Should You Buy AI Quantum Computing Stocks? A Single, Powerful Argument

Table of Contents

The Immaturity of Quantum Computing Technology

While quantum computing holds immense promise, revolutionizing fields from medicine to materials science, it's crucial to understand its current state. We are still in the relatively early stages of development, a fact that significantly impacts the viability of AI quantum computing stocks as a short-term investment. The technology is far from reaching its theoretical potential.

- Significant technological hurdles remain before widespread practical application. Building and maintaining stable quantum computers is incredibly challenging. The delicate nature of quantum bits (qubits) makes them highly susceptible to errors caused by environmental interference. Error correction remains a major obstacle.

- Current quantum computers are highly experimental and prone to errors. Existing quantum computers are limited in their qubit count and processing power. Their error rates are substantially higher than classical computers, limiting their usefulness for complex computations.

- Scalability and stability are major challenges hindering progress. Scaling up the number of qubits while maintaining their coherence and stability is a monumental task. Larger quantum computers are more difficult to control and maintain, leading to increased error rates.

- "Quantum supremacy" demonstrations are often limited in scope and practical application. While some quantum computers have demonstrated a capability to outperform classical computers on specific, highly specialized tasks, these demonstrations haven't translated into widespread practical applications yet. The ability to solve real-world problems remains a key challenge. This impacts the short-term value of many AI Quantum Computing stocks.

The High-Risk, High-Reward Nature of AI Quantum Computing Stocks

Investment in AI quantum computing companies is inherently speculative. While the potential rewards are enormous – think revolutionary advancements in medicine, materials science, and artificial intelligence itself – the risks are equally significant. This is a sector for long-term investors with a high-risk tolerance, and understanding this is key to responsible investing in AI quantum computing stocks.

- Stock prices are highly volatile and subject to dramatic fluctuations. News regarding technological breakthroughs or setbacks can cause significant price swings, creating both opportunities and potential for substantial losses.

- Many companies are pre-revenue or have limited revenue streams. Most companies in this sector are focused on research and development, meaning there's little or no current return on investment for shareholders.

- Significant capital investment is required for research and development. The high cost of research and development poses a significant challenge for many companies, potentially impacting their long-term viability.

- Regulatory uncertainty and geopolitical factors could influence market performance. Government regulations and international relations can significantly impact the development and adoption of quantum computing technologies.

Assessing Your Risk Tolerance

Before investing in AI quantum computing stocks, it's crucial to honestly assess your own risk tolerance and investment goals. This is not a suitable investment for risk-averse investors. Your investment strategy should account for the volatility inherent in this sector.

- Consider your overall investment portfolio and its diversification. Investing in AI quantum computing stocks should only be a small part of a well-diversified portfolio.

- Only invest money you can afford to lose completely. The potential for significant losses is real, so only invest funds that you can afford to lose without impacting your financial well-being.

- Have a long-term investment horizon, as significant returns may take years to materialize. This is not a get-rich-quick scheme. Expect a long wait before seeing significant returns on your investment in AI quantum computing stocks.

- Consult a financial advisor before making any investment decisions. A qualified financial advisor can help you assess your risk tolerance and determine if this type of investment aligns with your overall financial goals.

Conclusion

Investing in AI quantum computing stocks offers the potential for extraordinary returns, but carries considerable risk due to the current immaturity of the technology. The single most powerful argument influencing your decision should be your realistic assessment of the technology's current developmental stage and your tolerance for significant risk. Understanding the high-risk, high-reward nature of this investment is paramount.

Call to Action: Before diving into the world of AI quantum computing stocks, carefully weigh the high-risk, high-reward nature of this investment. Conduct thorough research, understand the technological limitations, and assess your risk tolerance before making any investment decisions in AI quantum computing stocks or other related high-risk investments. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

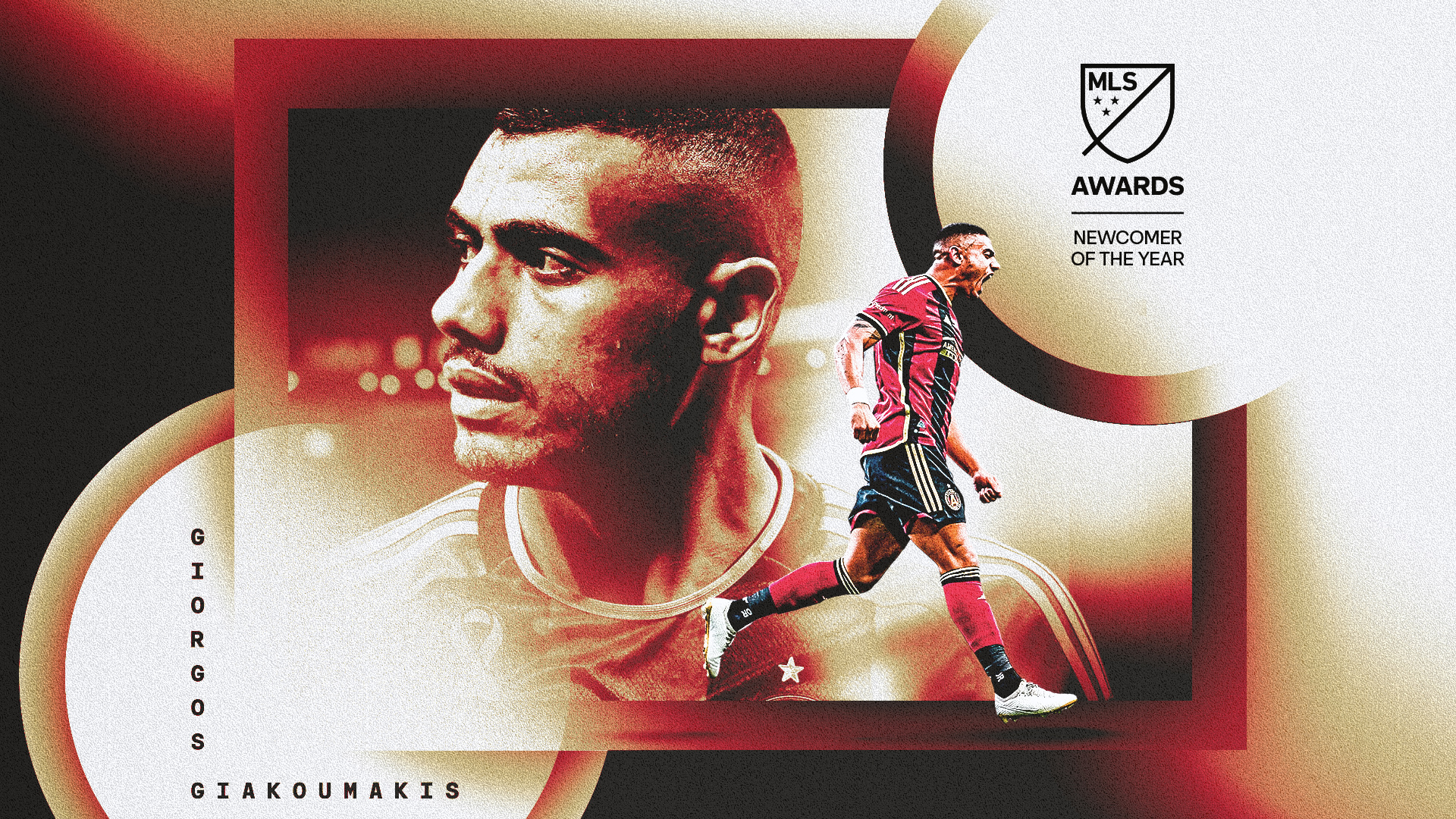

Obstacles To A Successful Mls Transfer For Giorgos Giakoumakis

May 21, 2025

Obstacles To A Successful Mls Transfer For Giorgos Giakoumakis

May 21, 2025 -

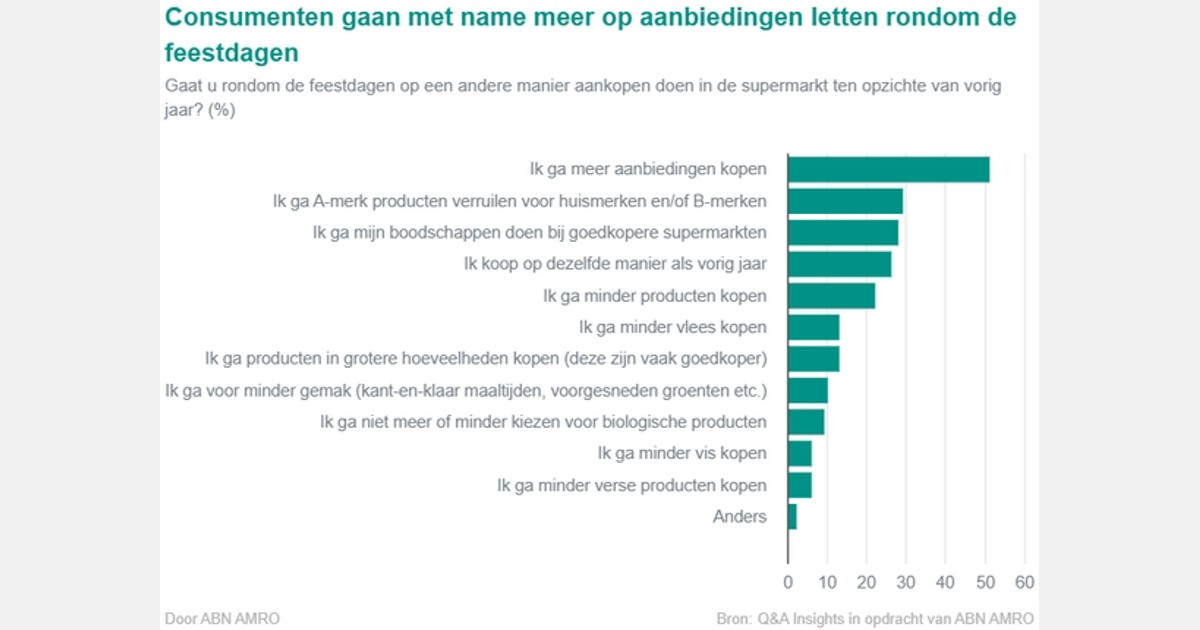

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 21, 2025

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 21, 2025 -

Retired 4 Star Admiral Convicted On Bribery Charges

May 21, 2025

Retired 4 Star Admiral Convicted On Bribery Charges

May 21, 2025 -

Abn Amro Daling Voedselexport Naar Vs Door Nieuwe Heffingen

May 21, 2025

Abn Amro Daling Voedselexport Naar Vs Door Nieuwe Heffingen

May 21, 2025 -

Abn Amros Bonus System Investigation And Potential Fine

May 21, 2025

Abn Amros Bonus System Investigation And Potential Fine

May 21, 2025

Latest Posts

-

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025