Slowing Growth Forces SSE To Cut Spending By £3 Billion

Table of Contents

The Impact of Inflation and Rising Interest Rates on SSE's Financial Performance

SSE's decision to slash its spending by £3 billion is a direct consequence of the current economic headwinds. Soaring inflation and increased interest rates have severely impacted the company's financial performance and long-term investment strategy. These factors have created a perfect storm, squeezing profitability and forcing difficult choices.

- Increased operational costs: The cost of materials, labor, and other operational expenses has risen sharply, eroding SSE's profit margins. This increased cost of doing business necessitates a reassessment of capital expenditure.

- Higher borrowing costs: Securing funding for new projects has become significantly more expensive due to rising interest rates. This makes large-scale investments less financially viable, forcing a reevaluation of project feasibility.

- Reduced consumer spending: The cost-of-living crisis has led to decreased energy consumption as consumers seek to reduce their bills. This lower demand impacts revenue projections and necessitates a more cautious approach to investment.

- Pressure on profit margins: The combined effect of increased costs and reduced demand has put immense pressure on SSE's profit margins, forcing the company to take decisive action to protect its financial stability.

Details of the £3 Billion Spending Cut: What Projects are Affected?

The £3 billion reduction in spending represents a significant restructuring of SSE's investment portfolio. While the company hasn't detailed every project affected, the cuts are likely to impact various aspects of its operations.

- Renewable energy projects: A portion of the cuts will likely affect investments in new renewable energy projects, such as wind farms and solar power plants. The higher cost of capital makes these large-scale projects less attractive in the current economic environment.

- Network infrastructure upgrades: Essential upgrades to the electricity network may also be delayed or scaled back. While crucial for long-term reliability, these projects are often capital-intensive and vulnerable to budget constraints.

- Other operational investments: Cuts are also expected in other operational areas, potentially impacting maintenance, research and development, and other non-essential expenditures. This prioritization of essential services will likely affect the timeline for various internal projects.

- Geographic impact: The geographical impact of the cuts remains unclear, but it is likely that projects in regions with higher development costs or lower expected returns will be prioritized for reduction or delay. Specific project names and locations are expected to be revealed in further announcements.

SSE's Response and Future Strategies for Growth

SSE is responding to this challenging environment by implementing a range of strategies focused on efficiency and cost optimization. Beyond the £3 billion spending cut, the company is exploring additional measures to navigate the economic downturn.

- Restructuring plans: The company is likely to undertake a review of its organizational structure, potentially leading to job cuts or departmental reorganizations to improve efficiency.

- New partnerships and collaborations: Seeking strategic partnerships to share resources and risks could become a crucial strategy for SSE in the coming years.

- Long-term strategic vision: The company will need to adapt its long-term strategic vision, focusing on projects with quicker returns and lower capital expenditure requirements.

- Emphasis on efficiency and cost optimization: Internal efficiency drives and cost-cutting measures will play a significant role in SSE's future strategies. These measures will focus on streamlining operations and eliminating redundancy.

Investor Reaction and Stock Market Performance

The announcement of the SSE spending cuts has naturally impacted investor sentiment and the company's share price.

- Immediate share price impact: The market's initial reaction to the news was likely negative, with a potential short-term dip in the SSE share price. However, long-term effects will depend on the company's ability to implement its new strategies effectively.

- Analyst comments and predictions: Financial analysts will offer varied opinions and predictions regarding the long-term effects of the spending cuts on SSE's performance.

- Comparison to competitor performance: The impact of the cuts will need to be compared to similar responses by competing energy companies to assess the relative effectiveness of SSE's strategy.

The Future of SSE and the Implications of its Spending Cuts

The £3 billion SSE spending cuts represent a significant response to economic challenges. The cuts impact various areas of SSE’s operations, from renewable energy investments to network upgrades. While the short-term impact on the company's performance may be negative, the long-term success will depend on the company's ability to successfully implement its new strategies and navigate the current economic uncertainty. The broader impact on the energy sector remains to be seen, with other energy companies likely facing similar pressures.

Stay updated on SSE spending cuts and their implications for the energy sector. Follow financial news outlets and SSE's official announcements for further developments. Learn more about the impact of SSE's financial decisions by researching the broader economic factors affecting the energy industry.

Featured Posts

-

Itv 4s The Saint Episode Listings And Air Times

May 25, 2025

Itv 4s The Saint Episode Listings And Air Times

May 25, 2025 -

Understanding The Hells Angels

May 25, 2025

Understanding The Hells Angels

May 25, 2025 -

The Truth About Elon Musks Dogecoin Holdings

May 25, 2025

The Truth About Elon Musks Dogecoin Holdings

May 25, 2025 -

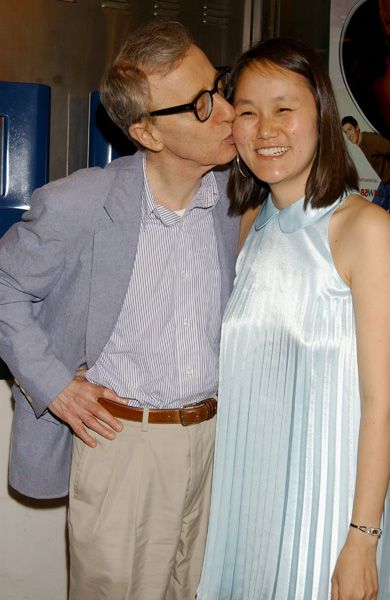

Sean Penn Questions Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025

Sean Penn Questions Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025 -

Your Dream Country Escape Real Estate And Lifestyle Advice

May 25, 2025

Your Dream Country Escape Real Estate And Lifestyle Advice

May 25, 2025