SMFG Eyes Minority Stake In India's Yes Bank

Table of Contents

SMFG's Strategic Rationale Behind the Investment

SMFG's global expansion strategy centers on strategically entering high-growth emerging markets. India, with its burgeoning economy and vast untapped potential, presents an irresistible opportunity. A minority stake in Yes Bank offers SMFG several key advantages:

- Access to the Indian Market: Gaining a foothold in one of the world's fastest-growing economies significantly expands SMFG's market reach and client base. This allows them to tap into the immense potential of the Indian banking sector and offer their services to a large, underserved population.

- Portfolio Diversification: Investing in Yes Bank diversifies SMFG's investment portfolio, mitigating risk associated with over-reliance on any single market. This strategic move strengthens their overall financial resilience.

- High Return Potential: The Indian banking sector offers significant long-term growth prospects. SMFG likely anticipates substantial returns on its investment as Yes Bank recovers and expands its operations.

Bullet Points:

- Increased market share in Asia, solidifying SMFG's position as a major player.

- Diversification of investment portfolio, reducing overall risk exposure.

- Potential for significant long-term growth in the dynamic Indian banking sector.

- Strategic partnership opportunities within Yes Bank's extensive network, leveraging synergies.

Implications for Yes Bank

Yes Bank has faced challenges in recent years, requiring a strategic intervention to bolster its financial standing and regain investor confidence. SMFG's investment could be the catalyst for a significant turnaround:

- Capital Infusion: A substantial capital injection from SMFG can strengthen Yes Bank's balance sheet, improving its capital adequacy ratio and overall financial health. This addresses a key vulnerability and enhances its stability.

- Technological Advancements: SMFG's expertise in advanced banking technologies and digital solutions can help Yes Bank modernize its operations and improve efficiency. This includes upgrading its digital banking platforms and streamlining internal processes.

- Improved Governance: SMFG's involvement could bring enhanced corporate governance practices to Yes Bank, improving transparency and accountability, and fostering investor confidence.

Bullet Points:

- Capital injection to strengthen its balance sheet and improve financial stability.

- Access to SMFG's advanced banking technologies and expertise, leading to modernization.

- Improved risk management and corporate governance structures, enhancing investor trust.

- Potential for enhanced customer service and a wider range of innovative product offerings.

Market Reactions and Analyst Opinions

News of the potential SMFG investment has generated considerable market interest. While initial stock price reactions have been positive, reflecting investor optimism, analysts offer varied perspectives:

- Stock Price Fluctuations: Yes Bank's share price has shown noticeable volatility following the news, indicating the market's sensitivity to the deal's progress.

- Analyst Predictions: Some analysts predict a successful partnership, highlighting the synergistic potential and long-term growth prospects. Others express caution, citing potential challenges and risks associated with integrating two vastly different corporate cultures.

- Potential Risks and Challenges: Challenges include regulatory approvals, cultural differences between the two organizations, and the successful integration of systems and operations.

- Comparison with Similar Investments: Analysts are drawing parallels with other successful and unsuccessful foreign investments in the Indian banking sector, providing valuable insights.

Bullet Points:

- Stock price fluctuations reflecting the market's optimism and uncertainty.

- Analyst predictions ranging from optimistic to cautious, considering potential benefits and challenges.

- Potential risks associated with regulatory hurdles, cultural differences, and integration complexities.

- Comparisons with similar investments in the Indian banking sector offer valuable context.

Regulatory Approvals and Future Outlook

The successful completion of the SMFG investment hinges on securing necessary regulatory approvals from the Reserve Bank of India (RBI). This process may take time and involve detailed scrutiny.

- Timeline for Regulatory Approvals: The timeline remains uncertain, depending on the RBI's review process and the complexity of the deal.

- Impact on Competition: The investment could intensify competition within the Indian banking sector, prompting other players to enhance their offerings and strategies.

- Long-Term Strategic Implications: This partnership holds significant long-term strategic implications for both SMFG and Yes Bank, shaping their future growth trajectories and market positions.

- Potential for Further Investments: A successful investment in Yes Bank could pave the way for further SMFG investments in the Indian market, signaling a broader commitment to the region's financial landscape.

Bullet Points:

- Timeline for regulatory approvals remains dependent on RBI's review process.

- Potential impact on competition within the already dynamic Indian banking sector.

- Long-term strategic implications for both SMFG and Yes Bank's future growth and market position.

- Potential for further SMFG investments in India's promising financial market.

Conclusion: The SMFG-Yes Bank Partnership – A Promising Venture?

The potential SMFG investment in Yes Bank represents a significant development, with potentially transformative implications for both companies and the broader Indian banking sector. SMFG's strategic rationale, driven by diversification and growth opportunities in a rapidly expanding market, aligns well with Yes Bank's need for capital infusion and technological upgrades. While regulatory hurdles and integration challenges exist, the potential benefits are substantial. Market reactions have been mixed, reflecting investor optimism tempered by uncertainty. The successful completion of the SMFG's potential acquisition of a stake in Yes Bank could signal a new chapter of growth and stability for Yes Bank and a significant expansion of SMFG's presence in the Indian financial landscape. Stay updated on further developments regarding the SMFG investment in Yes Bank and share your thoughts in the comments section below!

Featured Posts

-

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025 -

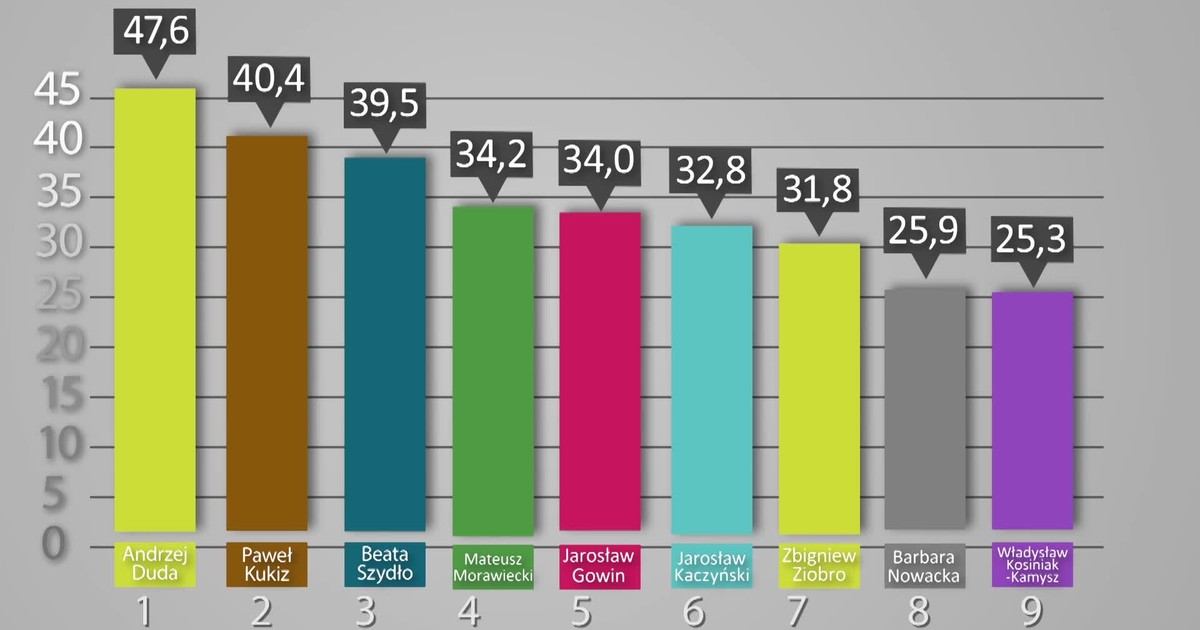

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025 -

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit

May 07, 2025

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit

May 07, 2025 -

Lewis Capaldi Performs For First Time In 2024 At Tom Walkers Charity Event

May 07, 2025

Lewis Capaldi Performs For First Time In 2024 At Tom Walkers Charity Event

May 07, 2025 -

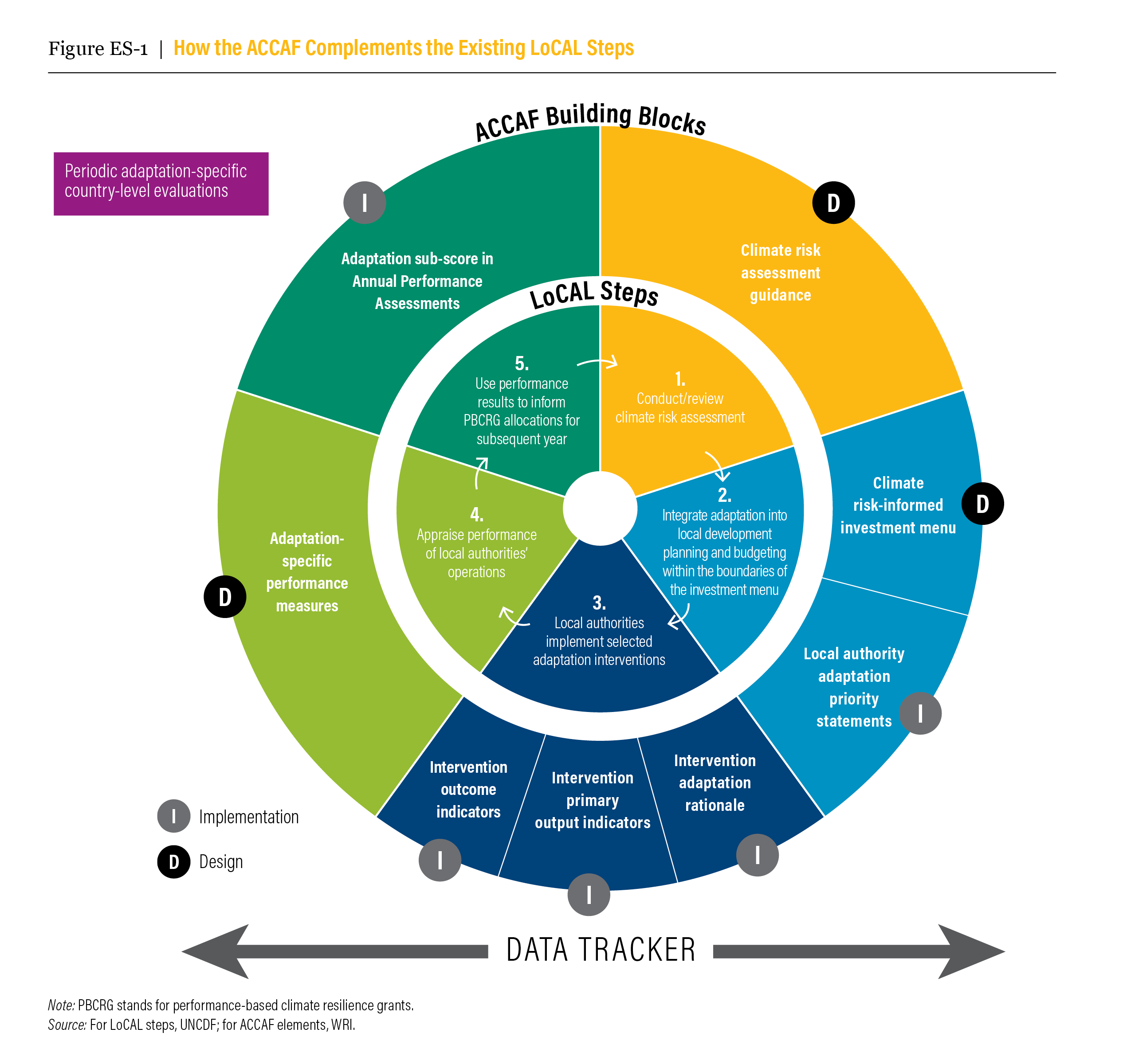

Strengthening Resilience Sustainable Transformation In Least Developed Countries

May 07, 2025

Strengthening Resilience Sustainable Transformation In Least Developed Countries

May 07, 2025