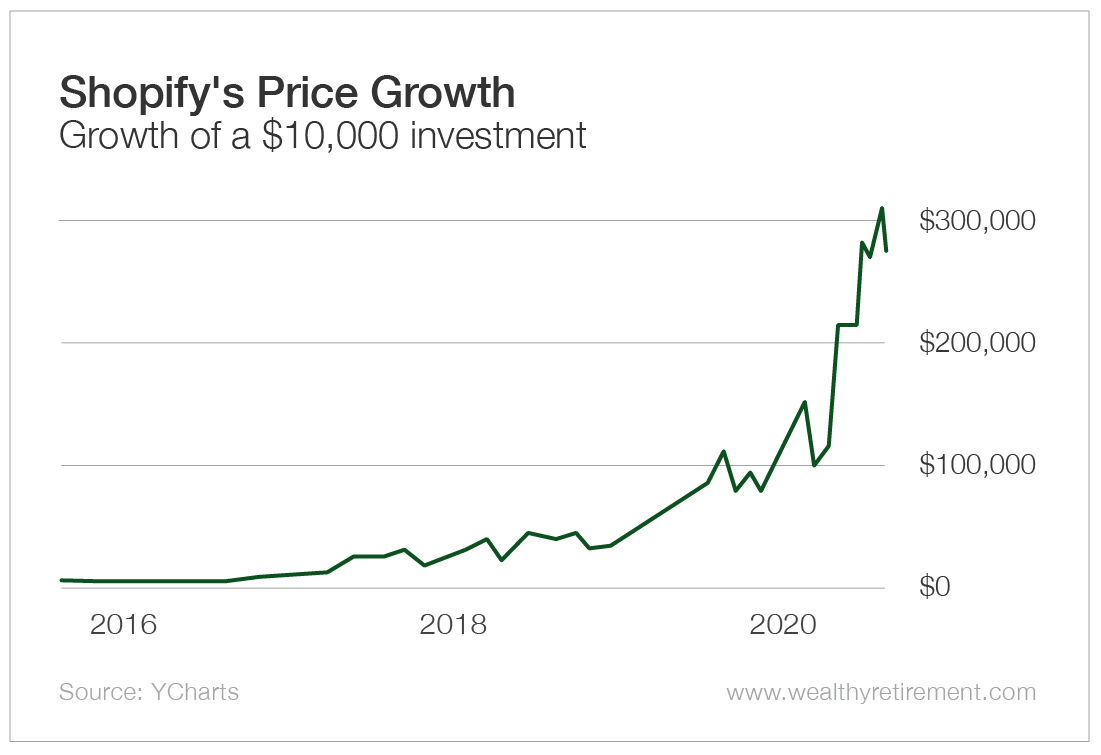

Shopify has established itself as a dominant player in the e-commerce platform market. Its consistent growth trajectory and significant market share are key drivers of investor confidence.

- Revenue Growth: Shopify has consistently demonstrated strong revenue growth year over year, reflecting the increasing adoption of its platform by merchants worldwide.

- Merchant Base Expansion: The number of merchants utilizing Shopify's platform continues to expand rapidly, signifying its appeal and effectiveness.

- Global Expansion: Shopify's expansion into new markets and its adaptability to diverse e-commerce needs further strengthens its global presence.

Innovative Product Development and Features

Shopify's ongoing commitment to innovation plays a crucial role in its continued success. The introduction of new features enhances the merchant experience and attracts new users.

- Shopify Payments: This integrated payment processing system streamlines transactions and reduces reliance on third-party providers.

- Shopify Shipping: The company's shipping solutions simplify logistics and offer competitive rates.

- App Ecosystem: A thriving app ecosystem allows merchants to customize their stores and access specialized functionalities.

Resilience During Economic Uncertainty

Shopify has demonstrated remarkable resilience during periods of economic uncertainty. This stability and adaptability are key factors influencing investor sentiment.

- Strong Financial Performance: Despite economic downturns, Shopify has maintained robust financial performance, showcasing its ability to navigate challenging conditions.

- Strategic Adaptations: The company has proactively adapted its strategies to meet evolving market demands, contributing to its continued success.

Analyst Predictions and Future Outlook for Shopify Stock

The Nasdaq 100 listing has spurred significant analysis of Shopify's future trajectory.

Expert Opinions on the Stock's Performance

Financial analysts largely hold positive views on Shopify's future performance following its Nasdaq 100 inclusion. Many predict continued growth, driven by the factors discussed above.

- Price Target Increases: Several analysts have increased their price targets for Shopify stock, reflecting their confidence in the company's future prospects.

- Positive Growth Forecasts: Analysts generally anticipate continued strong revenue growth and market share expansion for Shopify in the coming years.

Potential Risks and Challenges

Despite the positive outlook, potential risks and challenges should be acknowledged.

- Increased Competition: The e-commerce platform market is competitive, and Shopify faces ongoing challenges from established and emerging players.

- Economic Headwinds: Macroeconomic factors, such as inflation and recessionary pressures, could impact consumer spending and, consequently, Shopify's performance.

- Regulatory Changes: Changes in regulations, particularly those concerning data privacy and e-commerce operations, could affect Shopify's operations and profitability.

Conclusion

Shopify stock's impressive 14%+ surge following its inclusion in the Nasdaq 100 index is a testament to its robust market position and strong growth trajectory. The listing enhanced market visibility, boosted investor confidence, and increased trading volume. Underlying factors such as strong e-commerce growth, continuous innovation, and resilience during economic uncertainty further contribute to the positive outlook. While potential risks exist, analysts generally maintain a positive outlook on Shopify stock. Keep an eye on Shopify stock and monitor the Shopify stock price for continued updates as the company navigates its exciting future. Learn more about investing in Shopify by researching the company's financial reports and staying updated on analyst predictions.

Featured Posts

-

Real Madrid Legt E50 Miljoen Op Tafel Voor Huijsen

May 14, 2025

Real Madrid Legt E50 Miljoen Op Tafel Voor Huijsen

May 14, 2025 -

Viols Commis Par Un Oqtf L Udr Reclame Une Indemnisation Immediate Des Victimes

May 14, 2025

Viols Commis Par Un Oqtf L Udr Reclame Une Indemnisation Immediate Des Victimes

May 14, 2025 -

Urgent Recall Walmart Pulls Tortilla Chips And Jewelry Kits From Shelves

May 14, 2025

Urgent Recall Walmart Pulls Tortilla Chips And Jewelry Kits From Shelves

May 14, 2025 -

Eurojackpot Jakoi Neljae Laehes Puolen Miljoonan Euron Voittoa Taessae Voittopaikat

May 14, 2025

Eurojackpot Jakoi Neljae Laehes Puolen Miljoonan Euron Voittoa Taessae Voittopaikat

May 14, 2025 -

Elite Young English Talent Spurs And Palace In Transfer Pursuit

May 14, 2025

Elite Young English Talent Spurs And Palace In Transfer Pursuit

May 14, 2025