SpaceX Valuation Soars: Musk's Stake Tops Tesla Investment By $43 Billion

Table of Contents

Elon Musk's SpaceX has achieved a monumental milestone, surpassing even his Tesla investment in net worth. Recent valuations place SpaceX's worth significantly higher than Musk's stake in Tesla, a remarkable feat highlighting the explosive growth of the private space exploration industry. This article delves into the factors driving this astronomical rise in SpaceX's valuation and what it means for the future of space travel and investment.

The Staggering Valuation of SpaceX

Numbers Behind the News

The precise SpaceX valuation fluctuates depending on the source and the timing of funding rounds, but recent reports suggest a valuation exceeding $150 billion. This represents a substantial increase from previous rounds and significantly surpasses many traditional aerospace companies. For instance, according to Morgan Stanley research cited in various financial news outlets such as CNBC and Bloomberg, this figure represents a massive jump from previous valuations.

- Specific Increase: While exact figures vary slightly, the increase represents a multi-billion dollar surge in value over the last few years.

- Comparison to Aerospace Giants: This valuation places SpaceX among the most valuable aerospace companies globally, dwarfing many established players.

- Valuation Discrepancies: It’s important to note that different sources may offer slightly varying valuations due to the complexities of private company valuations.

Factors Contributing to the Increased Valuation

Several key factors have fueled SpaceX's meteoric rise:

- Starlink's Success: Starlink, SpaceX's satellite internet constellation, is a major driver. With millions of subscribers and projections for substantial revenue growth, it's a significant contributor to the company's overall worth.

- Government Contracts: Lucrative contracts with NASA and the U.S. military for launch services and other space-related projects provide a stable revenue stream and boost investor confidence.

- Technological Advancements: SpaceX's pioneering work on reusable rockets, significantly reducing launch costs, is a game-changer in the space industry. The ambitious Starship program, aiming for fully reusable, super-heavy-lift launch capability, further enhances its future prospects.

- Investor Confidence: The company’s consistent success and innovative approach have attracted substantial investments, further driving up its valuation.

Musk's Financial Empire: SpaceX vs. Tesla

Comparing Musk's Holdings

Elon Musk's stake in SpaceX is now reportedly worth more than his Tesla holdings, marking a significant shift in his financial empire.

- Percentage Ownership: While the exact percentage of Musk's ownership in SpaceX is not publicly disclosed, it's substantial enough to make his SpaceX stake far more valuable than his Tesla ownership.

- Current Estimated Value: As SpaceX's valuation has increased dramatically, so has the estimated worth of Musk's holdings, overtaking his Tesla holdings.

- Historical Comparison: This is a relatively recent development. Just a few years ago, Musk's Tesla shares represented a significantly larger portion of his net worth.

Implications for Investment Strategies

This shift has significant implications for investors:

- Future Growth Potential: Both SpaceX and Tesla are considered high-growth companies, but the SpaceX valuation suggests potentially higher returns in the space exploration sector, given the relatively nascent nature of the commercial space industry.

- Diversification Considerations: Investors should consider diversifying their portfolios to include exposure to both established sectors (like electric vehicles represented by Tesla) and emerging high-growth sectors (like private space exploration).

- Risk Assessment: Investing in SpaceX or other private space companies involves greater risk compared to established companies, though the potential rewards are also substantial.

The Future of SpaceX and the Space Industry

Starship's Role in Future Growth

Starship's successful development and deployment will be pivotal for SpaceX's future valuation.

- Reduced Launch Costs: Starship aims to dramatically reduce launch costs, potentially opening up space exploration to a wider range of players and applications.

- Increased Space Access: This increased accessibility will boost demand for space-related services, furthering SpaceX's potential growth.

- Competition: However, the success of Starship is not guaranteed, and increased competition from other emerging private space companies will play a significant role.

Long-Term Projections and Market Dominance

SpaceX is well-positioned to become a dominant player in the space industry.

- Market Share Projections: Starlink is already a significant player in the satellite internet market and is projected to capture a considerable share. SpaceX’s launch services also show significant potential for growth.

- Acquisitions and Partnerships: Future acquisitions and strategic partnerships could further propel SpaceX's growth and dominance.

- Geopolitical Factors: Global geopolitical factors and space policies will certainly influence the competitive landscape and impact SpaceX's growth trajectory.

Conclusion

The soaring SpaceX valuation underscores not only Elon Musk's entrepreneurial success but also the rapidly expanding potential of the private space exploration sector. The success of Starlink, coupled with advancements in reusable rocket technology and ambitious projects like Starship, positions SpaceX for continued growth and market dominance. Investors should carefully consider the significant implications of this shift, balancing the high-growth potential with the inherent risks associated with space-related ventures. Stay informed about future developments in the SpaceX valuation and the broader space industry to make informed investment decisions. Understanding the factors influencing SpaceX's market capitalization is crucial for anyone interested in space-related investments.

Featured Posts

-

Massive Whistleblower Payout Credit Suisse Settles For 150 Million

May 09, 2025

Massive Whistleblower Payout Credit Suisse Settles For 150 Million

May 09, 2025 -

The Latest On Doohan At Williams Addressing Colapinto Driver Rumors

May 09, 2025

The Latest On Doohan At Williams Addressing Colapinto Driver Rumors

May 09, 2025 -

Expensive Babysitter Leads To Even Pricier Daycare One Mans Story

May 09, 2025

Expensive Babysitter Leads To Even Pricier Daycare One Mans Story

May 09, 2025 -

Apples Ai Future A Crossroads Analysis

May 09, 2025

Apples Ai Future A Crossroads Analysis

May 09, 2025 -

Beautiful Castle Near Manchester The Venue For Olly Murs Massive Music Festival

May 09, 2025

Beautiful Castle Near Manchester The Venue For Olly Murs Massive Music Festival

May 09, 2025

Latest Posts

-

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

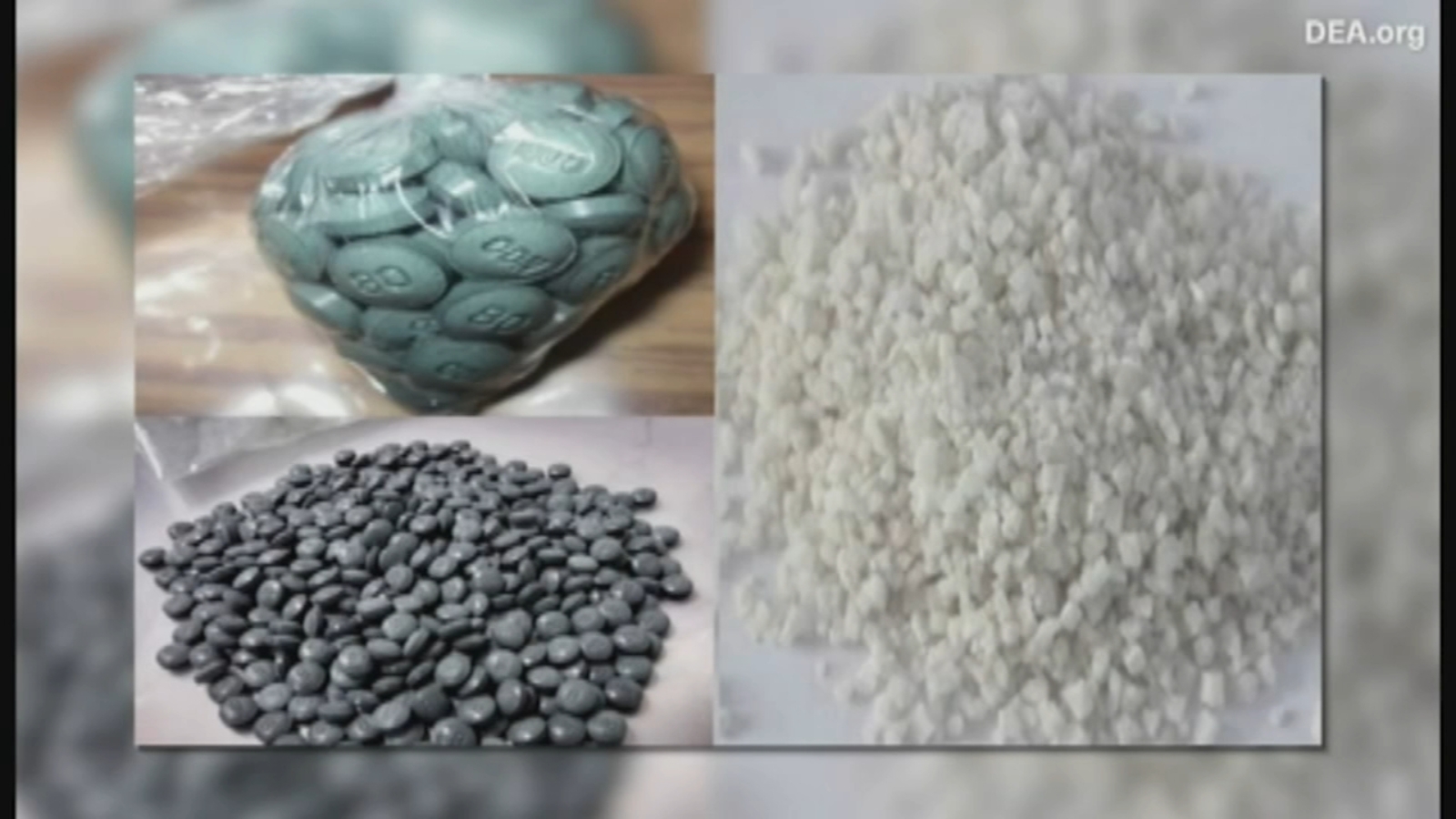

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025 -

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025 -

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025