Stock Market Prediction: Will These 2 Stocks Beat Palantir In 3 Years?

Table of Contents

Palantir Technologies: Current Performance and Future Outlook

Financial Analysis of Palantir

Palantir, known for its data analytics platform used by government and commercial clients, has shown significant revenue growth in recent years. However, profitability remains a key focus. Examining its financial statements reveals a mixed picture. Over the past three years, Palantir has demonstrated consistent revenue increases, but profitability has fluctuated, influenced by significant investments in research and development. Key financial ratios like the Price-to-Earnings (P/E) ratio remain relatively high, reflecting its growth potential but also its valuation. The reliance on large government contracts, while currently strong, presents a potential risk for future revenue stability. Palantir’s competitive advantage lies in its proprietary technology and strong relationships with government agencies, but intense competition in the data analytics space is a significant challenge.

- Strong government contracts but potential for decreased reliance. Future government spending could impact revenue.

- High growth potential but also high valuation. The current market capitalization reflects expectations of future growth but also presents significant risk.

- Dependence on specific technologies and market segments. A failure to adapt or innovate could stifle growth.

Growth Potential and Risks

Palantir's growth potential hinges on expanding its market share in both government and commercial sectors. The company is actively pursuing new markets and developing new products. However, significant risks exist. Increased competition from established tech giants and agile startups is a constant threat. Changes in government regulations and data privacy laws could also impact Palantir's operations and revenue. Economic downturns often affect government and corporate spending on technology, posing another challenge.

- Risk of new competitors entering the market. The data analytics field is highly competitive.

- Potential for slowing government spending. Budget constraints could affect Palantir's government contracts.

- Vulnerability to changes in data privacy regulations. Compliance with evolving regulations requires significant investment and adaptation.

Competitor 1: Databricks – A Detailed Analysis

Databricks' Business Model and Competitive Advantages

Databricks operates in the data and AI space, offering a unified analytics platform. Unlike Palantir's focus on specific government and commercial clients, Databricks caters to a broader range of businesses and industries. Databricks' competitive advantages include its open-source foundation, strong developer community, and scalable architecture.

- Unique technology or approach. Databricks' Lakehouse architecture offers a unified platform for data storage and processing.

- Stronger market position in a specific niche. It dominates the lakehouse architecture market.

- Potential for faster growth. The company's platform is used in various industries and is experiencing strong adoption.

Databricks' Financial Health and Growth Projections

While Databricks is a privately held company, its revenue growth is impressive, and its financial health appears strong. Based on industry reports and analyst estimates, Databricks shows robust growth projections, potentially exceeding Palantir's growth rate in the next three years.

- Higher revenue growth potential. Analysts predict significant revenue growth for Databricks in the coming years.

- Lower debt-to-equity ratio (estimated). Its financial structure is likely more stable than Palantir’s, based on industry comparisons.

- Stronger profit margins (estimated). Databricks could achieve higher profitability due to its scalable platform.

Competitor 2: Snowflake – A Detailed Analysis

Snowflake's Business Model and Competitive Advantages

Snowflake is a cloud-based data warehousing company, offering a highly scalable and flexible platform for storing and processing large datasets. Its business model differs from Palantir’s by focusing on a broader range of clients and providing a more easily accessible and user-friendly platform. Snowflake boasts strong brand recognition and a large customer base.

- Strong brand recognition and customer loyalty. Snowflake is a well-established name in the cloud data warehousing space.

- Extensive distribution network. Its cloud-based platform is accessible globally.

- Diversified revenue streams. Snowflake serves a wide range of clients in various industries.

Snowflake's Financial Health and Growth Projections

Snowflake, being a publicly traded company, offers greater transparency regarding its financial performance. Its financial indicators suggest consistent profitability and strong cash flow generation. Analysts predict continued, albeit possibly slower than Databricks, growth over the next three years.

- Consistent profitability. Snowflake demonstrates steady profitability and positive cash flow.

- Strong cash flow generation. This allows for continued investment in growth and expansion.

- Potential for acquisitions. Snowflake’s strong financial position enables strategic acquisitions.

Conclusion

This analysis suggests that both Databricks and Snowflake present compelling alternatives to Palantir, potentially outperforming it over the next three years. Databricks' rapid growth in the lakehouse architecture market and Snowflake's consistent profitability and expansive platform offer attractive investment prospects. However, Palantir remains a significant player, particularly in the government sector. This analysis is based on current information and future performance is not guaranteed. Market conditions and unforeseen events could significantly influence the performance of all three companies.

Call to Action: Are you interested in making informed decisions about your stock market investments? Continue your research on stock market prediction and consider exploring the potential of Databricks and Snowflake for your portfolio. Conduct your own thorough due diligence before making any investment decisions. Remember, this analysis is for informational purposes only and is not financial advice.

Featured Posts

-

Gaza Under Siege Hunger Sickness And Crime Flourish Under Blockade

May 10, 2025

Gaza Under Siege Hunger Sickness And Crime Flourish Under Blockade

May 10, 2025 -

Greenlands Future Navigating Geopolitical Shifts After Trumps Threats

May 10, 2025

Greenlands Future Navigating Geopolitical Shifts After Trumps Threats

May 10, 2025 -

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025 -

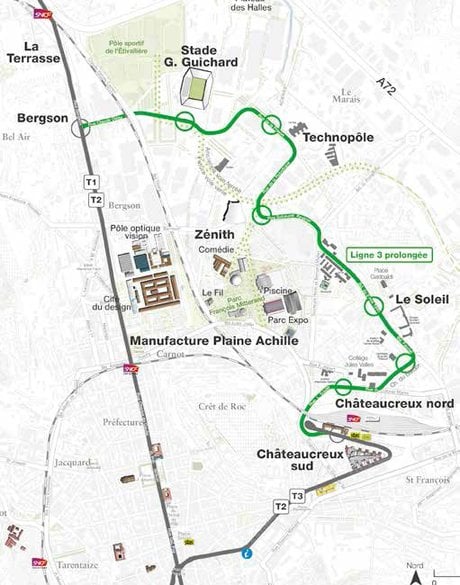

3e Ligne De Tram A Dijon La Concertation Du Conseil Metropolitain

May 10, 2025

3e Ligne De Tram A Dijon La Concertation Du Conseil Metropolitain

May 10, 2025