Should I Buy Palantir Stock Ahead Of The May 5th Earnings Announcement?

Table of Contents

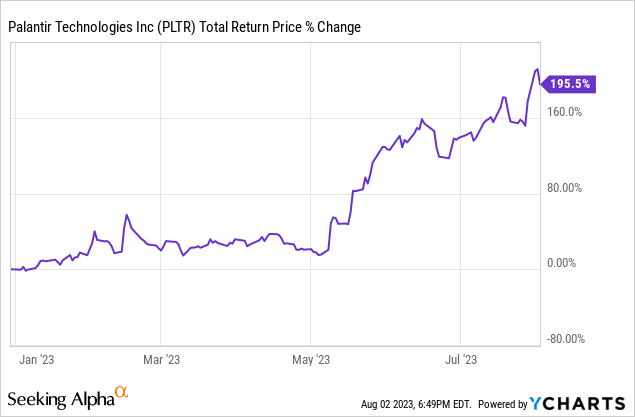

Analyzing Palantir's Recent Performance and Market Trends

Palantir's stock price has shown significant volatility in recent months. Understanding this recent performance, alongside broader market trends, is critical before considering a purchase. Leading up to the May 5th earnings announcement, we've seen [insert recent stock price performance data, e.g., "a fluctuation between $X and $Y"]. This volatility reflects not just Palantir's own performance but also broader macroeconomic factors impacting the technology sector.

- Key financial metrics to watch: Revenue growth, particularly in the commercial sector, will be crucial. Investors will also be scrutinizing profitability margins and cash flow, looking for signs of sustainable growth.

- Competitor analysis: Palantir faces competition from established players like Microsoft and smaller, agile startups in the big data analytics market. Analyzing Palantir's competitive advantage, particularly in government contracts and its unique Foundry platform, will be important.

- Impact of geopolitical events: Palantir's significant government contracts make it sensitive to geopolitical events and shifts in government spending. Current global tensions could impact its future revenue streams.

Assessing the Potential Impact of the May 5th Earnings Report

The May 5th earnings report holds significant weight for Palantir's stock price. The market's reaction will largely depend on whether the company meets or exceeds expectations.

- Potential scenarios:

- Exceeding expectations: Strong revenue growth, especially in the commercial sector, and improved profitability could trigger a significant positive stock price reaction.

- Meeting expectations: Meeting analysts' predictions might lead to a modest positive or neutral reaction.

- Falling short of expectations: Disappointing results could cause a sharp decline in the Palantir stock price.

- The role of guidance: Palantir's guidance for future financial performance will heavily influence investor sentiment. Positive projections for future quarters could offset any short-term disappointments.

- Historical analysis: Review Palantir's past earnings announcements and the subsequent market reactions to gain insight into potential outcomes. This historical data provides valuable context and can help you gauge likely responses to this year's report.

Evaluating the Risks and Rewards of Investing in Palantir Stock

Investing in Palantir stock involves both significant potential rewards and considerable risks. A balanced assessment of both is crucial before making a decision.

- Risk assessment factors:

- Volatility: Palantir stock is known for its volatility, making it a high-risk investment.

- Market conditions: Broader macroeconomic factors, like interest rate hikes and inflation, can significantly impact technology stocks like Palantir.

- Company-specific risks: Dependence on government contracts and intense competition in the big data analytics market represent company-specific risks.

- Potential for long-term growth: Palantir's strategic vision, focusing on AI and expanding its commercial offerings, positions it for potential long-term growth.

- Alternative investment options: Consider diversifying your portfolio and exploring alternative investments with potentially lower risks.

Expert Opinions and Alternative Perspectives

Several financial analysts and market experts have offered diverse opinions on Palantir stock. While some express optimism about Palantir's long-term prospects, others highlight the significant risks involved. It's crucial to gather a range of perspectives.

- Quotes/Summaries of Expert Opinions: [Insert quotes or summaries of expert opinions from reputable financial news sources, citing the sources].

- Links to Relevant Articles: [Include links to relevant articles and analyses from financial news websites].

- Opposing Viewpoints: It's essential to consider counterarguments and dissenting opinions to avoid bias and make a well-informed decision.

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

The decision of whether to buy Palantir stock before the May 5th earnings announcement is complex. While the company's long-term potential is promising, the inherent risks associated with its volatility and dependence on government contracts are undeniable. Our analysis suggests that a "wait and see" approach might be prudent. Review the earnings report, analyze the market reaction, and assess the post-earnings guidance before committing to a significant investment. Remember, thorough research is crucial before making any stock market investment.

Share your thoughts on the future of Palantir stock in the comments below! Further research into Palantir earnings and Palantir investment strategies is encouraged to refine your investment approach.

Featured Posts

-

Cnn Chief Justice Roberts Shares Story Of Identity Mix Up

May 09, 2025

Cnn Chief Justice Roberts Shares Story Of Identity Mix Up

May 09, 2025 -

Voter Fraud Charges Whittier Residents Rally Behind American Samoan Family

May 09, 2025

Voter Fraud Charges Whittier Residents Rally Behind American Samoan Family

May 09, 2025 -

Palantir Stock Down 30 Is Now The Time To Buy

May 09, 2025

Palantir Stock Down 30 Is Now The Time To Buy

May 09, 2025 -

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025 -

Trumps Greenland Gambit A Deeper Look At Increased Danish Influence

May 09, 2025

Trumps Greenland Gambit A Deeper Look At Increased Danish Influence

May 09, 2025

Latest Posts

-

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025 -

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025 -

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025 -

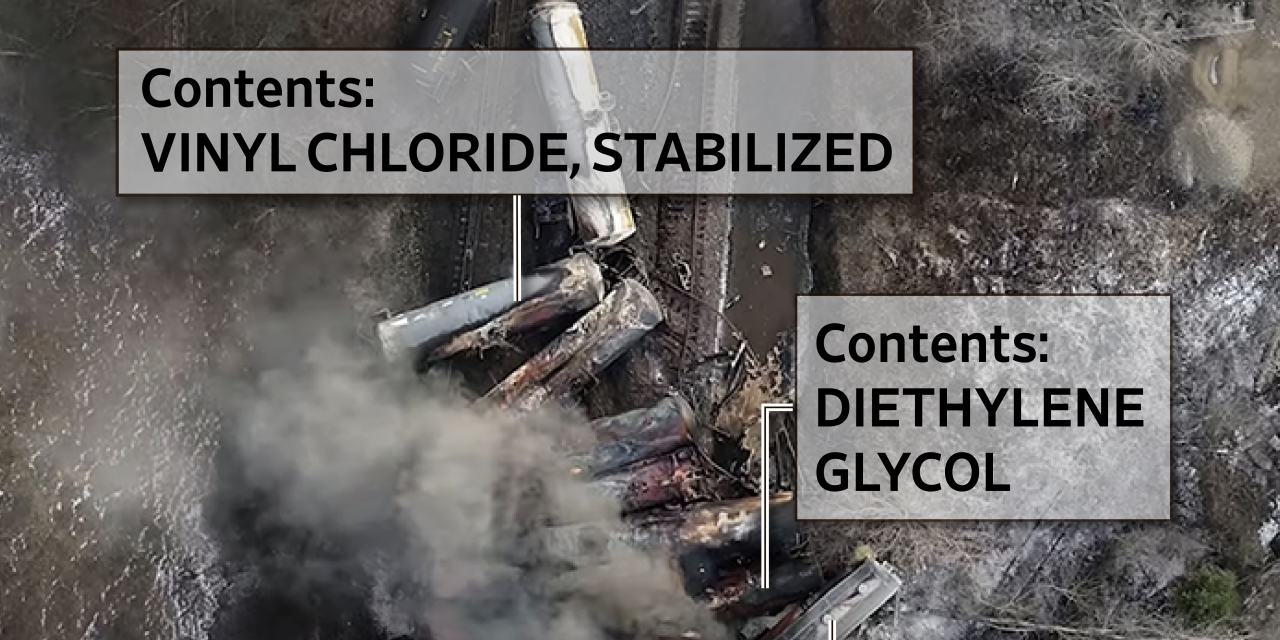

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025