Should You Buy BigBear.ai Stock Today?

Table of Contents

BigBear.ai's Business Model and Competitive Advantage

BigBear.ai is a leading provider of artificial intelligence (AI) and data analytics solutions, primarily serving the government, defense, and commercial sectors. Its business model centers on delivering advanced, AI-powered capabilities to solve complex challenges.

AI-powered Solutions and Target Markets

BigBear.ai offers a diverse portfolio of AI-driven solutions, including:

- Cybersecurity: Protecting critical infrastructure and sensitive data through advanced threat detection and response.

- Data Analytics: Transforming massive datasets into actionable insights for improved decision-making.

- Machine Learning: Developing predictive models to forecast future trends and optimize operations.

- Geospatial Intelligence: Leveraging location data for enhanced situational awareness and analysis.

BigBear.ai boasts a strong track record of successful projects, including:

- Securing multi-million dollar contracts with major government agencies.

- Developing innovative AI solutions that have significantly improved operational efficiency for clients.

- Demonstrating consistent revenue growth through strategic partnerships and expansion into new markets.

Competitive Landscape and Market Position

BigBear.ai operates in a competitive market, with established players and emerging startups vying for market share. Key competitors include:

- Palantir Technologies: Focuses on big data analytics and data integration for government and commercial clients.

- CACI International: Provides IT and professional services to government and commercial clients, including data analytics and AI capabilities.

- Booz Allen Hamilton: Offers similar services, including data analytics and cybersecurity.

BigBear.ai’s competitive advantage lies in its specialized AI-powered solutions, deep expertise in specific industries (particularly government and defense), and agile approach to problem-solving. However, competition remains fierce, requiring constant innovation and adaptation to maintain market position.

Financial Performance and Future Outlook

Analyzing BigBear.ai's financial performance is crucial for assessing its investment potential.

Recent Financial Results

BigBear.ai’s recent financial statements reveal:

- Revenue Growth: While specific figures fluctuate, the company has shown consistent growth in revenue in recent years, demonstrating market demand for its products and services. (Note: Always reference the latest financial reports for the most up-to-date figures).

- Earnings Per Share (EPS): BigBear.ai may show losses or low EPS initially, typical of growth companies heavily investing in R&D. (Reference specific financial reports for exact numbers).

- Profitability: The company's path to profitability depends on continued revenue growth and efficient cost management. Analyzing its operating margins and gross margins provides insight into its financial health. (Use data from recent financial statements).

Growth Projections and Potential

Analyst predictions and BigBear.ai's own projections point towards significant long-term growth potential, driven by:

- Increasing demand for AI and data analytics solutions: The market for AI-driven solutions is expanding rapidly, presenting substantial opportunities for growth.

- Strategic partnerships and acquisitions: Expanding market reach and capabilities through collaborations and acquisitions is key.

- New product launches and technological advancements: Continued innovation will drive future growth.

Risk Assessment for BigBear.ai Stock

Investing in BigBear.ai stock carries inherent risks, which potential investors must consider carefully.

Market Risks and Volatility

The stock market is inherently volatile, and BigBear.ai shares are no exception. Risks include:

- Economic downturns: Recessions can negatively impact demand for BigBear.ai's services, especially in the government and commercial sectors.

- Geopolitical instability: Global events can impact investor sentiment and create market uncertainty.

- Competition: Intense competition from established players and innovative startups could impact market share and profitability.

Company-Specific Risks

BigBear.ai faces unique challenges, such as:

- Dependence on government contracts: A significant portion of its revenue might be derived from government contracts, making it vulnerable to changes in government spending.

- Technological disruption: Rapid technological advancements could render its current offerings obsolete.

- Execution risk: The successful implementation of its growth strategies and new product launches is not guaranteed.

Conclusion: Should You Invest in BigBear.ai Stock?

BigBear.ai presents an intriguing investment opportunity. Its innovative AI solutions, strong client base, and growth projections are attractive. However, significant risks associated with the stock market and BigBear.ai's business model must be acknowledged. Whether or not to invest in BigBear.ai stock depends heavily on your individual risk tolerance and investment goals. Consider your investment timeline and diversification strategy.

Recommendation: This analysis does not constitute financial advice. Before investing in BigBear.ai stock, conduct thorough due diligence, consult with a qualified financial advisor, and carefully review the company's financial statements and SEC filings. Remember to diversify your portfolio to mitigate risk.

Call to Action: Do your own due diligence before investing in BigBear.ai stock. Consider your risk tolerance before investing in BigBear.ai shares. Learn more about BigBear.ai and its investment prospects through independent research and analysis.

Featured Posts

-

Sconto Eccezionale Hercule Poirot Su Play Station 5 Meno Di 10 E

May 20, 2025

Sconto Eccezionale Hercule Poirot Su Play Station 5 Meno Di 10 E

May 20, 2025 -

Big Bear Ai Stock A Current Market Overview

May 20, 2025

Big Bear Ai Stock A Current Market Overview

May 20, 2025 -

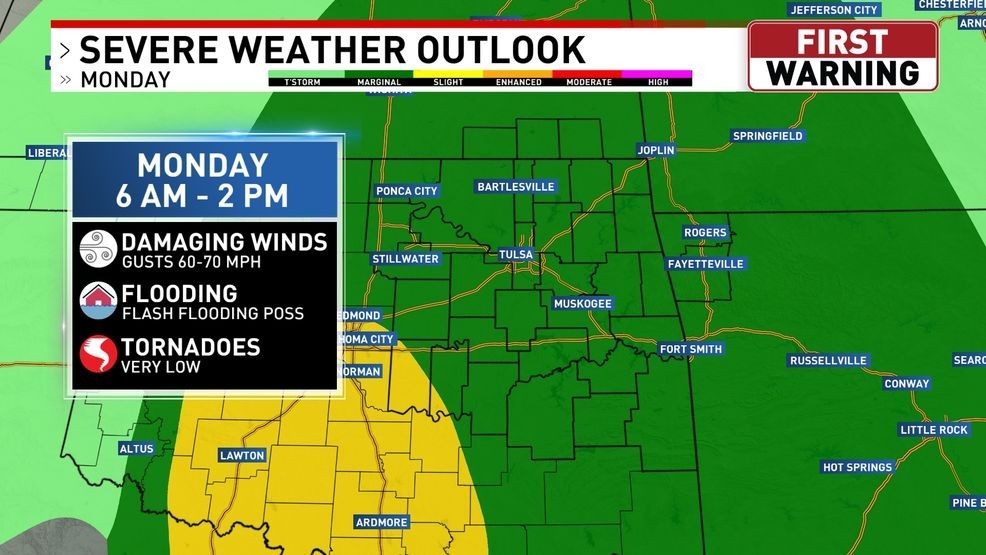

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025 -

A Hell Of A Run Examining Ftv Lives Impact

May 20, 2025

A Hell Of A Run Examining Ftv Lives Impact

May 20, 2025 -

Market Analysis Explaining The D Wave Quantum Inc Qbts Stock Plunge Of 2025

May 20, 2025

Market Analysis Explaining The D Wave Quantum Inc Qbts Stock Plunge Of 2025

May 20, 2025