Should You Buy Palantir Stock After Its Recent 30% Decline?

Table of Contents

Analyzing Palantir's Recent Performance and the 30% Decline

Understanding the Reasons Behind the Drop

Several factors likely contributed to Palantir's recent stock price decline. The broader market downturn, marked by increased volatility and investor anxiety, certainly played a role. Profit-taking after previous gains is another plausible explanation; investors who had seen significant returns might have chosen to cash out.

- Market Volatility: The overall uncertainty in the stock market significantly impacts even strong performers like Palantir. News headlines concerning inflation, interest rate hikes, and geopolitical tensions all create a climate of risk aversion.

- Analyst Downgrades: Negative analyst reports or revised earnings estimates can trigger sell-offs. Any concerns voiced by financial analysts about Palantir's future prospects likely exacerbated the decline.

- Contract Concerns: While Palantir boasts a strong portfolio of government and commercial contracts, delays or concerns about securing future contracts could contribute to investor apprehension. This uncertainty can impact the perception of the company's future revenue stream. Keywords: Palantir stock decline, PLTR stock performance, market volatility, investor sentiment.

Examining Palantir's Financials

Analyzing Palantir's financial reports is crucial for understanding its current health and future growth trajectory. While revenue growth has been impressive, profitability remains a key area to watch. Investors should scrutinize the company's revenue growth, earnings, cash flow, and debt levels to assess its financial stability.

- Revenue Growth: Palantir has demonstrated consistent revenue growth, but the rate of growth needs to be evaluated in the context of the overall market and the company's projections.

- Profitability: Palantir's path to profitability is a critical factor. While the company is showing increasing revenue, achieving consistent profitability is essential for long-term success and investor confidence.

- Cash Flow: Strong positive cash flow indicates the company's ability to generate funds internally, supporting growth and reducing reliance on external financing. Keywords: Palantir revenue, Palantir earnings, Palantir financial statements, profitability, cash flow.

Assessing Palantir's Long-Term Growth Potential

Palantir's Competitive Advantage

Palantir's proprietary technology offers a significant competitive advantage in the big data analytics market. Its platform's ability to process and analyze vast amounts of data allows clients to gain valuable insights and make more informed decisions. However, the competitive landscape is evolving rapidly.

- Technological Innovation: Palantir's continued investment in research and development is crucial for maintaining its technological edge and adapting to emerging trends in artificial intelligence and machine learning.

- Government Contracts: Palantir's strong presence in government contracts provides a stable revenue stream. However, reliance on these contracts can also be a source of risk.

- Commercial Clients: Expanding its commercial client base is crucial for Palantir's long-term growth and diversification. Keywords: big data analytics, data mining, artificial intelligence, government contracts, commercial clients, Palantir competitors.

Future Market Opportunities

The long-term outlook for the big data analytics market is positive, presenting significant growth opportunities for Palantir. Expanding into new sectors and developing innovative products and services are key strategies for capitalizing on this market potential.

- New Markets: Palantir has the potential to expand its reach into new sectors such as healthcare, finance, and the energy industry.

- New Products and Services: Continuously developing and refining its product offerings is crucial for staying ahead of the competition and meeting the evolving needs of clients.

- Global Expansion: Expanding its operations into new geographical markets can unlock significant growth opportunities. Keywords: market growth, future trends, technological innovation, Palantir growth strategy.

Risk Factors to Consider Before Investing in Palantir Stock

Valuation and Stock Price

Palantir's current valuation should be carefully examined relative to its historical performance, future projections, and compared to competitors within the big data analytics sector. The stock price remains volatile, making accurate predictions challenging.

- Price-to-Sales Ratio: Analyzing Palantir's price-to-sales ratio (P/S) provides insight into its valuation relative to its revenue.

- Comparable Companies: Comparing Palantir's valuation to that of its competitors can help determine if it's overvalued or undervalued.

- Future Growth Expectations: The market's expectations for future growth significantly impact stock valuation. Any slowdown in growth could lead to further price declines. Keywords: Palantir valuation, stock price prediction, market risk, investment risk.

Other Risks

Besides valuation concerns, several other risks are associated with investing in Palantir stock. These include dependence on government contracts, intense competition, and regulatory hurdles.

- Government Contract Dependence: Reliance on government contracts can introduce instability and susceptibility to political and budgetary changes.

- Competition: The big data analytics market is fiercely competitive, with established players and new entrants constantly vying for market share.

- Regulatory Compliance: Navigating complex regulatory landscapes, especially in sectors with sensitive data, poses significant challenges. Keywords: investment risks, Palantir risks, geopolitical risk, regulatory compliance.

Conclusion: Should You Buy Palantir Stock Now?

The decision of whether to buy Palantir stock after its recent decline is complex, balancing potential rewards against considerable risks. While Palantir possesses strong technology and a growing market opportunity, significant uncertainties remain concerning its valuation, profitability, and dependence on government contracts. The recent 30% drop might present an attractive entry point for some investors with a high-risk tolerance, but careful consideration of the factors outlined above is essential. Ultimately, the decision of whether or not to buy Palantir stock is a personal one, dependent on your individual risk tolerance and investment strategy. However, by carefully considering the factors outlined above, you can make a more informed decision about whether this recent dip represents a buying opportunity for Palantir PLTR.

Featured Posts

-

Kto Je Slovenska Dakota Johnson

May 10, 2025

Kto Je Slovenska Dakota Johnson

May 10, 2025 -

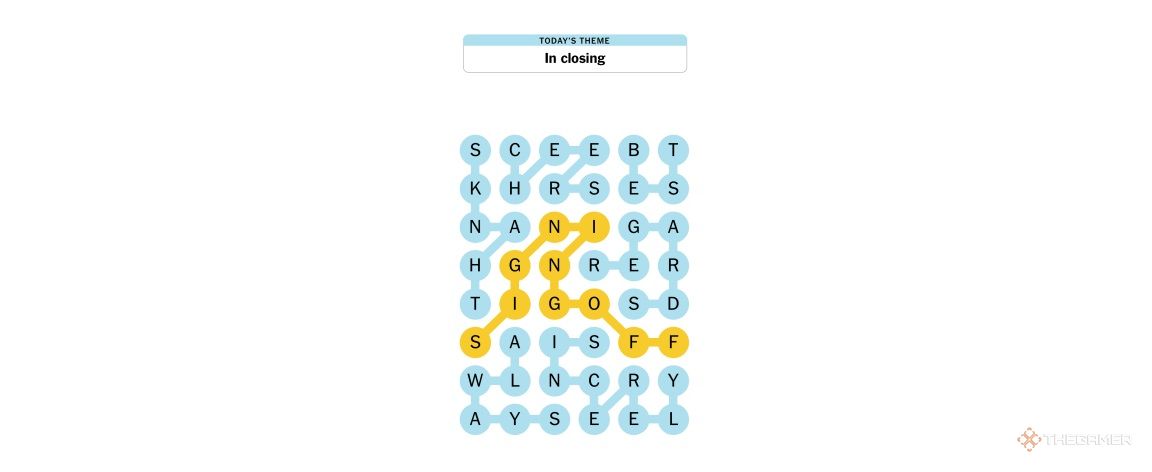

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025 -

Microsoft Activision Deal Ftcs Appeal And What It Means

May 10, 2025

Microsoft Activision Deal Ftcs Appeal And What It Means

May 10, 2025 -

Concarneau S Impose A Dijon 0 1 En National 2 04 Avril 2025

May 10, 2025

Concarneau S Impose A Dijon 0 1 En National 2 04 Avril 2025

May 10, 2025 -

Abcs Programming Strategy Analyzing The High Potential Repeat Episodes In March 2025

May 10, 2025

Abcs Programming Strategy Analyzing The High Potential Repeat Episodes In March 2025

May 10, 2025