Should You Follow Wedbush's Lead On Apple Stock Despite Price Target Cut?

Table of Contents

Understanding Wedbush's Rationale for the Price Target Cut

Wedbush's price target reduction for Apple stock wasn't a random decision; it was based on several factors they believe will impact Apple's future performance.

Factors Cited by Wedbush:

- Concerns about iPhone Sales: Wedbush likely cited slowing iPhone sales growth, perhaps due to saturation in key markets or increased competition. This is a crucial factor for Apple, as the iPhone remains its flagship product and a major revenue driver.

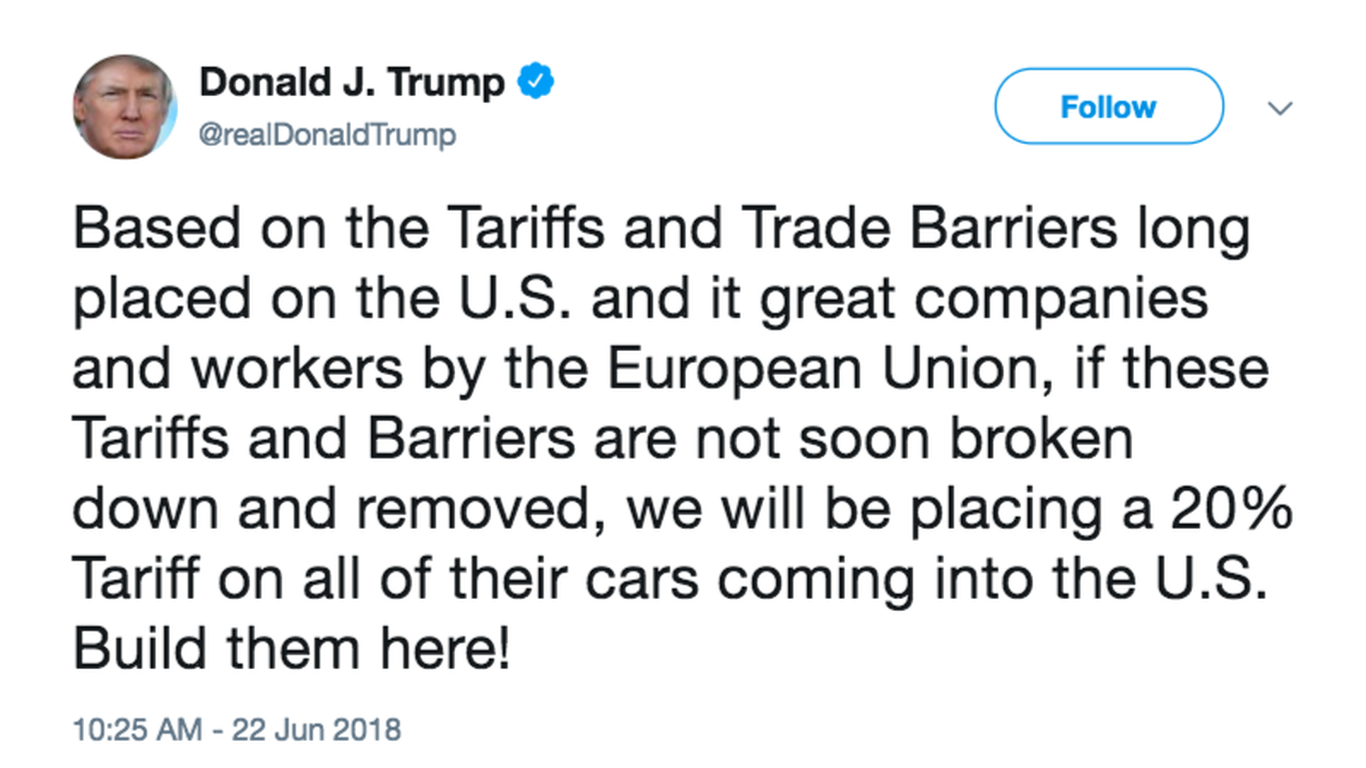

- Macroeconomic Headwinds: The current global economic climate, characterized by inflation and potential recessionary pressures, is a significant concern. Reduced consumer spending directly impacts demand for high-priced electronics like iPhones and other Apple products.

- Increased Competition: The smartphone market is fiercely competitive. Wedbush may have pointed to growing competition from Android manufacturers, who are offering compelling alternatives at lower price points.

- Supply Chain Issues: While perhaps less prominent now than in previous years, lingering supply chain disruptions could still impact Apple's production and sales.

Assessing the Validity of Wedbush's Arguments:

While Wedbush's concerns are valid points to consider, it's crucial to analyze their weight. Are these temporary headwinds, or do they signal a more significant long-term challenge for Apple? Counterarguments might include Apple's strong brand loyalty, its expansion into high-growth sectors like services and wearables, and its proven ability to navigate economic downturns. Comparing Wedbush's analysis with other analyst reports and predictions provides a more balanced perspective.

Apple's Current Financial Performance and Future Outlook

To effectively assess the impact of Wedbush's price target cut, we need to examine Apple's recent performance and future prospects.

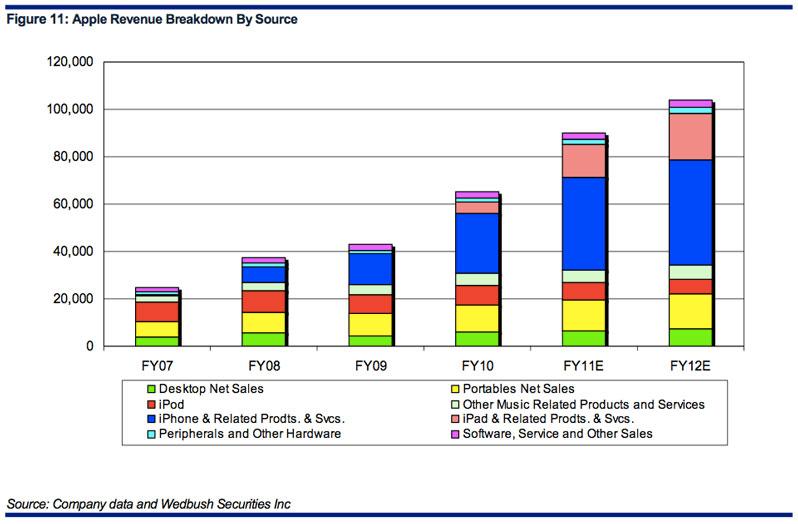

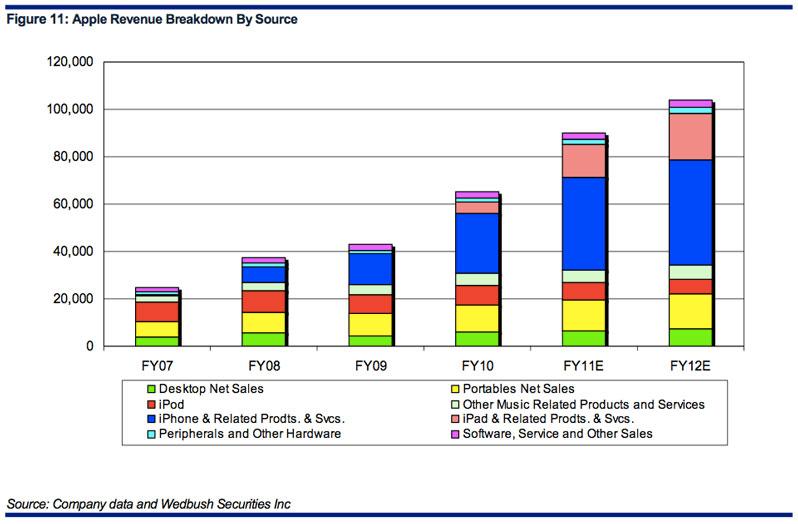

Recent Earnings and Revenue:

Apple's recent financial reports should be carefully scrutinized. Key performance indicators (KPIs) such as revenue growth, profit margins, and earnings per share (EPS) provide valuable insights into the company's financial health. While some quarters might show slower growth, sustained profitability and positive trends in certain areas suggest underlying strength.

Growth Prospects in Key Sectors:

Apple's future growth hinges on its success in diversifying beyond the iPhone. The services sector, including Apple Music, iCloud, and the App Store, continues to show strong growth. Wearables like the Apple Watch and AirPods also represent significant opportunities. Analyzing Apple's market share and competitive landscape in these sectors helps determine its growth potential in the years to come. Expansion into emerging markets also offers significant untapped potential.

Alternative Investment Strategies Considering the Price Target Cut

The price target cut presents investors with several choices.

Hold, Sell, or Buy?

The decision to hold, sell, or buy more Apple stock depends on your risk tolerance and investment goals. Holding onto the stock assumes a belief in Apple's long-term potential, while selling mitigates potential losses. Buying more AAPL at a potentially lower price could be a strategic move for long-term investors employing dollar-cost averaging to reduce risk.

Diversification and Portfolio Allocation:

Regardless of your decision regarding Apple stock, remember the importance of diversification. Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces overall risk. Consider investing in other sectors to balance your exposure to the tech industry.

Managing Risk in Your Apple Stock Investment

Investing in the stock market always carries inherent risks.

Understanding Market Volatility:

The tech sector, and Apple in particular, is known for its volatility. Understanding and assessing market risks is vital. Thorough research, understanding company financials, and monitoring market trends are crucial risk mitigation strategies.

Setting Stop-Loss Orders:

A stop-loss order automatically sells your shares when the price falls below a predetermined level. This helps limit potential losses if the stock price continues to decline. This is a valuable risk management tool, though it doesn't eliminate all risks. Coupled with a well-defined investment plan, stop-loss orders can be a helpful component of a robust investment strategy.

Conclusion: Making Informed Decisions about Your Apple Stock Investment

Wedbush's price target cut for Apple stock is a factor to consider, but it shouldn't be the sole determinant of your investment strategy. The arguments for and against following their recommendation are complex, involving an assessment of Apple's financial health, future growth prospects, and the overall market conditions. Conduct your own thorough research and make informed decisions about your Apple stock investment based on your personal circumstances. Remember to carefully consider the implications of Wedbush's price target cut on your overall portfolio strategy. Keywords: Apple stock, AAPL investment, price target, analysis, portfolio.

Featured Posts

-

Italy Changes Citizenship Law Great Grandparents Right To Citizenship

May 24, 2025

Italy Changes Citizenship Law Great Grandparents Right To Citizenship

May 24, 2025 -

European Shares Rise On Trump Tariff Hints Lvmh Falls

May 24, 2025

European Shares Rise On Trump Tariff Hints Lvmh Falls

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Museum Programs

May 24, 2025

The Impact Of Trump Era Funding Cuts On Museum Programs

May 24, 2025 -

300 Million Hit Marks And Spencer Details Cyberattack Impact

May 24, 2025

300 Million Hit Marks And Spencer Details Cyberattack Impact

May 24, 2025 -

Sundays National Rally Demonstration A Reality Check For Le Pens Presidential Ambitions

May 24, 2025

Sundays National Rally Demonstration A Reality Check For Le Pens Presidential Ambitions

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025