Should You Invest In Palantir Stock Before May 5th? A Comprehensive Review

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir's recent performance and financial health are crucial factors in determining whether to invest in PLTR stock before May 5th. Let's delve into the key metrics.

Revenue Growth and Profitability

Analyzing Palantir's financial reports reveals a mixed bag. While revenue growth has been positive, profitability remains a key area of focus for investors.

- Key Financial Metrics: Examine recent quarterly and annual reports for key metrics like revenue, gross profit margin, operating income, and net income. Compare these figures year-over-year to understand the growth trajectory.

- Year-over-Year Comparison: Look for consistent growth in revenue and improvement in profitability margins. A shrinking net loss or movement toward profitability is a positive sign for long-term investors.

- Analyst Predictions: Consider the predictions of reputable financial analysts regarding Palantir's future revenue and earnings. Do these predictions align with your own assessment of the company's prospects?

Government Contracts and Commercial Partnerships

Palantir's revenue streams are diverse, relying on both government contracts and commercial partnerships. Understanding the balance and growth potential of each is critical.

- Revenue Breakdown: Determine the percentage of revenue derived from each sector. A heavy reliance on government contracts might indicate greater susceptibility to budget cuts or geopolitical shifts.

- Key Contracts & Partnerships: Identify significant government contracts (e.g., with defense agencies) and key commercial partnerships (e.g., with large corporations in various industries). Analyze the potential longevity and value of each.

- Risks and Opportunities: Evaluate potential risks associated with each sector. For instance, government contract delays or changes in government priorities could impact revenue. Conversely, expansion into new commercial sectors offers significant growth potential.

Debt and Cash Flow

Assessing Palantir's debt levels and cash flow generation provides insight into its financial stability and future investment capacity.

- Key Debt Metrics: Analyze the company's debt-to-equity ratio, long-term debt, and interest coverage ratio to understand its financial leverage.

- Free Cash Flow Analysis: Examine Palantir's free cash flow (FCF) – the cash generated after accounting for capital expenditures. Strong and growing FCF indicates financial health and potential for future growth.

- Potential Concerns/Strengths: Identify any potential concerns regarding debt levels or cash flow. A high debt load could restrict future investment, while strong cash flow suggests financial strength and resilience.

Market Sentiment and Analyst Predictions

Gauging market sentiment and understanding analyst predictions are vital for evaluating Palantir stock before May 5th.

Stock Price Volatility

Palantir's stock price has historically been volatile. Understanding the factors contributing to this volatility is crucial.

- Historical Price Charts: Analyze historical price charts to identify periods of significant price fluctuations and the events that coincided with those periods.

- Key Price Fluctuations: Identify significant price increases or drops and try to correlate these to specific news events, financial reports, or broader market trends.

- Impacting Events: Understand the historical context of Palantir's price swings. This helps gauge potential future volatility.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations.

- Analyst Ratings (Buy/Hold/Sell): Analyze the consensus among financial analysts, considering the number of analysts issuing each rating.

- Average Price Targets: Note the average price target predicted by analysts, which reflects the average expected price over a specific time horizon.

- Range of Price Targets: Consider the range of price targets—a wide range indicates significant disagreement among analysts regarding Palantir's future value.

- Dissenting Opinions: Pay attention to any notable dissenting opinions, as these can offer valuable perspectives.

News and Events Impacting Palantir Stock

News and events significantly influence investor sentiment and the Palantir share price.

- Key News Events: Keep abreast of significant news, such as new contracts, product launches, partnerships, regulatory changes, or management shifts.

- Impact on Stock Price: Analyze the potential impact of these events on the stock price. Positive news tends to drive prices up, while negative news often has the opposite effect.

- Source Citation: Ensure the information you use comes from reliable sources, such as reputable financial news outlets and Palantir's official statements.

Risks and Potential Rewards of Investing in Palantir Before May 5th

Investing in Palantir before May 5th involves both potential rewards and significant risks. A thorough assessment is crucial.

Competition and Market Saturation

The big data analytics and software market is competitive. Evaluating Palantir's competitive position is essential.

- Key Competitors: Identify Palantir's main competitors (e.g., AWS, Google Cloud, Microsoft Azure). Assess their strengths and weaknesses relative to Palantir.

- Competitive Strengths: Analyze Palantir's competitive advantages, such as its specialized software, strong government relationships, or unique technological capabilities.

- Potential Threats: Identify potential threats, such as increased competition, technological disruption, or shifts in customer preferences.

Geopolitical Risks and Regulatory Uncertainty

Geopolitical events and regulatory uncertainty pose potential risks to Palantir, particularly its government contracts.

- Specific Geopolitical Risks: Identify specific geopolitical risks that could negatively impact Palantir's business. For example, international tensions or changes in government policies could affect its operations.

- Regulatory Hurdles: Evaluate potential regulatory hurdles that Palantir might face, such as data privacy regulations or antitrust concerns.

- Impact on Palantir's Stock Price: Assess how these geopolitical and regulatory factors could affect Palantir's stock price.

Potential for High Returns vs. High Risk

Weigh the potential for high returns against the inherent risks involved in investing in Palantir stock.

- Potential Upsides: Consider the potential for substantial returns from market share growth, successful new product launches, or strong financial performance.

- Potential Downsides: Acknowledge the possibility of financial losses, increased competition, or failure to meet growth expectations.

- Overall Risk Assessment: Conduct a thorough risk assessment based on your understanding of Palantir's business, financial health, and market position.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of its recent performance, market sentiment, and inherent risks. While Palantir shows potential for substantial growth, it's also a volatile stock with considerable risk. This review has analyzed key factors influencing its stock price, aiding your decision-making process. Remember to conduct your own thorough research and consider your risk tolerance before investing in any stock, including Palantir stock. The information presented here is for educational purposes and shouldn't be considered financial advice. Weigh the potential rewards and risks before deciding whether to invest in Palantir stock before May 5th. Remember to factor in the Palantir stock forecast and the current Palantir share price into your analysis.

Featured Posts

-

Your Complete Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025

Your Complete Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025 -

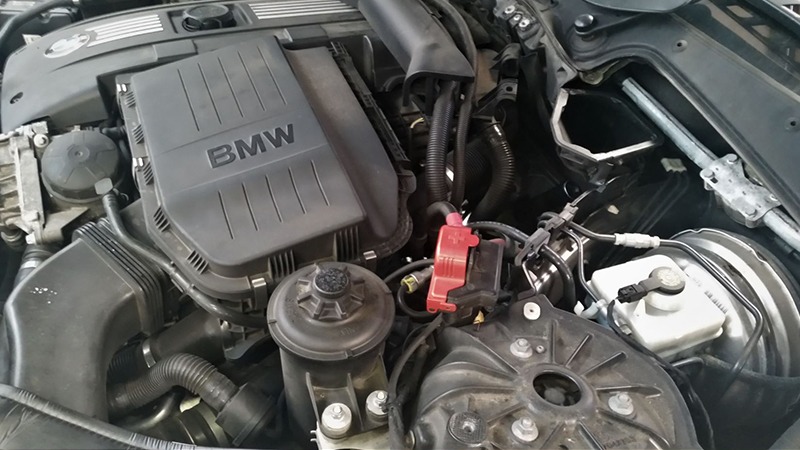

The China Market A Case Study Of Bmw And Porsches Struggles And Strategies

May 10, 2025

The China Market A Case Study Of Bmw And Porsches Struggles And Strategies

May 10, 2025 -

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

Paeivitetty Lista Britannian Kruununperimysjaerjestys

May 10, 2025

Paeivitetty Lista Britannian Kruununperimysjaerjestys

May 10, 2025 -

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025