Small Business Sustainability: Funding And Investment Strategies

Table of Contents

Exploring Funding Sources for Small Business Sustainability

Securing the right funding is paramount for small business sustainability. Let's explore various avenues available to you.

Traditional Loan Options

Traditional loans from banks and the Small Business Administration (SBA) are established routes to secure capital.

-

Bank Loans: These loans are offered by commercial banks and credit unions. They typically require a strong credit history, a detailed business plan, and collateral. Interest rates vary depending on your creditworthiness and the loan terms. The application process can be lengthy and involve significant paperwork.

-

SBA Loans: The SBA doesn't directly lend money; instead, it guarantees loans made by participating lenders, reducing the risk for the lender and potentially making it easier for small businesses to qualify. SBA loans often come with more favorable terms than traditional bank loans but still involve a rigorous application process.

Advantages and Disadvantages of Traditional Loans:

- Advantages: Easier access with good credit, established lending structures.

- Disadvantages: Stricter eligibility criteria, lengthy application process, potentially higher interest rates compared to some alternatives, collateral requirements can be significant.

Alternative Funding Options

Beyond traditional loans, several alternative funding options can support your small business sustainability.

-

Crowdfunding: Platforms like Kickstarter and Indiegogo allow you to raise capital from a large number of individuals. This is particularly useful for businesses with a strong online presence and a compelling story to tell. Success depends heavily on marketing and community engagement.

-

Peer-to-Peer (P2P) Lending: P2P lending platforms connect borrowers directly with individual investors, bypassing traditional financial institutions. This can offer faster funding and potentially more flexible terms, but interest rates can be higher.

-

Invoice Financing: If your business has strong accounts receivable, invoice financing allows you to receive immediate cash based on outstanding invoices. This improves cash flow but typically involves paying a fee for the service.

Advantages and Disadvantages of Alternative Funding:

- Advantages: Faster access to funds, lower barriers to entry for some options.

- Disadvantages: Higher interest rates potentially, suitability depends on the specific business model and creditworthiness.

Government Grants and Subsidies

Many governments offer grants and subsidies specifically designed to support small business sustainability. These programs often target specific industries or demographics. Research your local, regional, and national government websites for available programs.

- Eligibility Criteria: Each grant program has unique eligibility criteria, such as business type, location, and revenue.

- Application Process: Applications typically involve a detailed proposal outlining your business plan, financial projections, and the intended use of funds.

- Reporting Requirements: Grantees are usually required to submit regular reports demonstrating the progress and impact of the funding.

Developing a Robust Investment Strategy for Sustainable Growth

Securing funding is only half the battle; effective management is crucial for small business sustainability. A strong investment strategy ensures long-term success.

Creating a Comprehensive Business Plan

A well-structured business plan is essential for attracting investors and securing funding. It should include:

- Market Analysis: A detailed analysis of your target market, including market size, competition, and trends.

- Financial Projections: Realistic financial forecasts, including revenue projections, expense budgets, and cash flow statements.

- Management Team Overview: Highlight the experience and expertise of your management team.

Benefits of a Comprehensive Business Plan:

- Attracts investors, guides business decisions, secures funding, demonstrates understanding of the market.

Identifying Potential Investors (Angel Investors, Venture Capitalists)

-

Angel Investors: High-net-worth individuals who invest their own money in early-stage companies. They often provide mentorship and guidance in addition to capital.

-

Venture Capitalists: Professional investors who manage funds from institutional investors. They typically invest in high-growth potential companies with a clear exit strategy.

Strategies for Networking and Pitching:

- Attend industry events, leverage online networking platforms (LinkedIn), build relationships with mentors and advisors.

Managing Financial Resources Effectively

Effective financial management is critical for small business sustainability. This involves:

- Budgeting: Creating a detailed budget to track income and expenses.

- Cash Flow Management: Monitoring cash flow to ensure sufficient funds are available to meet obligations.

- Financial Forecasting: Projecting future financial performance to make informed business decisions.

- Financial Software: Utilizing financial software and tools to streamline financial processes.

Benefits of Effective Financial Management:

- Optimizes resource allocation, ensures financial stability, avoids financial difficulties, tracks progress effectively.

Conclusion

Securing sustainable funding and implementing a smart investment strategy are critical for the long-term success of your small business. By exploring the diverse funding options discussed – from traditional loans to alternative financing and government assistance – and by crafting a compelling business plan to attract investors, you can significantly enhance your chances of achieving lasting profitability and growth. Remember to thoroughly research and carefully consider each option to determine which best aligns with your business needs and goals. Don't hesitate to seek professional advice from financial consultants or mentors to guide you through the process of ensuring your small business sustainability.

Featured Posts

-

La Muerte De Juan Aguilera Un Hito En La Historia Del Tenis Espanol

May 19, 2025

La Muerte De Juan Aguilera Un Hito En La Historia Del Tenis Espanol

May 19, 2025 -

Gazze Balikcilarinin Hayati Savas Abluka Ve Yogun Calisma Sartlari

May 19, 2025

Gazze Balikcilarinin Hayati Savas Abluka Ve Yogun Calisma Sartlari

May 19, 2025 -

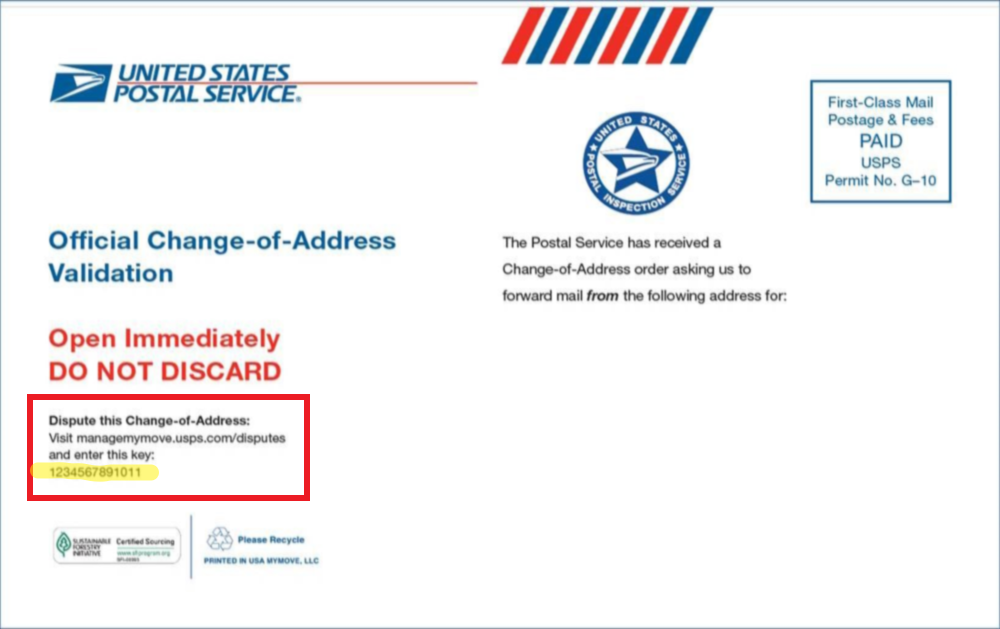

Royal Mail Address Change A Simple And Easy Process

May 19, 2025

Royal Mail Address Change A Simple And Easy Process

May 19, 2025 -

Aileler Ve Gencler Icin Sik Ve Fonksiyonel Nevresim Takimi Secenekleri 2025

May 19, 2025

Aileler Ve Gencler Icin Sik Ve Fonksiyonel Nevresim Takimi Secenekleri 2025

May 19, 2025 -

Haalands Five Goal Haul Propels Norway To World Cup Qualifying Victory

May 19, 2025

Haalands Five Goal Haul Propels Norway To World Cup Qualifying Victory

May 19, 2025