SSE Announces £3 Billion Reduction In Spending Plan Due To Slowing Growth

Table of Contents

Reasons Behind the £3 Billion Spending Reduction

The decision to slash £3 billion from SSE's spending plan is multifaceted, stemming from a confluence of factors impacting the energy sector and the wider economy. Economic uncertainty, driven by high inflation and rising interest rates, is a primary driver. These macroeconomic headwinds significantly increase the cost of borrowing, making it more expensive to finance large-scale energy projects.

- Increased inflation and rising interest rates: The increased cost of materials, labor, and financing makes previously viable projects less financially attractive, impacting the return on investment (ROI).

- Uncertainty in the energy market: Geopolitical instability and fluctuating energy prices create a volatile market, making long-term investment planning difficult and increasing risk. This volatility makes predicting future energy demands and pricing challenging, affecting the profitability of new energy projects.

- Potential regulatory changes: Changes in government policy and regulation can significantly affect the viability of energy projects. Uncertainty surrounding future regulations adds to the risk associated with large-scale investments.

- Cost overruns on existing projects: Unexpected cost increases on current projects necessitate a reassessment of available resources and future commitments. This necessitates a more cautious approach to future investments.

- Reassessment of ROI for renewable energy projects: The return on investment for some large-scale renewable energy projects, like offshore wind farms, may have been reassessed downwards due to increased costs and uncertainties, leading to their postponement or cancellation.

Impact on SSE's Future Projects and Investment Strategy

The £3 billion reduction in spending will undoubtedly have a significant impact on SSE's future projects and overall investment strategy. The company will likely prioritize projects offering a faster return on investment and those with lower financial risk. This shift in priorities has far-reaching implications.

- Delayed or cancelled renewable energy projects: Several planned renewable energy projects, including wind and solar farms, may be delayed or cancelled outright due to the reduced budget. This could slow down the UK's transition to renewable energy.

- Reduced investment in grid infrastructure: Investment in upgrading and expanding the national electricity grid infrastructure, crucial for integrating new renewable energy sources, might be curtailed, potentially hindering the expansion of renewable energy capacity.

- Shift in investment priorities: SSE will likely focus on projects with a shorter payback period and lower risk profiles, possibly favouring smaller-scale projects or operational efficiency improvements over large-scale developments.

- Focus on optimizing existing assets: Existing assets will receive increased attention, with a focus on maximizing their efficiency and lifespan to reduce the need for new investments in the short term.

- Potential impact on job creation: The reduced investment could lead to fewer job opportunities in the renewable energy sector and potentially wider economic consequences within the communities reliant on these projects.

Broader Implications for the UK Energy Sector

SSE's drastic spending cuts have wider implications for the UK energy sector and the nation's energy transition goals. The reduction in investment could impact the overall pace of renewable energy development and the achievement of carbon emission reduction targets.

- Slowdown in the UK's energy transition: A reduction in investment in renewable energy projects could slow down the UK's transition to a cleaner energy system and hinder its ability to meet its climate change commitments.

- Impact on government targets: The government's ambitious targets for reducing carbon emissions could be jeopardized if private sector investment in renewable energy significantly declines.

- Concerns about investment confidence: SSE's decision may negatively impact investor confidence in the UK energy sector, making it harder for other companies to secure funding for renewable energy projects.

- Implications for energy security: Reduced investment could affect the UK's energy security, particularly if the focus shifts away from renewable energy sources and towards less sustainable alternatives.

- Effects on market competition: The reduced investment could impact competition within the energy market, potentially leading to market consolidation and a less diverse energy landscape.

Conclusion

SSE's announcement of a £3 billion spending cut is a significant development in the UK energy sector, reflecting the challenging economic climate and increased uncertainty within the energy market. The decision highlights the complexities of financing large-scale renewable energy projects in the current environment and raises concerns about the pace of the UK's energy transition. The impact on future renewable energy development and the broader energy landscape remains to be seen, but it's clear that reduced investment poses challenges to the UK's decarbonisation goals.

Call to Action: Stay informed about the evolving situation and the implications of SSE's reduced spending plan on the UK energy market. Follow us for further updates on SSE's investment strategy and the impact of this significant £3 billion spending reduction. Continue to research SSE spending cuts and their wider implications for energy investment and the UK's renewable energy goals.

Featured Posts

-

Remont Pivdennogo Mostu Oglyad Proektu Ta Finansovikh Vitrat

May 23, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Finansovikh Vitrat

May 23, 2025 -

Milly Alcock And Meghann Fahy Face Toxic Workplace In Siren Trailer

May 23, 2025

Milly Alcock And Meghann Fahy Face Toxic Workplace In Siren Trailer

May 23, 2025 -

First Test Bangladesh Mounts A Comeback Against Zimbabwe

May 23, 2025

First Test Bangladesh Mounts A Comeback Against Zimbabwe

May 23, 2025 -

10 Definitive Pete Townshend Songs You Need To Hear

May 23, 2025

10 Definitive Pete Townshend Songs You Need To Hear

May 23, 2025 -

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 23, 2025

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 23, 2025

Latest Posts

-

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 23, 2025

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 23, 2025 -

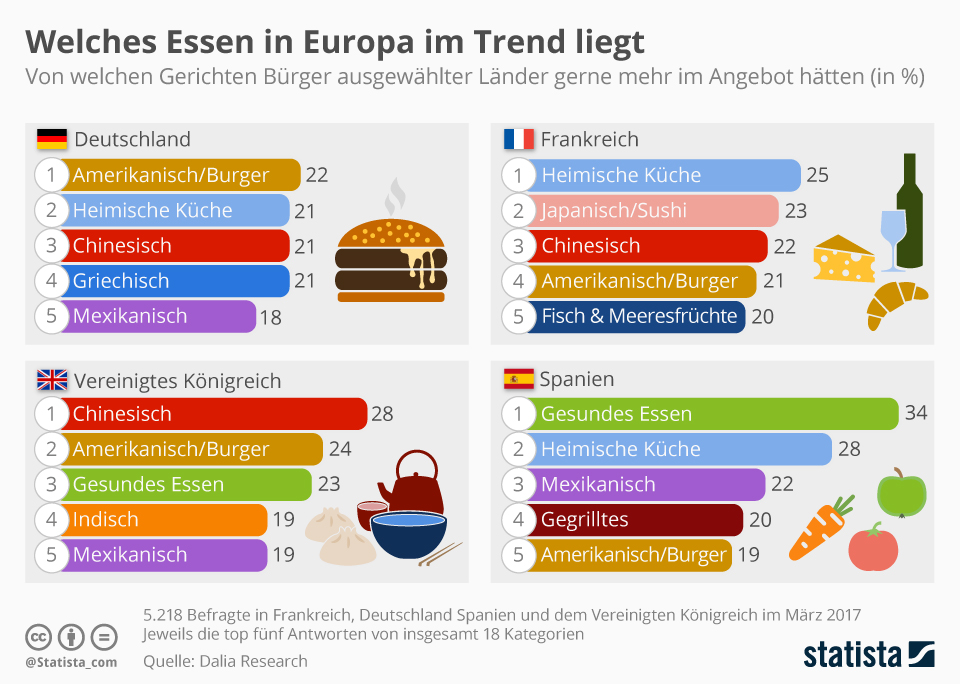

Essen Die Nummer 1 Unter Den Eissorten In Nrw

May 23, 2025

Essen Die Nummer 1 Unter Den Eissorten In Nrw

May 23, 2025 -

Eiskreationen In Essen Der Unerwartete Sieger In Nrw

May 23, 2025

Eiskreationen In Essen Der Unerwartete Sieger In Nrw

May 23, 2025 -

Nrw Eis Trend Diese Sorte Liegt In Essen Vorn

May 23, 2025

Nrw Eis Trend Diese Sorte Liegt In Essen Vorn

May 23, 2025 -

Nordrhein Westfalen Uni Notenmanipulation Gefaengnisstrafen Fuer Angeklagte

May 23, 2025

Nordrhein Westfalen Uni Notenmanipulation Gefaengnisstrafen Fuer Angeklagte

May 23, 2025