SMFG In Talks To Acquire Yes Bank Stake: Sources

Table of Contents

SMFG's Strategic Interest in the Indian Market

SMFG's reported interest in Yes Bank stems from its aggressive expansion strategy in Asia. The firm recognizes India's burgeoning economy and vast potential as a highly lucrative market for foreign investment. India's large and growing middle class, coupled with increasing financial inclusion initiatives, presents a massive opportunity for growth in the banking sector. SMFG's strategic move reflects its keen understanding of this potential.

- Aggressive Asian Expansion: SMFG has consistently demonstrated an appetite for expansion in the Asian market, seeking out strong partners and acquiring strategic assets to fuel its growth.

- India's Economic Potential: India's robust economic growth and projected future expansion make it an attractive destination for foreign direct investment (FDI), particularly in the financial sector.

- Synergistic Partnership: A partnership with Yes Bank would allow SMFG to leverage Yes Bank's established infrastructure and customer base in India, significantly accelerating its market penetration.

- Proven Acquisition Strategy: SMFG has a history of successful acquisitions and investments in emerging markets, indicating a well-defined strategy for integrating new assets and maximizing returns.

Yes Bank's Current State and Need for Investment

Yes Bank, while a significant player in the Indian banking sector, has faced challenges in recent years. The bank has undergone a period of financial restructuring and is actively seeking capital infusion and strategic partnerships to bolster its financial stability and fuel future growth. An acquisition by SMFG could be a pivotal step in this recovery process.

- Financial Restructuring: Yes Bank's recent financial history includes periods of significant stress, necessitating restructuring efforts to improve its balance sheet.

- Capital Infusion Requirement: The bank requires a substantial capital infusion to meet regulatory requirements and support future lending activities and expansion.

- Strategic Partnership Benefits: A strategic partnership with a globally recognized financial institution like SMFG would significantly enhance Yes Bank's credibility, attract new investors, and improve its overall financial health.

- Regulatory Hurdles: Securing the necessary regulatory approvals from the Reserve Bank of India (RBI) and other relevant authorities will be a crucial step in the acquisition process.

Potential Implications of the Acquisition

The potential acquisition of a stake in Yes Bank by SMFG carries significant implications for the Indian banking sector and the broader economy. The deal could fundamentally alter the competitive landscape, attracting further foreign investment and stimulating economic growth.

- Impact on Competition: The merger could lead to increased competition within the Indian banking sector, potentially benefiting consumers through improved services and lower fees.

- Increased Foreign Investment: The acquisition would be a strong signal to other international financial institutions, potentially attracting more FDI into India's financial market.

- Benefits for Yes Bank Customers: An infusion of capital and expertise from SMFG could result in enhanced customer service, improved technology, and a wider range of financial products for Yes Bank customers.

- Economic Growth and Job Creation: The merger could lead to increased economic activity, potentially creating jobs and opportunities within the banking sector and related industries.

Uncertainties and Challenges

While the potential benefits are significant, the SMFG-Yes Bank deal also faces several uncertainties and challenges. The complexities of international acquisitions and regulatory approvals cannot be overlooked.

- Regulatory Approvals: Navigating the regulatory landscape and obtaining necessary approvals from Indian and potentially Japanese regulatory bodies will be a time-consuming and complex process.

- Risks and Mitigation Strategies: Both SMFG and Yes Bank will need to carefully assess and mitigate various risks associated with the acquisition, including integration challenges, potential losses, and reputational risks.

- Due Diligence and Negotiations: A thorough due diligence process is essential to evaluate Yes Bank's financial health and operational capabilities, and successful negotiations will be crucial for deal completion.

- Deal Completion Uncertainties: Several factors, including unforeseen financial issues or changes in regulatory environments, could potentially delay or derail the acquisition.

Conclusion

The potential acquisition of a significant stake in Yes Bank by SMFG represents a significant development in the Indian banking sector. This deal could revitalize Yes Bank while furthering SMFG's expansion in a key Asian market. However, several uncertainties and challenges remain before the deal is finalized. The success of this venture will depend on effective regulatory navigation, thorough due diligence, and a carefully executed integration strategy.

Call to Action: Stay tuned for further updates on this potentially game-changing SMFG and Yes Bank acquisition. Follow us for the latest news and analysis on the SMFG and Yes Bank merger talks and their impact on the Indian banking landscape. Keep an eye on developments surrounding this major SMFG investment opportunity.

Featured Posts

-

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025 -

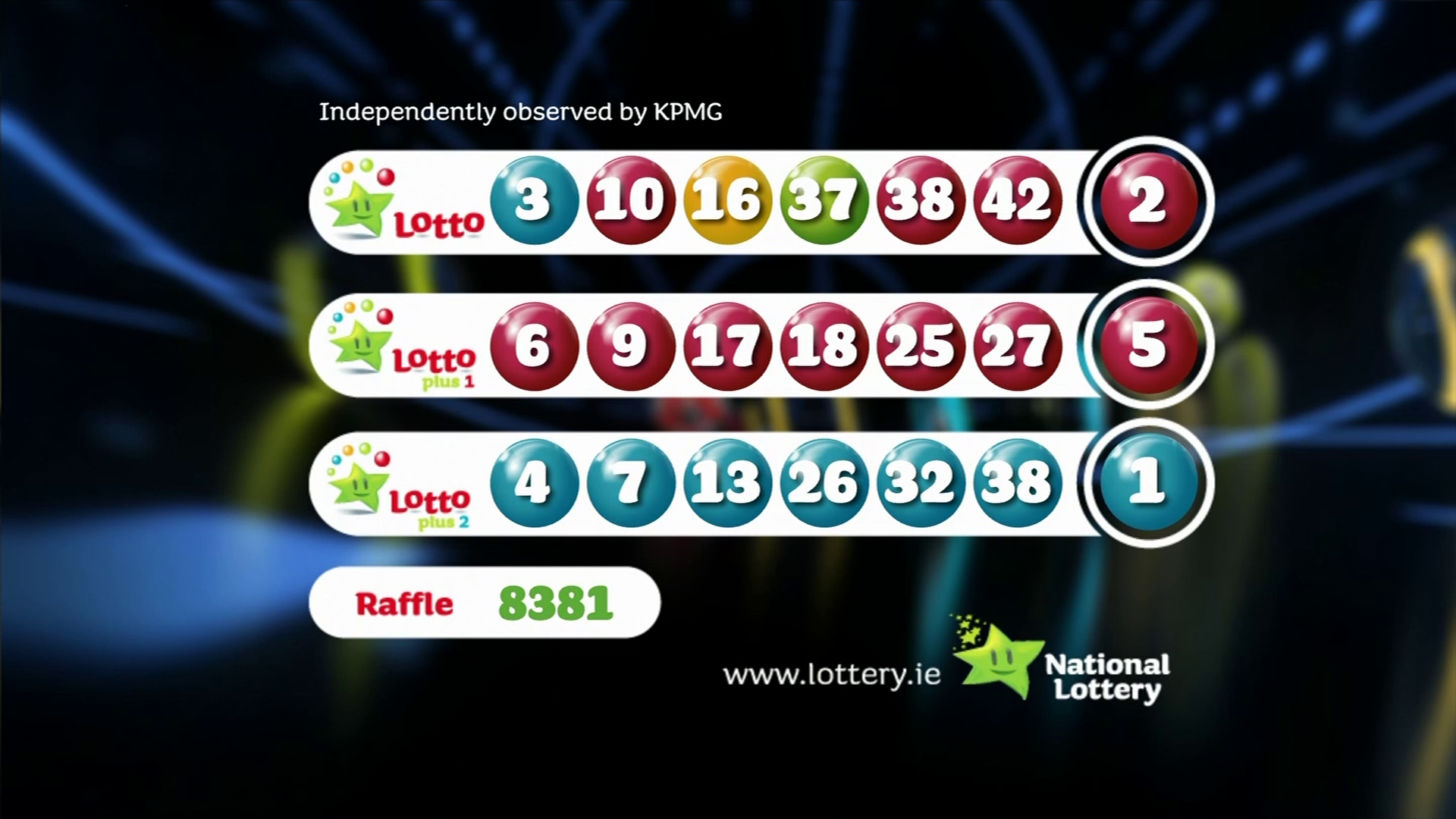

Lotto Results Get The Latest Numbers For Lotto Plus 1 And Lotto Plus 2

May 07, 2025

Lotto Results Get The Latest Numbers For Lotto Plus 1 And Lotto Plus 2

May 07, 2025 -

Minnesota Timberwolves Dark Horse Contender For The Nba Playoffs

May 07, 2025

Minnesota Timberwolves Dark Horse Contender For The Nba Playoffs

May 07, 2025 -

John Wick 5 Keanu Reeves Speaks Out On The Future Of The Franchise

May 07, 2025

John Wick 5 Keanu Reeves Speaks Out On The Future Of The Franchise

May 07, 2025 -

The Karate Kids Enduring Legacy Impact And Influence On Pop Culture

May 07, 2025

The Karate Kids Enduring Legacy Impact And Influence On Pop Culture

May 07, 2025