Should You Buy Apple Stock Now? Wedbush's Perspective After Price Target Cut

Table of Contents

Keywords: Apple stock, Apple price target, Wedbush, buy Apple stock, Apple stock price, Apple investment, stock market, tech stock, investment strategy, Apple stock forecast

Investing in the stock market always involves risk, and decisions about whether to buy Apple stock are no exception. Recently, Wedbush Securities, a prominent investment bank, lowered its price target for Apple stock, sending ripples through the investment community. This action prompts a crucial question for potential investors: should you buy Apple stock now? Let's delve into the details and explore the implications of this price target cut.

Wedbush's Price Target Cut: The Details

Wedbush recently reduced its Apple stock price target, signaling a shift in their outlook for the tech giant. While the specific numbers will vary depending on the timing of this article's publication (always check for the most up-to-date information), let's assume, for illustrative purposes, that the previous target was $200 and the new target is $180. This represents a significant decrease and warrants careful consideration by investors.

- Reasoning behind the cut: Wedbush's reasoning likely included concerns about several factors. These could range from potential softening iPhone demand due to macroeconomic headwinds to concerns about the competitive landscape and supply chain disruptions. Their report likely detailed these specific concerns in greater depth.

- Other analyst actions: It's essential to consider the broader analyst sentiment. Have other firms also downgraded Apple, or are there counterbalancing upgrades? Examining the consensus view from various financial institutions provides a more comprehensive picture.

- Wedbush report link: [Insert link to Wedbush report here, if publicly available].

Analyzing the Impact on Apple's Stock Price

The immediate market reaction to Wedbush's price target cut is critical to understanding its impact. Following the announcement, Apple's stock price likely experienced a decrease.

- Percentage change: The percentage change in Apple's stock price immediately following the announcement provides a measure of the market's response to the news. A significant drop might suggest widespread agreement with Wedbush's concerns, while a minimal reaction might indicate investor resilience.

- Comparison to the tech sector: It's crucial to compare Apple's performance to the broader technology sector. If the entire tech sector is experiencing a downturn, the impact of Wedbush's report might be less significant than if Apple underperforms its peers.

- Investor sentiment and trading volume: Analyzing investor sentiment through social media, news articles, and trading volume provides additional context. High trading volume after the announcement indicates heightened investor activity and uncertainty.

Long-Term Outlook for Apple Stock: Beyond the Short-Term Dip

While a price target cut might cause short-term volatility, investors should consider Apple's long-term growth prospects. Apple boasts a robust ecosystem and a strong financial position.

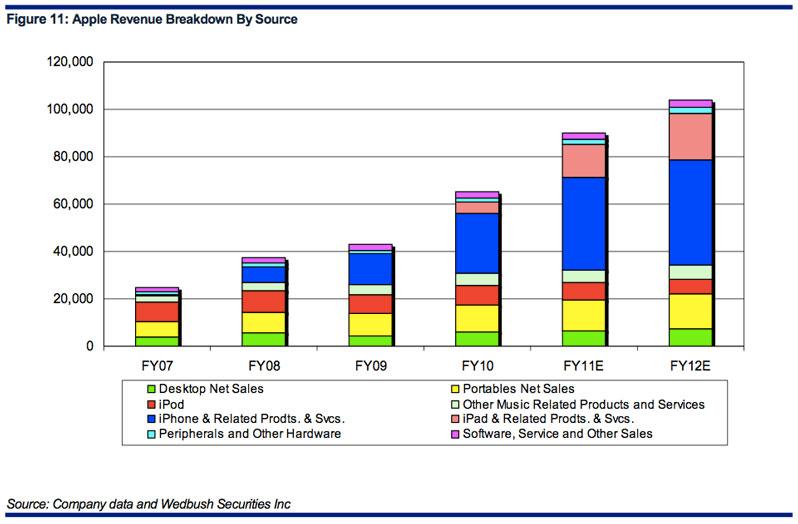

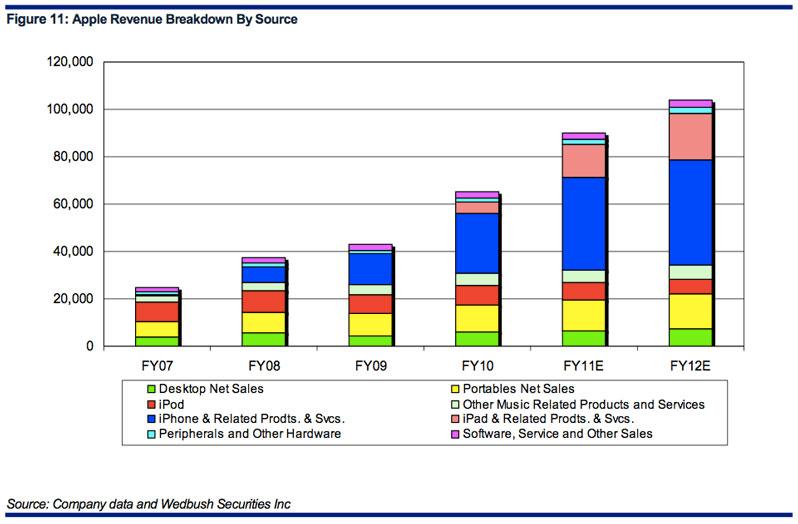

- Strengths of the Apple ecosystem: Apple's services segment, including Apple Music, iCloud, and the App Store, provides recurring revenue streams and demonstrates strong growth potential. Wearables like the Apple Watch and AirPods also contribute significantly to overall revenue.

- Future product launches and innovations: Apple's history of innovation is a key driver of its long-term success. Anticipated future product launches and technological advancements can significantly impact its stock price in the long run.

- Financial health and balance sheet: Apple's strong financial health and substantial cash reserves provide a buffer against economic downturns. This financial strength offers investors a degree of security.

- Competitive landscape and market share: While competition exists, Apple maintains a strong market share in several key product categories. Its brand loyalty and premium positioning provide a competitive advantage.

Considering Macroeconomic Factors

Broader macroeconomic conditions significantly influence Apple's stock performance.

- Consumer spending: Inflation, interest rates, and recessionary fears can impact consumer spending on discretionary items, such as Apple products. Economic uncertainty might lead to reduced demand.

- Supply chain impact: Global supply chain disruptions can affect Apple's production and delivery of products, potentially impacting revenue and profits.

Alternative Investment Strategies: Diversification and Risk Management

Investing in Apple stock should be part of a broader investment strategy.

- Diversified portfolio: Diversification across different asset classes and sectors reduces risk. Don't put all your eggs in one basket.

- Investment goals and risk tolerance: Define your investment goals and risk tolerance before making any investment decisions.

- Other investment options: Explore other tech stocks or investment opportunities beyond Apple to balance your portfolio.

Conclusion

Wedbush's price target cut for Apple stock raises valid concerns, but it's not the sole determinant of whether to buy Apple stock now. While the short-term outlook might be uncertain due to macroeconomic factors and potential softening demand, Apple's long-term growth prospects remain strong due to its robust ecosystem, financial health, and innovative capabilities. The decision of whether to buy Apple stock is ultimately yours. Weigh the risks and rewards carefully, conduct thorough research, and, if necessary, consult a financial advisor before investing. Remember, this article is for informational purposes only and does not constitute financial advice. Should you buy Apple stock now? The answer depends on your individual circumstances and investment strategy.

Featured Posts

-

Sergey Yurskiy Vospominaniya V Teatre Mossoveta

May 25, 2025

Sergey Yurskiy Vospominaniya V Teatre Mossoveta

May 25, 2025 -

Escape To The Country Choosing The Right Location For You

May 25, 2025

Escape To The Country Choosing The Right Location For You

May 25, 2025 -

20 Anos Depois O Impacto Duradouro Do Trailer E Sua Frase Marcante

May 25, 2025

20 Anos Depois O Impacto Duradouro Do Trailer E Sua Frase Marcante

May 25, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 25, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 25, 2025 -

Analysis Mia Farrows Reaction To Trumps Congressional Address And The State Of American Democracy

May 25, 2025

Analysis Mia Farrows Reaction To Trumps Congressional Address And The State Of American Democracy

May 25, 2025