SSE Responds To Economic Slowdown With £3 Billion Spending Cut

Table of Contents

SSE, a leading integrated energy company in the UK, plays a crucial role in electricity generation, distribution, and retail. Its operations span a wide range of energy sources, including renewable energy projects like wind farms and hydro power, as well as traditional power generation and network infrastructure. This £3 billion reduction in spending represents a considerable shift in their operational strategy.

Details of the £3 Billion Spending Cut

The £3 billion spending cut announced by SSE impacts several key areas of its operations. The company aims to streamline its investment portfolio, focusing resources on projects deemed most strategically important. This involves a combination of project delays, reduced capital expenditure, and workforce adjustments.

The specifics of these cuts include:

- Reduced Capital Expenditure: SSE will significantly reduce its investment in new projects across various sectors. This includes scaling back on planned expansions and upgrades to existing infrastructure.

- Project Delays: Several renewable energy projects, including offshore wind farm developments and grid connection upgrades, will experience delays. This impacts the company's timeline for achieving its net-zero targets.

- Workforce Adjustments: While not explicitly stated as widespread layoffs, SSE has indicated a hiring freeze in certain departments and a focus on operational efficiency, potentially leading to some job losses through attrition. This reflects a broader trend within the energy sector in response to economic uncertainty.

Specific examples of the spending cut include:

- Delay of the proposed offshore wind farm project "Seabreeze," pushing back its completion date by at least two years.

- Reduction in planned upgrades to the electricity grid in the North East of England, delaying crucial infrastructure improvements.

- Hiring freeze across several departments, impacting future growth and expansion plans within the company.

Reasons Behind SSE's Decision

SSE's decision to implement this substantial spending cut stems from a confluence of economic factors that are negatively impacting profitability and future investment potential.

The key reasons behind SSE's decision include:

- Soaring Inflation: Increased costs of raw materials, labor, and transportation have significantly impacted SSE's operational expenses, squeezing profit margins.

- Rising Interest Rates: Higher interest rates increase the cost of borrowing, making it more expensive to finance new projects and impacting the overall financial viability of investments.

- Reduced Consumer Spending: The economic slowdown has led to decreased energy consumption, affecting SSE's revenue streams and reducing the return on investment for new projects.

- Regulatory Uncertainty: Changes in government policies and regulations regarding energy investments and renewable energy support schemes add uncertainty to future project planning.

These factors combined create a challenging environment for SSE, forcing the company to reassess its spending priorities and make difficult decisions to ensure long-term financial stability.

Impact on SSE's Future Investments and Projects

The £3 billion spending cut has significant implications for SSE's future investment plans and its ability to achieve its ambitious renewable energy targets.

Potential impacts include:

- Delays in Achieving Net-Zero Targets: The postponement of several renewable energy projects will undoubtedly delay SSE's progress towards achieving its net-zero emission goals.

- Reduced Capacity for Renewable Energy Expansion: The scaled-back investment in new renewable energy projects limits SSE's future capacity for growth in this crucial sector.

- Potential Job Losses: While not explicitly stated as large-scale layoffs, the hiring freeze and focus on efficiency could lead to job losses through natural attrition and potential restructuring within the company.

- Impact on UK Energy Security: Delayed grid upgrades and reduced renewable energy capacity could negatively impact the UK's energy security and its transition to a greener energy system.

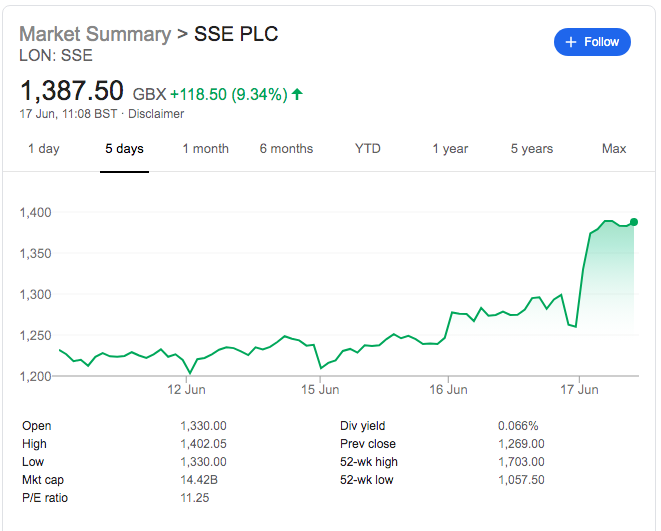

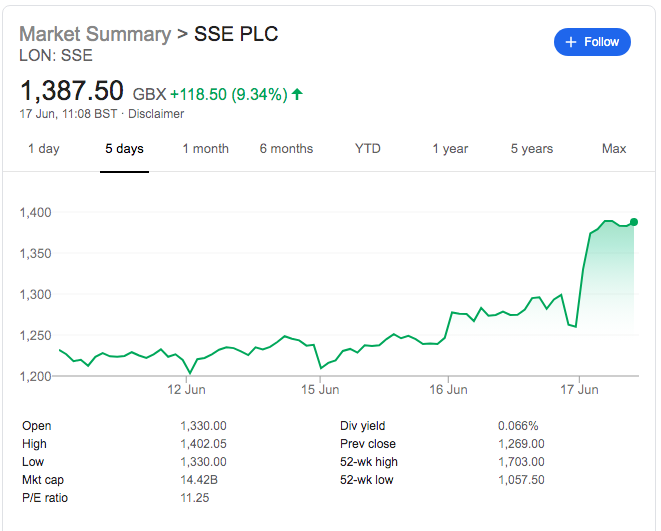

Market Reaction and Analyst Commentary

The announcement of SSE's £3 billion spending cut was met with a mixed reaction in the stock market. Initial share price dips were followed by a degree of recovery as investors digested the news.

Analyst commentary reflects a range of opinions:

- Analyst A: "While the cuts are a necessary measure in the current climate, they could hinder SSE's long-term growth potential and delay its renewable energy ambitions."

- Analyst B: "The decision reflects the harsh realities of the current economic landscape. It’s a prudent move by SSE to preserve financial stability in the short-term."

- Analyst C: "The cuts are likely to have a knock-on effect on the broader UK energy sector, potentially delaying other significant infrastructure projects and influencing investor confidence."

Conclusion: SSE's £3 Billion Spending Cut and the Future of the UK Energy Sector

SSE's £3 billion spending cut is a significant event, highlighting the pressures facing the UK energy sector in the context of the current economic slowdown. The reasons behind this decision, ranging from inflation and interest rate hikes to reduced consumer demand and regulatory uncertainty, are multifaceted and represent a complex challenge for the company and the wider industry. The potential long-term impact on SSE's growth strategy, its commitment to renewable energy, and the UK's energy security necessitates careful monitoring. The reduction in investment could lead to delays in crucial projects and potentially impact the nation’s transition to cleaner energy.

Stay updated on the evolving situation with SSE and its impact on the UK energy sector by following our regular updates on [your website/news source]. Keep abreast of further developments concerning SSE spending cuts and their influence on the UK energy market and the economic slowdown’s overall effect.

Featured Posts

-

Meskr Jdyd Lmntkhb Amryka Thlathy Jdyd Tht Qyadt Bwtshytynw

May 22, 2025

Meskr Jdyd Lmntkhb Amryka Thlathy Jdyd Tht Qyadt Bwtshytynw

May 22, 2025 -

La Demande Croissante De Cordistes A Nantes Un Marche En Expansion

May 22, 2025

La Demande Croissante De Cordistes A Nantes Un Marche En Expansion

May 22, 2025 -

Blake Lively Allegedly A Look At Recent Reports And Speculation

May 22, 2025

Blake Lively Allegedly A Look At Recent Reports And Speculation

May 22, 2025 -

Debat Betaalbare Huizen In Nederland Abn Amro En Geen Stijl

May 22, 2025

Debat Betaalbare Huizen In Nederland Abn Amro En Geen Stijl

May 22, 2025 -

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025

Latest Posts

-

Extended Partnership Ooredoo Qatar And Qtspbfs Continued Success

May 23, 2025

Extended Partnership Ooredoo Qatar And Qtspbfs Continued Success

May 23, 2025 -

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025 -

Ooredoo Qatar And Qtspbf Extend Successful Partnership

May 23, 2025

Ooredoo Qatar And Qtspbf Extend Successful Partnership

May 23, 2025 -

Trinidad And Tobago Police Shed Light On Kartels Security Measures

May 23, 2025

Trinidad And Tobago Police Shed Light On Kartels Security Measures

May 23, 2025 -

Police Source Kartels Security Restrictions Detailed Trinidad And Tobago Newsday

May 23, 2025

Police Source Kartels Security Restrictions Detailed Trinidad And Tobago Newsday

May 23, 2025