Should You Buy XRP After Its 400% Price Increase? A Detailed Look.

Table of Contents

Understanding XRP's Recent Price Surge

Several factors contributed to XRP's remarkable price increase. Let's break down the key influences:

The Ripple Lawsuit's Impact

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has significantly impacted XRP's price. The outcome of this lawsuit remains a major catalyst for price movements.

- Positive Rulings: Partial court victories for Ripple have boosted investor confidence, leading to price increases. Positive legal developments often translate into renewed optimism and buying pressure.

- Negative Rulings: Conversely, negative rulings or setbacks in the lawsuit can trigger significant price drops as investor sentiment shifts. The uncertainty surrounding the legal proceedings continues to create volatility.

- Impact on Investor Sentiment: The lawsuit's progression directly affects investor sentiment. Positive news fuels FOMO (fear of missing out), driving up demand and price. Negative news can lead to selling pressure and price corrections.

Market Sentiment and Crypto Adoption

Broader market trends and the overall cryptocurrency landscape also influence XRP's price.

- Correlation with Bitcoin's Price: Like most cryptocurrencies, XRP's price is often correlated with Bitcoin's price. A bullish Bitcoin market typically boosts XRP's price, while a bearish Bitcoin market can negatively impact it.

- Increased Institutional Investment in Crypto: Growing institutional interest in cryptocurrencies contributes to overall market growth, benefiting XRP alongside other major players. Increased institutional adoption often signals greater market maturity and stability.

- Social Media Hype and FOMO: Social media plays a significant role in driving market sentiment. Positive news and hype can create FOMO, pushing prices up quickly. However, this can also lead to unsustainable price bubbles and sharp corrections.

- Overall Crypto Market Cap Influence: The overall cryptocurrency market capitalization significantly impacts individual cryptocurrencies. A positive market trend usually benefits XRP, while a negative trend can lead to considerable losses.

Technological Advancements and Ripple's Activities

Ripple's ongoing development efforts and strategic partnerships contribute to the long-term prospects of XRP.

- New Features and Updates: Continuous improvements to the XRP Ledger (XRPL) enhance its functionality and attract developers and users. This can positively impact XRP's adoption and price.

- Expansion into New Markets: Ripple's expansion into new geographic regions and markets increases XRP's potential for wider adoption and usage. Increased global reach translates to greater demand and potential price appreciation.

- Collaborations and Partnerships: Strategic partnerships with financial institutions and businesses bolster Ripple's credibility and increase XRP's use cases. This legitimacy enhances investor confidence.

- Adoption by Financial Institutions: Growing adoption of XRP by financial institutions for cross-border payments demonstrates its practical application and strengthens its position in the market. This institutional adoption is a key driver of long-term growth.

Assessing the Risks of Investing in XRP After a Significant Price Increase

While XRP's recent price surge is exciting, it's crucial to acknowledge the inherent risks:

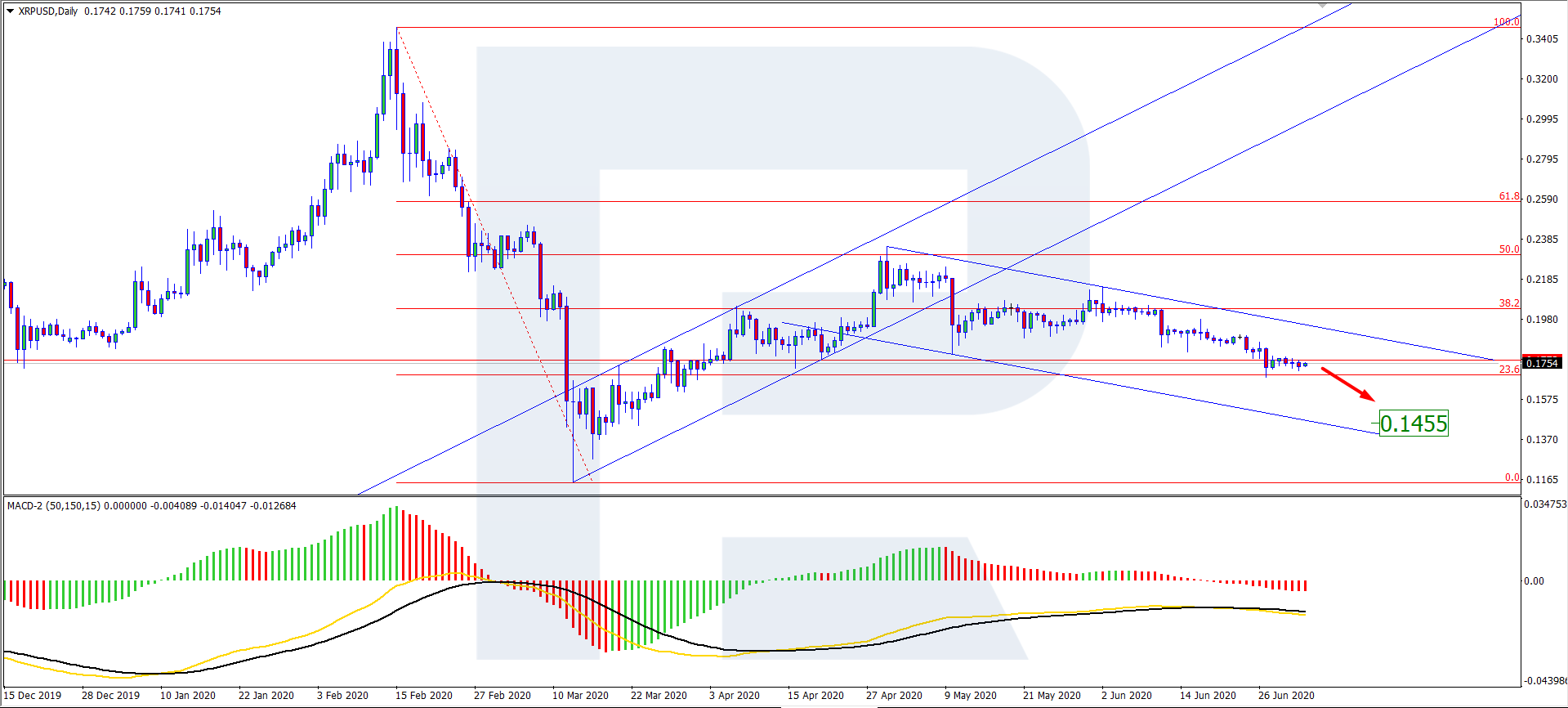

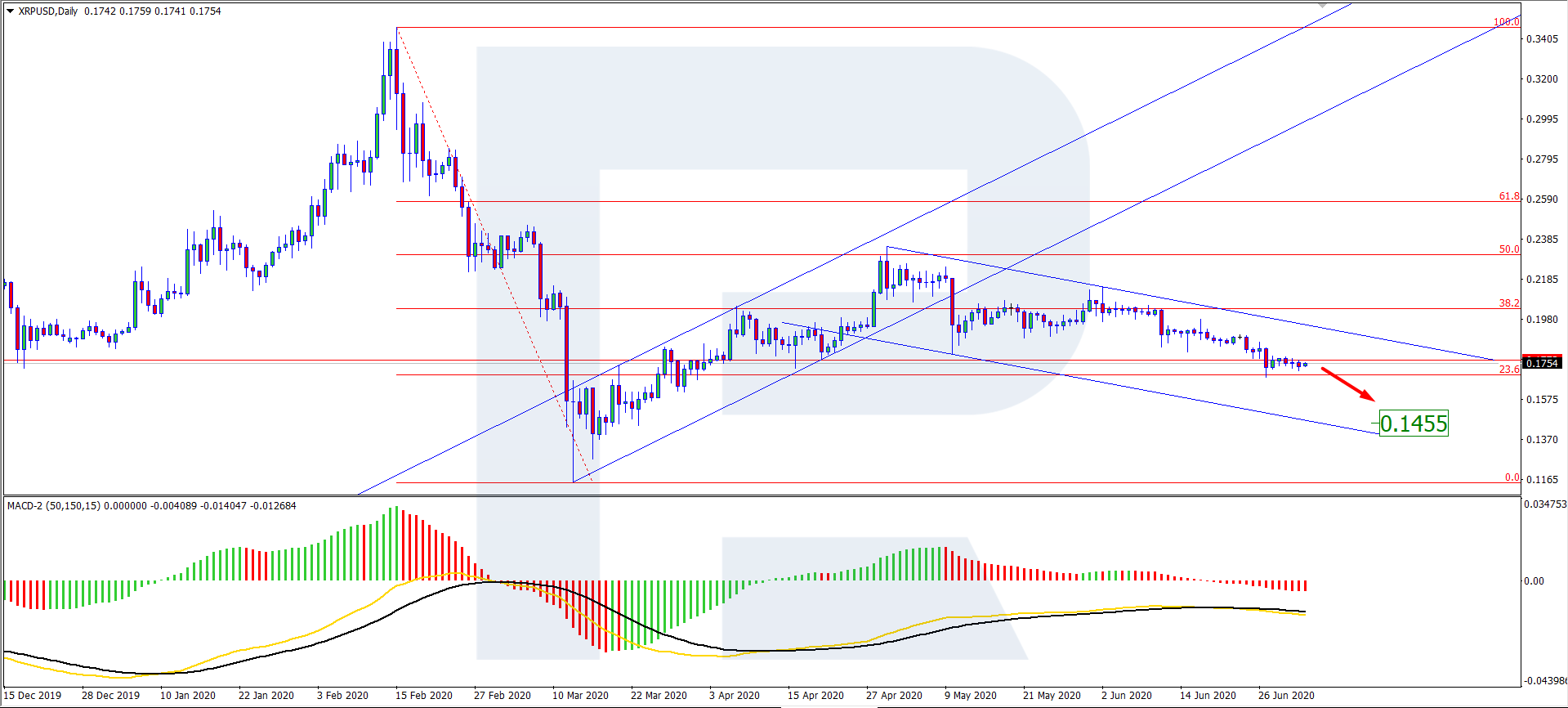

Volatility and Price Correction

Cryptocurrencies are inherently volatile, and XRP is no exception. A significant price increase is often followed by a correction.

- Historical Price Fluctuations: XRP's price history demonstrates its susceptibility to significant price swings. Past performance is not indicative of future results, but it highlights the volatility inherent in the asset.

- Risk of Losing Investment: Investing in XRP carries the risk of substantial financial losses. Price corrections can wipe out significant portions of an investment.

- Potential for a Significant Market Downturn: A broader cryptocurrency market downturn can severely impact XRP's price, regardless of its fundamental strength. Market downturns are a recurring risk in the crypto space.

- Impact of Regulatory Uncertainty: Regulatory uncertainty remains a significant risk factor. Unfavorable regulations could severely hamper XRP's price.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is constantly evolving and remains uncertain.

- Varying Regulatory Stances Globally: Different countries have different regulatory approaches toward cryptocurrencies, creating a complex and uncertain environment. These varying regulations can impact XRP's accessibility and use.

- Impact of Potential Future Regulations: New regulations could significantly impact XRP's price, either positively or negatively. Regulatory clarity is crucial for long-term stability.

- Risks of Legal Challenges: The ongoing Ripple lawsuit highlights the risk of legal challenges that can negatively impact the price of XRP. Legal uncertainties pose a significant threat to its future trajectory.

- The Difference Between SEC Regulation and Other International Regulatory Bodies: The SEC's stance on XRP differs from that of other international regulatory bodies. Understanding these differences is critical for assessing the global risk profile of XRP.

Competition in the Crypto Market

XRP faces stiff competition from other cryptocurrencies.

- Major Competitors: XRP competes with other cryptocurrencies, such as Bitcoin, Ethereum, and others, for market share and investor attention. This competition limits potential market dominance.

- Market Share: XRP's market share compared to other cryptocurrencies influences its price and long-term potential. A declining market share can signify decreasing investor confidence.

- Innovative Features of Competing Cryptocurrencies: The emergence of competing cryptocurrencies with innovative features poses a challenge to XRP's dominance. Continuous innovation is essential for its long-term competitiveness.

- Long-Term Market Dominance Potential: XRP's potential for long-term market dominance is uncertain due to the competitive nature of the cryptocurrency market. Sustaining competitiveness requires constant adaptation and innovation.

Factors to Consider Before Investing in XRP

Before making any investment decision, careful consideration is paramount:

Your Investment Goals and Risk Tolerance

Aligning investments with personal financial goals and risk tolerance is crucial.

- Long-term vs. Short-term Investment Strategies: Determine whether XRP aligns with your long-term or short-term investment goals. Long-term strategies often tolerate higher volatility.

- Diversification of Investment Portfolio: Diversifying your portfolio reduces risk by spreading investments across different asset classes. Investing solely in XRP is highly risky.

- Understanding Your Own Risk Appetite: Accurately assess your risk tolerance before investing in high-volatility assets like XRP. Only invest what you can afford to lose.

- Defining Your Personal Investment Timeline: Determine your ideal timeframe for investment. Short-term investors should be prepared for significant price fluctuations.

Due Diligence and Research

Thorough research is essential before investing in any cryptocurrency.

- Consult Reputable Financial Advisors: Seek advice from qualified financial advisors to get personalized guidance and help navigate the complexities of crypto investment.

- Research Market Analysis and Predictions from Trusted Sources: Use reputable sources for market analysis and predictions, but remember that these are not guarantees of future performance.

- Understanding Whitepapers and Technological Underpinnings: Understand the technology behind XRP and its potential use cases. Review the Ripple whitepaper for thorough information.

- Analyzing Social Media Sentiment Critically: While social media can provide valuable information, interpret it critically and avoid basing decisions solely on hype.

Conclusion

XRP's 400% price increase presents both exciting opportunities and considerable risks. While the potential for further growth exists, careful consideration of the factors discussed—market volatility, regulatory uncertainty, and competition—is crucial. Before investing in XRP, conduct thorough due diligence, align your investment strategy with your risk tolerance, and consult with a financial advisor if necessary. Remember, investing in cryptocurrencies like XRP involves significant risk, and you could lose some or all of your investment. Therefore, make informed decisions based on your own research and understanding of the market. Should you buy XRP? The answer depends entirely on your individual circumstances and risk profile. So, proceed cautiously and make informed decisions about your XRP investment.

Featured Posts

-

Examining Voter Participation In Florida And Wisconsin Signals Of The Political Moment

May 02, 2025

Examining Voter Participation In Florida And Wisconsin Signals Of The Political Moment

May 02, 2025 -

Check The Winning Lotto Numbers Wednesday April 9th Draw

May 02, 2025

Check The Winning Lotto Numbers Wednesday April 9th Draw

May 02, 2025 -

Fallout From George Floyd Protest Fbi Reassigns Agents Featured In Viral Photo

May 02, 2025

Fallout From George Floyd Protest Fbi Reassigns Agents Featured In Viral Photo

May 02, 2025 -

Wizarding World Holiday Marathon On Syfy Your Complete Guide

May 02, 2025

Wizarding World Holiday Marathon On Syfy Your Complete Guide

May 02, 2025 -

Wildfire Betting A Reflection Of Our Times The Los Angeles Case

May 02, 2025

Wildfire Betting A Reflection Of Our Times The Los Angeles Case

May 02, 2025

Latest Posts

-

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025 -

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan To Pakistan

May 10, 2025

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan To Pakistan

May 10, 2025 -

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025 -

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025 -

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025