Significant Saudi Regulatory Change To Reshape The ABS Market

Table of Contents

New Regulations and Their Impact on Market Accessibility

The recent regulatory overhaul aims to enhance the accessibility and efficiency of the Saudi ABS market. Several key changes are driving this transformation:

Simplified Issuance Procedures

The streamlining of issuance procedures is a cornerstone of these reforms. This simplification promises to significantly reduce barriers to entry, particularly for smaller issuers. The anticipated benefits include:

- Reduced Paperwork: The new regulations aim to minimize bureaucratic hurdles, cutting down on the extensive documentation previously required.

- Faster Approvals: The approval process is expected to be significantly faster, reducing the time-to-market for ABS issuances. This could potentially reduce application processing time from an average of six months to as little as six weeks.

- Increased Market Participation: With simplified procedures, a wider range of issuers, including SMEs, are expected to enter the market, leading to increased liquidity and diversification.

- Regulatory Bodies Involved: The Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are the primary regulatory bodies spearheading these changes, working in conjunction to implement and enforce the new legislation.

Enhanced Transparency and Disclosure Requirements

Improved transparency is vital for building investor confidence and attracting both domestic and international capital. The new regulations mandate:

- Standardized Reporting: The introduction of standardized reporting formats ensures consistent and comparable data across all ABS issuances, facilitating easier analysis and comparison.

- Increased Disclosure: Issuers are now required to provide more comprehensive disclosures on the underlying assets, their performance, and associated risks. This includes mandatory disclosure of underlying asset details and performance metrics.

- Enhanced Investor Confidence: The increased transparency is expected to significantly boost investor confidence, attracting a larger pool of both local and international investors to the Saudi ABS market.

- Improved Due Diligence: Clearer disclosure simplifies the due diligence process for investors, allowing them to make more informed investment decisions.

Revised Credit Rating Standards

The regulatory changes also include adjustments to credit rating requirements for ABS issuance. This aims to align Saudi Arabia with international best practices:

- Adoption of International Best Practices: The new standards aim to align Saudi credit rating methodologies with internationally recognized standards, increasing the credibility and comparability of ABS ratings.

- Implications for Issuers: Issuers will need to meet stricter criteria to obtain favorable credit ratings, encouraging higher standards of risk management.

- Impact on Investor Perception: Stronger credit rating standards contribute to a more robust and reliable market, fostering increased investor confidence and potentially lower borrowing costs for issuers.

- Rating Agencies Involved: Major international credit rating agencies are expected to play a crucial role in the evaluation and rating of ABS issuances under the new framework.

Opportunities for Growth in the Saudi ABS Market

The regulatory reforms unlock significant growth opportunities within the Saudi ABS market:

Increased Investment in Infrastructure Projects

ABS is expected to play a crucial role in financing the Kingdom's ambitious infrastructure development plans:

- Funding Large-Scale Projects: ABS provides a flexible and efficient mechanism for financing large-scale projects like renewable energy initiatives and transportation infrastructure improvements.

- Attracting Private Investment: The use of ABS can attract significant private investment, supplementing public funds and fostering economic diversification.

- Diversifying Funding Sources: ABS offers a diversified funding source for infrastructure projects, reducing reliance on traditional bank financing.

Expansion of the Mortgage-Backed Securities (MBS) Market

The regulatory changes are specifically designed to stimulate growth in the Saudi MBS market:

- Facilitating MBS Growth: The simplified issuance procedures and enhanced transparency measures are specifically tailored to support the development of the MBS market.

- Increased Homeownership: The expansion of the MBS market is expected to increase access to affordable housing and boost homeownership rates in Saudi Arabia.

- Government Support: Government initiatives, including potential government guarantees for MBS issuance to mitigate risk, are expected to further accelerate market expansion.

Attracting Foreign Investment and Expertise

The regulatory reforms aim to attract significant foreign investment and expertise into the Saudi ABS market:

- Attracting International Investors: Improved transparency, standardized reporting, and alignment with international standards make the Saudi ABS market more attractive to international investors.

- Knowledge Transfer: Increased foreign participation brings valuable expertise and best practices, further enhancing the development of the market.

- Government Initiatives: The Saudi Arabian government has implemented several initiatives to attract foreign investment into its financial sector, including potential relaxation of foreign ownership restrictions in certain areas.

Challenges and Potential Risks

Despite the significant opportunities, the implementation of these changes presents several challenges:

Implementation Challenges and Practical Considerations

Successful implementation requires careful planning and execution:

- Potential Bottlenecks: There could be potential bottlenecks in updating IT systems and processes to meet the new regulatory requirements.

- Need for Clarification: Some aspects of the new regulations may require further clarification to ensure consistent interpretation and application.

- Training and Resources: Sufficient training and resources will be crucial for market participants to adapt to the new framework.

Managing Systemic Risk and Investor Protection

Robust risk management and investor protection mechanisms are crucial for the long-term success of the market:

- Strengthening Risk Management: Robust risk management frameworks are essential to ensure the stability and resilience of the Saudi ABS market.

- Investor Protection: Mechanisms must be in place to protect investors from potential losses and maintain investor confidence.

- Regulatory Oversight: Effective regulatory oversight is critical to ensure market transparency and prevent systemic risks.

Conclusion

The regulatory changes impacting the Saudi ABS market represent a crucial turning point for the Kingdom's financial sector. These reforms, focusing on transparency, simplified procedures, and robust investor protection, offer substantial growth potential. While implementation challenges are anticipated, the potential for increased investment in infrastructure, expansion of the MBS market, and the attraction of foreign capital is considerable. Staying informed about these developments and adapting to the evolving regulatory landscape is essential for all stakeholders. Understanding the implications of these changes is key to successfully navigating the dynamic Saudi ABS market. Stay updated on the latest developments and seize the emerging opportunities in this transformative market.

Featured Posts

-

Medvedev Missili Nucleari E Russofobia La Terapia Dell Ue

May 02, 2025

Medvedev Missili Nucleari E Russofobia La Terapia Dell Ue

May 02, 2025 -

Boulangerie Normande Son Poids En Chocolat Pour Le Nouveau Ne De L Annee

May 02, 2025

Boulangerie Normande Son Poids En Chocolat Pour Le Nouveau Ne De L Annee

May 02, 2025 -

Pasifika Sipoti April 4th News And Information

May 02, 2025

Pasifika Sipoti April 4th News And Information

May 02, 2025 -

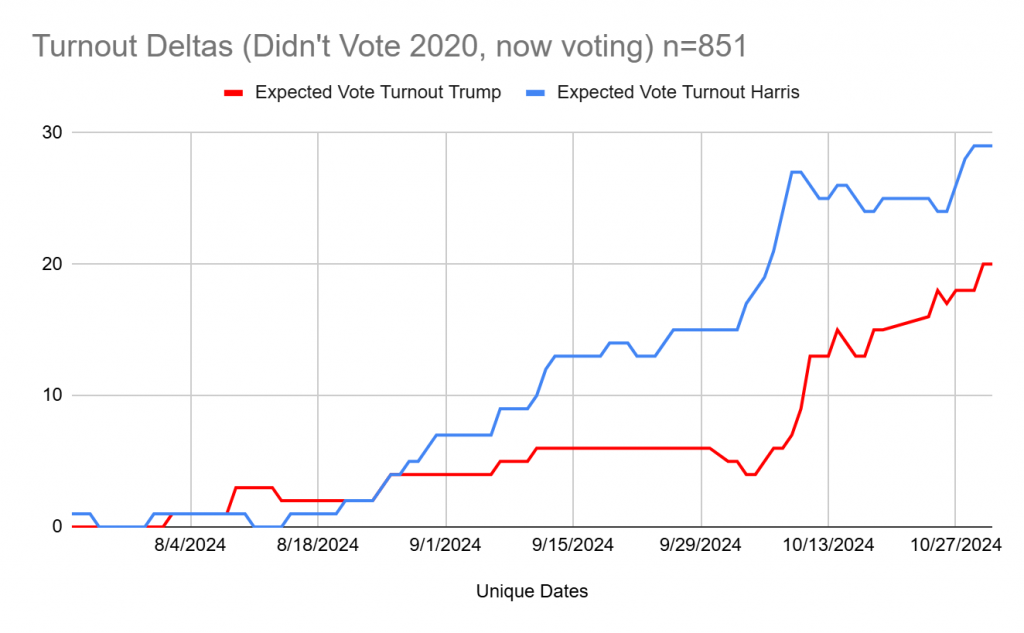

Florida And Wisconsins Election Turnout A Reflection Of Current Political Dynamics

May 02, 2025

Florida And Wisconsins Election Turnout A Reflection Of Current Political Dynamics

May 02, 2025 -

Ghana Election 2020 Techiman South Court Case Concludes

May 02, 2025

Ghana Election 2020 Techiman South Court Case Concludes

May 02, 2025

Latest Posts

-

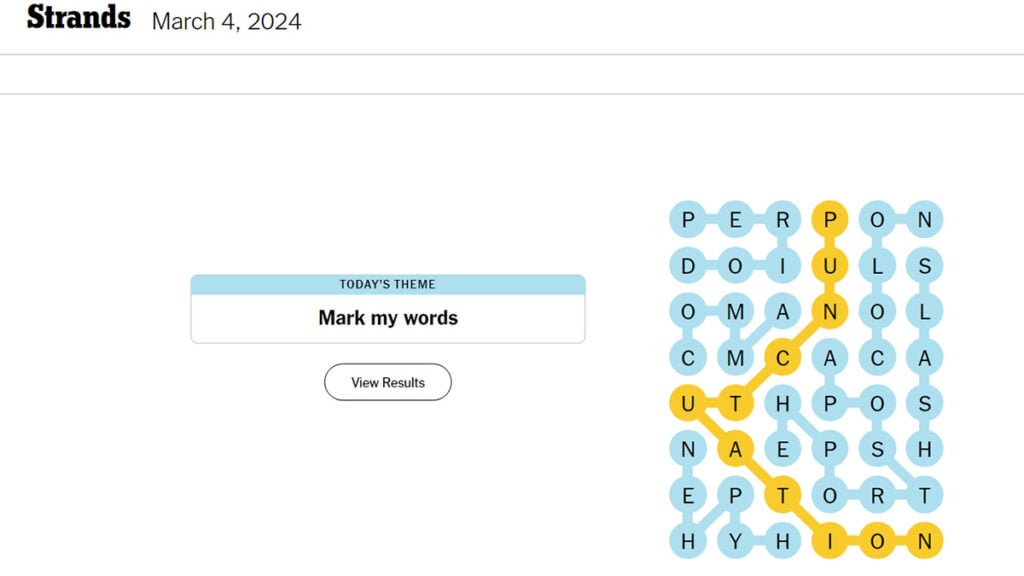

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 10, 2025

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025 -

Nyt Spelling Bee Solutions April 4th 2025 Complete Guide

May 10, 2025

Nyt Spelling Bee Solutions April 4th 2025 Complete Guide

May 10, 2025 -

Nyt Strands April 10th 2024 Game 403 Hints And Answers

May 10, 2025

Nyt Strands April 10th 2024 Game 403 Hints And Answers

May 10, 2025 -

Nyt Strands April 12th 2024 Solutions Game 405

May 10, 2025

Nyt Strands April 12th 2024 Solutions Game 405

May 10, 2025