Stock Market Reaction: Analyzing Trump's Tariff Plan And UK Trade Agreement

Table of Contents

Trump's Tariff Plan and its Stock Market Impact

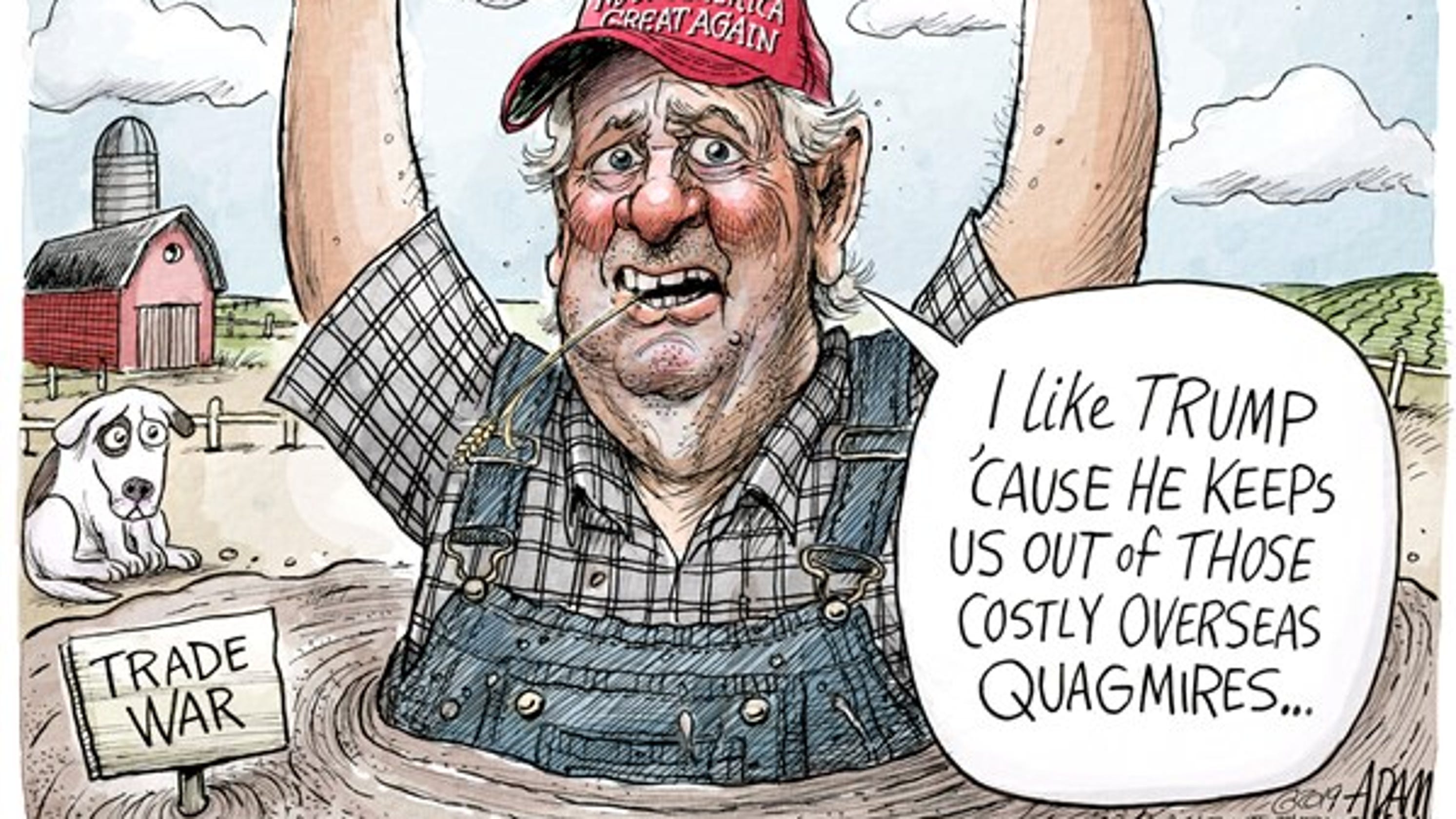

Trump's imposition of tariffs on various goods sparked considerable debate and significantly impacted the stock market reaction. Let's delve into the specifics:

Sector-Specific Analysis

Tariffs didn't affect all sectors equally. The stock market reaction varied greatly depending on industry exposure to international trade.

- Manufacturing: Companies heavily reliant on imported materials or exporting finished goods experienced significant price fluctuations. For example, the steel and aluminum tariffs initially boosted domestic steel prices, benefiting some US steel producers, but negatively impacted manufacturers using steel as a raw material. The Dow Jones Industrial Average, which includes several manufacturing giants, reflected this volatility.

- Technology: The tech sector, while less directly affected by tariffs on physical goods, faced challenges due to trade tensions with China, impacting supply chains and potentially slowing growth. The Nasdaq Composite, a technology-heavy index, saw periods of both gains and losses as these issues unfolded.

- Agriculture: The agricultural sector was particularly vulnerable to retaliatory tariffs imposed by other countries. Farm stocks suffered, reflecting the decline in exports and the overall impact on agricultural commodity prices.

The following chart (insert chart here illustrating stock performance of various sectors during tariff periods) visually represents the differential stock market reaction across sectors.

Investor Sentiment and Volatility

The announcement and implementation of tariffs created uncertainty, significantly impacting investor sentiment and increasing market volatility.

- Increased Risk Aversion: Investors became more risk-averse, shifting their portfolios away from equities and into safer assets like government bonds.

- Decreased Investment: Business investment also suffered, as uncertainty about future trade policies discouraged capital expenditure.

- Media Influence: Negative media coverage amplified fears and further fueled market volatility. The VIX (Volatility Index), a key indicator of market uncertainty, spiked during periods of intense trade disputes.

(Insert chart here showing VIX performance during tariff announcements.)

Long-Term Economic Consequences

Trump's tariff policies had potential long-term economic consequences, with knock-on effects for the stock market reaction.

- Inflation: Tariffs increased the price of imported goods, contributing to inflationary pressures.

- Supply Chain Disruptions: Trade disputes disrupted global supply chains, leading to shortages and higher prices.

- International Relations: Strained international trade relations negatively impacted global economic growth, impacting overall stock market reaction.

Predicting the precise long-term impacts requires considering future policy adjustments and the evolving global economic landscape.

UK Trade Agreement and its Stock Market Implications

Brexit and subsequent trade agreements had a profound impact on the UK and global markets, significantly influencing the stock market reaction.

Brexit's Initial Impact

The Brexit referendum in 2016 and the initial uncertainty surrounding the UK's withdrawal from the EU caused significant volatility in the FTSE 100 and other UK-related indices.

- FTSE 100 Performance: The FTSE 100 experienced sharp declines following the referendum vote, reflecting investor concerns about the economic consequences of Brexit.

- Sector-Specific Impacts: Sectors such as finance and automotive, heavily integrated with the EU market, were disproportionately affected.

(Insert chart here showing FTSE 100 performance around the Brexit referendum and initial negotiations).

Post-Brexit Trade Deals and Market Adjustments

Post-Brexit trade agreements resulted in varied stock market reaction.

- EU Trade Deal: The trade agreement with the EU had a mixed impact, with some sectors benefiting from continued access to the single market while others faced challenges due to new trade barriers.

- Deals with Other Countries: Trade deals with countries outside the EU offered new opportunities for some UK businesses, leading to positive stock market reaction in relevant sectors.

The long-term implications depend on the success of these new trade agreements in diversifying the UK economy and attracting foreign investment.

Uncertainty and Future Outlook

Uncertainty remains regarding the long-term economic consequences of Brexit and its impact on the UK stock market reaction.

- Potential Risks: Ongoing trade negotiations, potential disruptions to supply chains, and investor uncertainty pose risks to the UK stock market.

- Potential Opportunities: New trade agreements and the potential for economic restructuring could create opportunities for growth and investment.

Expert opinions vary, but most acknowledge that the UK stock market's performance will continue to be significantly influenced by the evolution of its trade relationships.

Conclusion: Understanding Stock Market Reactions to Global Trade Policies

Understanding the stock market reaction to global trade policies like Trump's tariffs and the UK's trade agreement is crucial for informed investment decisions. This article highlights the complex interplay between geopolitical events, sector-specific impacts, investor sentiment, and long-term economic consequences. To effectively navigate the market, staying informed about global trade policies and their implications is paramount. Further research into specific sectors, indices like the Dow Jones, S&P 500, Nasdaq, and FTSE 100, and volatility indices like the VIX will provide a more comprehensive understanding of stock market reaction to major global events. Stay informed, conduct thorough research, and make informed decisions regarding your investment portfolio.

Featured Posts

-

Thomas Mueller Tva Klubbar Jagar Bayern Muenchen Stjaernan

May 11, 2025

Thomas Mueller Tva Klubbar Jagar Bayern Muenchen Stjaernan

May 11, 2025 -

Payton Pritchards New Shoe Deal With Converse

May 11, 2025

Payton Pritchards New Shoe Deal With Converse

May 11, 2025 -

Celtics Payton Pritchard Signs With Converse

May 11, 2025

Celtics Payton Pritchard Signs With Converse

May 11, 2025 -

Duplantis Diamond League Debut A New Era In Pole Vault

May 11, 2025

Duplantis Diamond League Debut A New Era In Pole Vault

May 11, 2025 -

Merlin And Arthur A Medieval Tale Revealed On A Book Cover

May 11, 2025

Merlin And Arthur A Medieval Tale Revealed On A Book Cover

May 11, 2025