Should You Invest In Palantir Before May 5th? Weighing The Risks And Rewards

Table of Contents

Palantir's Recent Performance and Future Outlook

Analyzing Recent Financial Results

Palantir's recent financial performance offers a mixed bag. Analyzing recent earnings reports is crucial for understanding the company's current trajectory. To invest in Palantir successfully, you must carefully review this data.

- Positives: Recent quarters have shown growth in revenue, particularly in the commercial sector. This indicates a diversification beyond its initial reliance on government contracts. Strong customer retention rates also point towards a robust business model. Key Performance Indicators (KPIs) related to customer acquisition and product adoption should also be studied.

- Negatives: Profitability remains a concern for some investors. While revenue growth is positive, the path to sustained profitability needs continued monitoring. Expenses, particularly research and development, are significant.

Analyzing "Palantir revenue growth," "Palantir earnings," and "Palantir stock price" trends is vital for assessing the company's financial health and predicting future performance. The company's ability to manage expenses while driving revenue growth will greatly impact its future valuation.

Market Position and Competition

Palantir operates in the highly competitive data analytics market. Its main competitive advantages lie in its powerful software platforms, Gotham and Foundry, which cater to government and commercial clients, respectively. However, the "data analytics market" is crowded.

- Competitors: Palantir faces competition from established players like Microsoft, Amazon Web Services (AWS), and Google Cloud, all offering robust data analytics solutions.

- Competitive Advantages: Palantir differentiates itself through its focus on complex data integration and analysis, particularly for security-sensitive applications. Its strong relationships with government agencies also provide a significant competitive edge.

- Competitive Disadvantages: The high cost of its solutions and the steep learning curve can limit market adoption. The company's "Palantir market share" needs further expansion in the commercial sector to become less reliant on government contracts.

Understanding Palantir's position within the "big data competitors" landscape is crucial for determining its long-term growth potential.

Future Growth Projections

Analyst forecasts for Palantir's future growth vary. Some analysts predict significant growth driven by expanding commercial adoption and government contracts, particularly in areas like cybersecurity and AI. Others express concerns about the company's profitability and intense competition.

- Analyst Ratings: Examining the range of analyst ratings (buy, hold, sell) and their accompanying rationales is critical for a comprehensive view of future "Palantir growth forecast" and "Palantir stock forecast." Look for a consensus or common themes among the analysts.

- Factors Influencing Growth: Factors such as new product launches, strategic partnerships, successful penetration of new markets, and the overall state of the global economy will all significantly impact future performance.

Examining "Palantir future prospects" requires a careful consideration of both optimistic and pessimistic viewpoints.

Assessing the Risks of Investing in Palantir

Valuation and Market Volatility

Palantir's current valuation is a key factor to consider before investing. Its "Palantir valuation" relative to its peers and the overall market is important to assess. The tech sector is known for its volatility, so understanding the potential for significant "Palantir stock volatility" and "market risk" is critical. A high valuation might imply the market is already pricing in significant future growth, leaving less room for substantial gains.

Dependence on Government Contracts

Palantir's historical reliance on government contracts presents a significant risk. Changes in government priorities, budget cuts, or shifts in political landscapes could negatively impact revenue streams. Understanding the "government contracts risk" and the proportion of "Palantir government revenue" is crucial for assessing potential vulnerabilities.

Technological Disruption

The rapid pace of technological change introduces the risk of "technological disruption." Emerging AI technologies and innovations from competitors constantly challenge Palantir's existing solutions. The company's capacity for continuous "Palantir innovation" and adaptation will be vital for maintaining its competitive edge.

Weighing the Rewards of Investing in Palantir Before May 5th

Potential for Significant Returns

Despite the risks, the potential for "Palantir return on investment" is substantial. Positive growth projections and favorable market sentiment could drive significant price appreciation. Investing in Palantir could offer investors access to a high-growth stock with the potential for outsized returns. The "Palantir investment potential" hinges on the company's ability to execute its strategy and overcome the challenges it faces.

Long-Term Growth Potential

Palantir's long-term vision focuses on its role in the rapidly growing data analytics market. The "data analytics market growth" provides a supportive backdrop for the company's long-term aspirations. A "long-term investment" in Palantir could be rewarding if the company successfully navigates the challenges and capitalizes on the opportunities in the market.

Specific Catalysts Before May 5th

If May 5th represents a specific event (e.g., earnings release, product launch, or contract announcement), the potential impact on the stock price needs careful analysis. A "positive earnings surprise" or a major contract win could trigger a significant price surge. Conversely, negative news could lead to a decline. Understanding the potential catalysts and their likely impact is vital for informed decision-making.

Conclusion

Investing in Palantir before May 5th presents a compelling opportunity, but it’s not without its risks. The company shows promise with its growth in the commercial sector and its leading position in certain niche markets. However, concerns remain regarding profitability, competition, and its reliance on government contracts. While the potential for significant returns exists, the market volatility and the inherent risks of investing in a high-growth tech company should be fully considered.

While investing in Palantir before May 5th presents both risks and rewards, the potential for significant returns makes it a stock worth careful consideration. Conduct thorough due diligence, including a review of recent financial reports, analyst projections, and a deep dive into the competitive landscape, before making any investment decisions related to investing in Palantir. Remember, this analysis is not financial advice; always consult with a qualified financial advisor before making any investment choices.

Featured Posts

-

Pakistan Stock Market Crisis Operation Sindoor Triggers Kse 100 Plunge

May 10, 2025

Pakistan Stock Market Crisis Operation Sindoor Triggers Kse 100 Plunge

May 10, 2025 -

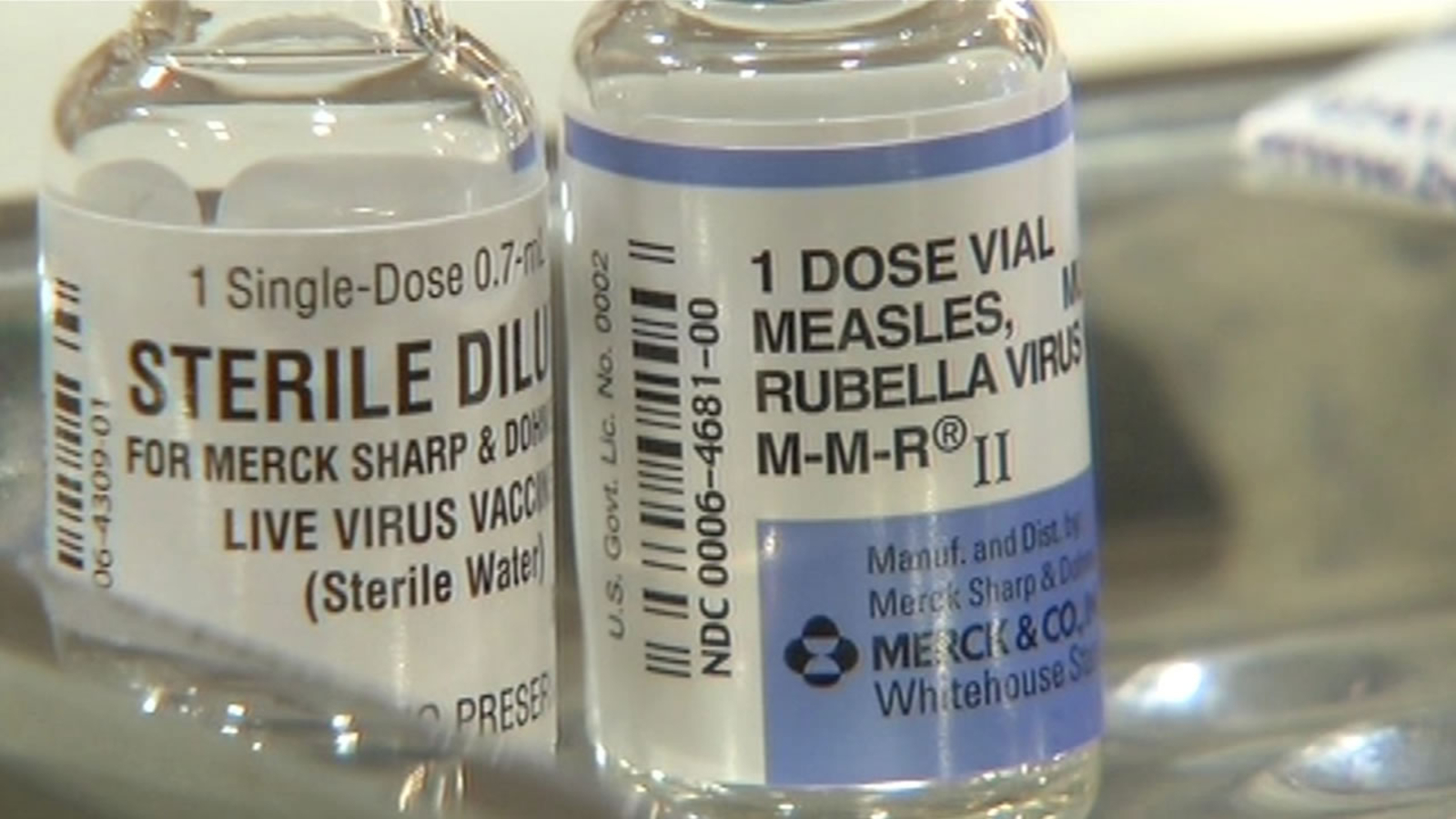

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025 -

New Tariff Baseline Trump Demands Exceptional Offers To Avoid 10 Increase

May 10, 2025

New Tariff Baseline Trump Demands Exceptional Offers To Avoid 10 Increase

May 10, 2025 -

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

May 10, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

May 10, 2025