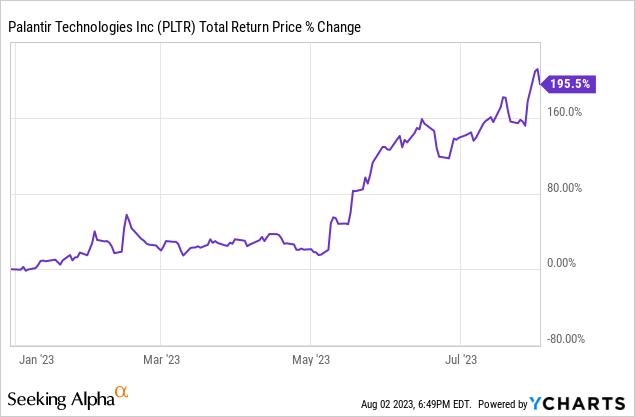

Should You Buy Palantir Stock Before Its Predicted 40% Rise In 2025?

Table of Contents

Palantir's Growth Potential and Future Prospects

Palantir's future success hinges on several key factors, influencing the validity of the predicted 40% stock price increase by 2025. Let's examine these growth drivers in detail.

Palantir Government Contracts and Revenue Streams

Palantir significantly relies on government contracts, particularly from the US government and its international allies. These contracts contribute substantially to Palantir's revenue and future growth projections.

- Significant Government Clients: Palantir works with various intelligence agencies, defense departments, and other governmental bodies worldwide, providing crucial data analytics and intelligence solutions. The continuation and expansion of these partnerships are vital for Palantir's sustained growth.

- Future Contract Wins: The potential for securing new government contracts is a key factor in assessing Palantir's future prospects. The company’s ability to win bids against competitors will directly impact its revenue streams and overall financial health. Analyzing the company's bidding success rate and the pipeline of potential contracts is crucial for investors.

- Impact on Revenue: The size and duration of these contracts directly influence Palantir's Palantir revenue and overall financial performance. Long-term contracts provide stability, while securing large contracts can significantly boost Palantir growth prospects. Keywords: Palantir government contracts, Palantir revenue, Palantir growth prospects, Palantir government clients.

Palantir Commercial Market Penetration and Growth

While government contracts are crucial, Palantir's expansion into the commercial market is equally important for long-term sustainability and diversification.

- Expanding Commercial Client Base: Palantir has been actively pursuing commercial clients across various sectors, including finance, healthcare, and aerospace. The success of this expansion will determine its ability to reduce reliance on government contracts.

- Competitive Landscape: The data analytics and AI market is highly competitive. Palantir faces established players and nimble startups. Analyzing Palantir's Palantir market share against its competitors is key to evaluating its long-term prospects. Keywords: Palantir commercial clients, Palantir commercial market, Palantir competition, Palantir case studies.

- Successful Partnerships: Strategic partnerships and successful Palantir case studies showcasing the value proposition to commercial clients are crucial for building trust and driving further adoption.

Palantir Technological Innovation and Future Developments

Palantir's commitment to research and development is a vital aspect of its future growth.

- Investment in R&D: Continuous investment in Palantir technology, particularly in areas like Palantir AI and advanced data analytics, is essential for staying competitive and developing innovative solutions.

- Impact of Advancements: New technologies can significantly enhance Palantir's offerings, attract new clients, and improve operational efficiency. Analyzing the pipeline of future technological advancements is crucial for evaluating the company's growth potential. Keywords: Palantir technology, Palantir AI, Palantir innovation, Palantir R&D.

- Product Launches and Partnerships: The launch of new products and strategic partnerships will drive growth by expanding Palantir's reach and capabilities.

Risks and Challenges Facing Palantir

Despite its growth potential, Palantir faces significant challenges that could impact the predicted 40% stock price increase.

Dependence on Large Contracts

Palantir's reliance on large government contracts presents significant risk.

- Contract Losses or Delays: The loss of major contracts or significant delays in contract renewals could severely impact Palantir's Palantir revenue and financial stability.

- Revenue Diversification: A key challenge for Palantir is diversifying its revenue streams beyond government contracts to mitigate this risk. Expanding its commercial client base is crucial in this regard. Keywords: Palantir contract risk, Palantir revenue diversification, Palantir contract renewal.

Competition and Market Saturation

The data analytics and AI market is becoming increasingly crowded.

- Increasing Competition: Palantir faces intense competition from established tech giants and emerging startups, impacting its ability to capture market share. Analyzing the competitive landscape and Palantir's ability to differentiate itself is critical. Keywords: Palantir competitors, Palantir market share, Palantir competitive landscape.

- Market Saturation: The risk of market saturation in specific niches could limit Palantir's growth potential.

Palantir Financial Performance and Valuation

A thorough analysis of Palantir's financial performance is crucial for any investment decision.

- Financial Statements: Examining Palantir's financial performance, including profitability, debt levels, and cash flow, is essential to understanding its financial health. Keywords: Palantir financial performance, Palantir valuation, Palantir stock valuation, Palantir profitability.

- Valuation: Assessing Palantir's current valuation relative to its growth prospects and comparing it to industry benchmarks is crucial for determining if the stock is currently overvalued or undervalued.

Conclusion: Should You Invest in Palantir Stock?

The predicted 40% rise in Palantir stock price by 2025 is certainly enticing, but it's essential to weigh the potential upside against the inherent risks. Palantir's growth potential is significant, driven by its government contracts, expansion into the commercial market, and technological innovation. However, its dependence on large contracts, intense competition, and financial performance must be carefully considered. Before investing in Palantir stock, conduct thorough due diligence. Analyze Palantir's financial reports, understand the competitive landscape, and consider your own risk tolerance. This article is for informational purposes only and does not constitute financial advice. Remember to consult with a qualified financial advisor before making any investment decisions related to Palantir stock or any other security. Further research on Palantir's financial reports and independent industry analysis is highly recommended to support your informed decision-making process.

Featured Posts

-

Ma Qdmh Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly Almsry

May 10, 2025

Ma Qdmh Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly Almsry

May 10, 2025 -

Snls Failed Harry Styles Impression His Response

May 10, 2025

Snls Failed Harry Styles Impression His Response

May 10, 2025 -

Can Anyone Break Ovechkins Nhl Goal Record 9 Potential Candidates

May 10, 2025

Can Anyone Break Ovechkins Nhl Goal Record 9 Potential Candidates

May 10, 2025 -

Kimbal Musk Beyond Elons Shadow Examining His Business Ventures And Philanthropy

May 10, 2025

Kimbal Musk Beyond Elons Shadow Examining His Business Ventures And Philanthropy

May 10, 2025 -

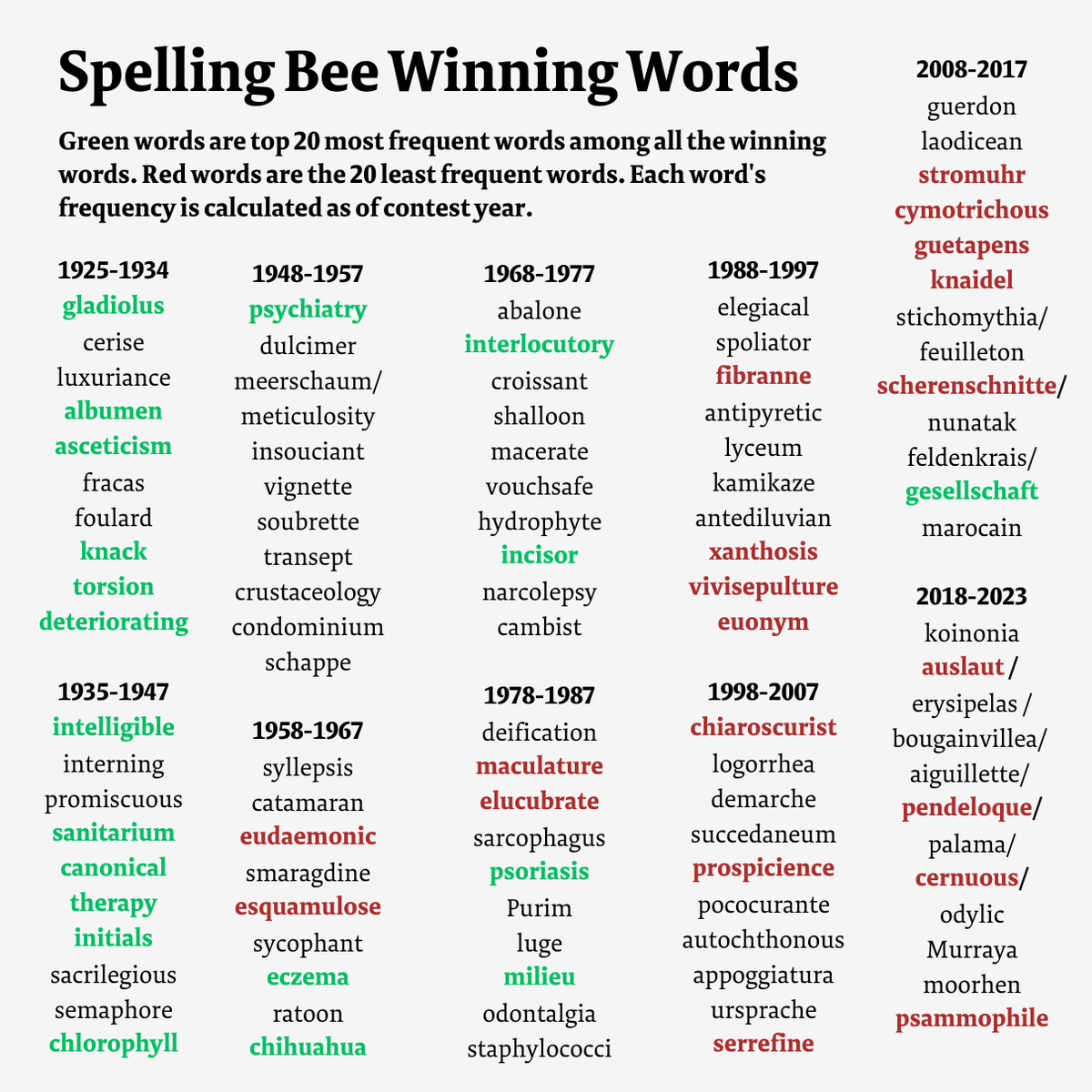

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025