SSE's Response To Slowing Growth: A £3 Billion Spending Cut Explained

Table of Contents

Keywords: SSE, spending cut, £3 billion, slowing growth, energy sector, capital expenditure, investment, energy transition, renewable energy, financial performance, market uncertainty, UK energy market, energy prices, inflation, interest rates, share price, investor confidence.

SSE, a major player in the UK energy sector, has recently announced a substantial £3 billion reduction in its planned capital expenditure. This drastic measure, representing a significant shift in the company's financial strategy, comes in response to slowing growth, increased market uncertainty, and a challenging economic climate. This article delves into the reasons behind this decision, its potential impact on SSE's future strategies, and what it signifies for the broader energy landscape.

Reasons Behind the £3 Billion Spending Cut

The decision to slash £3 billion from its capital expenditure reflects a confluence of factors impacting the energy sector and SSE's financial performance.

Slowing Growth in the Energy Market

The UK, and indeed the global, energy market is experiencing a period of slowing growth. High energy prices, fueled by geopolitical instability and supply chain disruptions, have dampened consumer demand. This reduced demand is further exacerbated by the current economic climate, which includes a cost-of-living crisis and fears of a potential recession. Statistics show a decline in overall energy consumption, impacting both household and industrial sectors.

- Declining consumer confidence: High energy bills are forcing consumers to cut back on their energy use, impacting overall demand.

- Increased competition: The energy sector is becoming increasingly competitive, making it harder for companies like SSE to justify large-scale investments.

- Uncertainty surrounding government policies and regulations: Changes in government policy and regulations relating to energy production and consumption create uncertainty for long-term investment planning.

Increased Market Volatility and Uncertainty

Geopolitical events, particularly the war in Ukraine, have created significant volatility in energy markets. Fluctuating fossil fuel prices directly impact the economics of renewable energy investments, making long-term forecasting extremely challenging. The resulting uncertainty increases the risks associated with large-scale capital expenditure projects.

- Impact of the war in Ukraine: The conflict has disrupted global energy supplies, leading to price spikes and increased market instability.

- Fluctuations in fossil fuel prices: The unpredictable nature of fossil fuel prices makes it difficult to accurately assess the return on investment for renewable energy projects.

- Concerns about inflation and rising interest rates: The current inflationary environment and rising interest rates make borrowing more expensive, increasing the cost of capital expenditure.

Review of Investment Portfolio and Prioritization

SSE is undertaking a thorough review of its existing investment portfolio, prioritizing projects based on profitability, risk, and alignment with long-term strategic goals. This process has inevitably led to the scaling back or cancellation of some projects.

- Focus shift towards more profitable and less risky ventures: The company is concentrating resources on projects with a higher probability of success and a quicker return on investment.

- Prioritization of projects aligned with long-term strategic goals: The focus remains on the energy transition, but investment will be more carefully targeted and strategically managed.

- Potential delays or cancellations of large-scale renewable energy projects: Some large-scale renewable energy projects may face delays or cancellations as SSE prioritizes its investment strategy.

Impact on SSE's Future Strategies and Energy Transition Goals

The £3 billion spending cut will significantly reshape SSE's investment strategy and influence its progress towards its energy transition goals.

Revised Investment Plans and Priorities

SSE's revised investment plans will prioritize operational efficiency and cost reduction. While the company remains committed to its renewable energy ambitions, the pace of investment will likely slow down. This may involve revising timelines for existing projects and potentially divesting from less profitable assets or business units.

- Increased focus on operational efficiency and cost reduction: SSE will seek to optimize its existing operations to improve profitability and reduce its reliance on new capital expenditure.

- Revised timelines for renewable energy projects: Some renewable energy projects may be delayed, pending a more favorable economic climate.

- Potential divestment from certain assets or business units: SSE may sell off non-core assets to free up capital and focus on its most promising ventures.

Implications for Shareholders and Investors

The £3 billion spending cut is likely to have a short-term negative impact on SSE's share price, as investors react to the news. However, in the long term, this move could contribute to improved financial stability and a stronger foundation for future growth. Open and transparent communication with investors will be crucial to maintain confidence.

- Short-term negative impact on share price: The announcement may initially lead to a decline in the company's share price.

- Long-term potential for improved financial stability: The restructuring could lead to a more resilient and financially sound company in the long run.

- Need for transparency and clear communication with investors: Maintaining open and honest communication with investors will be crucial to mitigate negative impacts on investor confidence.

Conclusion

SSE's £3 billion spending cut represents a significant response to slowing growth and market uncertainties in the energy sector. The decision signals a strategic shift toward greater financial prudence and a reassessment of investment priorities. While the short-term implications may include reduced investment in some renewable energy projects, the move could ultimately enhance the company's long-term financial stability and allow it to navigate the challenging energy landscape more effectively. Understanding SSE's response to slowing growth is crucial for investors and stakeholders alike. Stay informed about further developments in SSE's financial performance and its evolving strategies by following our updates on the company’s response to this significant £3 billion spending cut and the ongoing challenges in the energy sector.

Featured Posts

-

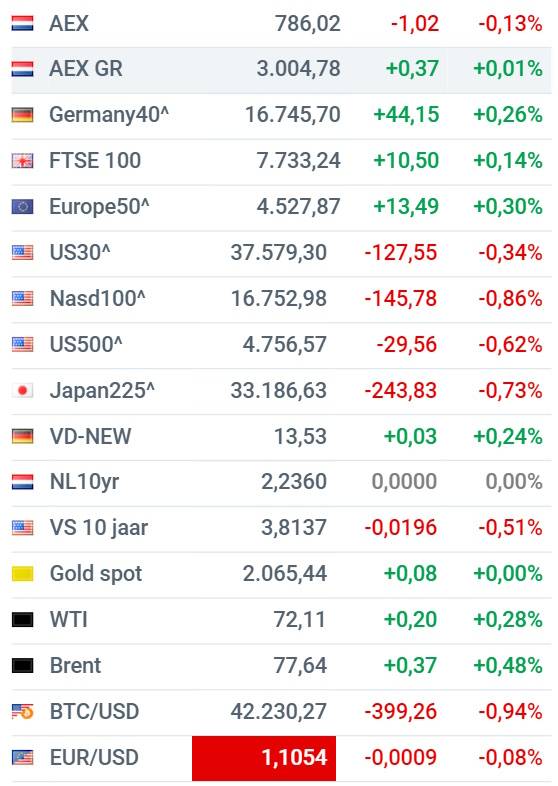

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025 -

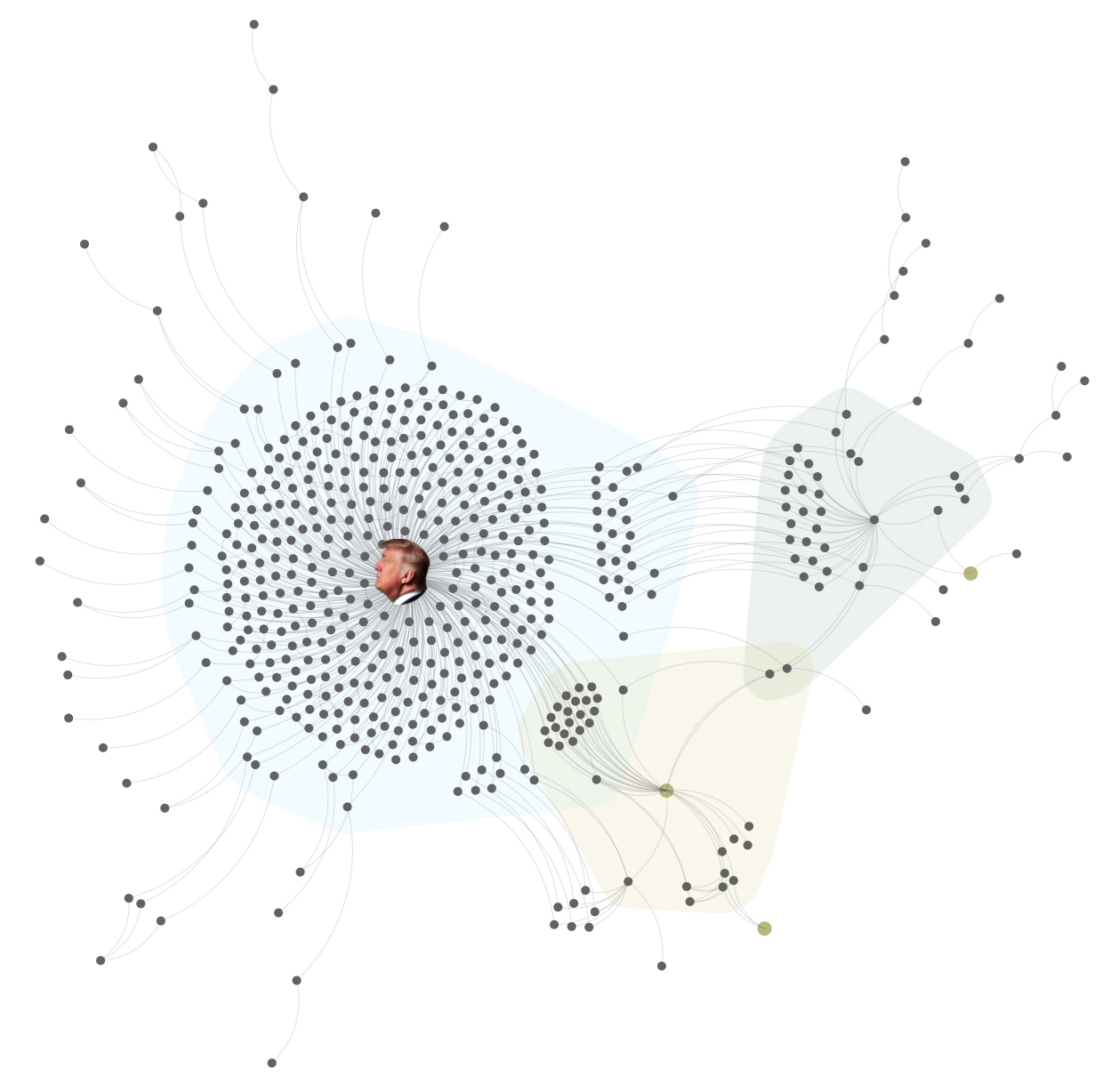

Investigating Potential Conflicts Of Interest Presidential Seals Gem Encrusted Watches And Elite Functions

May 25, 2025

Investigating Potential Conflicts Of Interest Presidential Seals Gem Encrusted Watches And Elite Functions

May 25, 2025 -

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Potentsialnykh Pobediteley

May 25, 2025

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Potentsialnykh Pobediteley

May 25, 2025 -

16 Nisan 2025 Stoxx Europe 600 Ve Dax 40 Endekslerinde Duesues

May 25, 2025

16 Nisan 2025 Stoxx Europe 600 Ve Dax 40 Endekslerinde Duesues

May 25, 2025 -

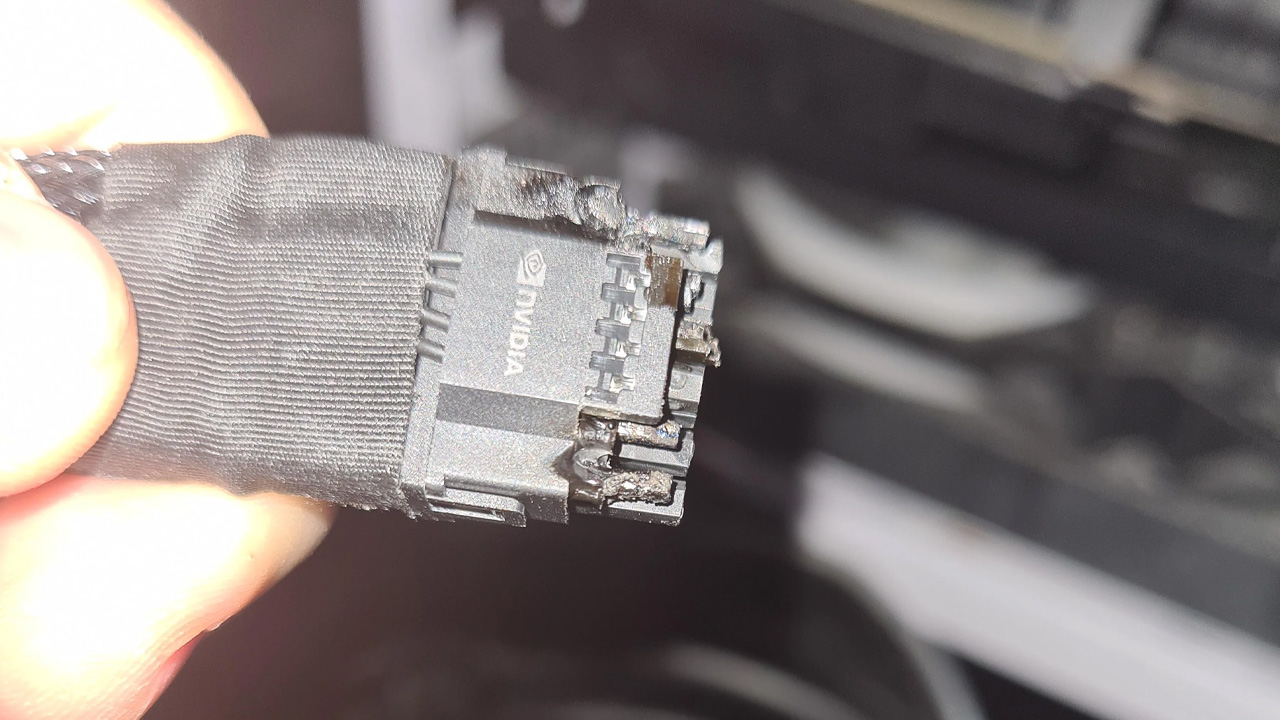

The Rtx 5060 Debacle What Went Wrong And What To Expect From Future Nvidia Releases

May 25, 2025

The Rtx 5060 Debacle What Went Wrong And What To Expect From Future Nvidia Releases

May 25, 2025

Latest Posts

-

A Practical Guide To Flash Flood Emergency Response And Prevention

May 25, 2025

A Practical Guide To Flash Flood Emergency Response And Prevention

May 25, 2025 -

How To Identify And React To A Flash Flood Emergency Situation

May 25, 2025

How To Identify And React To A Flash Flood Emergency Situation

May 25, 2025 -

Flash Flood Emergency Your Guide To Safety And Survival

May 25, 2025

Flash Flood Emergency Your Guide To Safety And Survival

May 25, 2025 -

Public Safety Issues Arising From Excessive Water Use In North Myrtle Beach

May 25, 2025

Public Safety Issues Arising From Excessive Water Use In North Myrtle Beach

May 25, 2025 -

Water Restrictions In North Myrtle Beach Due To Public Safety Concerns

May 25, 2025

Water Restrictions In North Myrtle Beach Due To Public Safety Concerns

May 25, 2025