Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Palantir's Recent Performance and Upcoming Earnings Report (May 5th)

Palantir's stock price has experienced considerable fluctuation in recent months, showcasing both periods of growth and significant dips. Understanding this volatility is crucial when considering a purchase before May 5th. The upcoming earnings report is undeniably significant, as it will provide a fresh snapshot of the company's financial health and future outlook. This report will likely be a major catalyst for price movement, influencing investor sentiment and potentially causing significant shifts in the stock's valuation.

- Key Financial Metrics: Investors will be closely watching key metrics such as year-over-year revenue growth, profitability margins (operating income, net income), and the growth rate of its customer base, particularly in the commercial sector.

- Recent News and Announcements: Any recent contracts secured, strategic partnerships formed, or technological advancements announced will impact the market's perception of Palantir's future prospects and influence the stock price. Keep an eye out for press releases and official company statements leading up to May 5th.

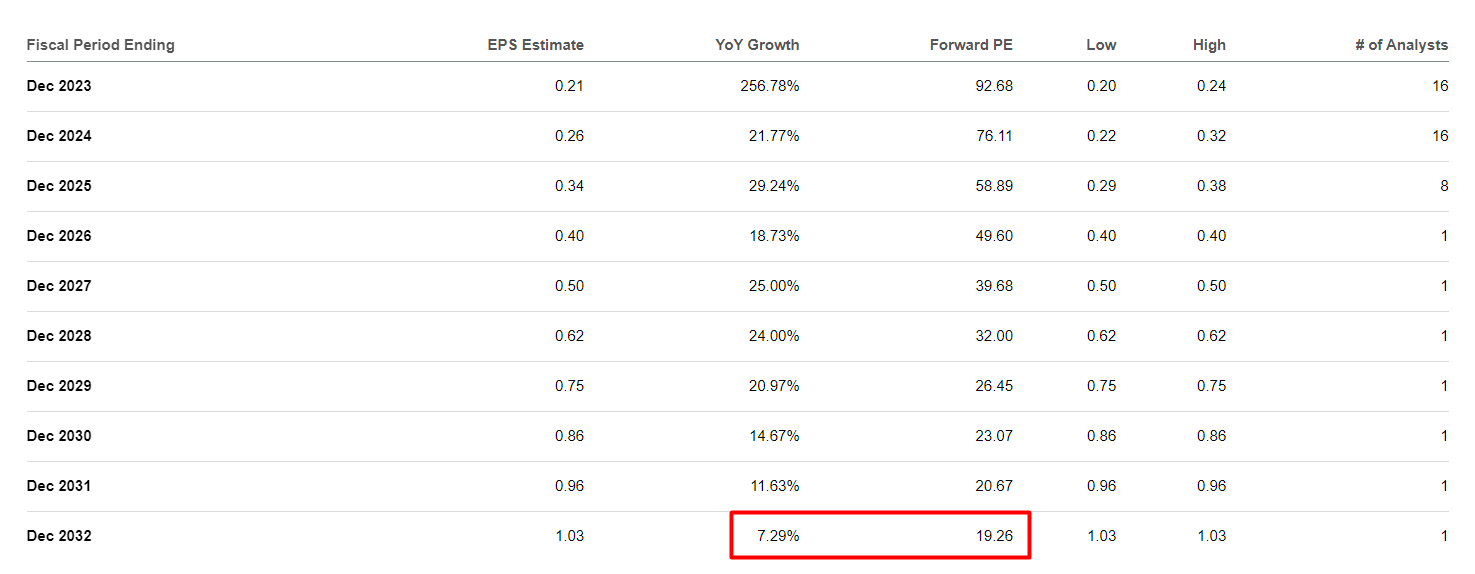

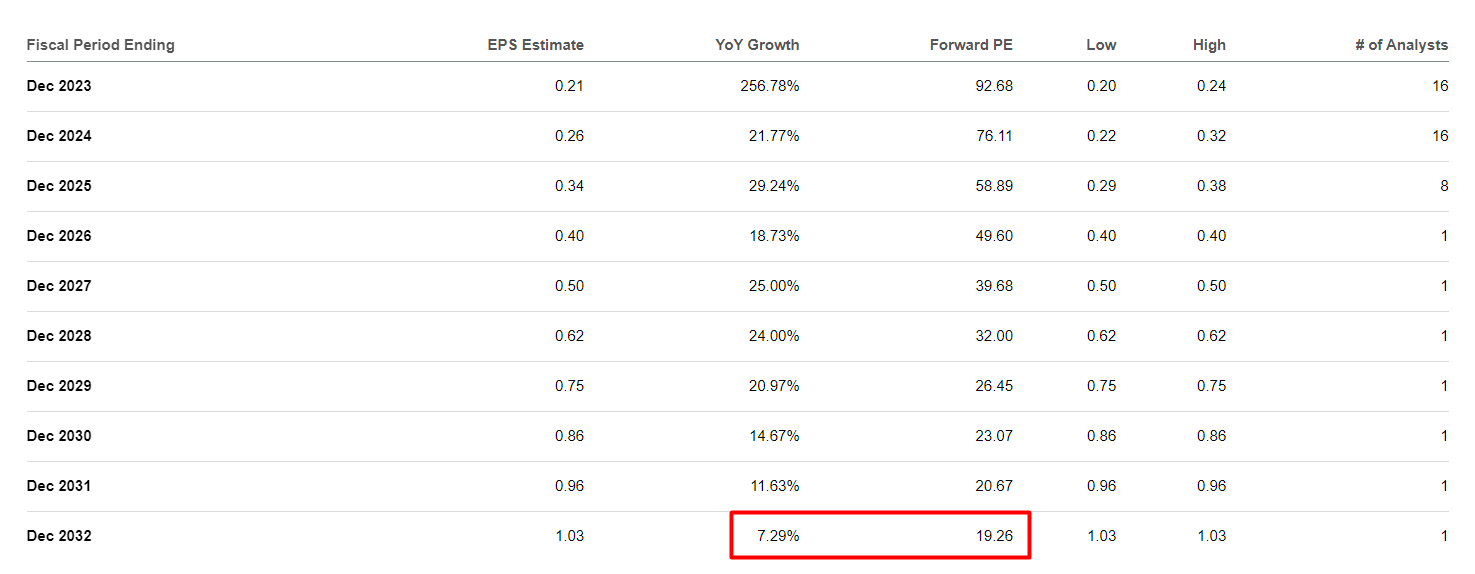

- Analyst Predictions: Analyst predictions for Palantir's Q1 2024 earnings vary widely, ranging from conservative estimates to more bullish forecasts. Understanding the range of expectations will help you assess the potential for upside or downside surprises.

Wall Street's Surprising Consensus on Palantir Stock

Despite the volatility, Wall Street's overall sentiment on Palantir stock presents a surprising picture. While some analysts maintain a bearish outlook, citing concerns about profitability and competition, others express bullish sentiment, highlighting Palantir's potential for long-term growth fueled by government contracts and expansion into the commercial sector. This mixed sentiment underscores the need for thorough due diligence before investing.

- Analyst Ratings: A diverse range of ratings from prominent analysts—including Buy, Sell, and Hold recommendations—reflect the uncertainty surrounding Palantir's future performance. Analyzing these ratings and their justifications is crucial for understanding the nuanced perspectives on the stock.

- Divergence of Opinion: The significant divergence of opinion among experts highlights the inherent risk and uncertainty involved in investing in Palantir. This highlights the importance of independent research and risk assessment.

- Rationale Behind Differing Viewpoints: Understanding the reasoning behind these differing viewpoints is vital. Some analysts may emphasize the risks associated with Palantir's dependence on government contracts, while others may focus on the potential for significant growth in the commercial market and the company’s innovative data analytics capabilities.

Key Factors Influencing Palantir's Stock Price

Several key factors significantly influence Palantir's stock price valuation. Understanding these elements is crucial for assessing the investment's potential risks and rewards.

- Government Contracts: Government contracts form a significant portion of Palantir's revenue. Fluctuations in government spending or delays in contract awards can significantly impact the company's financial performance and stock price.

- Commercial Sector Growth: Palantir's ability to penetrate and expand within the commercial sector is a critical factor determining its long-term growth potential. Success in this area could significantly boost revenue and investor confidence.

- Competition: Palantir operates in a competitive landscape filled with established players and emerging startups in the data analytics and artificial intelligence (AI) markets. Maintaining a competitive edge through innovation is crucial for its continued success.

- Technological Advancements: Palantir's continuous investment in research and development, and its ability to introduce innovative data analytics and AI solutions, will be vital in its effort to attract and retain customers in both the public and private sectors.

- Macroeconomic Conditions: Broader macroeconomic factors, such as interest rate hikes, inflation, and overall economic growth, can also significantly impact investor sentiment and the valuation of Palantir stock.

Assessing the Risk and Reward of Investing in Palantir

Investing in Palantir presents both significant potential rewards and considerable risks.

- Potential for High Growth: Palantir's innovative technology and potential for expansion in both the government and commercial sectors offer the potential for substantial returns for long-term investors.

- Potential for Substantial Losses: The inherent volatility of Palantir's stock price, combined with its dependence on large government contracts and the competitive nature of its market, presents a significant risk of substantial losses.

- Risk Tolerance: Investing in Palantir requires a high degree of risk tolerance. It's crucial to only invest an amount you can afford to lose.

Conclusion

Wall Street's consensus on Palantir stock before May 5th is mixed, reflecting the inherent uncertainty surrounding the company's future performance. The upcoming earnings report, coupled with continued growth in the commercial sector and the company's innovation, are key factors influencing the stock price. While Palantir offers potential for high growth, it also carries considerable risk.

Ultimately, the decision of whether to buy Palantir stock before May 5th is a personal one, dependent on your risk tolerance and investment strategy. However, by carefully analyzing the information presented here, and conducting your own thorough research, you can approach this decision with greater understanding. Remember to consult with a financial advisor if needed before making any investment decisions regarding Palantir stock or any other security.

Featured Posts

-

Inside The Refurbished Queen Elizabeth 2 A Cruise Ship Transformation

May 09, 2025

Inside The Refurbished Queen Elizabeth 2 A Cruise Ship Transformation

May 09, 2025 -

Behind The Scenes With Judge Jeanine Pirro Fears And A Personal Confession

May 09, 2025

Behind The Scenes With Judge Jeanine Pirro Fears And A Personal Confession

May 09, 2025 -

14 Edmonton Schools Accelerated Construction Timeline Announced

May 09, 2025

14 Edmonton Schools Accelerated Construction Timeline Announced

May 09, 2025 -

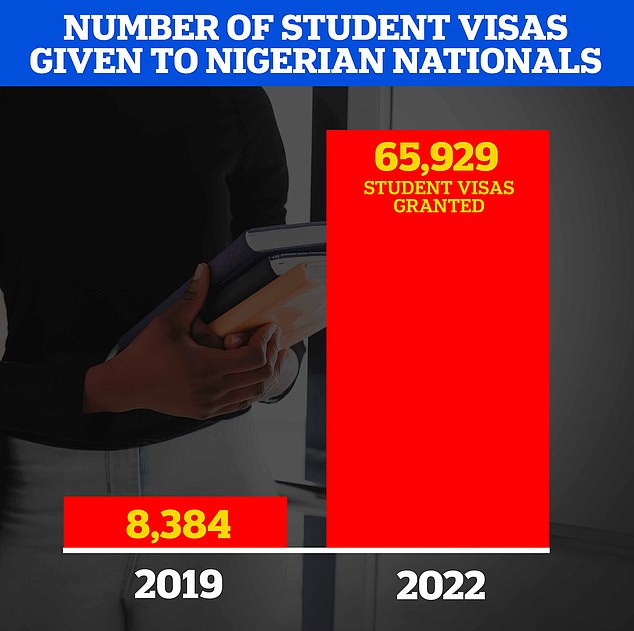

Increased Scrutiny For Nigerian Visa Applicants Amidst Uk Overstay Concerns

May 09, 2025

Increased Scrutiny For Nigerian Visa Applicants Amidst Uk Overstay Concerns

May 09, 2025 -

Nyt Strands April 9 2025 Comprehensive Guide To The Daily Crossword

May 09, 2025

Nyt Strands April 9 2025 Comprehensive Guide To The Daily Crossword

May 09, 2025

Latest Posts

-

The Kreischer Marriage Wifes Perspective On His Netflix Stand Up Comedy And Sex Jokes

May 09, 2025

The Kreischer Marriage Wifes Perspective On His Netflix Stand Up Comedy And Sex Jokes

May 09, 2025 -

The 10 Best Film Noir Movies For A Classic Film Fix

May 09, 2025

The 10 Best Film Noir Movies For A Classic Film Fix

May 09, 2025 -

Bert Kreischers Netflix Specials A Look At His Marriage And Risque Humor

May 09, 2025

Bert Kreischers Netflix Specials A Look At His Marriage And Risque Humor

May 09, 2025 -

Top 10 Film Noir Movies From Beginning To End

May 09, 2025

Top 10 Film Noir Movies From Beginning To End

May 09, 2025 -

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 09, 2025

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 09, 2025