SSE Growth Slowdown Leads To £3 Billion Spending Reduction: Implications For The Energy Sector

Table of Contents

Reasons Behind SSE's Reduced Spending

Several factors have converged to cause the dramatic reduction in SSE's investment plans. These interconnected challenges highlight the complexities facing the energy sector as it navigates a period of significant transition.

Increased Regulatory Uncertainty

The UK's evolving energy policy landscape has created significant uncertainty for investors. Changes in government regulations concerning renewable energy investment and the overall regulatory framework have made long-term planning extremely challenging.

- Examples of specific policies impacting investment: Frequent changes to subsidy schemes for renewable energy projects have created instability. The inconsistent application of planning permissions has also led to delays and increased costs.

- Potential legal challenges: The complexities of navigating environmental regulations and securing necessary permits have added to project timelines and costs. Legal challenges from environmental groups can further delay projects.

- Effects on project timelines: Uncertainty around future regulations leads to delays in project initiation and completion, impacting overall return on investment.

Higher Inflation and Increased Costs

Soaring inflation and persistent supply chain issues have significantly increased the cost of energy projects. This has made many previously viable projects uneconomical, forcing companies like SSE to reassess their investment strategies.

- Specific examples of increased material costs: The price of steel, copper, and other essential materials has skyrocketed, impacting the overall cost of construction.

- Labor shortages: A shortage of skilled labor in the energy sector has driven up labor costs and contributed to project delays.

- Impact on project feasibility studies: Increased costs have rendered many projects unfeasible, leading to cancellations or postponements. Feasibility studies now need to factor in significantly higher cost estimates.

Shifting Energy Landscape

The transition to renewable energy sources is fundamentally reshaping the energy sector. Traditional energy companies like SSE face significant challenges adapting to this changing market, requiring substantial investments in new technologies and infrastructure.

- Competition from new renewable energy players: The emergence of numerous smaller, agile renewable energy companies is increasing competition and putting pressure on margins.

- Need for grid upgrades: Integrating a growing volume of renewable energy into the national grid requires significant upgrades to grid infrastructure, demanding substantial investment.

- Investment in smart grid technologies: The digitalization of the energy grid requires investment in smart meters, data analytics, and other technologies to manage the fluctuating supply from renewable sources.

Impact on the Wider Energy Sector

The SSE growth slowdown has far-reaching implications for the wider UK energy sector, impacting investor sentiment, renewable energy deployment, and government policy.

Investor Confidence and Market Reactions

SSE's announcement has sent shockwaves through the energy market, impacting investor confidence and leading to share price fluctuations.

- Share price changes following the announcement: SSE's share price experienced a noticeable dip following the announcement, reflecting investor concerns.

- Impact on credit ratings: The reduction in spending could potentially impact SSE's credit rating, making it more expensive to secure future funding.

- Potential for further investment cuts by other energy companies: SSE's decision may encourage other energy companies to reassess their investment plans, further slowing down development in the sector.

Implications for Renewable Energy Development

The reduction in SSE's investment will likely slow down the deployment of renewable energy projects across the UK, potentially jeopardizing the country's climate change targets.

- Potential delays in renewable energy projects: Fewer projects will be initiated, and existing projects may face delays due to funding constraints.

- Impact on job creation: A slowdown in renewable energy development will negatively impact job creation in the sector.

- Challenges in meeting climate targets: The reduced investment threatens the UK's ability to meet its ambitious renewable energy targets and decarbonization goals.

Government Response and Policy Adjustments

The government is likely to respond to the challenges faced by the energy sector through policy adjustments designed to stimulate investment and support renewable energy deployment.

- Potential policy changes to encourage investment: The government may introduce new incentives, such as tax breaks or guaranteed returns, to encourage investment in renewable energy.

- Government support schemes for renewable energy: Existing support schemes may be strengthened or expanded to provide greater financial backing for renewable energy projects.

- Tax incentives for energy companies: Tax incentives could be implemented to encourage energy companies to invest in renewable energy infrastructure and research and development.

Potential Future Scenarios and Mitigation Strategies

Predicting the future of the energy sector requires considering various potential scenarios and developing effective mitigation strategies.

Scenario Planning for the Energy Sector

Different scenarios can be developed based on varying assumptions regarding government policy, economic conditions, and technological advancements.

- Optimistic vs. pessimistic scenarios: Optimistic scenarios assume favorable government policies, a stable economy, and rapid technological advancements. Pessimistic scenarios assume the opposite.

- Potential risks and opportunities: Risk assessment is crucial for identifying potential challenges and opportunities under different scenarios.

- Strategies for adapting to different scenarios: Energy companies must develop flexible strategies that can adapt to different economic and policy environments.

Strategies for SSE and Other Energy Companies

SSE and other energy companies need to adopt proactive strategies to navigate the current challenges and ensure their long-term sustainability.

- Focus on efficiency improvements: Optimizing operational efficiency and reducing costs are crucial for improving profitability and competitiveness.

- Exploring new business models: Energy companies need to explore innovative business models to adapt to the changing energy landscape.

- Collaboration with technology providers: Partnerships with technology providers can accelerate the adoption of new technologies and improve efficiency.

- Diversification of energy sources: Diversifying energy sources can reduce dependence on volatile fossil fuels and mitigate risks associated with fluctuating energy prices.

Conclusion: SSE Growth Slowdown and the Future of the Energy Sector

The £3 billion reduction in SSE's spending highlights the significant challenges facing the UK energy sector. Regulatory uncertainty, inflation, and the energy transition are creating headwinds for investment and renewable energy deployment. Addressing these challenges requires proactive strategies from energy companies, including cost optimization and innovation, along with supportive government policies to stimulate investment and ensure a smooth transition to a sustainable energy future. Stay informed about developments in the energy sector and the continuing impact of the SSE growth slowdown. Follow future updates on the topic of "SSE growth slowdown," "renewable energy investment," and "energy policy reform" to stay abreast of crucial developments in this rapidly changing landscape.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025 -

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025 -

Chat Gpt And Open Ai The Federal Trade Commissions Investigation

May 24, 2025

Chat Gpt And Open Ai The Federal Trade Commissions Investigation

May 24, 2025 -

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Latest Posts

-

The Jonas Brothers Joe Jonas And A Hilarious Fan Encounter

May 24, 2025

The Jonas Brothers Joe Jonas And A Hilarious Fan Encounter

May 24, 2025 -

How Joe Jonas Handled A Married Couples Fight Over Him

May 24, 2025

How Joe Jonas Handled A Married Couples Fight Over Him

May 24, 2025 -

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Response

May 24, 2025

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Response

May 24, 2025 -

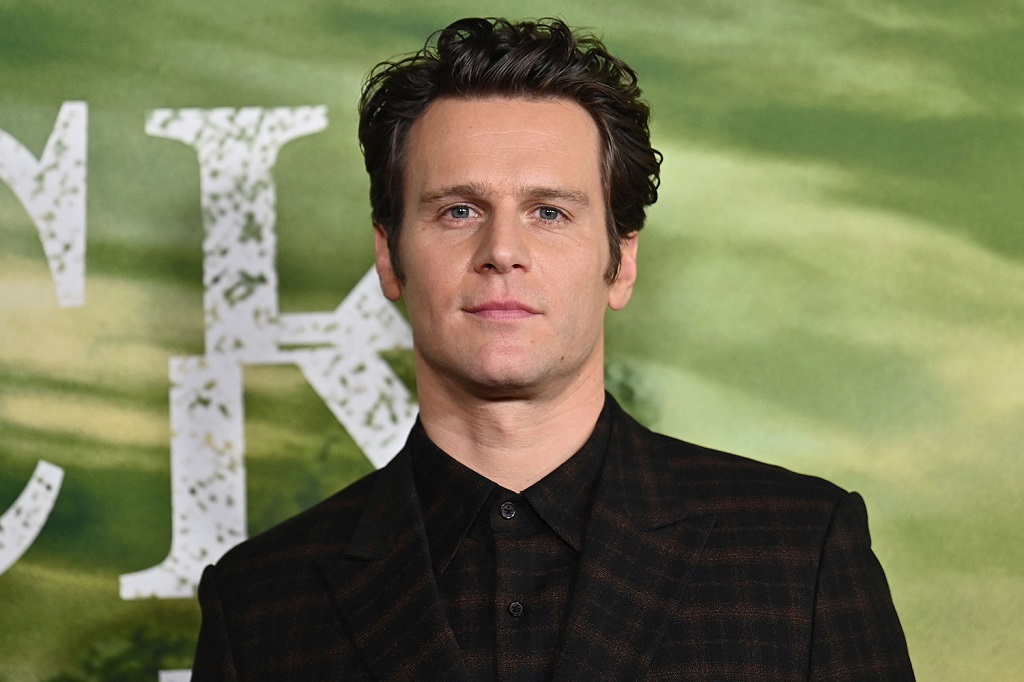

Jonathan Groff Could Just In Time Secure Him A Tony Award

May 24, 2025

Jonathan Groff Could Just In Time Secure Him A Tony Award

May 24, 2025 -

Jonathan Groffs Tony Awards Potential A Look At Just In Time

May 24, 2025

Jonathan Groffs Tony Awards Potential A Look At Just In Time

May 24, 2025