Should You Buy The Dip? Analyst Opinion On Entertainment Stock

Table of Contents

Current Market Conditions Affecting Entertainment Stocks

Several factors are currently impacting the performance of entertainment stocks. Understanding these conditions is crucial before deciding whether to buy the dip.

The Impact of Inflation and Recession Fears

The current economic climate is significantly affecting consumer spending. Inflation and recession fears are leading to reduced disposable income, directly impacting entertainment budgets.

- Reduced disposable income: Consumers are prioritizing essential spending, leading to decreased discretionary spending on entertainment.

- Impact on streaming subscriptions: We are seeing a potential slowdown in new streaming subscriptions and even cancellations of existing ones as consumers tighten their belts.

- Potential box office slowdown: Higher ticket prices and economic uncertainty could lead to a decrease in moviegoers, impacting box office revenue for studios.

For example, recent data from [cite a reputable source, e.g., Statista] shows a [percentage]% decrease in consumer spending on entertainment in [specific time period]. This highlights the tangible impact of the current economic climate.

Technological Disruption and its Influence

The entertainment landscape is rapidly evolving, with technological disruption playing a major role. The rise of streaming services has fundamentally altered viewing habits and increased competition within the industry.

- Competition from new entrants: The streaming market is saturated, with numerous players vying for market share. This intense competition puts pressure on profit margins.

- Cord-cutting trends: Traditional cable television subscriptions continue to decline as consumers embrace streaming alternatives.

- The evolving media landscape: The shift towards digital content distribution requires companies to adapt quickly, which presents both opportunities and challenges.

Companies like [mention specific examples, e.g., Netflix, Disney+] are actively navigating these changes, adapting their strategies to maintain competitiveness. Their market performance reflects the ongoing impact of this technological shift.

Analyst Opinions on Buying the Dip

Analyst opinions on whether to "buy the dip" in entertainment stocks are mixed, reflecting the inherent volatility of the sector.

Bullish Arguments for Investing Now

Some analysts remain bullish, citing several reasons for optimism.

- Strong content pipelines: Many entertainment companies have robust content pipelines, promising future growth and revenue generation.

- Anticipated market recovery: Analysts predict a potential market recovery in the future, making current low prices an attractive entry point.

- Potential for mergers and acquisitions: Consolidation within the industry is likely, creating opportunities for significant gains through mergers and acquisitions.

For example, [cite a specific analyst and their report] predicts a [percentage]% increase in entertainment stock prices within the next [timeframe]. Their reasoning centers on [mention key arguments].

Bearish Concerns and Potential Risks

However, other analysts express caution, highlighting several potential risks.

- Uncertain economic outlook: The ongoing economic uncertainty makes predicting future market performance difficult.

- High debt levels of some companies: Some entertainment companies have significant debt burdens, increasing their vulnerability during economic downturns.

- Competitive pressures: The intense competition within the industry creates significant challenges for companies to maintain profitability.

[Cite a different analyst's report] expresses concerns about [mention specific risks], warning of potential further price drops. Their cautious outlook underscores the need for careful risk assessment.

Analyzing Specific Entertainment Stocks

Let's analyze the current market position of some key players in the entertainment industry.

Case Studies: Examples of Entertainment Companies and their Current Market Position

Individual entertainment stocks present unique opportunities and challenges.

- Disney: [Analyze Disney's current performance, including its streaming services, theme parks, and film studios. Discuss its strengths and weaknesses.]

- Netflix: [Analyze Netflix's subscriber growth, content strategy, and competitive landscape. Discuss its strengths and weaknesses.]

- Warner Bros. Discovery: [Analyze Warner Bros. Discovery's merger, its content portfolio, and its strategic direction. Discuss its strengths and weaknesses.]

[Include charts and graphs visualizing the recent performance and key financial metrics (P/E ratio, revenue growth) for each company.]

Developing a Personalized Investment Strategy

Before investing in entertainment stocks, it's crucial to develop a personalized strategy.

Risk Tolerance and Investment Goals

Understanding your risk tolerance and investment goals is paramount.

- Long-term vs. short-term investment strategies: Are you investing for long-term growth or seeking short-term gains?

- Diversification of portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors.

- Appropriate asset allocation: Allocate your investments based on your risk tolerance and financial goals.

Due Diligence and Research

Thorough due diligence is essential before making any investment decision.

- Analyzing company reports: Carefully review financial statements, earnings calls, and other company disclosures.

- Consulting financial advisors: Seek advice from a qualified financial advisor before making any significant investment decisions.

- Monitoring market news: Stay informed about market trends and news affecting the entertainment industry.

Conclusion

The decision of whether to "buy the dip" in entertainment stocks is a personal one. While the industry offers potential for lucrative returns, it's essential to carefully weigh the current market conditions, analyst opinions, and your individual risk tolerance. The current economic uncertainty and intense competition necessitate thorough due diligence and a well-defined investment strategy. Remember to conduct comprehensive research and consider consulting a financial advisor before investing in any stock, particularly during periods of market volatility. Learn more about effectively analyzing entertainment stocks and making strategic investment choices to navigate this exciting yet challenging sector.

Featured Posts

-

Bryan Cranston Offers Update On Malcolm In The Middle Reboot Release Date Still Uncertain

May 29, 2025

Bryan Cranston Offers Update On Malcolm In The Middle Reboot Release Date Still Uncertain

May 29, 2025 -

Apoyo Grupo Frontera A Donald Trump La Banda Responde A Las Criticas

May 29, 2025

Apoyo Grupo Frontera A Donald Trump La Banda Responde A Las Criticas

May 29, 2025 -

Mena Alastqlal Hryt Wkramt

May 29, 2025

Mena Alastqlal Hryt Wkramt

May 29, 2025 -

Queensland Library Withdraws 15 000 Fellowship After Gaza Post Controversy

May 29, 2025

Queensland Library Withdraws 15 000 Fellowship After Gaza Post Controversy

May 29, 2025 -

Analisando O Sucesso A Influencia De Um Trailer Inovador Ha 20 Anos

May 29, 2025

Analisando O Sucesso A Influencia De Um Trailer Inovador Ha 20 Anos

May 29, 2025

Latest Posts

-

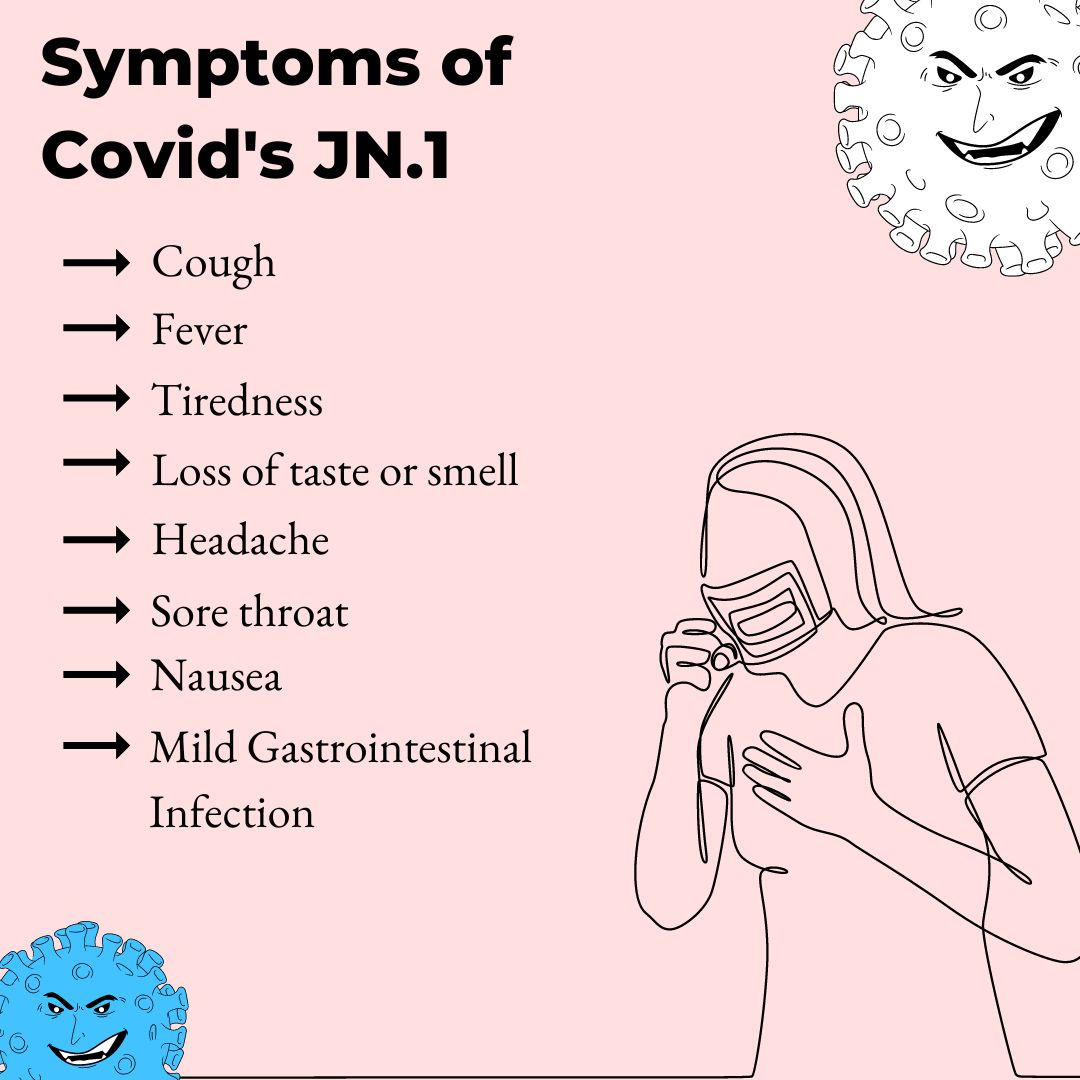

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025 -

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025 -

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025 -

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025 -

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025